Digital Subscriber Line DSL Chipsets Market Size & Growth:

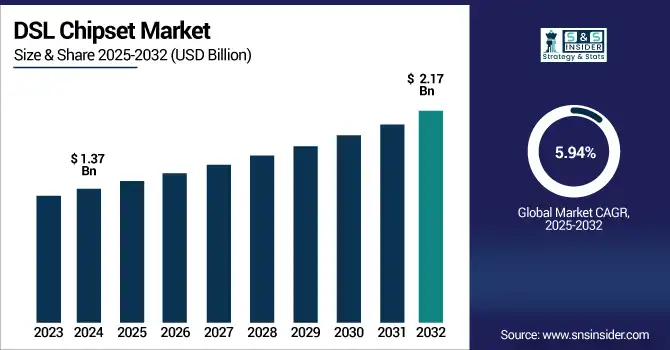

The Digital Subscriber Line (DSL) Chipsets Market Size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.17 billion by 2032 and grow at a CAGR of 5.94% over the forecast period 2025-2032.

To Get more information on DSL Chipset Market - Request Free Sample Report

The Global Market for DSL (Digital Subscriber Line) chipsets is transforming steadily as a function of broadband demand in the developing areas and the maintenance of legacy copper infrastructure. The report offers a detailed analysis of the industry across types, applications, technologies, end-users, and regions. Building on mature and advanced DSL standards such as VDSL and G.fast DSL can provide fast and economical broadband access in areas where full-fiber deployment may remain economically or logistically challenging. The market is transforming steadily due to broadband demand in developing areas and reliance on legacy copper infrastructure. Building on advanced standards like VDSL and G.fast, DSL offers fast, economical access where fiber is impractical. A key market trend is the growing use of DSL in hybrid networks to reduce fiber deployment costs.

For instace, Over 70% of global broadband infrastructure still utilizes copper-based last-mile connections, making DSL technologies highly relevant in hybrid networks.

The U.S. DSL Chipset Market size was USD 0.21 billion in 2024 and is expected to reach USD 0.31 billion by 2032, growing at a CAGR of 5.01% over the forecast period of 2025–2032.

The U.S. market continues to grow as DSL (Digital Subscriber Line) has remained in use in low-density rural and suburban regions which cannot be served economically by fiber-based infrastructure. This trend is further being driven by ongoing investment in broadband improvement and national programs to ensure digital inclusion. This will take forward existing initiatives of its promote advanced DSL technologies that increase network performance and capacity by providing a means for widespread and scaleable deployment as an alternative to full fibre leaves many of the connectivity and accessibility issues facing a large part of the country unaddressed.

For Instance, over 30 million U.S. households still rely on DSL lines, particularly in regions where fiber rollouts are unfeasible or delayed.

DSL Chipset Market Dynamics:

Key Drivers:

-

Cost Efficient DSL Chipsets Enhancing Legacy Copper and Enabling Gigabit Performance

Copper infrastructure replacement or upgrade is an expensive and prolonged process. With DSL chipsets, telecom operators can make the best of both worlds by prolonging their existing infrastructure and at the same time enhancing its performance. Gigabit-Level performance over copper enabled with technologies such as G.fast and DMT, a natural for urban apartments and multi-dwelling units DSL chipsets provide a cost-effective means for ISPs to satisfy demand for better service levels without a complete transition to fiber. The cost advantage is a major driver for market growth in the economy which are either budget constrained or are in transition phase.

Over 60% of urban dwellings in developing nations are in multi-dwelling units (MDUs), making DSL ideal for rapid broadband upgrades.

G.fast delivers up to 1 Gbps speeds over copper lines shorter than 100 meters, ideal for urban apartments and MDUs.

Restraints:

-

Physical Limitations of DSL Impact Its Scalability and Competitive Reach.

While DSL technologies have seen many advances, attenuation over longer copper lines is still a fundamental limitation. However, as you go farther away from the central office, the speed of DSL is drastically reduced. Since loop lengths are often longer in rural or low-density areas, this constraint makes DSL less available in such regions. And even G.fast needs extremely short copper loops for any of its theoretical speeds to be realized. As a result, these physical constraints affect the degree to which DSL can compete with fiber or wireless which explains why DSL loses in large scale broadband strategies.

Opportunities:

-

DSL Chipsets Powering Rural Connectivity and Government-Led Digital Inclusion Programs

Most developing countries have massive copper legacy networks and little fiber. These networks are also the primary means of affordable broadband access, and thus DSL chipsets provide an important bridge to high-speed Internet access without the need for extensive and costly infrastructure upgrades. Low-cost technologies are being piloted to bring rural internet connectivity, mainly through digital connectivity programs facilitated by governments. DSL chipsets are perfect for these type of initiatives, particularly those which support G.fast and VDSL. This creates a wide-open, untapped market for chipset vendors like Broadcom and Qualcomm that primarily target ISPs, telecom operators, and public connectivity rollouts.

