Electronic Wet Chemicals Market Size & Trends:

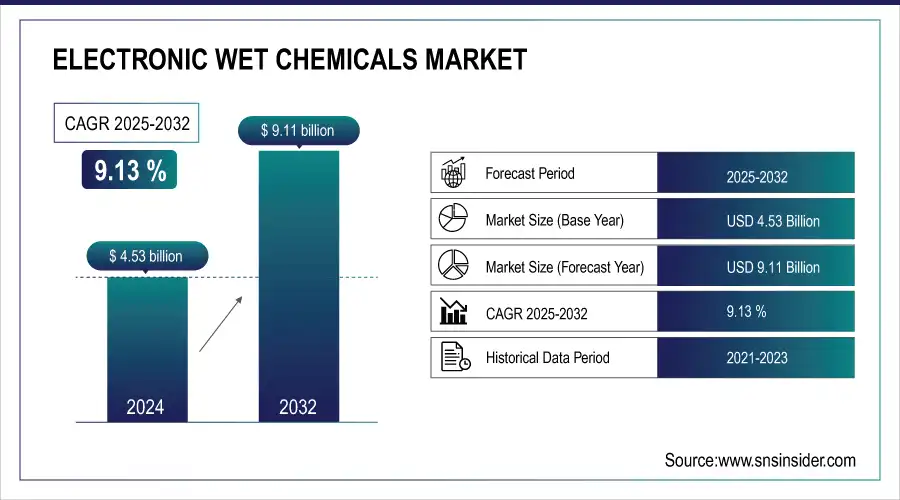

The Electronic Wet Chemicals Market size was valued at USD 4.53 Billion in 2024 and is projected to reach USD 9.11 Billion by 2032, growing at a CAGR of 9.13 % during 2025-2032.

To Get more information On Electronic Wet Chemicals Market - Request Free Sample Report

The electronic wet chemicals Market is expanding at a rapid pace due to rising requirement for ultra pure chemicals across the semiconductors electronics and solar industry. Such chemicals, including acids, solvents, and cleaning chemicals, are essential for wafer fabrication, circuit board manufacturing and advanced packaging. With the development of 5G, AI, and IoT and other technologies, the precision, and performance requirements of materials have become increasingly demanding. The trend toward sustainability is also stimulating the creation of green and efficient chemical processes. Supply chain worries are making local production and sourcing more critical. Demand for dependable, high purity chemicals that meet the highest industry standards is expected to sustain the market expansion.

Eastman has introduced a high-purity electronic grade isopropyl alcohol (IPA) to its EastaPure™ portfolio, ensuring superior quality and reliability for semiconductor manufacturers. This new solvent, made in the U.S., addresses growing demand by providing a domestically sourced solution with 99.99% purity and reliable supply.

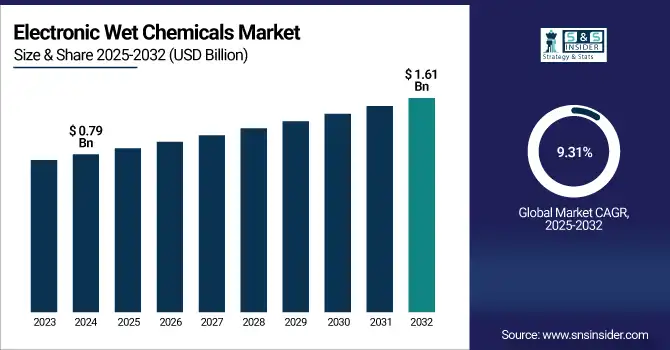

The U.S. electronic wet chemicals market size was valued at USD 0.79 Billion in 2024 and is projected to reach USD 1.61 Billion by 2032, growing at a CAGR of 9.31%, driven by increasing automation across industries like manufacturing and automotive, advancements in high-intensity LED and customizable lighting technologies, and the rise of AI and machine learning for enhanced image processing. Additionally, the adoption of machine vision in medical and food industries fuels market growth.

Electronic Wet Chemicals Market Dynamics:

Drivers:

-

Impact of Precision Cleaning on Semiconductor Manufacturing Yields and Operational Efficiency

High purity cleaning is critical when it comes to improving the yields in semiconductor fabrication of wafers and components, because nothing can be in that processed product that could degrade yields. Particles, oils and contaminants may produce microstructural defects in the semiconductor leading to poor performance and potential failure. Ultra-pure electronic wet chemicals, such as isopropyl alcohol and premium cleaning agents, can easily remove such contaminants from sensitive areas without causing damage. This cleaning facilitates higher quality control with less runout for less waste in production. The result is higher semiconductor chip yields, increased operating efficiency and a greater number of successful devices. The use of these sophisticated cleaning compositions is necessary to prevent compromising the integrity and performance of semiconductor devices and to maximize production efficiencies.

