Enterprise Manufacturing Intelligence Market Size

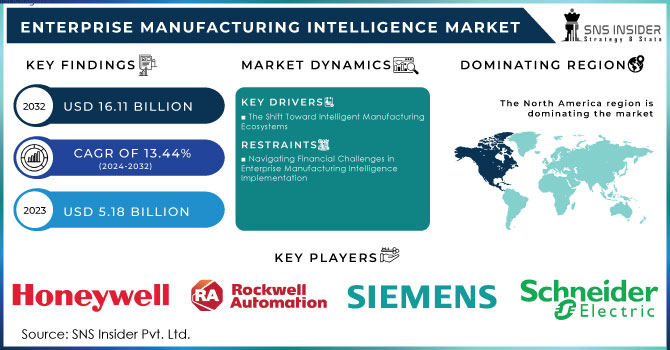

The Enterprise Manufacturing Intelligence Market Size was valued at USD 5.87 Billion in 2024 and is expected to grow to USD 16.11 Billion by 2032 and grow at a CAGR of 13.44% over the forecast period of 2025-2032

Get PDF Sample Report on Enterprise Manufacturing Intelligence Market - Request Sample Report

The Enterprise Manufacturing Intelligence (EMI) market is experiencing robust growth, fueled by the integration of advanced technologies and the shift toward Industry 5.0. As manufacturers increasingly adopt data-driven strategies, the demand for EMI solutions is surging, driven by three primary pillars: advanced data analytics, enhanced human-machine collaboration, and sustainability initiatives. A significant factor propelling this market is the growing need for real-time insights and predictive analytics, which enable manufacturers to optimize production processes and reduce operational costs. In fact, recent studies indicate that over 60% of manufacturers are prioritizing investments in digital transformation, highlighting the critical role of Enterprise Manufacturing Intelligence solutions.

As the data environment becomes more complex, driven by factors such as regulatory changes and evolving technologies, manufacturers must carefully manage compliance while leveraging data effectively. The landscape of the Enterprise Manufacturing Intelligence market is diverse, characterized by a mix of established firms and innovative startups. This competitive environment fosters continuous improvement and adaptation to meet the evolving demands of the manufacturing sector. The Enterprise Manufacturing Intelligence market is on a strong upward trajectory, fueled by the convergence of data analytics, AI, and IoT technologies within the framework of Industry 5.0. As manufacturers prioritize data-driven decision-making and embrace smart manufacturing principles, the Enterprise Manufacturing Intelligence market is set to thrive, presenting substantial opportunities for growth and innovation. by strategically investing in solutions and addressing inherent challenges, manufacturers can position themselves for long-term success in this dynamic landscape.

Key Enterprise Manufacturing Intelligence Market Trends:

-

Growing adoption of Industry 4.0 technologies such as IoT, AI, and data analytics to enhance efficiency.

-

Rising need for real-time connectivity and data analysis to optimize production processes and resource allocation.

-

Increasing demand for predictive maintenance to reduce unplanned downtime and cut operational costs.

-

Productivity gains of 20–30% from digital transformation initiatives encouraging wider EMI adoption.

-

Pressure on manufacturers to remain agile, ensure compliance, and achieve continuous improvement in competitive markets

Enterprise Manufacturing Intelligence Market Growth Drivers:

-

The Shift Toward Intelligent Manufacturing Ecosystems

The rise of smart manufacturing, driven by the adoption of Industry 4.0, is fundamentally transforming the landscape of manufacturing and significantly impacting the Enterprise Manufacturing Intelligence (EMI) market. Industry 4.0 embodies the integration of advanced technologies such as data analytics, the Internet of Things (IoT), and artificial intelligence (AI) to create interconnected systems that enhance operational efficiency and productivity. This evolution compels manufacturers to harness these technologies to streamline operations, reduce costs, and foster innovation. Manufacturing is the seamless connectivity between devices and systems, which facilitates the real-time collection and analysis of vast data volumes. This connectivity enables manufacturers to monitor equipment performance, optimize resource allocation, and track production processes effectively. EMI systems are crucial within this ecosystem, serving as the analytical backbone that transforms raw data into actionable insights. by leveraging Enterprise Manufacturing Intelligence solutions, manufacturers can pinpoint inefficiencies, minimize waste, and improve overall equipment effectiveness (OEE).

The rise of smart manufacturing, fueled by the digital transformation initiatives of Industry 4.0, is reshaping the manufacturing sector. Enterprise Manufacturing Intelligence systems are at the forefront of this evolution, empowering manufacturers to leverage data-driven insights for improved decision-making, operational excellence, and increased customer value. by embracing smart manufacturing, companies can position themselves for sustained success in an increasingly competitive environment.