Globally, over 70% of broadband connections in developing countries still rely on copper-based infrastructure.

Deploying DSL over existing copper costs up to 70% less than laying new fiber, making it ideal for government-funded rural rollouts

Challenges:

-

Price Sensitivity and Profitability Challenges in the Competitive DSL Chipset Landscape.

This is because the market for DSL chipsets is highly price sensitive across emerging economies. The fierce competition between manufacturers lowers prices, but often at the cost of profitability. Also with the DSL chipsets increasingly becoming standardized the differences based on performance are fading. Vendors need to hit a cost per watt but also have cutting-edge features: power efficiency, hybrid support, optimization for thermal. As the world broadband ecosystem optimizes for cost and consolidates, offering competitive, best-in-class solutions, at a profit, is a continuing challenge.

Digital Subscriber Line Chipsets Market Segmentation Analysis:

By Type

VDSL Type dominated the market share with 47.5% in 2024 due to its speed-to-distance performance efficiency and flexible installation services available over existing copper infrastructure. Still Nielsen for residential and small business broadband services. Broadcom Inc. is the leading supplier of VDSL chipsets, providing high performance, scalable solutions to major North American, European and Asian telecom operators where VDSL is still the technology of choice.

G.fast is anticipated to witness the fastest growth, at a 7.02% CAGR from 2024 to 2032, due to a capability to provide near-gigabit rates over relatively short runs of copper line. It's super popular for urban apartments, and for fiber-to-the-building setups. G.fast chipsets from companies like Sckipio Technologies are allowing telecom operators to achieve gigabit levels of internet speeds on a neighborhood basis; catering areas like high-density urban zones without requiring an expensive full fiber rollout.

By Application

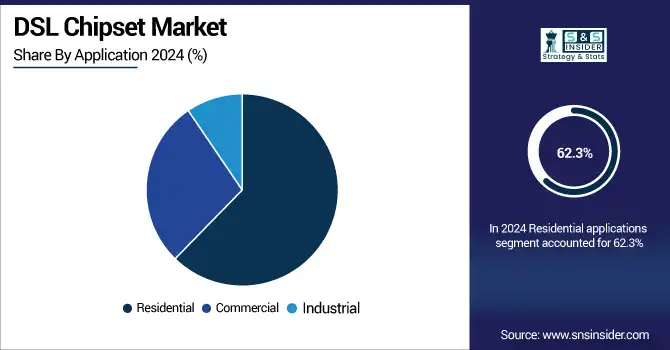

Residential applications dominates the DSL Chipset industry by 62.3% market share in 2024. In areas where fiber connections are not available, DSL is considered a comparatively cheaper internet option for suburban and rural residences. Consumer-grade DSL chipsets supplied by vendors like MediaTek Inc. have been implanted in millions of home routers around the world. By providing a competitive performance for streaming, videoconferencing, and other home internet applications, over this time, these chipsets have been instrumental in maintaining the in-home position of DSL.

The industrial segment is anticipated to grow with the highest CAGR of 8.37% from 2025 to 2032, owing to industry 4.0, remote diagnostics, and machine-to-machine connectivity. MaxLinear also has rugged industrial DSL chipsets with optimized performance for high-speed, low-latency links at factories and caravan sites. DSL is an excellent low-cost, high-value replacement option to wireless or fiber in rugged conditions, where continuous uptime is a must.

By Technology

Discrete Multitone Modulation (DMT) accounted for the largest market share of 34.2% in 2024 and is the basis of the ADSL and VDSL standard. This guarantees high flexibility with high efficiency within a wide frequency range. Infineon Technologies AG is the company's largest provider of DSL chipsets (DMT-enabled chipsets have gained favor among OEMs and ISPs because of their availability, resistance to noise and versatility for all types of deployment scenarios).

Multi-Carrier Modulation witnessed a strong growth outlook at a growth rate of 7.17% between 2025 to 2032, due to its superior spectral efficiency and adaptability. This enables better data throughput and performance in a noisy environment. Multi-carrier modulation, which Qualcomm Technologies will implement in its next generation of advanced DSL chipsets, is also a critical enabler for flexible broadband deployments in hybrid access networks that combine several technologies to provide best possible performance both through the set top box and for fixed modem terminals (FTTs) within the home.

By End-User

Residential segment dominates the DSL Chipset Market by 41.84% of market share. This is mainly because the internet can reach rural and semi-urban locations primarily at lower costs. STMicroelectronics DSL chipsets stimulate telecom operators to facilitate millions of households with home modems and gateways without large local infrastructure renovations. Globally, sustained DSL subscriptions amongst residential users (who continue to move the market volume)

Educational institutions will experience the highest CAGR of 8.19% for the period ranging from 2025 to 2032 due to the expansion of digital learning platforms and internet needs across the campus. Smart classrooms, online platforms, and administrative systems in institutions need stable connectivity. Realtek Semiconductor Corp., the most widely recognized chipset vendor in the world which provides a reliable, low-cost chipset for educational broadband networks, and driving the continued use of DSL as an educational broadband technology, specifically where fiber upgrades are economically and technically difficult due to budget constraints or legacy infrastructure.

