RF Interconnect Market Size:

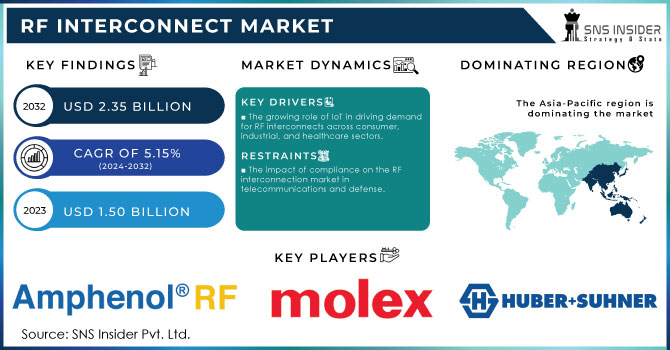

The RF Interconnect Market Size was valued at USD 1.50 Billion in 2023 and is expected to reach USD 2.35 Billion by 2032, growing at a CAGR of 5.15% over the forecast period 2024-2032.

The RF interconnect market is witnessing significant growth, driven by the increasing demand for high-frequency communication technologies across various industries. These components, including cables, connectors, and adapters, are critical in maintaining signal integrity and minimizing losses in communication systems that rely on RF technology. One of the major factors propelling the RF interconnect market is the rapid expansion of wireless communication networks.

Get More Information on RF Interconnect Market - Request Sample Report

As of early 2024, the U.S. has made substantial progress in 5G deployment, with estimates suggesting that over 85% of the U.S. population now has access to 5G services. This expansion is supported by federal initiatives aimed at accelerating the rollout of 5G infrastructure across urban and rural areas. As 5G technology rolls out globally, the need for reliable RF interconnect solutions has surged, particularly in telecom infrastructure. RF interconnects are essential in ensuring efficient signal transmission between base stations, antennas, and other components within the 5G network. The demand for faster data speeds and lower latency in 5G services has further driven the development of advanced RF interconnect systems capable of handling higher frequencies and greater data loads.

Healthcare is another sector where RF interconnects are gaining traction. With the growing adoption of wireless medical devices, such as wearable health monitors and telemedicine systems, reliable RF interconnect solutions are essential for ensuring accurate data transmission. According to a survey, about 66% of patients are willing to use wearable devices to track their health conditions, reflecting a growing acceptance of technology in personal health management and approximately 80% of healthcare providers are using some form of wireless technology for patient monitoring, with 50% reporting that it has improved patient outcomes. Wireless communication in healthcare is critical for real-time monitoring and diagnosis, making RF interconnects a key component in the evolving landscape of healthcare technology.

RF Interconnect Market Dynamics

Drivers

-

The growing role of IoT in driving demand for RF interconnects across consumer, industrial, and healthcare sectors.

The Internet of Things (IoT) has ushered in a new era where devices, systems, and even medical equipment can now send information to each other over the Internet. The increasing adoption of IoT devices is one of the key factors that are driving the RF interconnect market as these devices require multiple RF components for wireless communication. IoT applications ranging from smart homes to industrial automation demand robust RF interconnects to deliver fast and reliable communication among devices. Consumer electronics IoT-enabled smart home devices (smart thermostats, security cameras, and voice-activated assistants). RF interconnects are used to communicate between these nodes and other end devices in your home so that you can control everything remotely over the cloud. In the industrial field, IoT is also used to revolutionize optimized production by bringing together interconnected sensors, machines, and control systems to create smart factories. And RF interconnects make communication among these parts smooth. Healthcare IoT is connecting devices in patient health and lifestyle monitoring remote patient monitoring IOT, interconnected medical devices. RF interconnects are necessary for these systems to deliver sensor and device data to healthcare providers so that timely diagnosis and treatment can be made. The rising adoption of IoT across industries will drive growth in this market with the need for robust, dependable RF interconnect solutions.

-

The rising demand for RF interconnects is driven by 5G networks and autonomous vehicles in the era of high-speed data transmission.

Increasing demand for high-speed data transmission across various applications would propel the growth of the RF interconnects market. 5G networks, autonomous vehicles, smart cities, and IoT (Internet of Things) applications will be instrumental in market growth. RF interconnects are key to achieving higher data rates, lower latency, and greater bandwidth on today's communication systems. This has been most true in the telecommunications industry. The proliferation of 5G technology is reshaping the wireless communications landscape by demanding RF interconnect solutions that handle higher frequencies with low-loss, high-quality signal transmission. The expansion of 5G networks internationally requires service providers to advance their infrastructure, demanding more sophisticated RF interconnect solutions. Another contributor is the auto industry. The demand for RF interconnects is increasing gradually as the sensors, cameras, and communication systems are being integrated into autonomous and connected vehicles. These enable communication among different in-car systems and outside networks to ensure that operation is smooth and safe.

