Extruders Market Report Scope & Overview:

Get More Information on Extruders Market - Request Sample Report

The Extruders Market Size was valued at USD 10.0 billion in 2023 and is expected to reach USD 14.9 billion by 2032 and grow at a CAGR of 4.5% over the forecast period 2024-2032.

The Extruders Market has seen significant growth, driven by technological advancements, strategic mergers, and the rising demand for sustainable solutions. Several factors fuel this growth, including the increasing use of extrusion in industries such as automotive, construction, and food processing. The shift towards automation and energy-efficient systems heavily influences the market dynamics. Manufacturers are focusing on improving the capabilities of extruders to handle diverse materials, including metals, plastics, and rubber, to meet the requirements of various end-use industries. Companies are investing in R&D to enhance the flexibility and performance of extruder systems, which is contributing to the increasing adoption of these technologies. Additionally, there is a growing emphasis on recycling and sustainability, pushing for innovations in extrusion technologies that allow the processing of recycled materials with minimal environmental impact. An example of this shift is seen in Nupur Recyclers Limited, which ventured into aluminum extrusion manufacturing in October 2024, as part of its strategy to expand into sustainable practices in the manufacturing sector. This move is in line with the increasing focus on sustainable production methods, which are becoming essential in industries looking to reduce their carbon footprint.

Recent developments in the market underscore the significant trends of partnerships and acquisitions as companies seek to expand their product offerings and global reach. In August 2024, US Extruders entered a strategic partnership with Colin Sutherland, aiming to enhance their market presence and expand product lines. This partnership is expected to improve their ability to deliver high-quality, customized extruders to meet the needs of various sectors. Similarly, Vintech made a strategic acquisition in August 2024, purchasing the sealing and extrusion unit of Rehau Automotive, which strengthened its position in the automotive industry by integrating advanced extrusion technology. The acquisition of Reel Power's downstream extrusion equipment line by Novatec in September 2024 also reflects a strategic move to diversify and expand capabilities in the extrusion market. Furthermore, in February 2024, Davis-Standard completed the acquisition of Extrusion Technology GR, bolstering its portfolio with advanced extrusion technologies aimed at serving industries like medical and packaging. These developments showcase the market's trend toward consolidation and innovation, driven by the need for more specialized and efficient extrusion solutions across a range of applications.

Extruders Market Dynamics:

Drivers:

-

Increasing Demand for Custom Extrusion Solutions across Automotive, Packaging, and Food Processing Sectors Drives Market Growth

-

Rising Adoption of Sustainable and Eco-Friendly Extrusion Technologies Promotes Recycling and Waste Reduction

-

Government Regulations and Environmental Policies Push for Energy-Efficient and Green Extrusion Solutions

Stringent government regulations and environmental policies are increasingly influencing the growth of the extruders market by pushing manufacturers toward energy-efficient and green extrusion solutions. Governments worldwide are implementing stricter environmental standards, particularly related to energy consumption and emissions in manufacturing processes. As a result, extruder manufacturers are investing in energy-efficient technologies that reduce carbon footprints while maintaining high production standards. Extrusion equipment that uses less energy and reduces material waste not only aligns with global sustainability goals but also helps companies lower operational costs. For instance, newer models of extruders incorporate heat recovery systems and low-energy consumption designs, making them more attractive to industries looking to comply with environmental regulations. This growing emphasis on energy efficiency is expected to drive further innovation in the extruders market as manufacturers seek to meet both regulatory requirements and consumer demand for greener products.

Restraint:

-

High Initial Investment Costs and Maintenance Expenses of Advanced Extrusion Equipment Limit Market Expansion

One of the key restraints for the growth of the extruders market is the high initial investment required for advanced extrusion equipment. While extruders offer significant long-term cost savings and operational efficiencies, the upfront capital investment for purchasing and installing modern extruders can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). Furthermore, the maintenance and servicing costs associated with sophisticated extrusion equipment can be substantial, as these systems often require specialized technicians and spare parts to ensure optimal operation. As extruders become more complex with the integration of automation and advanced technologies, maintenance expenses also increase, adding to the overall operational costs. This can discourage potential buyers from investing in new extrusion systems, particularly in industries where cost control is a critical factor. As a result, the high costs associated with both acquiring and maintaining advanced extrusion systems may hinder market growth in certain regions and industries.

