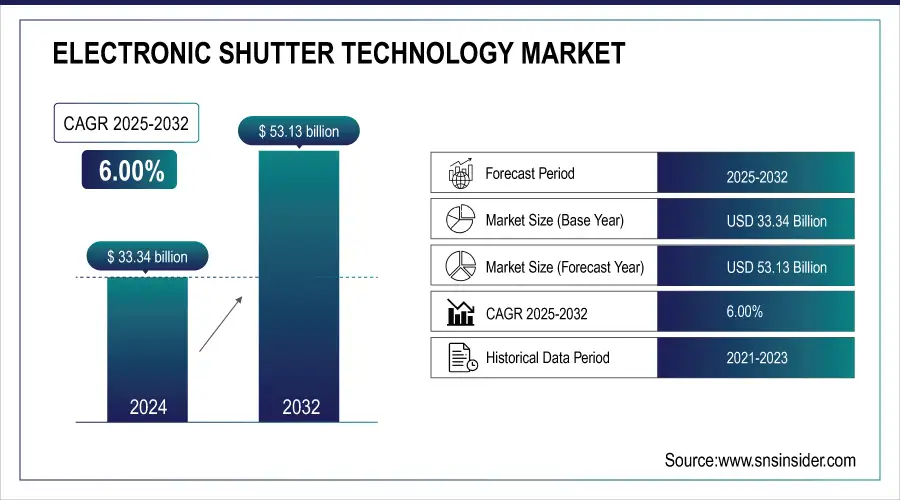

Electronic Shutter Technology Market Size & Growth:

The Electronic Shutter Technology Market Size was valued at USD 33.34 Billion in 2024 and is projected to reach USD 53.13 Billion by 2032, growing at a CAGR of 6.00% during 2025-2032.

The Electronic Shutter Technology market is growing rapidly, mainly due to the technology-based shutters that are focused on CMOS sensors as they cover the increasing market with a low cost, high performance, and versatility among applications such as consumer electronics, automotive, and surveillance. In terms of deployment segment, rolling shutters are presently dominating driven primarily due to their right blend of cost-effective nature and high precision imaging process as compared to global shutters serving the niche markets demanding highly precise image capturing. Expanding demand for high-speed imaging in smartphones, self-driving cars, and industrial automation pushed growth. While modular designs and hybrid shutter systems bring flexibility, CMOS-based solutions will continue their dominance through 2032 driven by sensor technology advances and further adoption in emerging markets.

Hasselblad 907X Hasselblad combines an old-school design with a 100MP modern sensor in the 907X, which redefines medium format shooting in a modular way. Already put through its paces in Japan, it offers an alternative waist-level shooting style that harkens back to Hasselblad’s film roots.

To Get more information on Electronic Shutter Technology Market - Request Free Sample Report

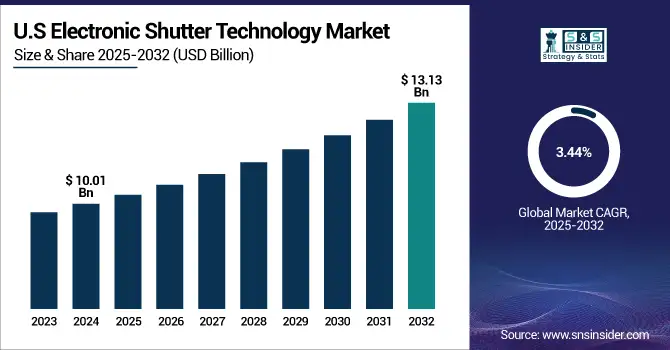

The U.S Electronic Shutter Technology Market Size was valued at USD 10.01 Billion in 2024 and is projected to reach USD 13.13 Billion by 2032, growing at a CAGR of 3.44% during 2025-2032. This Electronic Shutter Technology Market growth is driven by increasing adoption of advanced CMOS sensor-based shutters across consumer electronics, automotive, and security sectors. Innovations in rolling and global shutter technologies, coupled with rising demand for high-speed imaging and enhanced image quality, are fueling market expansion and technological advancements in the region.

