Entertainment Robots Market Size & Trends:

The Entertainment Robots Market size was valued at USD 3.16 billion in 2024 and is expected to reach USD 15.25 billion by 2032 and grow at a CAGR of 21.79% over the forecast period of 2025-2032.

The global market report provides an in-depth entertainment robots market analysis, in which the market is classified on the basis of type, application, material type, end-user and region. That offers insights into the current trends, technological innovations, and competitive strategies contributing to growth. Covering market dynamics, emerging technologies, and business models, the report enables stakeholders react to changing trends, identify new opportunities, and make informed decisions in a rapidly developing and fast maturing market for entertainment robotics.

To Get more information on Entertainment Robots Market - Request Free Sample Report

For instance, over 65% of entertainment robot developers release at least one new model or feature update annually.

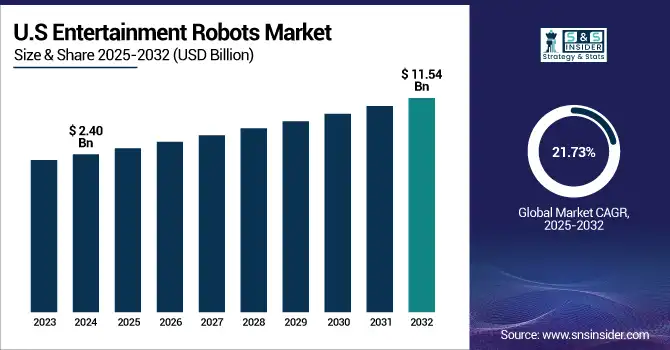

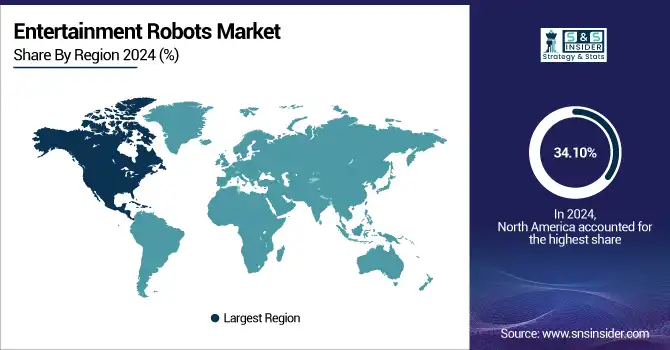

The U.S. Entertainment Robots Market size was USD 2.40 billion in 2024 and is expected to reach USD 11.54 billion by 2032, growing at a CAGR of 21.73% over the forecast period of 2025–2032.

The U.S. market is thriving as smart robotic toys move towards early adoption, increasing investment in AI-enabled learning platforms across schools and colleges, and a strong demand from educational and media sectors. Additional factors contributing to the rapid development of robotics technology sales include the evolution in robotics technology, increased consumer awareness of robots and leading robotics manufacturers. All these factors in turn put the U.S. in an important role in fuelling global progress across the entertainment robots market.

For instance, 61% of U.S. parents are familiar with interactive robotic toys that support learning and social development.

Entertainment Robots Market Dynamics:

Key Drivers:

-

Rising Demand for Educational and Interactive Robots in Classrooms and Homes Globally

Market growth is driven by the increasing need for educational and interactive robots in classrooms and homes globally. These robots are engaging, interactive, and teach STEM, making these products perfect for formal or informal settings. Many schools and parents are already investing in programmable robots that aid at home or at school, in teaching kids coding, logical thinking, and problem solving. With increasing adoption of tech-based tools by educational institutions, the sales of school-based robots to provide official curriculum and gamified learning is rapidly rising, contributing to the overall global entertainment robots market growth.

For instance, 58% of AI-powered robots used in education came preloaded with modules aligned to national or state-specific curricula.

Restraints:

-

High Costs of Development, Customization, and Maintenance of Entertainment Robots

Entertainment robots suffer from major constraints in mass adoption due to high costs of development, customization, and longevity of robot maintenance. They incorporate advanced hardware including high-resolution cameras, AI chips, complex sensors and moving parts, which skyrockets the cost of production and retail price. Such costs are unmanageable by many educational institutions and low-to-mid income consumers. It also incurs recurring costs as for the maintenance and upgrades you will need the technical know-how. Due to these cost considerations, small businesses and schools in emerging economies are dissuaded from mass adoption of entertainment robots, limiting growth potential in price-sensitive markets.

Opportunities:

-

Integration of Entertainment Robots in Therapy, Elderly Care, and Emotional Wellness Applications

Growth Opportunities – Potential for the integration of entertainment robots for use in therapy, elder care, and emotional wellness applications. Growing concern about mental health and aging societies have made it possible for the use of companion robots in healthcare settings for alleviating loneliness, anxiety, and stress. This includes interactive robots that provide medication reminders and emotional support, which are mainly found in assisted living centers. Being non-traditional is the approach here but the primary feature that creates the difference lies in their ability to converse with users, engage and recognize facial expressions, and provide feedback based on your custom inputs in a personalized manner making them a potent tool to be used in non-traditional care. Manufacturers now have profitable new options beyond traditional toy and learning categories.

