Low Voltage Circuit Breaker Market Size & Growth:

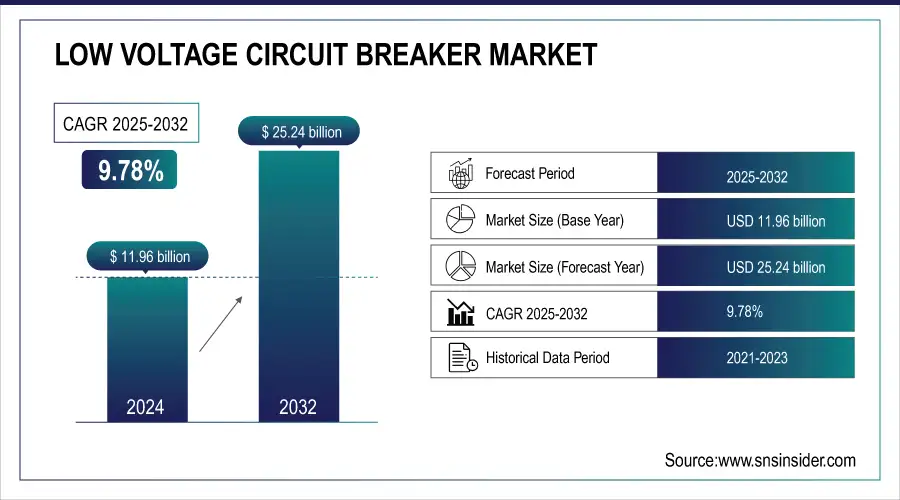

The Low Voltage Circuit Breaker Market Size was valued at USD 11.96 billion in 2024 and is expected to reach USD 25.24 billion by 2032 and grow at a CAGR of 9.78 % over the forecast period 2025-2032. The Low Voltage Circuit Breaker Market is experiencing significant growth, driven by the increasing demand for electrical safety across various industries. As electricity consumption rises in residential, commercial, and industrial sectors, the need for efficient protection systems becomes increasingly vital. Low-voltage circuit breakers play an essential role in safeguarding against electrical faults, overloads, and short circuits, ensuring both the longevity of equipment and the safety of users. This market growth is further amplified by the rapid expansion of urban infrastructure and the integration of renewable energy sources such as solar and wind power. Technological advancements in these breakers, particularly the integration of digital and smart technologies, are boosting market demand. The rise of the Internet of Things (IoT) in power management systems has revolutionized electrical safety, enabling remote monitoring and control. These smart breakers enhance operational efficiency and real-time monitoring, making them indispensable for modern power management solutions focused on automation and energy efficiency.

Get more information on Low Voltage Circuit Breaker Market - Request Sample Report

One key feature contributing to the market's growth is the short-time delay characteristic of low-voltage circuit breakers. This feature, which ranges from 6 to 30 cycles, ensures coordination with other protective devices. During testing, a current of 1.5 to 2.5 times the short-time pickup is injected, and the trip time is recorded, validated by manufacturer time-current curves. Ground fault pickup settings are another critical aspect, typically set between 20% to 60% of the continuous current rating of the overcurrent protection device, ensuring the breaker activates only when the current exceeds a safe level. These innovations and market trends highlight the increasing demand for smart, reliable, and efficient low-voltage circuit breakers.

Low Voltage Circuit Breaker Market Size and Forecast:

-

Market Size in 2024: USD 11.96 Billion

-

Market Size by 2032: USD 25.24 Billion

-

CAGR: 9.78% (from 2024 to 2032)

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Low Voltage Circuit Breaker Market Highlights:

-

Increasing urban expansion and infrastructure development are driving the demand for low-voltage circuit breakers in residential, commercial, and industrial applications.

-

Growing adoption of smart city projects and intelligent energy management systems is boosting the demand for advanced, smart low-voltage circuit breakers with real-time monitoring capabilities.

-

Expansion of solar and wind power installations is increasing the need for low-voltage circuit breakers to manage fluctuating power outputs and protect energy systems.

-

Growing emphasis on preventing overloads, short circuits, and fire hazards is strengthening the market demand for efficient and reliable circuit protection solutions.

-

Retrofitting smart circuit breakers in older infrastructures remains a restraint due to compatibility issues, high upgrade costs, and the need for skilled technicians.

-

Integration of IoT and automation features is creating new opportunities for market players to deliver intelligent, connected, and energy-efficient breaker solutions.