Enterprise Manufacturing Intelligence Market Restraints:

-

Navigating Financial Challenges in Enterprise Manufacturing Intelligence Implementation

High implementation costs pose a formidable barrier to the widespread adoption of Enterprise Manufacturing Intelligence (EMI) systems. The initial investment required for these advanced solutions can be substantial, encompassing expenses such as software licenses, hardware acquisition, and essential infrastructure upgrades. For many manufacturers, particularly small and medium-sized enterprises (SMEs), allocating the necessary budget for EMI system integration is a significant challenge.

With limited financial resources and tighter profit margins, SMEs often find it difficult to justify large capital expenditures on new technologies. Reports indicate that the cost of implementing advanced manufacturing technologies, including EMI systems, can range from USD 1 million to USD 5 million, depending on operational complexity. Furthermore, surveys reveal that approximately 46% of manufacturing executives view budget constraints as a substantial barrier to adopting new technologies. Consequently, only 25% of SMEs have embraced advanced manufacturing technologies due to financial limitations. While the potential return on investment (ROI) for EMI systems can be significant—averaging 20-30% within the first three years—the high upfront costs deter many manufacturers from pursuing these solutions. Additionally, ongoing maintenance costs can account for 15-25% of the initial investment annually, further straining the budgets of SMEs. Addressing these financial barriers is crucial for enhancing the competitiveness and innovation potential of the manufacturing sector.

Enterprise Manufacturing Intelligence Market Segment Analysis:

By Deployment Type

Based on Deployment Type, in 2024, embedded deployment solutions dominated the market, capturing 74% of the total market share. Embedded EMI solutions are seamlessly integrated into manufacturing systems and equipment, facilitating real-time data collection and analysis. This deployment type offers numerous benefits, including continuous performance monitoring, which allows manufacturers to quickly identify and address issues, thereby improving operational efficiency. Additionally, embedded solutions significantly reduce latency, enabling rapid data-driven decision-making crucial in high-paced manufacturing settings. They also bolster operational resilience by delivering actionable insights directly at the source, empowering operators to proactively tackle production abnormalities. While the initial investment for embedded systems may be considerable, they often lead to long-term cost savings by minimizing downtime and optimizing resource use.

By Offering

In 2024, the software segment emerged as the dominant player in the Enterprise Manufacturing Intelligence (EMI) market, capturing 65% of total revenue. EMI software solutions encompass various applications that collect, analyze, and visualize data from manufacturing processes, enabling manufacturers to leverage data analytics for better decision-making. Key features include advanced data analytics, which uncovers trends and generates actionable insights to drive operational efficiency, as well as real-time monitoring that allows for the swift identification and resolution of potential issues. Seamless integration with existing manufacturing systems and IoT devices enhances productivity, while user-friendly interfaces, such as intuitive dashboards, facilitate data interpretation. Several notable company launches in 2024 have bolstered this segment, including an advanced analytics platform that integrates artificial intelligence (AI) and machine learning (ML) for improved predictive analytics, a cloud-based Enterprise Manufacturing Intelligence solution designed for streamlined data integration across production lines, and new software focused on IoT integration, enabling seamless data collection and analysis.

Enterprise Manufacturing Intelligence Market Regional Analysis:

North America Enterprise Manufacturing Intelligence Market Insights

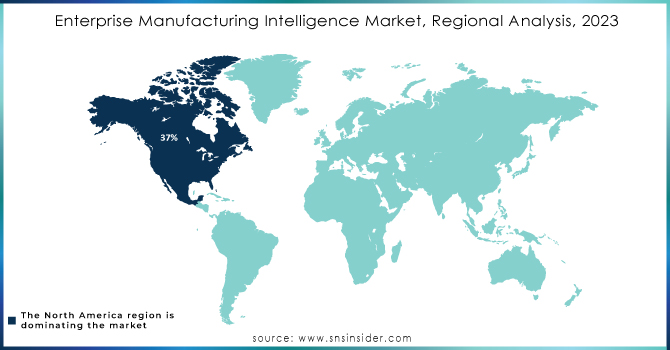

In 2024, North America solidified its position as the leading region in the Enterprise Manufacturing Intelligence (EMI) market, accounting for 37% of the total market share. This dominance can be attributed to several driving factors. The region is a hub of technological innovation, with a robust infrastructure that supports the development and implementation of advanced manufacturing technologies. Companies are increasingly adopting data analytics, IoT, and artificial intelligence (AI) to improve operational efficiency, thereby boosting demand for EMI solutions. Additionally, North America's diverse manufacturing sector spanning automotive, aerospace, pharmaceuticals, and consumer goods faces constant pressure to optimize operations and reduce costs, making EMI solutions vital for competitiveness. Organizations are also prioritizing digital transformation, leading to significant investments in Enterprise Manufacturing Intelligence systems that facilitate real-time data collection and analysis, enhancing decision-making and operational resilience. Supportive government initiatives promoting advanced manufacturing practices further stimulate market growth, along with funding opportunities for technology adoption.

