Linear Devices Market Size Analysis:

The Linear Devices Market size was valued at USD 6.19 billion in 2025 and is expected to grow at a CAGR of 5.07% to reach USD 10.15 billion by 2035.

Linear Devices Market trends are driven by the rising integration of precision analog components in electric vehicles, industrial automation, and portable medical devices. Additionally, the demand for low-power, high-reliability linear ICs is increasing due to the growth of IoT, 5G, and edge computing applications. Advancements in sensor interface technologies, increasing deployment of medical imaging and diagnostic equipment and rapid development of embedded systems in edge computing are some other impactful factors supporting the Linear Devices Market growth. In addition, the rising deployment of automation in logistics and smart infrastructure and growing need for improved analog performance in adverse environmental conditions is also playing a key role in driving growth of the global advanced analog integrated circuit market in coming years–looked the developed and emerging economies.

Market Size and Forecast:

-

Market Size in 2025 USD 6.19 Billion

-

Market Size by 2035 USD 10.15 Billion

-

CAGR of 5.07% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get More Information On Linear Devices Market - Request Free Sample Report

Linear Devices Market Trends:

• Growing adoption of high-precision and low-power linear ICs in EV power management, factory automation, and medical diagnostics to improve efficiency and signal accuracy.

• Rising use of linear amplifiers and voltage regulators in portable and wearable healthcare devices, supported by over 150 million analog-enabled diagnostic device shipments in 2024.

• Expansion of 5G networks and edge computing increasing demand for linear signal conditioning chips for low-latency and real-time data processing.

• Rapid integration of linear devices in ADAS architectures, with more than 85% of new vehicles using precision amplifiers, comparators, and voltage references for sensor interfaces.

• Increasing demand for rugged, radiation-hardened, and high-temperature linear ICs in aerospace, defense, smart infrastructure, and industrial IoT applications.

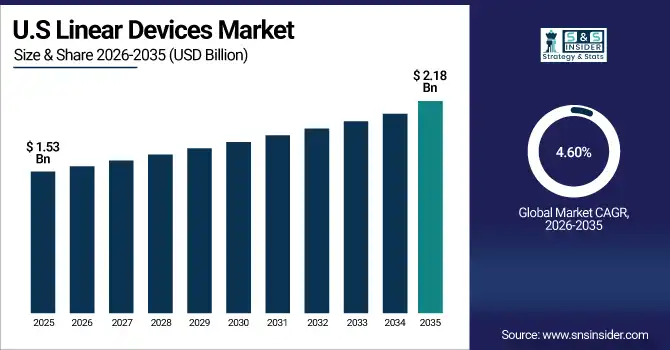

The U.S. Linear Devices Market size was valued at USD 1.53 billion in 2025 and is projected to grow at a CAGR of 4.60%, reaching USD 2.18 billion by 2035. The adoption of linear devices, such as LDO among end-use electronics industries including EVs, industrial automation, medical electronics, and edge computing is growing across the U.S. region, attributable to strong R&D investments and a well-established semiconductor manufacturing infrastructure.

Linear Devices Market Growth Drivers:

-

High Precision and Low Power Trends Drive Linear Devices Demand Across EVs Automation and 5G Applications

The global Linear Devices Market is driven by factors that includes the trend toward high-precision analog components in electric vehicles, factory automation, and medical diagnostics. The trend for energy-efficient devices is expected to boost demand for low-power operational amplifiers and voltage regulators. Furthermore, the penetration of 5G networks and edge computing is driving up the demand for linear signal processing chips to support near real-time data processing, and more efficient connectivity.

-

In 2024, global shipments of analog-enabled portable diagnostic devices, such as ECGs and pulse oximeters surpassed 150 million units, most using linear amplifiers for signal accuracy.

Linear Devices Market Restraints:

-

Shortage of Skilled Analog Engineers Slows Innovation and Extends Time to Market for Linear Devices

The unavailability of skilled analog design engineers is one of the key challenges identified in the global Linear Devices Market, hindering innovation and prolonging development cycle times. Linear analog devices differ significantly from digital ICs, as they are heavily reliant on domain knowledge and manual tuning, which are inherently hampering scaling for most companies. Moreover, the time-to-market is further delayed due to the extensive validation and testing procedures required for mission-critical applications (automotive and aerospace) before deploying the system.

