Enteral Feeding Devices Market Size Analysis:

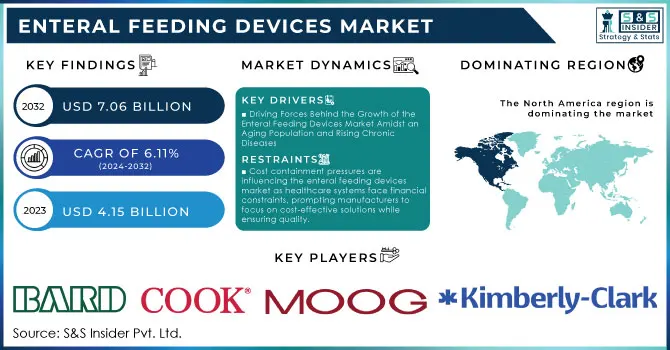

The Enteral Feeding Devices Market size was valued at USD 4.15 billion in 2023 and is expected to reach USD 7.06 billion by 2032 and grow at a CAGR of 6.11% over the forecast period 2024-2032.

To Get More Information on Enteral Feeding Devices Market - Request Sample Report

The enteral feeding devices market promises significant growth in the presence of a rising geriatric population along with an augmented prevalence of chronic diseases. These chronic diseases include diseases such as diabetes, cancers, and gastrointestinal disorders and often interfere with the body's oral consumption of foods. Consequently, enteral feeding devices prove safe and highly efficient routes to deliver appropriate nutrients while the patient can recover along with improvements in quality. It is particularly more common in geriatric patients, who are more inclined to chronic diseases and related malnutrition. The 60 years or older world population is anticipated to nearly double by 2050; thus, there is expected to be exponential growth in the demand for effective nutritional support in the care of geriatric patients.

Advanced technology in devices for enteral feeding like tri-funnel replacement G-tubes and J-tubes having reverse balloon design is propelling the market forward. Additionally, the more recent protocols, like the "Feed Early Enteral Diet Adequately for Maximum Effect" (FEED ME) utilized in U.S. surgical trauma ICUs, are also stimulating greater usage and cost subsidization of these products. Growth is also given by preterm births, wherein preterm babies, because of an immature digestive system, frequently fail to feed orally and, therefore, require enteral feeding devices for essential nutrition. Since preterm birth accounts for approximately one in ten U.S. infants born, per the CDC, the present increased demand for neonatal nutrition support is evident.

Improving the awareness of more patients and caregivers about nutritional needs is also likely to be beneficial for growth. Education from healthcare companies about this aspect focuses more on how nutrition is actually essential for managing disease and thus highlights the requirement for enteral feeding solutions. For example, Nestlé Health Science developed an online resource, in collaboration with healthcare professionals, to inform and support patients with cancer and their caregivers about nutrition and nutrition counseling. As nutritional intake has increasingly been appreciated as an important determinant of health when oral feeding is inadequate, patients and their caregivers value enteral nutrition more. These, along with increased healthcare expenditure, advanced healthcare infrastructure, and increasing surgeries globally, help strengthen the market outlook of enteral feeding devices during the following years.

|

Category |

Statistics |

Source |

|---|---|---|

|

Global Bedridden Population |

Approximately 2.6 million people are bedridden in the U.S. alone. |

National Institutes of Health (NIH) |

|

Global Enteral Feeding Patients |

An estimated 3 million patients in the U.S. require enteral nutrition annually. |

American Society for Parenteral and Enteral Nutrition (ASPEN) |

|

Chronic Disease Prevalence |

60% of older adults have at least one chronic illness that may require enteral feeding. |

World Health Organization (WHO) |

|

Geriatric Population Needing Care |

About 30% of older adults in nursing homes are on enteral feeding. |

Centers for Medicare & Medicaid Services (CMS) |

|

Malnutrition Rates in Hospitalized Patients |

20-50% of hospitalized patients experience malnutrition, increasing the need for enteral feeding. |

Journal of Parenteral and Enteral Nutrition |

|

Preterm Infants Requiring Enteral Feeding |

Approximately 80% of preterm infants require enteral feeding due to underdeveloped digestive systems. |

American Academy of Pediatrics (AAP) |

Enteral Feeding Devices Market Dynamics

Drivers

- Driving Forces Behind the Growth of the Enteral Feeding Devices Market Amidst an Aging Population and Rising Chronic Diseases

The aging world population is one of the most significant growth drivers in the enteral feeding devices market. The number of people aged 60 years and above is growing fast around the world. As reported by the United Nations, in 2021, this population was about 13.9% of the global population, and it is expected to reach 21.2% by 2050. Developed regions already have a high proportion of the elderly, while developing countries are experiencing rapid aging trends due to increased access to healthcare and improved life expectancy.