Opportunity:

-

Expanding Demand for Extrusion Solutions in Emerging Economies Presents Untapped Market Potential

Emerging economies, particularly in Asia-Pacific, Latin America, and parts of Africa, represent untapped opportunities for the extruder market. As industrialization continues in these regions, the demand for extruded products in various sectors such as automotive, construction, and packaging is on the rise. With rapid urbanization and increased infrastructure development, emerging economies are poised to become key markets for extrusion technologies. Furthermore, the growing middle class in these regions is driving demand for consumer goods that require extruded materials, such as packaging for food, electronics, and personal care products. Companies looking to expand their market share can benefit from targeting these regions, where there is a growing need for both standard and customized extrusion solutions. The rise of manufacturing facilities in emerging markets, coupled with supportive government policies to boost local production, is expected to fuel the growth of the extruders market in these regions.

-

Growing Focus on Research and Development Drives Innovation in Extrusion Technologies for Diverse Applications

-

Technological Advancements in 3D Printing Integration with Extrusion Processes Open New Market Opportunities

Challenge:

-

Technological Complexity and High Customization Requirements Pose Challenges for Extruder Manufacturers in Meeting Diverse Industry Needs

One of the major challenges in the extruders market is the technological complexity and high degree of customization required to meet the specific needs of various industries. As industries like automotive, medical, and electronics demand increasingly specialized extruded products, manufacturers must develop highly customized extrusion solutions that can handle complex materials and production processes. This often involves integrating advanced technologies such as multi-screw extrusion, hybrid systems, and highly precise control mechanisms to meet specific material properties and quality standards. However, developing and maintaining such customized systems can be technologically demanding and costly, requiring significant investment in R&D and skilled labor. The need for continuous innovation to cater to diverse and rapidly evolving market demands presents a persistent challenge for extruder manufacturers, especially as industries seek to push the boundaries of extrusion technology for more specialized applications.

| Strategy | Description | Benefits | Examples |

|---|---|---|---|

| Energy-Efficient Extruders | Implementing advanced technology to reduce energy consumption during extrusion processes. | Lower energy bills | Use of servo-driven motors in extrusion machines. |

| Reduced carbon footprint | |||

| Advanced Die Technologies | Utilizing modern die designs that reduce material waste and improve extrusion speed. | Increased yield | Spiral and multi-hole dies to enhance material flow. |

| Reduced material waste | |||

| Preventive Maintenance Programs | Regular maintenance schedules to avoid costly downtimes and extend the lifespan of extruders. | Reduced downtime | Scheduled inspections for key parts (screws, motors). |

| Lower repair costs | |||

| Automation & Remote Monitoring | Integrating automation systems that monitor and optimize production processes in real-time, reducing human error and labor costs. | Higher precision | Use of IoT and AI to monitor extrusion conditions. |

| Reduced labor costs | |||

| Material Recycling | Reprocessing scrap and waste materials during production to reduce raw material costs. | Lower raw material costs | Closed-loop systems for recycling extruded plastics. |

| Eco-friendly production |

Extruders Market Segmentation Overview

By Extruder Type

Single-Screw Extruders dominated the extruder market in 2023, accounting for approximately 45% of the market share. Single-screw extruders are widely used due to their simplicity, cost-effectiveness, and versatility in processing a range of materials, particularly in the plastics industry. They are commonly employed for producing films, sheets, and profiles, making them a go-to option for many applications in sectors like packaging and consumer goods. For example, in the food packaging industry, single-screw extruders are essential for creating plastic films that offer both protection and easy processing. Despite the growing demand for twin-screw extruders in specific applications, the overall dominance of single-screw extruders remains strong due to their established use in low- to medium-volume production runs.