Digital Subscriber Line (DSL) Chipsets Market Regional Outlook:

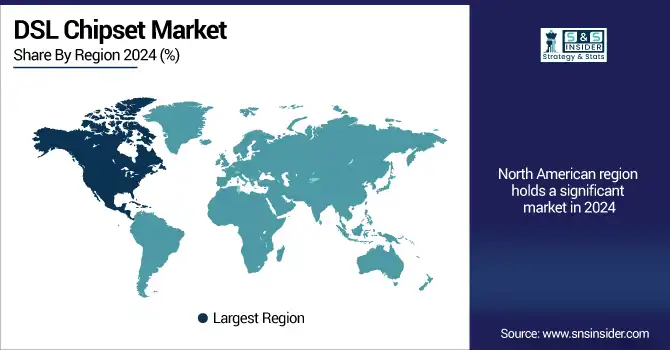

North America holds a significant share in the DSL Chipset Market, driven by steady demand in rural and suburban areas where fiber deployment is limited. The U.S. leads the region with ongoing broadband upgrade initiatives. Continued reliance on copper infrastructure and government support for digital inclusion are contributing to the sustained adoption of DSL technologies across North America.

-

The U.S. dominates the North American DSL Chipset Market due to widespread suburban and rural DSL usage, slow fiber expansion in certain areas, and active government funding for broadband infrastructure, especially in underserved and remote regions.

Asia Pacific dominated the DSL Chipset Market with a 33.98% share in 2024 and is expected to grow at the fastest CAGR of 6.58% through 2032. High reliance on legacy copper infrastructure in countries like China and India, along with government-led rural connectivity and broadband expansion initiatives, is driving strong adoption and continued growth of DSL technologies across the region.

-

China leads the Asia Pacific DSL Chipset Market owing to its vast copper network base, high population density, and strong government-backed broadband deployment programs targeting both urban and rural connectivity enhancements.

Europe holds a considerable share in the DSL Chipset Market, supported by well-established telecom infrastructure and widespread DSL adoption across residential and commercial sectors. Countries like Germany, the UK, and France continue to rely on VDSL and hybrid solutions. Additionally, regulatory support for affordable broadband and gradual transitions to fiber networks are sustaining demand for DSL technologies across the region.

-

Germany dominates the European DSL Chipset Market due to its widespread VDSL deployment, strong reliance on existing copper networks, and gradual fiber transition. Telecom providers continue investing in DSL upgrades, making Germany the region’s largest contributor to DSL chipset demand.

The DSL Chipset Market in the Middle East & Africa is led by the UAE, supported by advanced telecom networks and smart city initiatives. In Latin America, Brazil dominates due to its large rural population, continued reliance on DSL infrastructure, and national broadband programs aimed at expanding internet access.

Get Customized Report as per Your Business Requirement - Enquiry Now

Digital Subscriber Line (DSL) Chipsets Companies are:

Major Key Players in DSL Chipset Market are Broadcom Inc., MediaTek Inc., Qualcomm Technologies, Inc., STMicroelectronics, Intel Corporation, Infineon Technologies AG, MaxLinear, Inc., Realtek Semiconductor Corp., Sckipio Technologies, Lantiq and others.

Recent Developments:

-

In June 2025, Broadcom released the BCM65550, its next-gen G.fast vector processor designed for high-density deployments. It supports crosstalk cancellation across up to 192 twisted-pair copper ports, enabling seamless hybrid G.fast and VDSL operations without compromising performance.

-

In February 2025, MediaTek unveiled the M90 5G‑Advanced modem, delivering up to 12 Gbps downlink speeds with enhanced uplink performance (+20%). While focused on wireless, its efficient, AI-enhanced architecture supports hybrid broadband applications, including DSL-fiber convergence in gateway devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.37 Billion |

| Market Size by 2032 | USD 2.17 Billion |

| CAGR | CAGR of 5.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ADSL Type, VDSL Type, G.fast Type) • By Application (Residential, Commercial, Industrial) • By Technology (Frequency Division Multiplexing (FDM), Discrete Multitone Modulation (DMT), Multi-Carrier Modulation, Packet Switching, Circuit Switching) • By End-Users (Small and Medium Enterprises (SMEs), Large Enterprises, Residential Users, Educational Institutions, Government Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Broadcom Inc., MediaTek Inc., Qualcomm Technologies, Inc., STMicroelectronics, Intel Corporation, Infineon Technologies AG, MaxLinear, Inc., Realtek Semiconductor Corp., Sckipio Technologies, Lantiq. |