Low Voltage Circuit Breaker Market Drivers:

-

Impact of Urbanization and Infrastructure Expansion on Low-Voltage Circuit Breaker Demand

The rapid expansion of urban infrastructure and urbanization is a significant driver behind the growing demand for low-voltage circuit breakers. As cities grow, there is a rising need for electricity in residential, commercial, and industrial buildings. This surge in power demand makes low-voltage circuit breakers essential to ensure the safety and reliability of electrical systems in new developments. These breakers are critical in protecting circuits from overloads, short circuits, and electrical faults, thereby preventing damage to equipment and reducing fire risks. Increased urbanization leads to more construction of residential complexes, commercial facilities, and public infrastructure, all of which rely heavily on electrical systems. Low-voltage circuit breakers play a vital role in these settings by preventing electrical issues that can disrupt power supply or damage costly equipment. Additionally, the growing trend of smart cities, which integrate digital technologies into urban infrastructure, boosts the need for advanced, smart circuit breakers capable of managing electricity flows, ensuring grid stability, and offering real-time monitoring. The development of renewable energy sources like solar and wind also influences the demand for these breakers, as these systems require protection against fluctuating power outputs. As electrical systems become more complex, driven by automation and smart technologies, the need for efficient and reliable low-voltage circuit breakers will continue to rise, contributing to the market’s growth. This trend underscores the critical role these devices play in enhancing the safety and efficiency of modern urban electrical infrastructures.

Low Voltage Circuit Breaker Market Restraints:

-

Challenges of Integrating Smart Features in Low Voltage Circuit Breaker Market

Integrating smart features such as remote monitoring, fault detection, and IoT capabilities into low-voltage circuit breakers poses significant technical challenges, especially in older electrical infrastructures. Retrofitting these systems requires compatibility between new technologies and existing setups, often necessitating costly upgrades. The installation process becomes even more complex when considering the seamless integration of smart breakers with other network components like sensors and control units. Additionally, these advanced systems require specialized skills and training for technicians, as their complexity exceeds that of traditional circuit breakers. Without proper expertise, the safety benefits of features like real-time fault detection may not be fully realized, potentially undermining the effectiveness of the technology. Despite their advantages in safety, automation, and energy efficiency, these smart circuit breakers introduce integration difficulties and increased costs, creating barriers to widespread adoption.

Low Voltage Circuit Breaker Market Segment Analysis:

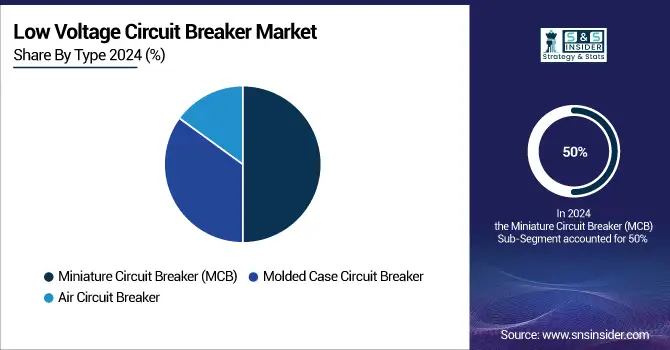

By Type

In 2024, the Miniature Circuit Breaker (MCB) segment accounted for approximately 50% of the revenue in the Low Voltage Circuit Breaker Market, highlighting its dominance. This can be attributed to its widespread application across residential, commercial, and small-scale industrial sectors. MCBs are highly valued for their ability to provide reliable protection against overloads and short circuits, ensuring operational safety and equipment longevity. Their compact design, ease of installation, and cost-effectiveness make them the preferred choice for modern electrical systems, particularly in urbanizing regions with increasing demand for residential and commercial construction. Furthermore, advancements in smart MCBs, including features like remote monitoring and IoT compatibility, have further enhanced their adoption, aligning with the global trend toward automation and energy efficiency.

By Application

In 2024, the Energy Allocation segment dominated the Low Voltage Circuit Breaker Market, capturing approximately 57% of the total revenue. This growth is driven by the increasing need for efficient power distribution in both renewable energy systems and traditional electrical grids. Energy allocation applications rely heavily on low-voltage circuit breakers to ensure the stable and safe transfer of electricity across networks, protecting systems from overloads and short circuits. The rise of renewable energy sources, such as solar and wind power, further boosts demand for these breakers, as they are essential in managing fluctuating power levels and maintaining grid stability. Additionally, the growing focus on smart grids and automated power distribution has increased the adoption of advanced circuit breakers with energy-efficient features.