The aged population, coupled with their increasing diseases, such as cancers, neurological conditions, and gastrointestinal disorders, often interfered with normal ways of intake practices, thus increasing demands for enteral feeding devices. The fact is that almost 60 percent of WHO's reports of aged people suffering at least one chronic disease a year which increases nutritional support demands. Technological advancements are also fostering this change, as equipment for enteral feeding includes wireless connectivity and real-time monitoring, which allows the healthcare provider to assess nutrition better. In addition, equipment is becoming more comfortable and less obtrusive, potentially leading to better compliance and patient satisfaction.

Further increased awareness of the benefits of enteral nutrition accelerates the growth of the market as healthcare providers acknowledge the significance of this nutritional feeding in patients who cannot be fed normally. Even awareness and access campaigns like the national initiative by India to curb child malnutrition through the use of enteral feeding devices have expanded the market.

Restraints

-

Cost containment pressures are influencing the enteral feeding devices market as healthcare systems face financial constraints, prompting manufacturers to focus on cost-effective solutions while ensuring quality.

-

The shift to value-based healthcare models is increasing demand for enteral feeding devices that demonstrate both clinical benefits and cost-effectiveness in enhancing patient outcomes and reducing long-term healthcare expenses.

Enteral Feeding Devices Market Segmentation Analysis

By Product

In 2023, the enteral feeding pump dominated the market at 50.8%. This is because these pumps are made to provide more user-friendly and safer nutrition care. Enteral feeding is the process where food and nutrients are delivered to the stomach through a feeding tube that is connected to an electric pump. Advances in healthcare infrastructure and technology, such as compact, reliable, and easy-to-use devices, like Covidien's Kangaroo ePump, will help increase demand for enteral feeding pumps over the forecast period.

The low-profile gastrostomy device market is expected to grow with a remarkable CAGR of 5.4%. These have been developed as low-profile alternatives to traditional gastrostomy tubes and include the Passport low-profile gastrostomy devices marketed by Cook Medical and Kimberly-Clark's MIC-KEY tubes. They are widely prescribed because they can be easily hidden and applied to most patients.

By Age Group

The adult age group segment led the market with a 91.3% revenue share in 2023. According to a study published by NCBI, around 70-80% of pregnant women experience nausea and vomiting during pregnancy. In such cases, enteral nutrition can help prevent complications, such as fetal intrauterine growth restriction, preterm birth, and maternal dehydration. Enteral feeding involves delivering liquid nutrients through a tube directly into the gastrointestinal tract. Additionally, the WHO reports that approximately 45% of deaths in children under 5 are linked to undernutrition, and UNICEF estimates that about 3 million young individuals die annually from malnutrition. Common types of enteral feeding formulas for infants include nasojejunal, nasoduodenal, gastrostomy, and jejunostomy tubes.

By Indication

In 2023, the cancer care segment led the market with a 27.9% revenue share. Enteral feeding is also commonly used for critically ill patients with various other conditions, including COPD, cystic fibrosis, and respiratory disorders. For instance, Abbott's Pulmocare is an enteral feed product specifically designed for these conditions. Enteral feeding can also aid in treating inflammation, postoperative stress, and infections.

The orphan diseases segment is anticipated to experience the fastest growth rate over the coming years. According to India’s Ministry of Health and Family Welfare (MoHFW), approximately 300 million people worldwide live with rare diseases, with around 72% being genetic and roughly 70% of these genetic conditions beginning in childhood. Increased awareness of enteral nutrition and the growing number of orphan diseases are expected to drive the market’s rapid growth over the forecast period.

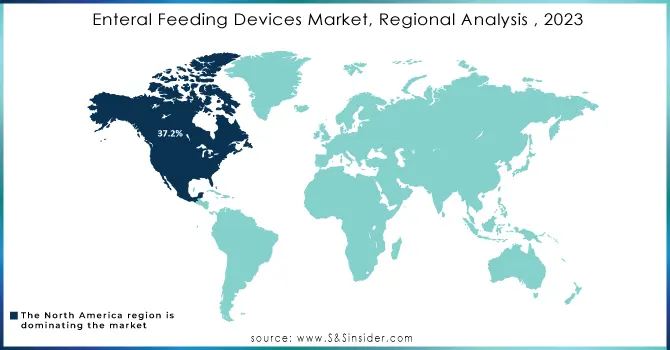

Regional Insights

In 2023, North America accounted for the largest share of the enteral feeding devices market, holding 37.2% of the total market. This growth is primarily attributed to the rising number of premature infants requiring critical care; the CDC reported that approximately 1 in 10 babies born in the U.S. in 2021 were preterm. Additionally, the region's expanding geriatric population, which is particularly vulnerable to chronic diseases leading to various disorders—including gastrointestinal, metabolic, and neurological conditions—further drives demand for enteral feeding devices.

Asia Pacific region is expected to exhibit the fastest growth in the coming years, fueled by a large patient base and an increasing elderly population. Lifestyle changes are contributing to a higher prevalence of chronic diseases such as cancer, diabetes, gastrointestinal disorders, and autoimmune diseases, which in turn is expected to escalate the demand for enteral feeding devices for effective dietary management. Countries like Japan and China, with their significant elderly demographics at heightened risk for chronic conditions, are particularly relevant in this context. Moreover, nutritional deficiencies are more prevalent among the geriatric population in Asia, further intensifying the need for enteral feeding solutions. According to the World Hunger Education Service, around 70% of all malnourished children reside in Asia, highlighting the region's critical need for improved nutritional support through enteral feeding devices.

Do You Need any Customization Research on Enteral Feeding Devices Market - Inquire Now

Enteral Feeding Devices Market Key Players

-

C.R. Bard – PEG tubes, gastrostomy tubes, jejunostomy tubes

-

Cook Medical – Passport

-

Boston Scientific Corporation – Enteral stents, feeding tubes

-

Moog Inc. – Infinity Enteral Feeding Pumps

-

Fresenius Kabi AG – Nutritional formulations, enteral feeding pumps

-

Danone Medical Nutrition – Nutritional formulas for enteral feeding

-

Kimberly-Clark – MIC-KEY

-

Abbott Nutrition – Pulmocare, Ensure, Jevity

-

B Braun Melsungen AG – B. Braun Enteroport

-

Avanos Medical, Inc. – CORTRAK 2

-

Cardinal Health – Kangaroo pumps

-

Applied Medical Technology, Inc. – Low-profile gastrostomy, jejunal tubes

-

Vygon India – Enteral feeding tubes, connectors

-

Fidmi Medical – Low-profile feeding devices

-

ALCOR Scientific – Enteral Nutrition Pump

-

Amsino International, Inc. – Enteral feeding sets, tubes

Recent Developments in the Enteral Feeding Devices Market

-

In May 2024, Danone announced the successful completion of its acquisition of Functional Formularies, a prominent whole food tube feeding company in the U.S., from Swander Pace Capital. This acquisition, aligned with Danone's Renew strategy, enhances the company's Medical Nutrition portfolio in the U.S. by expanding its range of enteral tube feeding products.

-

In September 2023, Cardinal Health launched the Kangaroo OMNI enteral feeding pump to provide patients with customized options throughout their enteral feeding journey.

-

In August 2023, Cardinal Health introduced the NTrainer System 2.0, designed to shorten NICU stays for premature and newborn infants by helping them develop the oral coordination skills needed for independent feeding while offering clinicians real-time data to track progress.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.15 billion |

| Market Size by 2032 | US$ 7.06 billion |

| CAGR | CAGR of 6.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Giving Set, Enteral Feeding Pump, Percutaneous Endoscopic Gastrostomy Device, Low Profile Gastrostomy Device, Nasogastric Tube, Gastrostomy Tube) • By Age Group (Adults, Pediatrics) • By Indication (Alzheimer’s, Nutrition Deficiency, Cancer Care, Diabetes, Chronic Kidney Diseases, Orphan Diseases, Dysphagia, Pain Management, Malabsorption/GI Disorder/Diarrhea, Others) • By End-use (Hospitals, Home Care) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Conmed Corporation, C.R. Bard, Cook Medical, Boston Scientific Corporation, Moog Inc., Fresenius Kabi AG, Danone Medical Nutrition, Kimberly-Clark, Abbott Nutrition, B Braun Melsungen AG, Avanos Medical, Inc., Cardinal Health, Applied Medical Technology, Inc., Vygon India, Fidmi Medical, ALCOR Scientific, Amsino International, Inc. |

| Key Drivers | • Driving Forces Behind the Growth of the Enteral Feeding Devices Market Amidst an Aging Population and Rising Chronic Diseases |

| Restraints | • Cost containment pressures are influencing the enteral feeding devices market as healthcare systems face financial constraints, prompting manufacturers to focus on cost-effective solutions while ensuring quality. • The shift to value-based healthcare models is increasing demand for enteral feeding devices that demonstrate both clinical benefits and cost-effectiveness in enhancing patient outcomes and reducing long-term healthcare expenses. |