For instance, interactive robots used in therapy for children with ASD improved social response and engagement by 30%.

Challenges:

-

Ensuring Data Privacy and Child Safety in AI-Powered Entertainment Robots

Data protection and the safety of children when using entertainment robots based on artificial intelligence is another contentious issue. To customize interactions with the user, these bots sometimes capture voice, facial expressions, and/or behaviors, which creates additional attack threats in terms of information processing. The upsurge in surveillance, unauthorized access to data and malady of personal information understandably makes parents, educators and regulators uneasy. And this means abiding by child protection laws such as COPPA and GDPR. A single security breach could result in reputational and legal consequences, forcing companies to spend a great deal of money to create solid, privacy-first system architectures.

Entertainment Robots Market Segmentation Analysis:

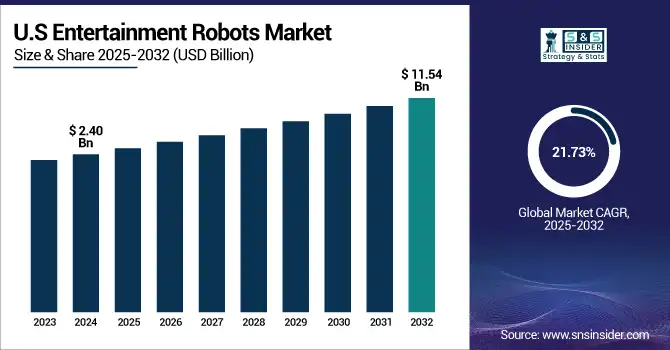

By Product

In 2024, Robot Toys accounted for a 44.10% revenue share of the Entertainment Robots Market. Robot toys lead the market due to their broad customer base which mainly includes children and young adults. These have some aspects of interaction as a voice to recognize, a mirror to take a facial expression with a learning ability. Innovation early on was driven by companies such as WowWee Group Limited with products such as robot pets and interactive toys. Due to their rising demand in the market place, robotic toys have stayed strong in the global market, due to the popularity of the holiday and festivities.

Educational Robots is expected to have the fastest growth during 2024 to 2032, with a CAGR of 22.55% during this period. The rising demand for interactive digital learning tools and the natural inclination of many edtech curriculums to be STEM focused play to the strengths of educational robots. Makeblock Co., Ltd. : Empowering the World with AI Coding Robots and DIY Learning Kits. While the heart of industries such as entertainment robots are largely autonomous and interactive systems, which are also being used as educational level, schools, and parents are also using these tools to promote personalized learning, making this type of product segment in the entertainment robots industry the fastest growing.

By Application

In 2024, the largest Entertainment Robots Market share, 27.80%, was accounted for by Water and Wastewater Treatment. Although not typical applications for entertainment robots, installations are also appearing at water-themed attractions and fountains as a niche application. Shows and theme parks employ robotic systems that utilize synchronized illumination, movement, and music Compounding with this is the rise in popularity of robotic entertainment in water features such as fountain displays by firms such as Fountain People, Inc. They add up to the significant gross receipts from those high-engagement setups in public venues, so it's sort of an under-reported but solidly zealous performer for this category.

Food and Beverage Processing is anticipated to be the fastest-growing segment, growing at a CAGR of 23.55% during 2024 to 2032. These entertainment robots are used in interactive restaurants and cafes more and more frequently. Humanoids are in the service and performing routines that upraise customer experience. Keenon Robotics Co., Ltd has been a trailblazer in robotic wait staff solutions, especially in the Asia region. The use of robots will also start to spike in food and beverage settings in general, making this segment the fastest-growing application area, as experiential dining gathers momentum globally.

By Material Type

In 2024, Stainless Steel accounted for the highest revenue share of 31.80%. The most common material usage is stainless steel as it is less prone to corrosion and is quite durable while ensuring a look and feel good for entertainers that face the public. That property makes it ideal for things such as structural parts and safety-critical designs. Boston Dynamics uses stainless steel for its quick and humanoid robots for interactive exhibitions and in live performances. The hygienic and durable nature of this material helps to keep it among the top in the industry.

The Composite Materials is anticipated to have the highest growth rate during the forecast period of 2024 to 2032, at a CAGR of 24.19%. Composite materials are light, high-stiffness, and energy-efficient making it a perfect choice for soft entertainment robots where mobility is a key requirement. They are widely utilized in next-generation robots that require quick responsiveness and long battery life. In humanoid robots by UBTECH Robotics Corp., composite designs provide a solution for lightweight robots to move freely. Demand for flexible and efficient designs will continue to push the industry to innovate with materials, and composites are well positioned to take the lead in this area.

By End-User

The education sector accounted for the highest revenue share of 38.20% in 2024, and is projected to grow at the highest CAGR of 22.58% in the coming years during 2024 to 2032. The sector largest utilizing robots for interactive, hands-on and STEM-based learning is still education, which also continues to top the list. Cognitive development and adaptive teaching — These robots assist with cognitive development and adaptive teaching. LEGO Education comes in here with its coding and robotics kits that are used in schools globally. Decreasing digital education programs and government support will lead to this end-user segment remain dominate in the market.