Restraints

-

The impact of compliance on the RF interconnection market in telecommunications and defense.

The RF interconnection market is governed by strict regulatory standards and certifications, especially in the telecommunication and defense & aerospace sectors. RF components must pass a range of national and international standards to avoid interfering with other communication systems, as well as ensure they function at the optimum level could be efficient, and not dangerous. The RF interconnect solutions have to meet these regulatory requirements, which typically increases the cost and complexity related to implementation and deployment. For example, in telecommunication applications, the RF interconnects deployed for 5G networks are supposed to adhere to stringent frequency and performance regulations mandated by regulatory bodies like the FCC) within the United States and ITU worldwide. In the defense arena, RF components must meet military-grade specifications, allowing them to endure rough conditions and operate dependably in all mission-critical scenarios. These regulations can be a burden to both research universities and businesses, particularly those working across numerous regions with different regulatory environments. Stricter standards require compliance, which means that it is a little difficult for newcomers to start afresh or large corporate organizations to adopt new RF technologies.

RF Interconnect Market Segmentation Overview

By Type

RF Cables dominated the market in 2023 with a 36% market share because they are widely used for transmitting high-frequency signals in sectors such as telecommunications, aerospace, and defense. They play a vital role in preserving signal integrity over long-distance transmissions, which is essential for applications such as cellular networks and satellite communications. Large corporations such as Amphenol Corporation and TE Connectivity incorporate RF cables in their advanced communication systems. Their ability to support high-speed data transfer, low signal loss, and flexibility make them a top choice in commercial and industrial sectors.

RF Coaxial Adapters are expected to see a rapid growth rate during 2024-2032, as they play a crucial role in linking different RF components in systems. They guarantee smooth communication across a variety of applications among cables, connectors, and devices. Pasternack Enterprises and Huber+Suhner use RF coaxial adapters for testing, measuring equipment, radar, and communication systems. Due to the fast progress in telecommunications technology, such as 5G infrastructure and IoT devices, there is a growing demand for adaptable, high-performance interconnect solutions like RF coaxial adapters, making it the fastest-growing segment in the RF Interconnect Market.

By Frequency

The "Up to 50GHz" frequency range led the market with a 55% market share in 2023, which is crucial in various important industries such as telecommunications, aerospace, and defense. This frequency band is commonly used in 5G networks, radar technology, and satellite communications, where transmitting high-frequency signals with minimal disruption is vital. Amphenol RF and Molex offer cutting-edge RF interconnect solutions in this frequency range for industries with high demands.

The "Up to 6GHz" is expected to grow at the fastest CAGR during 2024-2023, mostly due to the extensive use of 5G networks, Wi-Fi 6, and IoT applications. This frequency band is essential for consumer electronics, automotive connectivity, and smart devices. TE Connectivity and Radiall are taking advantage of this market by creating affordable RF interconnect solutions with excellent performance for lower frequencies.

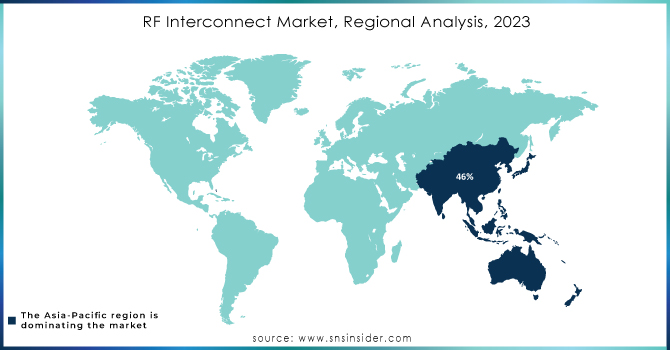

RF Interconnect Market Regional Analysis

The Asia-Pacific region dominated with a 46% market share in 2023, due to fast developments in telecommunications, consumer electronics, and automotive sectors. China, Japan, and South Korea are among the top countries worldwide in manufacturing and using RF components such as connectors and cables. The rising need for 5G infrastructure, higher adoption of IoT devices, and improvements in satellite communication systems are driving the market's dominance in the area. Numerous firms, like TE Connectivity and Amphenol, have a strong foothold in APAC, offering RF interconnect solutions to key players in the telecommunications and automotive industries.

