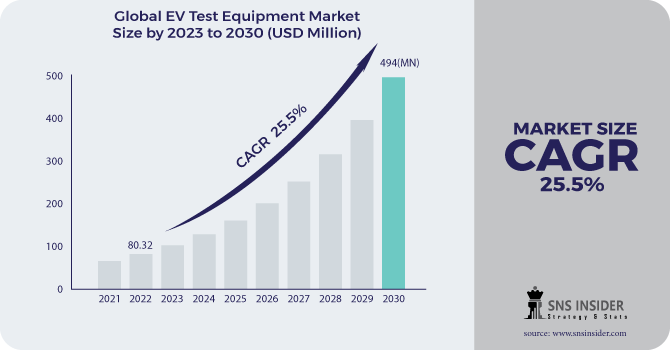

EV Test Equipment Market Size was valued at USD 80.32 million in 2022 and is expected to reach USD 494 million by 2030 and grow at a CAGR of 25.5% over the forecast period 2023-2030.

A vehicle that runs on electricity. For electric and hybrid automobiles, an EV tester is a must-have tool. For the electric vehicle, the acronym EV is used. Both repair shops and vehicle inspectors must adapt to the unique requirements of electric vehicles because of the electric motors, high-voltage batteries, rectifiers, and other components not found in ordinary, non-electric vehicles with combustion engines. There must be a high-voltage system and the proper equipment in the workshop if someone wants to offer service, maintenance, repairs, or general inspection for an electric car. EV test equipment is utilized to evaluate the functionality of various electric vehicle components, including the battery, the motor, and others, to ensure that the automotive parts remain competitive, deliver guaranteed performance, provide customer safety, and satisfy customers.

Arbin introduced a brand-new battery testing system with three electrodes in September of 2021. General Motors is the company that was responsible for developing and licensing the new patented three-electrode (3E) coin cell design.

KEY DRIVERS:

The development of new technology for batteries.

Widespread implementation of electronics in motor vehicles.

The expansion of the industry is being driven by the rising consumer demand for electric vehicles.

Government requirements to decrease environmental effects have driven automakers to develop e-vehicles.

RESTRAINTS:

A greater increase in the expense of equipment requiring advanced technologies.

It is anticipated that a reduction in subsidies for electric vehicles will slow the expansion of the market.

OPPORTUNITIES:

Improvements were made to electric vehicle charging stations.

Technical developments in test equipment.

The increasing demand for onboard diagnostic tools presents a potential opportunity for expansion.

CHALLENGES:

Balancing the high cost of test equipment with its great performance might have an impact on the market.

A lack of standardized process for the development of improved EV testing instruments.

Since then, the COVID-19 pandemic has had an impact on the worldwide economy in a number of nations. As a result of the lockdown, travel restrictions and business closures have occurred, which has disrupted the global supply chain for the electric vehicle testing equipment market. Because of the lockdown and the limits imposed by the government, the operations of service, repair, and overhaul have been hampered, which has resulted in a reduction in the requirements for EV test equipment. In addition, the enterprises are experiencing disruptions in their output as a consequence of the lockdown and the norms of social separation. In addition, there has been a decrease in the need for replacement parts due to the fact that there is currently a reduced need for maintenance due to the fact that everyone is working from home. The COVID-19 conference had a beneficial impact on the market for electric vehicles, as evidenced by the fact that the number of sales of electric vehicles has increased more than it did in the year prior. After the pandemic is over, there will be a renewed interest in electric vehicle (EV) testing equipment due to the expansion of the EV market.

The global market has been divided into BEV, HEV, and PHEV Based on the propulsion type segment. It is anticipated that the BEV market would experience significant expansion in the years to come. Because more attention is being paid to the development of charging infrastructure, battery electric vehicles (BEVs) are favored over plug-in hybrid electric vehicles (PHEVs).

Market, By Vehicle Type:

The global market has been divided into passenger cars and commercial vehicles Based on the vehicle type segment. It is anticipated that the passenger cars market would experience significant expansion in the years to come. Commercial vehicle sales and product offerings are expanding. A large portion of the market's growth can be attributed to commercial vehicles.

Market, By Application:

The global market has been divided into EV Component & Drivetrain, EV Charging, and Powertrain based on the application segment. It is anticipated that the EV Component & Drivetrain market would experience significant expansion in the years to come. Due to advancements in battery technology and the expansion of charging infrastructure around the world, EV charging test equipment is projected to take the lead in the future.

