FAKRA RF Connectors Market Size & Growth:

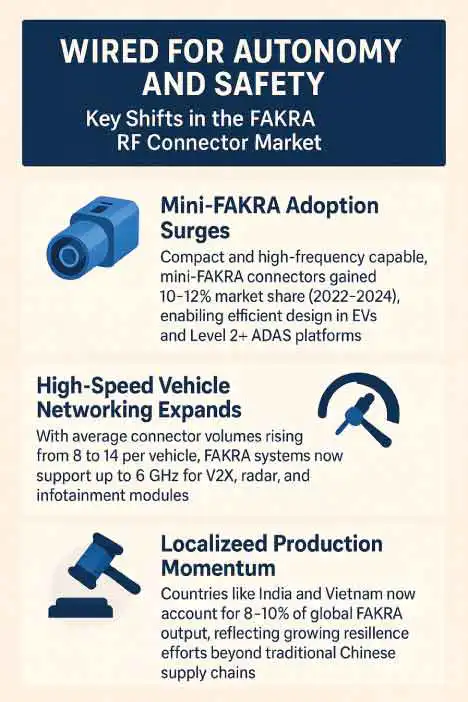

The global FAKRA RF Connectors Market, valued at USD 1.27 billion in 2024, is projected to reach USD 2.16 billion by 2032, growing at a CAGR of 6.88%. This growth is powered by the accelerating adoption of ADAS, V2X, and infotainment systems in connected vehicles. As vehicles evolve into data-driven platforms, FAKRA connectors are transitioning from standard RF couplers to critical enablers of automotive intelligence and safety.

Accelerating Automotive Intelligence, Compliance & Connectivity

With automotive electrification and autonomy racing ahead, standardization, safety regulations, and production resilience are reshaping global FAKRA demand. Innovations in miniaturized coaxial systems, robust compliance (UNECE, NHTSA), and local sourcing strategies are positioning FAKRA connectors at the heart of next-generation vehicle architectures.

Wired for Autonomy and Safety: Key Shifts in the FAKRA RF Connector Market

Explores how FAKRA connectors are evolving to support high-speed, secure data transmission. Their adoption is accelerating with the rise of ADAS, EVs, and V2X technologies.

Critical Fault Lines in the Vehicle Connectivity Stack

|

CHALLENGE |

STAT/FACT |

MARKET IMPACT |

|

System Failures |

~83% of connected vehicle prototypes report at least one connector failure |

Drives need for pre-tested, OEM-grade FAKRA harnesses and plug‑and‑play interfaces |

|

Signal Integrity Risks |

Radar blind spots traced to poor shielding or connector mismatch (2023 SAE) |

Spurs demand for low-loss, 360° shielded mini-FAKRA variants |

|

Production Dependency |

>60% of FAKRA connectors made in China (2022 baseline) |

Fuels reshoring and component standardization in U.S., Europe, and Asia |

|

Labor Skill Gaps |

Field reports cite miscrimping and reverse mating as major failure causes |

Accelerates shift to pre-terminated and color-coded FAKRA assemblies |

|

Policy Volatility |

Delays in ADAS mandates could impact billions in RF connector demand |

Makes market sensitive to UNECE/NHTSA legislative timelines |

Wired for Growth: Key Trends Driving the FAKRA RF Connectors Market

How Ordinary and Mini-FAKRA Connectors Are Powering the Next Generation of Automotive and Aerospace Connectivity

Geographical Breakdown of the FAKRA RF Connectors Market: 2024 Benchmarks and CAGR Projections

|

Region |

2024 Market Share (%) |

CAGR (2025–2032) |

Insights |

|

North America |

39% |

4.34% |

Driven by high ADAS penetration and telematics mandates in the U.S. |

|

Europe |

XX |

XX |

Luxury OEMs like BMW, Audi, Mercedes driving RF adoption |

|

Asia-Pacific |

26% |

9.03% (Fastest) |

China and Japan leading connected and intelligent vehicle deployment |

|

Latin America |

XX |

XX |

Gradual growth with expansion of infotainment in emerging auto sectors |

|

Middle East & Africa |

XX |

XX |

Infrastructure developments and smart vehicle adoption in UAE, S. Africa |

|

Country |

Vehicle Production (2024) |

Relevance to FAKRA Connectors |

|

China |

31.3 million units 33% of global output |

✔ Rapid rollout of ADAS systems ✔ Strong investment in ICV infrastructure ✔ Expansion of 5G/V2X |

|

United States |

10.6 million units |

✔ Over 90% ADAS penetration (AEB, FCW, LDW) ✔ High adoption of telematics, GPS, infotainment ✔ OEM push for autonomous tech |

|

Europe / Germany |

18 million units (Europe) 4.1 million units (Germany) |

✔ Premium OEMs (BMW, Audi, Mercedes) adopt advanced RF systems ✔ EV & luxury trends driving higher FAKRA density |

