Liquid Crystal Polymers Market Report Scope & Overview:

Get E-PDF Sample Report on Liquid Crystal Polymers Market - Request Sample Report

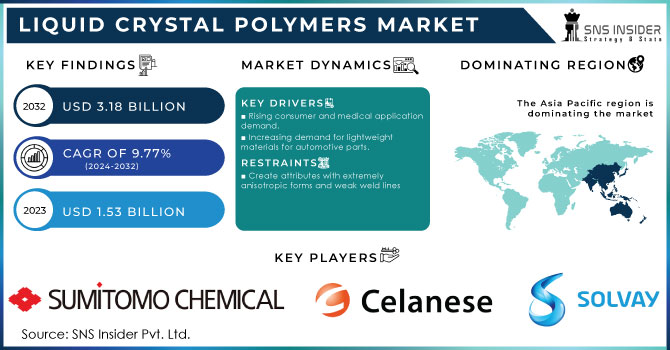

The Liquid Crystal Polymers Market Size was valued at USD 1.53 billion in 2023 and is expected to reach USD 3.18 billion by 2032 and growing at a CAGR of 9.77% over the forecast period 2024-2032.

The Liquid Crystal Polymers Market is experiencing significant growth driven by various market dynamics, including increasing demand from the electronics and automotive industry, advancements in 3D printing technology, and the growing need for lightweight materials with high-performance characteristics. Liquid crystal polymers are renowned for their unique properties, such as excellent thermal stability, chemical resistance, and mechanical strength, making them ideal for applications in high-tech industries. For instance, the demand for lightweight and durable materials in automotive applications is spurred by the need for fuel efficiency and performance enhancement. Recent developments in this field highlight the ongoing innovation and adoption of liquid crystal polymers. In November 2022, NematX unveiled its latest 3D printer, the Nex-01, at the Formnext trade fair, specifically designed to print with liquid crystal polymers. This advancement showcases the integration of liquid crystal polymers in additive manufacturing, enabling the production of complex geometries with enhanced material properties, which is crucial for industries that require precision-engineered components.

Furthermore, a breakthrough in harnessing liquid crystal technology for manufacturing has emerged, as researchers have developed a simple and versatile technique to create liquid crystal polymers that can be easily manipulated for various applications. In October 2024, this innovative method presents opportunities for producing custom shapes and functionalities, making liquid crystal polymers more accessible for a range of industries. The ability to control the alignment and properties of these materials opens new avenues in the electronics sector, where their use can lead to the development of advanced display technologies and flexible devices. Such advancements not only highlight the potential of liquid crystal polymers in traditional markets but also emphasize their role in fostering innovation in emerging fields. The continuous exploration and implementation of liquid crystal polymers in diverse applications reflect their growing significance in meeting modern manufacturing challenges and advancing technology.

Liquid Crystal Polymers Market Dynamics:

Drivers:

-

Increasing Adoption of Liquid Crystal Polymers in Automotive Applications Enhances Lightweight, Fuel-Efficiency, and Performance

The automotive industry is increasingly adopting liquid crystal polymers (LCPs) due to their exceptional properties, such as high thermal stability, mechanical strength, and lightweight characteristics. These properties help automotive manufacturers design components that are not only more durable but also contribute to fuel efficiency and overall vehicle performance. As automotive manufacturers face the pressure of meeting stringent environmental regulations, the demand for materials that reduce vehicle weight without compromising performance is growing. LCPs are ideal for applications such as electrical connectors, sensors, and other critical components, driving their increased use in electric and hybrid vehicles. Moreover, their resistance to heat and chemicals makes them suitable for harsh automotive environments. As automotive manufacturers continue to prioritize sustainability and performance optimization, the adoption of LCPs is expected to further increase, boosting their market growth.

-

Rising Demand for Advanced Electronics and Miniaturized Devices Drives LCP Market Expansion

-

Advancements in 3D Printing Technology Accelerate Demand for Liquid Crystal Polymers in Additive Manufacturing

-

High Demand for Lightweight, High-Strength Materials in Aerospace Sector Boosts LCP Adoption

-

Surging Demand for Medical Devices and Biocompatible Materials Drives Market Growth for Liquid Crystal Polymers

Restraint:

-

High Cost of Liquid Crystal Polymers Limits Widespread Adoption Across Price-Sensitive Industries

Opportunity:

-

Growing Focus on Sustainable Manufacturing Practices Opens New Market for LCPs in Eco-Friendly Products

As industries worldwide strive to meet sustainability goals, the demand for eco-friendly products is rapidly increasing, and liquid crystal polymers offer significant potential in this area. LCPs are known for their chemical stability and durability, which enhances product longevity and reduces the need for frequent replacements. Additionally, LCPs can be processed to meet environmentally conscious design standards, such as low emissions during production and minimal environmental impact. As consumers and industries alike become more focused on reducing their carbon footprint, the adoption of LCPs in environmentally friendly products is poised to rise, offering significant growth opportunities in sectors like electronics, automotive, and packaging.