Chemistry underpins the USD 50 billion global electronics materials market, growing at ~5% annually to support rising demand for electronic products. With U.S. electronics manufacturing resurging, domestic chemical production is expanding to support increased semiconductor capacity and boost the U.S. market share.

Opportunities:

-

Leveraging Connected Intelligence for Enhanced Quality Operations in Life Sciences

Adopting connected intelligence through cloud solutions in quality operations allows life sciences organizations to seamlessly integrate data across various departments, enhancing efficiency and decision-making. By leveraging artificial intelligence (AI), these cloud-based systems enable real-time insights, improve data accuracy, and drive proactive quality management throughout the product lifecycle. AI algorithms can analyze vast amounts of data from production, safety, and regulatory compliance, identifying patterns and potential risks early. This integration helps companies respond more swiftly to market demands, regulatory changes, and operational challenges, ultimately optimizing processes. Furthermore, connected intelligence reduces silos, fosters collaboration, and ensures that quality standards are consistently met, contributing to more operations that are efficient, reduced costs, and faster time-to-market for products.

Challenges:

-

Data Integration Complexity Impedes Seamless Quality Operations Across Functions

Data integration complexity is a significant challenge in adopting connected intelligence for quality operations. Pharmaceutical companies use different disparate systems within safety, regulatory, clinical, and manufacturing areas as well. Data stored in various databases and systems can be in varying formats or may be based on different technologies, complicating the task of aggregating and integrating data. The absence of the “right” middleware for facilitating seamless interaction across the previously cited systems may compromise time delays, errors, and decision-making support. In order to do this, businesses require strong integration tools that provide seamless data flow between systems, standardize data formats, and provide real-time access to reliable information. This integration must also be in accordance with compliance standards to adhere to regulate while streamlining operations and promoting data-driven decision-making throughout the product cycle.

Electronic Wet Chemicals Market Segmentation Analysis:

By Type

The acetic acid segment held a dominant electronic wet chemicals market share of around 55% in 2024, on account of its indispensable requirement across the semiconductor and electronic component cleaning industries. Its ability to extract impurities and demand for electronics and high tech is driving the market.

The isopropyl acid segment is expected to witness the fastest growth in the electronic wet chemicals market over 2025-2032, with a CAGR of 12.59%, due to its critical role in cleaning and surface preparation in semiconductor manufacturing. Its effectiveness in removing contaminants, coupled with increasing demand for high-performance electronics and advanced technologies, drives its rapid adoption.

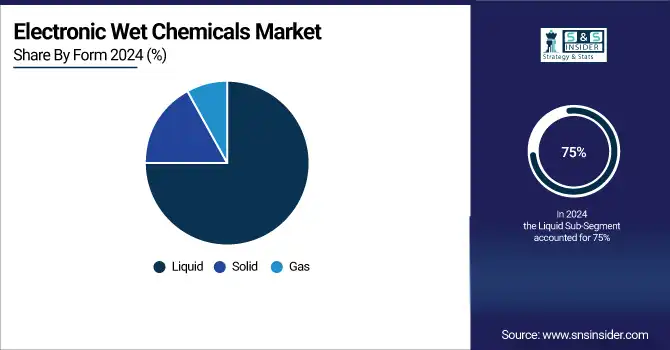

By Form

The liquid segment held a dominant share of around 75% in the electronic wet chemicals market in 2024, due to its wide application use in cleaning and etching process, as such on the semiconductor production. The need for high purity and accurate liquid chemicals for use in device manufacturing and surface treatment drive this predominance.

The gas segment is expected to witness the fastest growth in the electronic wet chemicals market from 2025-2032, with a CAGR of 12.55%. This segment growth is driven by growing usage of gas-based chemicals in etching and deposition for advanced semiconductor and display production technologies as it contributes to miniaturization and accuracy.

By Application

The Semiconductor Manufacturing segment held a dominant market share of around 46% in 2024 and is projected to experience the fastest growth during 2025-2032, at a CAGR of 10.21%. The growth is driven by increased demand for advanced semiconductors in AI, IoT, automotive, and consumer applications. With a growing market demand for smaller and higher powered chips, there is a greater dependence on high-purity wet chemicals for advanced etching and manufacturing processes.