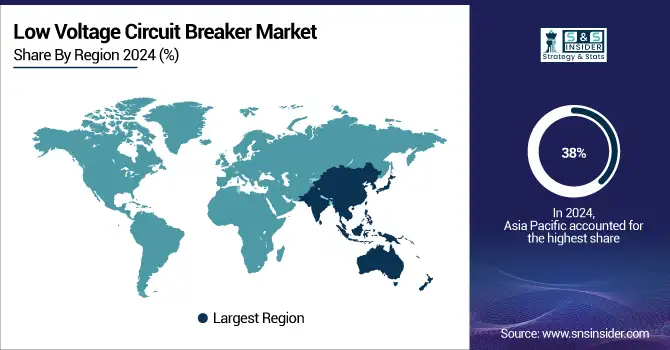

Low Voltage Circuit Breaker Market Regional Analysis:

Asia-Pacific Low Voltage Circuit Breaker Market Trends

In 2024, Asia-Pacific dominated the Low Voltage Circuit Breaker Market, capturing approximately 38% of global revenue. The region's leadership is driven by rapid industrialization, urbanization, and infrastructure development in economies like China, India, and Southeast Asia. High electricity consumption in residential, commercial, and industrial sectors has fueled the adoption of advanced safety systems. China’s investments in renewable energy projects, including solar and wind power, have amplified the demand for low-voltage circuit breakers to manage variable power levels. Similarly, India’s smart cities initiatives and power grid upgrades have boosted the market. Furthermore, the growing deployment of electric vehicle (EV) charging infrastructure across the region has reinforced demand for reliable and efficient energy distribution solutions.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Low Voltage Circuit Breaker Market Trends

North America is projected to be the fastest-growing region in the Low Voltage Circuit Breaker Market from 2024 to 2032. The region's growth is fueled by significant investments in renewable energy, smart grid projects, and advanced infrastructure. The United States, in particular, leads the market with extensive developments in renewable energy integration, such as solar and wind power, which require sophisticated low-voltage circuit breakers to manage variable loads and ensure grid stability. Canada is also contributing to the market's growth through initiatives focused on modernizing power distribution systems and expanding electric vehicle (EV) charging infrastructure. As EV adoption accelerates, the demand for reliable energy allocation solutions grows, driving the need for advanced circuit breakers. Furthermore, advancements in industrial automation and IoT-based energy management systems in the region are promoting the adoption of smart and digital low-voltage circuit breakers, ensuring enhanced operational efficiency and safety.

Europe Low Voltage Circuit Breaker Market Trends

Europe holds a significant share in the Low Voltage Circuit Breaker Market, driven by strong government support for energy efficiency and renewable energy adoption. Countries like Germany, France, and the UK are investing heavily in solar, wind, and smart grid infrastructure, requiring advanced low-voltage circuit protection solutions. The push for decarbonization and stringent regulatory standards for electrical safety further stimulates market growth. Additionally, the rise of smart homes, energy storage systems, and EV charging networks across the region is driving demand for digital and intelligent circuit breakers capable of real-time monitoring and load management.

Latin America Low Voltage Circuit Breaker Market Trends

Latin America is experiencing steady growth in the Low Voltage Circuit Breaker Market due to the modernization of power distribution networks and increasing investments in renewable energy. Brazil and Mexico are leading the region with initiatives in solar, wind, and hydroelectric power generation, which require advanced circuit protection solutions. The rise in industrial automation, EV adoption, and smart grid projects is further driving demand for intelligent low-voltage circuit breakers that offer enhanced monitoring, safety, and energy efficiency.

Middle East & Africa Low Voltage Circuit Breaker Market Trends

The Middle East & Africa (MEA) region is gradually emerging as a key market for low-voltage circuit breakers, supported by investments in infrastructure modernization and renewable energy projects. Countries like the UAE, Saudi Arabia, and South Africa are driving the deployment of smart grids and large-scale solar and wind farms. Industrial growth, urban electrification, and the expansion of commercial and residential projects are further boosting market demand.

Low Voltage Circuit Breaker Market Key Players:

-

ABB – (S200, Tmax XT, Emax 2)

-

Schneider Electric – (Masterpact, Acti9, Easy9)

-

Mitsubishi Electric Corporation – (NA Series, NF Series)

-

Siemens AG – (Sentron, 3VA, 5SY)

-

Eaton Corporation – (Series C, Power Defense)

-

Shanghai Liangxin Electrical Co., Ltd – (LX Series)

-

DELIXI – (MCB, MCCB)

-

Hangshen Electric – (MCCB, MCB)

-

CHINT Group – (MCCB, MCB)

-

Hyundai Electric and Energy Systems Co., Ltd – (HB Series)

-

Fuji Electric FA Component and Systems Co., Ltd – (DS Series, S3D)

-

Changsu Switchgear Mfg Co., Ltd. – (MCB, MCCB)

-

Hager Group – (DX3, DXL, P30)

-

People Electric Appliance Group Co., Ltd – (MCB, MCCB)

-

Panasonic Corporation – (MCBs, MCCBs)

-

Danfoss – (Circuit Breakers, Fused Switches)

-

Rockwell Automation, Inc. – (Bulletin 140M)

-

Circutor SA – (Circuit Breakers, Power Control)

-

Lovato Electric S.P.A. – (MCB, MCCB)

-

WEG Group – (MCB, MCCB, Surge Protection)

-

Carling Technologies, Inc. – (Circuit Breakers, Thermal Magnetic)

-

Britec Electric – (MCBs, MCCBs)

Key suppliers for raw materials and components in the Low Voltage Circuit Breaker Market include global manufacturers of critical components such as insulating materials, metal contacts, and electronics. Here are some prominent companies:

Raw Materials and Insulating Components

-

DuPont - Provides specialized polymers like nylon and thermoplastics for insulating components.