By Material

In 2023, Plastics dominated the extruders market and held the largest market share in the with a revenue share of 65%. Plastics are the most commonly extruded material across a wide range of industries due to their versatility, cost-effectiveness, and extensive applications in products such as films, sheets, profiles, and pipes. The demand for plastic extruded products has been driven by industries like packaging, automotive, and construction, where plastics offer durability, ease of molding, and cost savings. For example, in packaging, extruded plastic films are widely used for wrapping goods, while in the automotive industry, extruded plastic parts are critical for lightweight components that help improve fuel efficiency.

By Application

Pipe Extrusion dominated the extruder market in 2023, capturing approximately 30% of the market share. The pipe extrusion segment remains a key driver due to the growing demand for plastic pipes in industries like construction, water treatment, and infrastructure development. Plastic pipes, particularly those made from materials like PVC, are lightweight, corrosion-resistant, and cost-effective, making them the preferred choice for plumbing and drainage systems. For instance, in the construction industry, the increased demand for efficient water supply and sewage systems has significantly contributed to the growth of the pipe extrusion segment.

By End-Use Industry

Building & Construction dominated the extruder market in 2023, with a market share of 40%. The building and construction industry continues to be the largest consumer of extruded products, particularly plastics, for applications such as pipes, profiles, insulation materials, and flooring. The growing trend of urbanization and infrastructure development globally has increased the demand for extruded materials in construction projects. For example, plastic extrusions are widely used for creating window frames, door profiles, and plumbing systems in residential and commercial buildings. Additionally, the rising emphasis on energy-efficient buildings has driven demand for extruded materials like insulated panels and coatings.

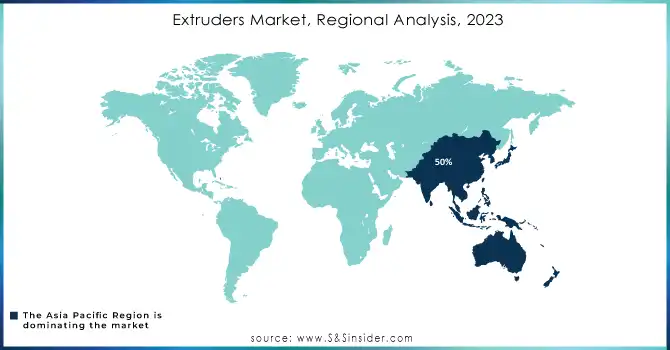

Extruders Market Regional Analysis

The Asia Pacific region dominated the extruder market in 2023, with a market share of 50%. This dominance can be attributed to several key factors, including the region's strong industrial base, rapid urbanization, and significant growth in end-user industries like construction, packaging, automotive, and electronics. Countries like China, India, and Japan play a central role in this dominance. China is the largest market for extruders, driven by its robust manufacturing sector, especially in industries such as automotive, consumer goods, and packaging. The country has seen a surge in demand for extruded products, particularly plastic pipes, profiles, and films, due to its vast infrastructure development and urban expansion. For instance, China has been investing heavily in urbanization and smart city projects, driving the need for efficient water supply and sewage systems, which rely heavily on extruded plastic pipes. India also contributes significantly to regional dominance with the increasing demand for plastic extrusions in its growing construction and automotive sectors. Japan, known for its advanced technology and innovation, is another major player in the Asia Pacific extruder market, especially in high-precision applications like medical devices and automotive parts. The region's well-established manufacturing ecosystem, combined with affordable labor and the growing demand for extruded products, further cement Asia Pacific's position as the leader in the global extruder market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

September 2024: Barbour acquired Keller Products' profile extrusion business to expand its product portfolio and strengthen its presence in the extrusion market, focusing on the automotive and construction sectors.

September 2024: Novatec sold its downstream extrusion equipment line to Reel Power as part of a strategy to focus on core areas, with Reel Power aiming to broaden its market offerings.