By End User Industry

The Electronics & Semiconductor Industry segment held a dominant share of around 56% in the electronic wet chemicals market in 2024, driven by the growing demand for advanced semiconductor devices, miniaturization of components, and increased use of electronic devices across various sectors such as consumer electronics, telecommunications, and computing.

The Automotive Industry segment is expected to witness the fastest growth in the electronic wet chemicals market from 2025-2032, with a CAGR of 10.99%. This expansion is driven by increasing sales of electric vehicles (EVs), which demand sophisticated electronics components and materials and greater demand for reliable wet chemicals in auto electronics and manufacturing.

Electronic Wet Chemicals Market Regional Outlook:

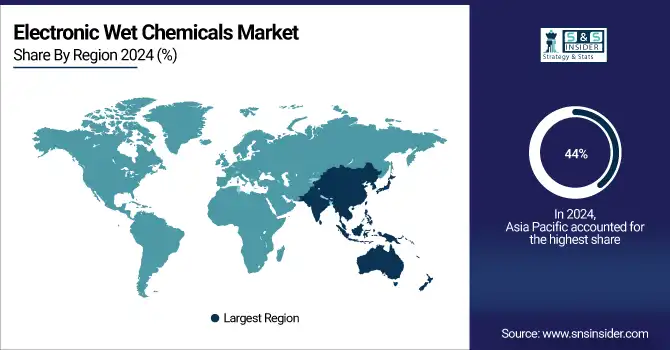

In 2024, the Asia-Pacific dominated the electronic wet chemicals market and accounted for 44% of revenue share, owing to presence of leading semiconductor manufacturing plants in countries such as Japan, Taiwan, South Korea, China, rising investment in advanced chip production, consumer electronics requirement, and favorable government initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

China leads the Asia-Pacific electronic wet chemicals market due to its strong semiconductor manufacturing base and rapid expansion of electronics production.

North America is projected to register the fastest CAGR of 10.37% during 2025-2032, due to rapid investments for semiconductor fab, rise in advanced technology, such as AI, 5G, and strong government support, such as CHIPS Act for domestic semiconductor manufacturer and supply chain resilience.

The U.S. leads the country in electronic wet chemicals market, due to robust semiconductor manufacturing, rising R&D investments, and strong presence of major chipmakers and tech firms.

In 2024, Europe emerged as a promising region in the electronic wet chemicals market, based on growing investments in semiconductor manufacturing facilities, favorable government policies promoting microelectronics, and growth in the clean energy and automotive industries. In addition, the region’s emphasis on technological self-sufficiency is underlining the need for high-purity chemical products.

LATAM and MEA is experiencing steady growth in the electronic wet chemicals market, which can be attributed to the growing investment in electronics manufacturing, increasing demand for consumer electronics, and supportive government policies. Data center proliferation and increasing interest in regionalizing semiconductor manufacturing are also driving the need for development of more advanced wet chemical processes.

Key Players:

The electronic wet chemicals market companies Air Products and Chemicals, Inc., BASF SE, Cabot Microelectronics Corporation, Dow Chemical Company, Fujifilm Corporation, Honeywell International Inc., KMG Chemicals, Inc., Linde plc, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Technic Inc. and Others.

Recent Developments:

-

In April 2025, BASF is investing in an additional semiconductor-grade sulfuric acid plant at its site in Ludwigshafen, Germany to support the growing demand for advanced semiconductor manufacturing solutions. The plant, which is expected to begin operations by 2027, will create a reliable, high-quality supply of key chemicals for chip making in Europe.

-

In October 2024, Honeywell plans to spin off its Advanced Materials business into an independent company by the end of 2025 or early 2026, focusing on sustainability-driven specialty chemicals and materials. The move will enhance strategic focus and financial flexibility to foster innovation and growth in advanced materials for various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.53 Billion |

| Market Size by 2032 | USD 9.11 Billion |

| CAGR | CAGR of 9.13% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acetic acid, Phosphoric acid and Isopropyl acid), • By Form (Liquid, Solid and Gas), • By Application (Semiconductor Manufacturing, Flat Panel Display (FPD) Manufacturing, Solar Cell Manufacturing and Printed Circuit Board (PCB) Manufacturing), • By End User Industry (Electronics & Semiconductor Industry, Solar & Photovoltaic Industry, Automotive Industry and Consumer Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The electronic wet chemicals market companies Air Products and Chemicals, Inc., BASF SE, Cabot Microelectronics Corporation, Dow Chemical Company, Fujifilm Corporation, Honeywell International Inc., KMG Chemicals, Inc., Linde plc, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Technic Inc. and Others |