The Electronic Shutter Technology market trends includes the rapid adoption of CMOS sensor-based shutters owing to low cost and high efficiency compared to traditional method, especially in consumer electronics and automotive sectors. Rolling shutters are still the most common type of shutters used in camera sensors as they offer a good compromise between price and image quality, while the preference for global shutters is increasing in high-precision applications such as industrial automation and surveillance. One new approach is a hybrid shutter which brings the best of both rolling and global. Moreover, the increasing demand abundant for high speed imaging, modular camera designs, integration of AI & IoT devices are fast fueling innovation and driving the growth of the global market.

Electronic Shutter Technology Market Dynamics:

Drivers:

-

Hybrid Sensor Technology Advances Driving Growth in Electronic Shutter Markets

The growth in the Electronic Shutter Technology market is being driven by the advance of hybrid shutter technology enabled by the development of hybrid sensor technologies combining the function of rolling and global screens. This technological development is minimizing the distortion of the image while keeping the price of the solution low and making the overall quality of the image better. This advancement is beneficial for all applications where high-speed and accurate imaging is required, such as consumer electronics, automotive, and security applications. The growing demand for imaging that is free from distortions and high resolution is causing hybrid sensors to become the technology of choice and stimulating further R&D in the field of shutter technologies for various applications.

Nikon’s new patent for a hybrid sensor combines rolling and global shutter tech to minimize distortion without high costs. This innovation builds on years of research and aims to balance image quality and performance in future cameras.

Restraints:

-

High Manufacturing Costs and Technical Challenges Restrict Market Growth

Rising manufacturing costs and inherent technical challenges, such as increased power consumption, heat generation, and reduced dynamic range in global shutter sensors, are significant restraints in the Electronic Shutter Technology market. These problems translate into higher costs for the products and reduced image quality in relation to rolling shutters that hinders their use for consumer and industrial applications where price is a concern. Also, this time complexity of designing advanced shutter systems means that products take too long to get into the hands of consumers. Consequently, while there is a strong demand for imaging that is both distortion-free and at high speeds, these issues are limiting overall market growth, as well as inhibiting innovation in a number of segments.

Opportunities:

-

Rising Demand for Silent, High-Speed Imaging Drives Growth in Electronic Shutter Market

The increasing preference for electronic-only shutters is creating significant opportunities in the imaging market. These shutters offer silent operation, faster burst speeds, and reduced camera shake, making them ideal for action, sports, and wildlife photography. As consumers and professionals seek improved performance and reliability, demand for advanced shutter technologies continues to grow. This shift encourages innovation and wider adoption of electronic shutter solutions across various segments, fueling overall market expansion and technological advancement.

The EOS R7 Mark II is said to have an electronic shutter only, allowing for silent, high-speed shooting to 40fps. The impetus behind this change is in line with trends in the industry to eliminate vibration and enhance performance with action photography.

Challenges:

-

Technical Limitations and Cost Constraints Hamper Electronic Shutter Market Growth

Technical limitations such as power consumption, heat generation but also image quality aspects such as noise or lack of dynamic range in global shutters are some of the major challenges in the Electronic Shutter Technology market. Moreover, increased manufacturing costs and integration complexities limit the adoption of such devices, particularly in price-sensitive segments. While there is a growing demand for advanced imaging solutions, these factors limit development cycle and slow down the market penetration. Overcoming these issues is vital to gain wider market adoption and long-term growth of electronic shutter technologies in consumer, automotive and industrial applications.

Electronic Shutter Technology Market Segmentation Analysis:

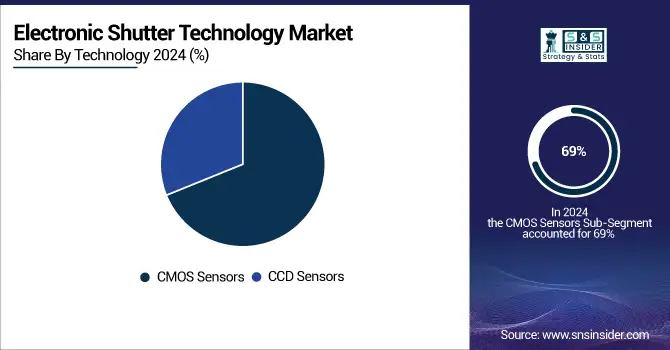

By Technology

In 2024, the CMOS Sensors segment accounted for approximately 69% of the Electronic Shutter Technology Market share, due to their affordability, performance, and broad applications in consumer electronics, automotive, etc. Growth continues for this segment, as technology improves. This is supplemented by the increased demand for fast reliable imaging solutions, thus presenting a favorable opportunity for the growth of CMOS-based shutters, as they are preferred over other types of sensors in the market.