Linear Devices Market Opportunities:

-

Emerging Opportunities Drive Growth of Linear Devices in ADAS Wearables Aerospace and Smart Infrastructure Applications

New opportunities are also emerging for linear devices in ADAS, wearable health monitoring, and IoT smart infrastructure. Demand for rugged, radiation-hardened linear ICs is also being driven by a growing number of applications in aerospace and defense. While analog linear corporations have little option however to develop their marketplace percent through partnerships, custom IC solutions, and growth to excessive-temperature, low-noise, and miniaturized device segments manufacture analog linear elements can regain great boom capability with the aid of using the increasing automation and digitization of developing economies.

-

In 2025, over 85% of new vehicles globally are equipped with at least Level 1 or Level 2 ADAS systems, relying heavily on linear signal amplifiers, voltage references, and precision comparators for sensor interfacing.

Linear Devices Market Segment Analysis:

By Product Type

Operational amplifiers held a 41.5% of the total linear devices market in 2025 and is expected to register fastest CAGR over 2026-2035. This growth is driven by the importance of these functions in applications ranging from signal conditioning, filtering, and amplification to automotive, industrial, and healthcare applications. Due to the growing utilization of precision analog functions in electric vehicles, medical diagnostics, and factory automation, operational amplifiers are being integrated into both standalone and embedded systems. Continuous improvements in low-power and high-temperature designs are making them even more appealing for small and mission-critical applications.

By Application

The Linear Devices Market was led by Consumer Electronics, which accounted for 33.5% of the total Linear Devices Market in 2025, owing to the extensive penetration of integrated analog components into smartphones, wearables, audio devices, and smart home devices. In compact, battery-driven electronics, linear devices including operational amplifiers and voltage regulators are vital for precision signals, power management, and noise reduction. This ongoing need for slim aesthetics, extended runtime, and high functioning in consumer gadgets drives the continual consumption of analog linear ICs in this space. During the forecast years of 2026-2035, Automotive is anticipated to emerge as the fastest growing application by registering highest CAGR driven by the increasing adoption of electric vehicles, ADAS, infotainment systems and battery management. This is driving widespread high-performance linear analog devices, as automotive applications are ever-increasingly safety-critical and require robust, reliable, and stable over temperature components.

By Distribution Channel

In 2025, offline distribution channels accounted for the largest share of the Linear Devices Market, at 68.3% owing to long-term relations between manufacturers and end-users particularly in automotive, aerospace, and industrial automation sectors. Distributors and direct sales teams remain important for providing tailored solutions, technical support, and bulk buying for larger projects. When it comes to high-reliability analog components, a large part of the enterprise still prefers offline channel for quality assurance and negotiation and after-sales service.

The online distribution segment is anticipated to hold the highest CAGR during 2026-2035, primarily due to accelerated digitization driving procurement and SMEs increasingly adopting widespread e-commerce platforms. Internet-based mediums have greater reach, visible cost, instantaneous stock availability, and turn-around time. Due to the need for quicker sampling and prototyping among design engineers and startups, online platforms are increasingly becoming the go-to choice for linear device sourcing.

By End-User

The manufacturing segment dominated the Linear Devices Market share, accounting for 31.5% of linear devices in 2025, and is expected to grow the fastest CAGR from 2026 to 2035. Rapid automation, adoption of robotics, and Industry 4.0 is emerging as one of the biggest drivers of growth in global manufacturing industries which is mainly responsible for this growth. In industrial machinery and equipment, linear devices, such as operational amplifiers, voltage regulators, and comparators are typically used for process control, sensor interfacing, and power regulation.