Transforming the U.S. FAKRA RF Connectors Market Through Policy, Safety, and Smart Mobility Innovation

The U.S. FAKRA RF Connectors Market, valued at USD 0.34 billion in 2024, is projected to reach USD 0.42 billion by 2032, reflecting a CAGR of 2.92%. This growth is fueled by stricter automotive safety standards, rising ADAS deployment, and a surge in connected vehicle infrastructure.

Wiring the Future of Mobility with U.S. FAKRA RF Connector Growth in ADAS and EV Integration

In the U.S., over 90% of key ADAS features were present in new vehicles by 2023 (NHTSA), while public EV charging ports surpassed 195,000 by early 2025 (AFDC/DOE), both accelerating demand for certified FAKRA RF connectors.

Smart Mobility Infrastructure Accelerates Demand for Intelligent FAKRA Connectors

Urban EV rollout, transit automation, and micro-grid electrification are driving large-scale deployment of RF connectors with diagnostics, remote monitoring, and predictive capabilities.

Barriers Hindering the U.S. FAKRA RF Connectors Market Expansion

|

Challenge |

Details |

|

Legacy procurement practices |

Continue to favor low-cost, non-certified alternatives, leading to risks in durability, safety, and standards compliance. |

|

Aging automotive electronics platforms |

Often lack native support for FAKRA connectors, requiring costly system redesigns or custom retrofitting. |

|

Fragmented state-level regulations |

Result in inconsistent adoption and enforcement, preventing cohesive, nationwide market growth. |

The FAKRA RF Connector Companies are:

Recent Developments:

- In Dec 2024, Amphenol RF launched a new IP67-rated FAKRA rear-mount bulkhead plug designed for high-reliability automotive and industrial applications with sealed 6 GHz data transmission

- In Dec 2024, Rosenberger’s Mini-Coax and TE Connectivity’s HSFM connectors now support up to 28 GHz, reducing space by up to 80% and enabling high-speed data systems for ADAS and EV architectures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.27 Billion |

| Market Size by 2032 | USD 2.16 Billion |

| CAGR | CAGR of 6.88% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

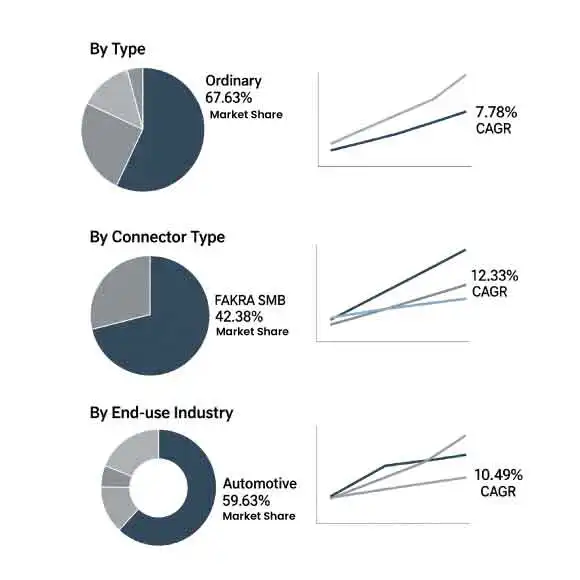

| Key Segments | • By Type(Ordinary FAKRA, Mini FAKRA) • By Connector type(FAKRA SMB connectors, FAKRA II connectors, FAKRA HSD connectors, Other connector types) • By End-use industry(Automotive, Aerospace and defense, Consumer electronics, Telecommunications, Other industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The FAKRA RF Connectors Market Companies are Amphenol RF, Rosenberger, TE Connectivity, Molex, JAE, Hirose Electric, Yazaki, Sumitomo Electric, APTIV, Radiall and Others. |