-

BASF - Supplies advanced engineering plastics and resins used in circuit breaker housing.

-

SABIC - Offers high-performance thermoplastics and composite materials.

Metal Contacts and Conductive Materials

-

Aurubis AG - Supplies copper and silver for high-conductivity contacts.

-

Mitsui Mining & Smelting - Provides precious and base metals for electrical contacts.

-

Jiangxi Copper Corporation - A leading provider of copper-based materials for contacts.

Electronic Components

-

Infineon Technologies - Manufactures semiconductors and smart modules for intelligent circuit breakers.

-

NXP Semiconductors - Supplies microcontrollers and sensors for smart monitoring features.

-

Analog Devices, Inc. - Develops signal processing and power management ICs for breakers.

Standard and Smart Circuit Breaker Assemblies

-

Eaton Corporation - Sources components globally for integrated low-voltage solutions.

-

ABB Ltd. - Partners with multiple suppliers to produce both traditional and smart circuit breakers.

-

Schneider Electric - Combines in-house and outsourced components for advanced breaker manufacturing.

Low Voltage Circuit Breaker Market Competitive Landscape:

ABB, established in 1988, is a global leader in electrification, offering advanced low-voltage circuit breakers designed for safety, efficiency, and smart energy management. Its portfolio includes SACE breakers like Tmax XT and Emax 2, featuring IoT integration, real-time monitoring, and energy control capabilities. ABB supports smart grids, renewable energy systems, and industrial automation, ensuring reliable circuit protection worldwide.

-

February 2024: ABB Electrification Service launched a new initiative to replace outdated circuit breakers with intelligent digital versions, boosting energy capacity by up to 20% and cutting operational costs by 30%, while extending the equipment’s lifespan by 30 years.

Schneider Electric, established in 1836, is a global leader in energy management and automation, providing advanced low-voltage circuit breakers for safe and efficient power distribution. Its portfolio includes innovative breakers like MasterPact and ComPacT, offering IoT connectivity, real-time monitoring, and energy optimization. Schneider supports smart buildings, renewable integration, and industrial automation, ensuring reliable and sustainable circuit protection worldwide.

-

March 2024: Schneider Electric introduced the MasterPacT MTZ Active, a cutting-edge low voltage air circuit breaker at Data Centre World in London. This innovative product enables real-time power monitoring, enhances energy efficiency, and accelerates sustainability goals for critical industries like data centers, offering a QR code solution for quick issue identification and resolution.

Mitsubishi Electric, established in 1921, is a leading global provider of electrical and electronic equipment, offering advanced low-voltage circuit breakers for safe and efficient power management. Its portfolio includes breakers with smart monitoring, IoT integration, and enhanced energy efficiency. Mitsubishi Electric supports industrial automation, renewable energy systems, and smart infrastructure, ensuring reliable circuit protection across diverse applications worldwide.

-

May 2024: Mitsubishi Electric has announced the establishment of a joint venture, Mitsubishi Electric FP Automation Vietnam Co., Ltd., to manufacture low-voltage circuit breakers, including air circuit breakers, starting in January 2025. The new factory in Vietnam will enhance Mitsubishi Electric's production capabilities to meet the growing demand for factory automation products across ASEAN countries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.96 Billion |

| Market Size by 2032 | USD 25.24 Billion |

| CAGR | CAGR of 9.78 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Miniature Circuit Breaker, Molded Case Circuit Breaker, Air Circuit Breaker) • By Application(Energy Allocation, Shut off Circuit, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB, Schneider Electric, Mitsubishi Electric Corporation, Siemens AG, Eaton Corporation, Shanghai Liangxin Electrical Co., Ltd, DELIXI, Hangshen Electric, CHINT Group, Hyundai Electric and Energy Systems Co., Ltd, Fuji Electric FA Component and Systems Co., Ltd, Changsu Switchgear Manufacturing Co., Ltd., Hager Group, People Electric Appliance Group Co., Ltd, Panasonic Corporation, Danfoss, Rockwell Automation, Inc., Circutor SA, Lovato Electric S.P.A., WEG Group, Carling Technologies, Inc., and Britec Electric. |