Asia Pacific Enterprise Manufacturing Intelligence Market Insights

In 2024, the Asia Pacific region distinguished itself as the fastest-growing market for Enterprise Manufacturing Intelligence (EMI), driven by rapid industrialization, technological advancements, and a strong emphasis on digital transformation. This impressive growth is underpinned by several crucial factors that facilitate the adoption of EMI solutions. Countries such as China, India, and Japan are leading the way in technological innovation, integrating Artificial Intelligence (AI), Internet of Things (IoT), and big data analytics into their manufacturing processes, thereby enhancing operational efficiency and encouraging the widespread deployment of EMI systems across diverse sectors. The region's manufacturing landscape is broad, encompassing industries like electronics, automotive, pharmaceuticals, and textiles. As manufacturers strive to optimize production and minimize costs, the demand for EMI solutions has surged, enabling improved data analysis and informed decision-making.

Europe Enterprise Manufacturing Intelligence Market Insights

The Europe EMI market is growing due to strong adoption of Industry 4.0, advanced automation, and stringent regulatory standards. Manufacturers leverage EMI solutions for real-time monitoring, predictive maintenance, and compliance. With rising investments in smart factories and sustainability initiatives, EMI adoption is accelerating across automotive, aerospace, and pharmaceutical industries to enhance productivity, efficiency, and competitiveness

Latin America (LATAM) and Middle East & Africa (MEA) Enterprise Manufacturing Intelligence Market Insights

The LATAM and MEA EMI markets are emerging, supported by industrial digitalization, government initiatives, and rising demand for operational efficiency. Growing investments in oil & gas, energy, and manufacturing sectors drive EMI adoption for predictive maintenance and resource optimization. Expanding smart factory projects and digital transformation efforts create significant opportunities, enabling businesses to improve productivity and global competitiveness

Get Customized Report as per your Business Requirement - Request For Customized Report

Enterprise Manufacturing Intelligence Market Key Players:

Some of the Enterprise Manufacturing Intelligence Market Companies are

-

Honeywell International Inc. (Honeywell Forge for Industrial)

-

Rockwell Automation Inc. (FactoryTalk Analytics)

-

Schneider Electric SE (AVEVA Enterprise Manufacturing Intelligence)

-

Siemens AG (Siemens Opcenter)

-

Aspen Technology Inc. (Aspen InfoPlus.21)

-

Dassault Systèmes SA (DELMIA Apriso)

-

Emerson Electric Co. (Syncade Manufacturing Execution System)

-

General Electric Co. (Proficy Plant Applications)

-

SAP SE (SAP Manufacturing Integration and Intelligence)

-

Yokogawa Electric Corporation (Exaquantum EMI)

-

ABB Ltd. (ABB Ability Manufacturing Operations Management)

-

Oracle Corporation (Oracle Manufacturing Cloud)

-

PTC Inc. (ThingWorx Industrial Innovation Platform)

-

Honeywell Process Solutions (Experion Process Knowledge System)

-

Mitsubishi Electric Corporation (MAPS SCADA EMI Solution)

-

Schneider Electric Software (Wonderware EMI)

-

Hitachi Ltd. (Hitachi Lumada Manufacturing Insights)

-

Tata Consultancy Services Ltd. (TCS Clever Energy EMI)

-

Siemens Digital Industries Software (Teamcenter Manufacturing)

-

IOTech Systems Limited (Edge Xpert for EMI)

Competitive Landscape for Enterprise Manufacturing Intelligence Market:

Siemens, through its Digital Industries Software division, plays a pivotal role in the Enterprise Manufacturing Intelligence (EMI) market with solutions like Siemens Opcenter and Teamcenter Manufacturing. The company focuses on integrating IoT, analytics, and automation to enable real-time data insights, optimize operations, and support manufacturers in achieving Industry 4.0-driven efficiency.

-

On September 30, 2024, Siemens highlighted the role of artificial intelligence in creating sustainable digital enterprises. The company discussed how AI can drive efficiency and resilience in manufacturing processes, enabling businesses to reduce waste and optimize resource use. by integrating AI technologies, manufacturers can enhance decision-making and support sustainability goals, illustrating a significant shift toward environmentally responsible practices in the industry.

| Report Attributes | Details |

| Market Size in 2024 | USD 5.87 Billion |

| Market Size by 2032 | USD 16.11 Billion |

| CAGR | CAGR of 13.44% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Embedded, Standalone) • By Offering (Software, Services) • By End-use Industry (Process Industry, Discrete Industry) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Aspen Technology Inc., Dassault Systèmes SA, Emerson Electric Co., General Electric Co., SAP SE, Yokogawa Electric Corporation, ABB Ltd., Oracle Corporation, PTC Inc., Honeywell Process Solutions, Mitsubishi Electric Corporation, Schneider Electric Software, Hitachi Ltd., Tata Consultancy Services Ltd., Siemens Digital Industries Software, IOTech Systems Limited. |