-

Exploring New Applications in Flexible and Wearable Electronics Presents Untapped Potential for LCP Market

-

Advancements in 3D Printing Technology Enable New Horizons for LCPs in Custom Manufacturing Solutions

Challenge:

-

Complex Manufacturing Processes and Limited Scalability Pose Challenges for Large-Scale Production of LCPs

- Consumer Behavior and Demand Trends Shaping the Liquid Crystal Polymers Market

| Trend | Description |

|---|---|

| Growing Demand for Miniaturized Electronic Devices | As electronics shrink in size while increasing in performance, LCPs are being adopted for their ability to create compact, high-performance components. |

| Shift Toward Sustainable and Eco-Friendly Products | Consumers and industries alike are prioritizing sustainability, pushing for LCPs that are durable, recyclable, and less harmful to the environment. |

| Preference for Lightweight and High-Performance Materials | Industries like automotive and aerospace are increasingly adopting LCPs for components that require both strength and lightness, contributing to fuel efficiency and performance. |

| Rise in Consumer Electronics and Wearables | The growing demand for devices like smartphones, smartwatches, and other wearables is driving the need for flexible, heat-resistant, and durable materials like LCPs. |

| Increased Focus on Smart and Flexible Electronics | The rise of flexible electronics, such as foldable displays and sensors, is creating a strong demand for LCPs due to their superior flexibility and performance under stress. |

The Liquid Crystal Polymers (LCP) market is witnessing notable shifts in consumer behavior and demand, driven by advancements in technology and changing industry needs. As electronic devices continue to miniaturize and become more performance-driven, the demand for compact, high-performance materials like LCPs has grown significantly. Simultaneously, there is an increasing preference for sustainable and eco-friendly products, prompting manufacturers to focus on recyclable and less harmful LCP formulations. Industries such as automotive and aerospace are driving the adoption of LCPs for lightweight yet durable components, while the surge in consumer electronics and wearables further fuels market demand. Additionally, the expanding market for flexible and smart electronics, such as foldable displays, is creating new opportunities for LCP applications, highlighting its flexibility and performance under stress. These trends reflect the evolving landscape of consumer needs and technological advancements, positioning LCPs as a critical material in various high-growth industries.

Liquid Crystal Polymers Market Segment Analysis

By Type

In 2023, Thermotropic LCPs dominated the Liquid Crystal Polymers market with an estimated market share of approximately 70%. Thermotropic LCPs are preferred over Lyotropic LCPs due to their superior processability and ability to form solid materials when heated. These properties make them ideal for high-performance applications in sectors such as automotive, electronics, and telecommunications, where they are used for components like connectors, antennas, and electronic devices. Thermotropic LCPs offer advantages such as high mechanical strength, heat resistance, and excellent dimensional stability, which are crucial for precision-engineered parts in demanding environments.

By Form

In 2023, Resins & Compounds dominated the Liquid Crystal Polymers market with an estimated market share of around 60%. Resins and compounds are the most widely used form of LCPs because they offer versatility in molding and extrusion processes, making them suitable for manufacturing complex parts across industries such as automotive, electronics, and healthcare. These forms allow manufacturers to create high-performance, durable components that maintain their properties under extreme conditions. The increasing demand for precision components in sectors like automotive and electronics drives the growth of this segment.

By End-Use Industry

In 2023, the Electronics sector led the Liquid Crystal Polymers market with a market share of approximately 40%. The electronics industry’s high demand for compact, lightweight, and heat-resistant materials is a key driver of LCP adoption. LCPs are used extensively in applications like connectors, flexible circuits, and antennas, particularly in devices such as smartphones, tablets, and wearable technology. Their ability to maintain high performance under extreme conditions makes them a preferred choice in the rapidly evolving electronics industry, where miniaturization and reliability are crucial.

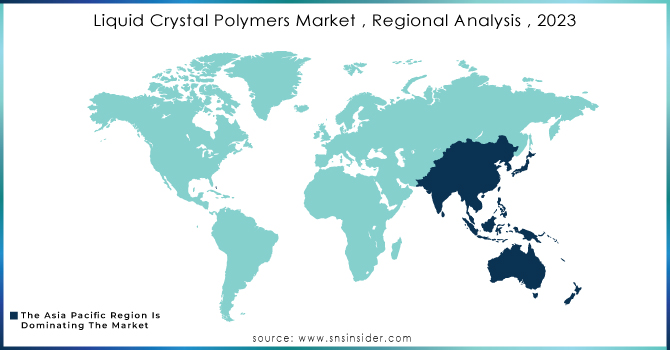

Liquid Crystal Polymers Market Regional Overview

In 2023, Asia Pacific dominated the Liquid Crystal Polymers (LCP) market with a market share of around 50%. The region's dominance is primarily attributed to the rapid industrialization and increasing demand from key sectors such as electronics, automotive, and telecommunications. Countries like China, Japan, and South Korea are leading the market due to their established manufacturing bases and strong presence in high-tech industries. For example, China is a major consumer and producer of LCPs, especially in the electronics and automotive industries, where LCPs are used for manufacturing connectors, flexible circuits, and precision parts. Japan is a global leader in the production of LCPs, with companies like Toray Industries and Mitsubishi Chemical driving innovation in high-performance materials. South Korea also contributes significantly to the market, with strong demand from the electronics and automotive sectors. Additionally, the rapid adoption of 5G technology in the region has led to a higher demand for LCPs in communication devices and components, further reinforcing the market's dominance in the Asia Pacific.

Moreover, in 2023, North America was the fastest-growing region in the Liquid Crystal Polymers market, with a CAGR of 9%. This growth can be attributed to the increasing demand for high-performance materials in advanced manufacturing applications, especially in the electronics, aerospace, and medical sectors. The United States is a key driver of this growth, with a strong focus on innovation and the adoption of next-generation technologies. For instance, the growing demand for electric vehicles (EVs) in the U.S. is contributing to the increased use of LCPs in automotive components like connectors, sensors, and lightweight structural parts, which help improve fuel efficiency and performance. Additionally, the aerospace and defense sectors in North America are increasingly relying on LCPs for producing durable and heat-resistant components used in aircraft and military applications. The medical devices industry is also expanding rapidly, with LCPs being used in drug delivery systems, diagnostic devices, and surgical instruments, further boosting market growth. The presence of key players in the region, along with strong R&D efforts and increasing industrial demand, positions North America as the fastest-growing region in the Liquid Crystal Polymers market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Liquid Crystal Polymers Market

-

Celanese Corporation (Vectra, Zenite)

-

Chang Chun Plastics Co. Ltd (CCLCP-100, CCLCP-200)

-

China National Petroleum Corporation (CNPC) (PetroChina LCP, LCP-CN Series)

-

DIC Corporation (Dicpurel, LC Series)

-

DuPont de Nemours, Inc. (Crastin, Zytel LCP)

-

Evonik Industries AG (Vestakeep LCP, Evonik LCP Series)

-

JX Nippon Oil and Energy Corporation (JNX-LCP Series, Parmax)

-

LG Chem Ltd. (LPL Series, LCP-E)

-

Mitsubishi Chemical Corporation (Novaduran, LAPEROS LCP)

-

Polyplastics Co., Ltd. (LAPEROS E6000, E4000)

-

RTP Company (RTP LCP Series, RTP 6000)

-

Shanghai Pret Composites Co., Ltd. (Pret LCP, Pret Advanced Series)

-

Shenzhen Wote Advanced Materials Co. Ltd (Wote-LCP, Advanced-LCP)

-

Solvay SA (Amodel, Xydar LCP)

-

Sumitomo Chemical Company (SUMIKASUPER LCP, E8000 Series)

-

Toray International, Inc. (Torelina, Ecomass LCP)

-

Toyobo Co., Ltd. (Vectran, Toyobo LCP Series)

-

UBE Industries, Ltd. (UBE LCP Series, UPLCP-100)

-

Ueno Fine Chemicals Industry Limited (UNL-LCP Series, Ueno-LCP)

-

Victrex plc (Victrex LCP Series, VICTREX 6000)

-

Wanhua Chemical Group Co., Ltd. (Wanhao LCP, Wanhua Polymer Series)

Recent Developments

-

March 2023: Solvay, a leader in specialized materials, announced the expansion of its Xydar liquid crystal polymers (LCP) portfolio with a new high-heat, flame-retardant grade designed to meet the stringent safety requirements for EV battery components.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.53 Billion |

| Market Size by 2032 | US$ 3.18 Billion |

| CAGR | CAGR of 9.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Thermotropic LCPs, Lyotropic LCPs) •By Form (Resins & Compounds, Films, Fibers) •By End-Use Industry (Automotive & Transportation, Electronics, Medical Devices, Packaging, Consumer Goods, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shanghai Pret Composites Co., Ltd., Ueno Fine Chemicals Industry Limited, Celanese Corporation, Sumitomo Chemical Company, Chang Chun Plastics Co. Ltd, Polyplastics Co., Ltd., Shenzhen Wote Advanced Materials Co. Ltd, JX Nippon Oil and Energy Corporation, Solvay SA, Toray International, Inc. and other key players |

| Key Drivers | • Rising Demand for Advanced Electronics and Miniaturized Devices Drives LCP Market Expansion • Advancements in 3D Printing Technology Accelerate Demand for Liquid Crystal Polymers in Additive Manufacturing |

| RESTRAINTS | • High Cost of Liquid Crystal Polymers Limits Widespread Adoption Across Price-Sensitive Industries |