North America is the fastest-growing region with a rapid CAGR during 2024-2032, because of the increasing need for advanced wireless communication technologies and military applications. There is a growing trend in the area towards implementing 5G, AI-powered IoT systems, and advancements in aerospace, all of which necessitate strong RF interconnect solutions. Major companies like Molex and HUBER+SUHNER are increasing their presence in North America to meet the rising demand for top-quality RF connectors, cables, and adapters.

Need Any Customization Research On RF Interconnect Market - Inquiry Now

Key Players in RF Interconnect Market

The major key players in the RF Interconnect Market are:

-

Amphenol RF (RF Connectors, RF Cable Assemblies)

-

Molex (RF Coaxial Connectors, RF Cable Assemblies)

-

HUBER+SUHNER (RF Connectors, RF Cables)

-

TE Connectivity (RF Connectors, RF Antennas)

-

Radiall (RF Connectors, RF Switches)

-

Pasternack Enterprises (RF Adapters, RF Attenuators)

-

Rosenberger (RF Test Cables, RF Coaxial Connectors)

-

Samtec (RF Cable Assemblies, RF Adapters)

-

JAE Electronics (RF Coaxial Connectors, RF Adapters)

-

Carlisle Interconnect Technologies (RF Cable Assemblies, RF Coaxial Connectors)

-

Fairview Microwave (RF Attenuators, RF Connectors)

-

Smiths Interconnect (RF Filters, RF Switches)

-

Cinch Connectivity Solutions (RF Coaxial Connectors, RF Cable Assemblies)

-

Delta Electronics (RF Coaxial Connectors, RF Components)

-

Digi-Key Electronics (RF Adapters, RF Antennas)

-

Mini-Circuits (RF Amplifiers, RF Splitters)

-

Weinschel Associates (RF Attenuators, RF Switches)

-

Maury Microwave (RF Calibration Kits, RF Adapters)

-

Times Microwave Systems (RF Coaxial Cables, RF Cable Assemblies)

-

Würth Elektronik (RF Connectors, RF Shielding Components)

Recent Development

-

February 2024: Amphenol RF announced a new series of RF connectors designed specifically for 5G applications, providing robust performance with low insertion loss. The connectors enhance the efficiency and reliability of 5G networks, catering to the increasing demand for high-frequency RF interconnects.

-

January 2024: RFMW unveiled a range of high-performance coaxial cable assemblies optimized for RF applications. These assemblies feature low-loss materials, making them ideal for applications in telecommunications and aerospace industries, where signal integrity is critical.

-

March 2023: Nuvotronics launched a new family of wideband RF couplers that utilize PolyStrata technology. This innovation allows for better thermal management and integration with devices using various technologies, such as GaN and silicon.

-

December 2023: Teledyne RF introduced new Ka-band RF interconnects to support satellite communications. These interconnects are designed to handle high power levels while minimizing signal loss, essential for effective communication in satellite applications.

-

October 2023: Mini-Circuits expanded its product line with a range of advanced microwave components, including RF amplifiers and filters, tailored for 5G and other high-frequency applications. These components are designed to meet the evolving demands of modern RF systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.50 Billion |

| Market Size by 2032 | USD 2.35 Billion |

| CAGR | CAGR of 5.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (RF Cable, RF Cable Assembly, RF Coaxial Adapter, Others) • By Technology (Up to 6GHz, Up to 50GHz, Above 50GHz) • By End User (Aerospace & Defense, Medical, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amphenol RF, Molex, HUBER+SUHNER, TE Connectivity, Radiall, Pasternack Enterprises, Rosenberger, Samtec, JAE Electronics, Carlisle Interconnect Technologies, Fairview Microwave, Smiths Interconnect, Cinch Connectivity Solutions, Delta Electronics, Digi-Key Electronics, Mini-Circuits, Weinschel Associates, Maury Microwave, Times Microwave Systems, Würth Elektronik |

| Key Drivers | • The growing role of IoT in driving demand for RF interconnects across consumer, industrial, and healthcare sectors. • The rising demand for RF interconnects is driven by 5G networks and autonomous vehicles in the era of high-speed data transmission. |

| RESTRAINTS | • The impact of compliance on the RF interconnection market in telecommunications and defense. |