March 2024: Entek launched new twin-screw extruder technology that enhances productivity, energy efficiency, and processing speeds, catering to industries such as plastics, food, and chemicals.

Key Players

-

BC Extrusion Holding GmbH (Extrusion Lines, Single-Screw Extruders)

-

Battenfeld-Cincinnati (Single-Screw Extruders, Twin-Screw Extruders)

-

Coperion GmbH (ZSK Twin-Screw Extruder, KTR Twin-Screw Extruder)

-

Davis-Standard, LLC (Single-Screw Extruders, Sheet Extruders)

-

Everplast Machinery Co., Ltd. (Plastic Extruders, Pipe Extruders)

-

Gneuss Kunststofftechnik GmbH (Filtration Systems, Extruder Systems)

-

Hans Weber Maschinenfabrik GmbH (Twin-Screw Extruders, Profile Extruders)

-

Keicher Engineering GmbH (Extruder Systems, Granulation Systems)

-

KraussMaffei Group (Single-Screw Extruders, Twin-Screw Extruders)

-

Leistritz AG (ZSE Twin-Screw Extruders, Single-Screw Extruders)

-

Milacron Holdings Corp. (Single-Screw Extruders, Melt Pumps)

-

NFM / Welding Engineers, Inc. (Twin-Screw Extruders, Compounding Extruders)

-

Nordson Corporation (Extrusion Coating Systems, Sheet Extrusion Systems)

-

Presezzi Extrusion S.p.A. (Aluminum Extrusion Presses, Tube Extruders)

-

Shibaura Machine Co., Ltd. (Injection Extruders, Rubber Extruders)

-

The Japan Steel Works Ltd., (Single-Screw Extruders, Aluminum Extruders)

-

Theysohn Extrusionstechnik GmbH (Profile Extruders, Twin-Screw Extruders)

-

Toshiba Machine Co., Ltd. (Injection Extruders, Extrusion Molding Machines)

-

USEON (Nanjing) Extrusion Machinery Co., Ltd (Plastic Extruders, Pipe Extruders)

-

Reifenhäuser GmbH & Co. KG (Film Extrusion Lines, Co-Extrusion Lines)

Material Suppliers:

-

BASF

-

ExxonMobil

-

Dow Chemical Company

-

SABIC

-

Lanxess

-

Covestro

-

DuPont

OEMs (Original Equipment Manufacturers):

-

Leistritz AG

-

NFM/Welding Engineers

-

Keicher Engineering GmbH

-

The Japan Steel Works, Ltd.

-

Theysohn Extrusionstechnik GmbH

-

Milacron Holdings Corp.

-

Welex

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.0 Billion |

| Market Size by 2032 | US$ 14.9 Billion |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Extruder Type (Single-Screw Extruder, Twin-Screw Extruder, Ram Extruder) •By Material (Plastics, Metals, Rubbers, Others) •By Application (Pipe Extrusion, Film Extrusion, Sheet Extrusion, Profile Extrusion, Wire & Cable Coating, Food Extrusion, Others) •By End-Use Industry (Building & Construction, Transportation, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Japan Steel Works, Ltd., BC Extrusion Holding GmbH, Shibaura Machine Co., Ltd., Keicher Engineering GmbH, Leistritz AG, USEON (Nanjing) Extrusion Machinery Co., Ltd, Presezzi Extrusion S.p.A., Davis-Standard, LLC, Milacron Holdings Corp., Theysohn Extrusionstechnik GmbH, NFM / Welding Engineers, Inc. and other key players |

| Key Drivers | • Increasing Demand for Custom Extrusion Solutions across Automotive, Packaging, and Food Processing Sectors Drives Market Growth •Technological Advancements and Automation in Extrusion Equipment Improve Efficiency and Expand Market Opportunities |

| RESTRAINTS | • High Initial Investment Costs and Maintenance Expenses of Advanced Extrusion Equipment Limit Market Expansion |