The CCD Sensors segment is expected to experience the fastest growth in Electronic Shutter Technology Market over 2025-2032 with a CAGR of 8.85%. This growth is driven by improved image quality and low-light performance, making CCD sensors ideal for professional photography, medical imaging, and security applications. Innovations reducing costs and power usage are also boosting adoption. As demand rises for high-precision imaging, CCD sensors are gaining market share despite CMOS dominance, contributing significantly to the sector’s overall expansion.

By Shuttering Type

In 2024, the Rolling segment accounted for approximately 68% of the Electronic Shutter Technology Market share, driven by its cost-effectiveness and widespread use in consumer electronics and automotive applications. Rolling shutters offer a balanced performance by providing good image quality at a lower cost compared to global shutters, making them popular for devices requiring fast and reliable imaging. Their continued adoption is supported by advancements that reduce rolling shutter distortions, helping maintain their strong position in the market.

The Global segment is expected to experience the fastest growth in Electronic Shutter Technology Market over 2025-2032 with a CAGR of 8.53%. Driven by distortion-free imaging in high-precision applications including industrial automation, security, and automotive, this projection-oriented growth shows no sign of slowing down through the forecast period. As global shutter technology improves and becomes more affordable and better performing, this will drive broader adoption. The global shutter segment is projected to gain strong market share and propel overall market growth will thrive, due to increasing demand for advanced imaging solutions across different industries for precision imaging.

By Application

In 2024, the Consumer Electronics segment accounted for approximately 31% of the Electronic Shutter Technology Market share, driven by increased need for high-speed high-quality imaging in smart phones, cameras, and wearable devices. The relentless improvement of shutter technologies, particularly CMOS-based solutions, are improving the performance of the images while keeping the costs affordable. This also triggers the growth of this segment as features such as slow motion video and real-time image processing in consumer gadgets are quickly becoming commonplace. However, this segment continues to be a significant revenue driver in the market, since consumer preference gradually shifts towards better photography and video.

The Automotive segment is expected to experience the fastest growth in Electronic Shutter Technology Market over 2025-2032 with a CAGR of 8.21%. This growth is driven by increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles requiring high-speed, reliable imaging. Electronic shutters enable precise image capture critical for safety and navigation. Rising investments in smart mobility and vehicle safety technologies further fuel demand, making the automotive sector a key driver of market expansion during this period.

By Implementation

In 2024, the CMOS Sensor Based Shutters segment accounted for approximately 65% of the Electronic Shutter Technology Market share, due to the low-cost, high-efficiency level of electronic shutters, as commonless consumer electronics as well as automotive applications. This segment is gaining from regular technology innovations that help improve image quality and speed while lowering power consumption. The increasing need for compact imaging systems with the capability of high speeds and dependability is boosting the demand for the global CMOS shutter market, and this segment is the biggest market driver and the most leading segment of the industry.

The CCD Sensor Based Shutters segment is expected to experience the fastest growth in Electronic Shutter Technology Market over 2025-2032 with a CAGR of 6.39%. The segment has the benefit of greater image quality and low-light performance, which is driving growth in professional photography, medical imaging, and high-precision industrial applications. With the ever-evolving technology dedicated to enhanced efficiency and cost containment, CCD-based shutters continue to improve. This segment will gain higher market share with increasing demand of high-fidelity imaging is expected to contribute great deal to overall market growth.

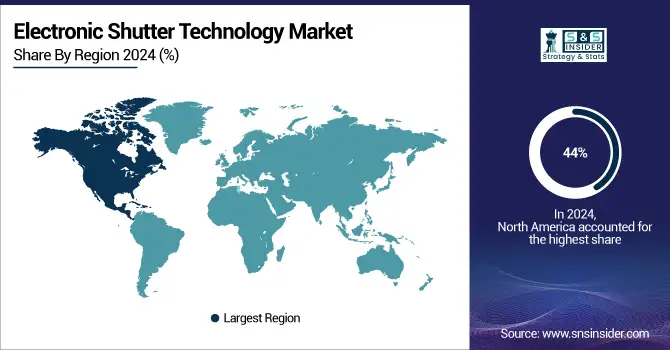

Electronic Shutter Technology Market Regional Overview:

In 2024 North America dominated the Electronic Shutter Technology Market and accounted for 44% of revenue share, attributed to concentrates of key industry players, technological infrastructure and high adoption of electronic shutter technology in the consumer electronics, automotive, and security sectors in North America. The increase in R&D investments and the growing demand for high-performance imaging solutions are also the factors driving the growth of the market. Also, presence of beneficial government policies, and growing collaboration between technology provider and end-user fuels the growth of region in the Global Direct Memory Access Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to witness the fastest growth in the Electronic Shutter Technology Market over 2025-2032, with a projected CAGR of 7.66%, owing to swift industrialization, booming consumer electronics, and expanding automotive and surveillance sectors. An increase in investment related to advanced manufacturing technologies, coupled with government initiatives that support digital innovation also play a role. Asia-Pacific is an important growth hub for the global electronic shutter market, attributed to higher adoption of imaging devices, driven by the regions large population size and growing middle class.

In 2024, Europe emerged as a promising region in the Electronic Shutter Technology Market, driven by strong demand in automotive, healthcare, and industrial automation sectors. The region benefits from advanced research facilities, supportive government policies, and growing investments in smart city and security projects. Additionally, increasing adoption of high-performance imaging technologies in manufacturing and surveillance contributes to steady market growth. Europe’s focus on innovation and sustainability positions it as a key player in the expanding electronic shutter technology landscape.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Electronic Shutter Technology Market, due to increasing investments in infrastructure, rising demand for security and surveillance systems, and expanding automotive and consumer electronics sectors. Growing urbanization and government initiatives to modernize technology frameworks further support market development. Although adoption rates are currently lower compared to developed regions, these markets offer significant potential for future expansion as awareness and access to advanced imaging technologies improve.

Electronic Shutter Technology Companies are:

The Key Players in Electronic Shutter Technology Market includes AMS AG, Canon, Inc., Galaxy Core, Inc., Hamamatsu Photonics K.K, Infineon Technologies AG, ON Semiconductor Corporation, OmniVision Technologies Inc., Panasonic Corporation, PMD Technologies AG, Sony Corporation, Samsung Electronics Co. Ltd., STMicroelectronics N.V., SK Hynix, Inc., Sharp Corporation, Toshiba Corporation, Teledyne Technologies Incorporated, Texas Instruments Incorporated, Aptina Imaging Corporation, Lattice Semiconductor Corporation, Cadence Design Systems, Inc. and Others.

Recent Developments:

-

In May 2025, Canon’s mid-range mirrorless cameras like the EOS R6 II now outperform flagship DSLRs such as the Nikon D6, offering advanced features at a lower cost. This shift highlights how modern technology has made high-quality imaging more accessible across camera tiers.

-

In Nov 2024, Sony Semiconductor Solutions announced the IMX925, a high-speed 24.55MP CMOS image sensor with global shutter technology designed for industrial imaging. It offers 394 fps processing, enhanced energy efficiency, and improved precision for faster recognition and inspection tasks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 33.34 Billion |

| Market Size by 2032 | USD 53.13 Billion |

| CAGR | CAGR of 6.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Electronic Shutter Technology market include AMS AG, Canon, Inc., Galaxy Core, Inc., Hamamatsu Photonics K.K, Infineon Technologies AG, ON Semiconductor Corporation, OmniVision Technologies Inc., Panasonic Corporation, PMD Technologies AG, Sony Corporation, Samsung Electronics Co. Ltd., STMicroelectronics N.V., SK Hynix, Inc., Sharp Corporation, Toshiba Corporation, Teledyne Technologies Incorporated, Texas Instruments Incorporated, Aptina Imaging Corporation, Lattice Semiconductor Corporation, Cadence Design Systems, Inc. and Others. |