Linear Devices Market Regional Analysis:

North America Linear Devices Market Insights

In 2025, North America held the largest share in the Linear Devices Market with a share of 33.7%, led by growing requirements from sectors, such as automotive, aerospace, industrial automation, and medical electronics. The region also has an entire ecosystem for semiconductors along with well-developed R&D infrastructure with major analog IC manufacturers such as Texas Instruments and Analog Devices. Rapid acceptance of electric vehicles, expansion of 5G infrastructure, and smart manufacturing are also boosting the demand for the market. Moreover, the demand continues to be driven hiring as a result of an increased defense spending and requirements for high-reliability analog components in mission-critical applications. Continued focus on innovation and automation is likely to ensure North America retains its market-leading position.

In 2025, the North American Linear Devices Market was led by the U.S., which benefit from the solid semiconductor manufacturing foundations, developed automotive and aerospace industries, in addition to the extensive industrial automation technologies penetration.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Linear Devices Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 5.76% over 2026-2035, driven by rising industrial automation, rapid electronics manufacturing, and increasing demand for electric vehicles and consumer electronics. The region's expanding semiconductor fabrication capabilities and growing investments in 5G infrastructure and smart city development are boosting the need for high-performance linear devices. Additionally, the widespread adoption of IoT, edge computing, and wearable health technologies is accelerating demand for compact, energy-efficient analog components. With strong government support for local manufacturing and digital transformation, the region presents significant opportunities for linear device suppliers targeting various high-growth application sectors.

China led in the Asia Pacific Linear Devices Market in 2025 supported by large scale electronics production, rising EV production, and huge investments in industrial automation, 5G infrastructure and semiconductor capabilities.

Europe Linear Devices Market Insights

The Linear Devices market in Europe is witnessing continuous growth, due to increasing demand for automotive, industrial automation and the renewable energy sectors. This region has a focus on high-reliability and energy-efficient analog components in areas, such as electric vehicles, smart factory, and medical device applications. Innovation is propelled by sound R&D capabilities and government backing of clean technologies and digital transformation. Furthermore, the existence of major semiconductor enterprises and cutting-edge design centers adds to the competitiveness of the region.

Latin America (LATAM) and Middle East & Africa (MEA) Linear Devices Market Insights

The Linear Devices Market in Middle East & Africa and Latin America is relatively matured owing to the expansion in industrial automation, infrastructure and increasing adoption of smart technologies. Improved manufacturing bases in such countries are spurring developments in sectors from automotive to telecommunications and consumer electronics that render further demand for analog components in Latin America.

Linear Devices Market Key Players:

Some of the major players in Global Linear Devices Market are Analog Devices, Texas Instruments, ON Semiconductor, STMicroelectronics, Infineon, NXP, Renesas, Maxim Integrated, ROHM, and Microchip.

Competitive Landscape for Linear Devices Market:

STMicroelectronics is a leading global supplier of linear and analog devices, offering operational amplifiers, voltage regulators, power management ICs, and signal conditioning solutions. Its linear products support automotive, industrial automation, 5G infrastructure, and consumer electronics, enabling high precision, low power consumption, and reliable performance across advanced applications.

-

In Sept 2024, STMicroelectronics launches 4th-gen STPOWER SiC MOSFETs for EV traction inverters.

ROHM Semiconductor is a key provider of linear and analog devices, delivering operational amplifiers, voltage regulators, voltage references, and power management ICs. Its linear solutions support automotive electronics, industrial automation, consumer devices, and renewable energy systems, emphasizing high precision, low noise, energy efficiency, and long-term reliability.

-

In April 2025, ROHM Semiconductor launched new industrial op‑amps (LMR1002F) with improved precision and efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.19 Billion |

| Market Size by 2035 | USD 10.15 Billion |

| CAGR | CAGR of 5.07% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Operational Amplifiers, Voltage Regulators, Comparators, Others) • By Application (Consumer Electronics, Automotive, Industrial, Telecommunications and Others) • By Distribution Channel (Online and Offline) • By End-User (BFSI, Healthcare, Retail, Manufacturing and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Analog Devices, Texas Instruments, ON Semiconductor, STMicroelectronics, Infineon, NXP, Renesas, Maxim Integrated, ROHM, and Microchip Technology Inc. |