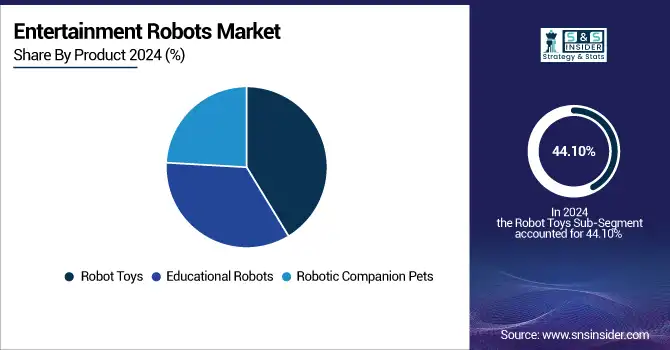

Entertainment Robots Market Regional Outlook:

North America market accounted for the highest market revenue at 34.10% in 2024. The supremacy of North America can be attributed to the early adoption of technology, the presence of the largest robotics manufacturers and high consumer expenditure on smart devices in the region. This is especially true of the U.S., where investments in AI and robotics are massive, the government is funding educational technology, and old media has already been transformed by automation. These factors serve as a catalyst for making North America the dominant region in the entertainment robots space.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. leads due to early adoption of robotic technologies, strong R&D infrastructure, high consumer spending on tech toys, and key players including Boston Dynamics and WowWee, fostering innovation in entertainment robots across educational and commercial sectors.

Asia Pacific is anticipated to grow at the fastest rate CAGR of 22.86% over 2024 to 2032, due to high economic growth, rapid urbanizations, and increase in disposable income which will lead to demand for robotics in education and entertainment Japan, South Korea and China are not only leading consumers of, but also leading producers of, entertainment robots. Government programs for AI-integrated education and increasing popularity of robot cafés, theaters, and exhibitions are considerably driving up regional adoption rates.

-

China dominates owing to extensive government support for robotics, large-scale manufacturing capabilities, and increasing integration of AI in consumer products. Companies including UBTECH Robotics and Makeblock drive growth through affordable, innovative entertainment robots for both educational and domestic use.

Europe is emerging as a significant player in the entertainment robots industry, driven by increasing investments in educational technology, strong emphasis on STEM learning, and the presence of innovative robotics startups. Countries including Germany, France, and the UK are adopting AI-integrated entertainment robots across schools, museums, and retail. Supportive regulatory frameworks and digitalization efforts further enhance market potential across the region.

-

Germany dominates Europe’s entertainment robots market due to its advanced robotics industry, strong R&D investments, and early adoption in education and retail sectors. Government support and technological innovation further boost its leadership across regional and global entertainment robotics deployments.

The UAE dominates the Middle East & Africa entertainment robots market due to its advanced digital infrastructure, AI investments, and focus on smart city development. In Latin America, Brazil leads with a strong consumer base, expanding tech landscape, and growing adoption of robotics in educational and media applications.

Entertainment Robots Companies are:

Major Key Players in Entertainment Robots Market are Sony Corporation, Hasbro, Inc., Ubtech Robotics Corp., SoftBank Robotics, Honda Motor Co., Ltd., WOWWEE Group Limited, Lego Group, Sphero, Inc., Blue Frog Robotics, Anki, Robotis Co., Ltd., Furhat Robotics, Miko (Emotix), Reach Robotics, Modular Robotics, Digital Dream Labs, ROOBO, Pal Robotics, AIBrain, Inc. and HANSON Robotics and others.

Recent Developments:

-

In January 2025, UBTECH unveiled the humanoid Tien Kung and associated educational solutions such as UGOT, Yanshee, uKit, and CreaLand at BETT 2025.

-

In July 2025, UBTECH introduced the Walker S2, noted as the world’s first humanoid capable of autonomously replacing its own battery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.16 Billion |

| Market Size by 2032 | USD 15.25 Billion |

| CAGR | CAGR of 21.79% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Robot Toys, Educational Robots and Robotic Companion Pets) • By Application (Water & Wastewater Treatment, Pulp & Paper Industry, Oil & Gas Industry, Power Generation and Food & Beverage Processing) • By Material Type (Stainless Steel, Ductile Iron, Carbon Steel, Plastic/Polymer and Composite Materials) • By End-User (Media, Education, Retail and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sony Corporation, Hasbro, Inc., Ubtech Robotics Corp., SoftBank Robotics, Honda Motor Co., Ltd., WOWWEE Group Limited, Lego Group, Sphero, Inc., Blue Frog Robotics, Anki , Robotis Co., Ltd., Furhat Robotics, Miko (Emotix), Reach Robotics, Modular Robotics, Digital Dream Labs, ROOBO, Pal Robotics, AIBrain, Inc. and HANSON Robotics. |