By Propulsion Type:

BEV

HEV

PHEV

By Vehicle Type:

Passenger cars

Commercial vehicles

By Application:

EV Component & Drivetrain

EV Charging

Powertrain

.png)

A surge in the demand for electric vehicles across Europe is expected to result in Europe holding a significant portion of the worldwide market for test equipment for EVs in the not-too-distant future. The swift growth of electric vehicle component manufacturers across the region has also resulted in an increase in the availability of testing equipment for the EV market. There is a significant presence of original equipment manufacturers and tier-1 suppliers in Europe. As a result, the market for test equipment for electric vehicles in Europe is likely to experience a significant expansion in the near future. Due to a growth in the manufacturing of electric vehicles across the area, it is anticipated that the Asia Pacific would hold a substantial share of the global market for test equipment for EVs, followed by Europe.

REGIONAL COVERAGE:

North America

The USA

Canada

Mexico

Europe

Germany

The UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Arbin Instruments, Dewesoft, FEV group Gmbh, Atesteo Gmbh, AVL List Gmbh, Blum-Novotest Gmbh, Burke Porter Group, Horiba Ltd, Chroma Ate, and KUKA AG are some of the affluent competitors with significant market share in the EV Test Equipment Market.

| EV Test Equipment Market | Details |

|---|---|

| Market Size in 2022 | US$ 80.32 Million |

| Market Size by 2030 | US$ 494 Million |

| CAGR | CAGR of 25.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Propulsion Type (BEV, HEV, PHEV) • by Vehicle Type (Passenger cars, Commercial vehicles) • by Application (EV Component & Drivetrain, EV Charging, Powertrain) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Arbin Instruments, Dewesoft, FEV group Gmbh, Atesteo Gmbh, AVL List Gmbh, Blum-Novotest Gmbh, Burke Porter Group, Horiba Ltd, Chroma Ate, and KUKA AG |

| Key Drivers | •The development of new technology for batteries. •Widespread implementation of electronics in motor vehicles. |

| RESTRAINTS | •A greater increase in the expense of equipment requiring advanced technologies. •It is anticipated that a reduction in subsidies for electric vehicles will slow the expansion of the market. |

The EV Test Equipment Market is expected to reach USD 494 million by 2030

The forecast period of the EV Test Equipment Market is 2022-2030.

Major players in the market are Arbin Instruments, Dewesoft, FEV group Gmbh, Atesteo Gmbh, AVL List Gmbh, Blum-Novotest Gmbh, Burke Porter Group, Horiba Ltd, Chroma Ate, and KUKA AG., and others in the final report.

The report is segmented into two types by Propulsion Type, by Application.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia war

4.3 Impact of ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Global EV Test Equipment Market Segmentation, By Propulsion Type

8.1 BEV

8.2 HEV

8.3 PHEV

9. Global EV Test Equipment Market Segmentation, By Vehicle Type

9.1 Passenger cars

9.2 Commercial vehicles

10. Global EV Test Equipment Market Segmentation, By Application

10.1 EV Component & Drivetrain

10.2 EV Charging

10.3 Powertrain

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 the USA

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 the UK

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 The Netherlands

11.3.7 Rest of Europe

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 South Korea

11.4.3 China

11.4.4 India

11.4.5 Australia

11.4.6 Rest of Asia-Pacific

11.5 The Middle East & Africa

11.5.1 Israel

11.5.2 UAE

11.5.3 South Africa

11.5.4 Rest

11.6 Latin America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Rest of Latin America

12. Company Profiles

12.1 KUKA AG,

12.1.1 Financial

12.1.2 Products/ Services Offered

12.1.3 SWOT Analysis

12.1.4 The SNS view

12.2 Arbin Instruments

12.3 Dewesoft

12.4 FEV Group Gmbh

12.5 Atesteo Gmbh

12.6 AVL List Gmbh

12.7 Blum-Novotest Gmbh

12.8 Burke Porter Group

12.9 Horiba Ltd

12.10 Chroma Ate

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share analysis

13.3 Recent Developments

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Self-Driving Car And Trucks Market had a worth of $1.52 billion in 2022 and is projected to attain $3.14 billion by 2030, experiencing a Compound Annual Growth Rate (CAGR) of 9.5% during the estimated timeframe from 2023 to 2030

The Industrial Vehicles Market Size was valued at USD 39.44 billion in 2022 and is expected to reach USD 54.09 billion by 2030 and grow at a CAGR of 4.02% over the forecast period 2023-2030.

Automotive Fasteners Market size was valued at USD 24.13 billion in 2023 and is expected to reach USD 32.41 billion by 2031 and grow at a CAGR of 3.74% over the forecast period 2024-2031.

The Yacht Market Size was valued at USD 9.43 billion in 2022 and is expected to reach USD 13.94 billion by 2030 and grow at a CAGR of 5% over the forecast period 2023-2030.

The Automated Parking System Market Size was valued at USD 2.08 billion in 2023 and is expected to reach USD 6.02 billion by 2030 and grow at a CAGR of 14.50% over the forecast period 2024-2031.

The Automotive Seats Market size was valued at USD 58,289 Mn in 2022 and is expected to reach USD 81,759 Mn by 2030. And grow at a CAGR of 4% over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone