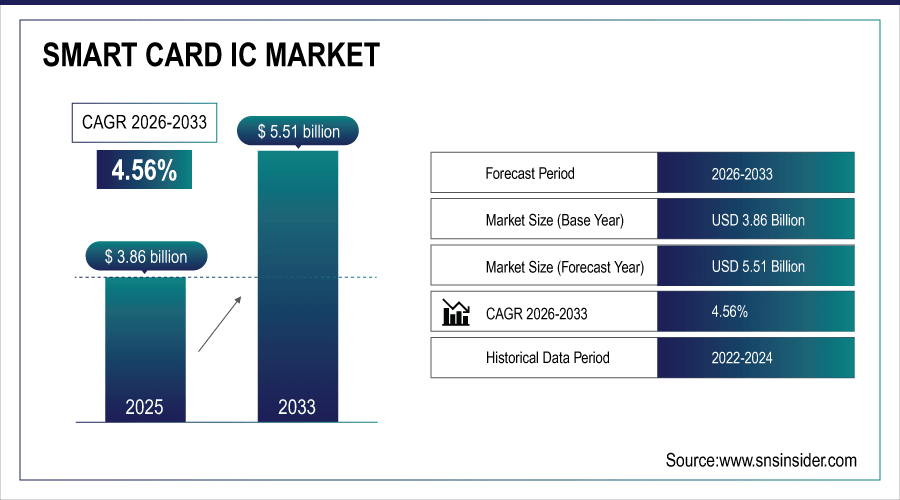

Smart Card IC Market Size & Growth:

The Smart Card IC Market size was valued at USD 3.86 Billion in 2025E and is projected to reach USD 5.51 Billion by 2033, growing at a CAGR of 4.56% during 2026-2033.

The Smart Card IC Market analysis highlights the rapid adoption of secure and versatile integrated circuits across multiple sectors. Contact, contactless, and dual-interface ICs dominate, with increasing demand for advanced 16-bit and 32-bit chip technologies. Payment, identification, healthcare, and transit applications drive significant market growth, supported by government and commercial programs. Miniaturization, embedded NFC, and biometric features are emerging trends enhancing functionality and security. Leading manufacturers are expanding production capacity and innovating to meet global demand, while regional adoption varies across developed and emerging markets.

Smart card IC shipments hit 22B units; 60% contactless. 32-bit chips grow 25%. Payment/ID drive 70% demand. NFC/biometric ICs up 30%. Asia leads adoption; global market valued at $5.8B.

To Get More Information On Smart Card IC Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.86 Billion

-

Market Size by 2033: USD 5.51 Billion

-

CAGR: 4.56% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Smart Card IC Market Trends

-

The demand for contactless and dual-interface smart card ICs is rising rapidly, driven by secure payment systems, transit applications, and convenience-focused consumer solutions globally.

-

Increasing adoption of 16-bit and 32-bit ICs enhances processing speed, security, and multi-application functionality, catering to government ID programs and high-end commercial smart cards.

-

Smart card ICs are integrating NFC and biometric features, enabling secure authentication, mobile payments, and access control, reflecting growing consumer and enterprise security requirements.

-

Trend towards smaller, thinner, and flexible ICs supports compact card designs, wearable devices, and multi-application use, while reducing production costs and improving durability.

-

Emerging markets, including Asia-Pacific and Latin America, are driving adoption across banking, healthcare, transit, and loyalty programs, fueling global market growth and IC shipment volumes.

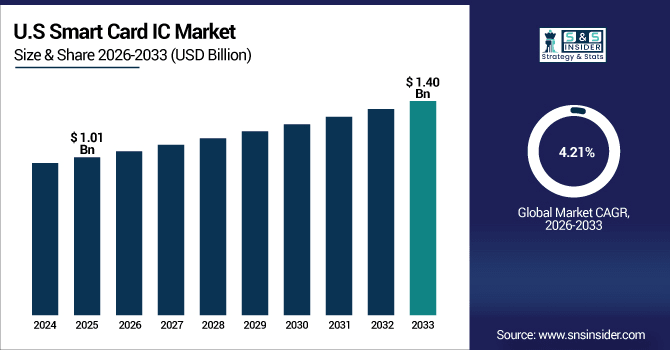

The U.S. Smart Card IC Market size was valued at USD 1.01 Billion in 2025E and is projected to reach USD 1.40 Billion by 2033, growing at a CAGR of 4.21% during 2026-2033. Smart Card IC Market growth is driven by increasing demand for secure and contactless payment solutions across banking and retail sectors. Rising government initiatives for national ID and healthcare programs boost adoption of advanced IC technologies. Integration of NFC and biometric features enhances security and convenience, supporting multi-application usage. Rapid urbanization and digitalization in emerging markets expand the end-user base for smart card ICs. Continuous innovation by leading manufacturers, coupled with cost-efficient production, strengthens market penetration globally.

Smart Card IC Market Growth Drivers:

-

Rising demand for secure, contactless payment solutions and multi-application smart card IC adoption globally

The Smart Card IC Market is primarily driven by growing demand for secure, convenient, and contactless payment systems. Government initiatives for national identification, healthcare, and transit programs are expanding adoption. Advanced technologies, including NFC and biometric-enabled ICs, enhance security and multi-application functionality. Rising digitalization, increased consumer awareness, and urbanization in emerging markets further propel market growth. Leading manufacturers are investing in R&D, improving production capacity and efficiency to meet global demand.

Contactless payments drive 55% IC demand. Govt ID/health programs deploy 6B ICs. NFC adoption up 40%, biometric ICs grow 38%. Urbanizing EMs contribute 50% volume. R&D spend rises 22%.

Smart Card IC Market Restraints:

-

High production costs, security concerns, and complex manufacturing processes limiting widespread smart card IC adoption

The growth of the Smart Card IC Market faces restraints due to high manufacturing costs and complexity in production. Security vulnerabilities and potential data breaches pose risks that may deter adoption. Additionally, reliance on specialized fabrication processes and raw materials can increase operational expenses. Market penetration in smaller enterprises and rural regions remains limited due to cost sensitivity. These factors collectively constrain the rapid and large-scale deployment of smart card IC solutions globally.

Smart Card IC Market Opportunities:

-

Emerging markets, IoT integration, and biometric-enabled smart cards present significant growth opportunities in the market

The Smart Card IC Market is witnessing strong opportunities as advancements in hybrid imaging technologies merge traditional analog aesthetics with modern digital innovation. Growing consumer preference for compact, lightweight, and versatile devices that integrate smartphone connectivity, film-simulation effects, and direct print functions is fueling adoption. This shift is encouraging manufacturers to expand product portfolios, catering to Gen Z and creative professionals seeking dedicated imaging tools, thereby accelerating innovation and unlocking new revenue streams across imaging and printing ecosystems.

APAC/LATAM drive 45% global IC growth. 1.2B IoT/wearables integrate smart ICs. Biometric ICs surge 35% in gov/enterprise. Multi-app cards hit 8B units. E-payment adoption grows 28% YoY.

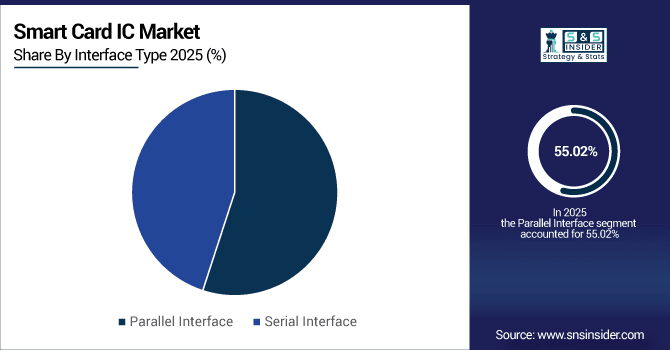

Smart Card IC Market Segment Analysis

-

By interface type, parallel interface ICs held the largest share at 55.02% in 2025, while serial interface ICs are the fastest-growing segment with a CAGR of 6.50%.

-

By contact type, contact smart card ICs led the market with a 45.21% share in 2025, while contactless ICs are the fastest-growing segment with a CAGR of 7.8%.

-

By application, payment applications dominated the market with a 38.65% share in 2025, whereas identification applications are growing the fastest at a CAGR of 8.10%.

-

By chip technology, 8-bit ICs accounted for 51.84% of the market in 2025, whereas 32-bit ICs are expanding fastest with a CAGR of 9.57%.

By Interface Type, Parallel Interface Lead While Serial Interface Registers Fastest Growth

Parallel interface ICs currently lead the market, largely due to their compatibility with legacy systems and robust performance in traditional applications. They are widely used in payment, transit, and identification systems where high reliability is required. Conversely, serial interface ICs are registering the fastest growth as newer applications demand faster communication, lower power consumption, and improved integration with modern devices. This shift reflects the market’s transition toward efficient, multi-functional, and flexible IC solutions suitable for next-generation smart card applications.

By Contact Type, Contact Leads Market While Contactless Registers Fastest Growth

Contact smart card ICs currently lead the market due to their widespread adoption in banking, payment cards, and government ID programs. Their reliability, established infrastructure, and security features make them the preferred choice for large-scale deployments. However, contactless smart card ICs are registering the fastest growth, driven by rising demand for convenient, touch-free transactions in payments, transit, and access control systems. Increasing consumer preference for speed, hygiene, and mobility is accelerating the adoption of contactless solutions globally.

By Application, Payment Dominate While Identification Shows Rapid Growth

Payment applications dominate the Smart Card IC market, accounting for the largest share due to extensive use in credit, debit, and prepaid cards worldwide. These ICs provide secure, reliable, and convenient transaction capabilities. Meanwhile, identification applications are showing rapid growth, supported by government initiatives for national IDs, e-passports, and healthcare cards. Rising digitalization, increasing citizen awareness, and technological advancements in secure identification solutions are fueling market expansion in this segment, particularly in emerging economies.

By Chip Technology, 8-bit Lead While 32-bit Grow Fastest

8-bit smart card ICs continue to dominate the market because of their simplicity, cost-effectiveness, and suitability for basic applications such as loyalty and transit cards. However, 32-bit ICs are experiencing the fastest growth, driven by increasing demand for high-performance applications, advanced encryption, multi-application cards, and secure government ID programs. Rising adoption of NFC, biometric authentication, and IoT-enabled smart cards are fueling the need for higher processing power, making 32-bit ICs the preferred choice for cutting-edge smart card solutions.

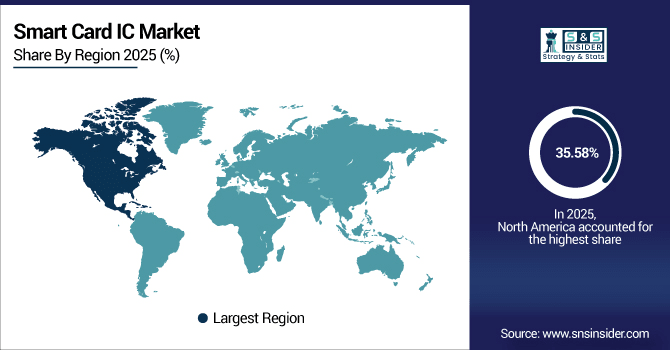

North America Smart Card IC Market Insights

In 2025E North America dominated the Smart Card IC Market and accounted for 35.58% of revenue share, this leadership is due to the strong adoption of Smart Card ICs across banking, healthcare, transit, and government sectors. Contact ICs dominate due to existing infrastructure, while contactless ICs are growing rapidly for payments and access control. Multi-application ICs with NFC and biometric integration are increasingly deployed.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Smart Card IC Market Insights

The U.S. leads the North American Smart Card IC market with extensive adoption in banking, healthcare, government, and enterprise security applications. Contact ICs hold the largest share, but contactless ICs are growing fastest due to demand for convenient, touch-free payments.

Asia-pacific Smart Card IC Market Insights

Asia-pacific is expected to witness the fastest growth in the Smart Card IC Market over 2026-2033, with a projected CAGR of 5.13% due to rapid digitalization, government ID programs, and widespread adoption of payment and transit cards. Countries like China, India, and Japan are driving demand for contactless and dual-interface ICs. High population density and growing urbanization support large-scale deployments. Increasing investments in smart infrastructure and IoT-enabled devices further accelerate adoption.

China Smart Card IC Market Insights

China is a key growth hub for Smart Card ICs, driven by government-backed national ID programs and cashless payment initiatives. Contactless ICs are increasingly used in transit and banking. Rapid urbanization and smart city projects boost IC demand.

Europe Smart Card IC Market Insights

Europe’s Smart Card IC market is driven by financial services, government ID, and transit applications. Contact ICs lead, but dual-interface ICs are gaining momentum for multi-functional cards. Stringent compliance with EMV and ISO standards ensures high security. Adoption is further supported by national ID programs and smart city projects.

Germany Smart Card IC Market Insights

Germany is a key market in Europe for Smart Card ICs, driven by government initiatives such as e-ID programs and secure digital identity projects. Contact ICs dominate due to their reliability in banking and identification applications.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Card IC Market Insights

The Smart Card IC Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing adoption in banking, transit, and government programs. Contactless ICs are growing fastest due to urbanization and digital payment initiatives. Limited infrastructure in rural areas slows penetration, but government-backed projects boost adoption. Rising demand for secure identification and multi-application ICs presents growth opportunities.

Smart Card IC Market Competitive Landscape:

Qualcomm is a leading provider of secure and high-performance Smart Card IC solutions. Its chips support contactless, dual-interface, and NFC-enabled applications across banking, transit, and government ID programs. Focus on innovation, R&D, and partnerships allows Qualcomm to maintain strong market presence and cater to growing global demand for advanced smart card ICs.

-

In September 2025, Qualcomm has been enhancing its smart card IC portfolio by integrating advanced security features and optimizing power efficiency. These improvements aim to support the growing demand for secure and efficient contactless payment solutions.

Fujitsu Semiconductor offers reliable smart card IC solutions with a focus on secure payment, identification, and transit applications. The company emphasizes high-quality manufacturing, advanced chip technology, and multi-application ICs. Strong presence in Asia-Pacific and global markets, combined with continuous innovation, drives adoption in banking, government, and commercial programs.

-

In August 2025, Fujitsu Semiconductor announced the development of a new series of smart card ICs designed to meet the evolving security requirements of digital identity applications. These ICs incorporate advanced encryption technologies and are tailored for use in government-issued identification cards and secure access systems.

Samsung Electronics provides smart card ICs with advanced processing capabilities, security features, and contactless functionality. Its ICs are widely used in payment, transit, and identification applications. Samsung leverages semiconductor expertise and R&D to enhance chip performance, meet global standards, and drive adoption of NFC, biometric, and multi-application smart cards worldwide.

-

In July 2025, Samsung Electronics has been focusing on expanding its smart card IC offerings to include solutions compatible with emerging biometric authentication methods. The company's latest ICs are designed to enhance security and user convenience in applications such as mobile payments and secure access control systems.

Infineon Technologies AG is a major player in the smart card IC market, offering secure, high-performance chips for payment, identification, and transit applications. Its focus on advanced 16-bit and 32-bit ICs, encryption technologies, and compliance with global standards ensures strong adoption across government and commercial programs globally.

-

In December 2024, Infineon Technologies AG celebrated the success of its 28 nm security ICs and smart card solutions at TRUSTECH 2024. The company highlighted the growing adoption of its products in secure identification and payment applications, underscoring its leadership in the smart card IC market.

Smart Card IC Companies are:

-

Fujitsu Semiconductor

-

Samsung Electronics

-

Infineon Technologies AG

-

Texas Instruments

-

NXP Semiconductors

-

STMicroelectronics

-

Toshiba Electronics

-

Winbond Electronics

-

Cisco Systems

-

Renesas Electronics

-

ON Semiconductor

-

Sony Semiconductor Solutions

-

Thales Group

-

Giesecke Devrient

-

IDEMIA

-

Diebold Nixdorf

-

HID Global

-

Watchdata Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.86 Billion |

| Market Size by 2033 | USD 5.51 Billion |

| CAGR | CAGR of 4.56% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Contact Type (Contact, Contactless, and Dual Interface) • By Application (Payment, Identification, Healthcare, Transit, and Loyalty) • By Interface Type (Parallel Interface and Serial Interface) • By Chip Technology ( 8-bit, 16-bit, and 32-bit) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Qualcomm, Fujitsu Semiconductor, Samsung Electronics, Infineon Technologies AG, Texas Instruments, Microchip Technology, NXP Semiconductors, STMicroelectronics, Toshiba Electronics, Winbond Electronics, Cisco Systems, Renesas Electronics, ON Semiconductor, Sony Semiconductor Solutions, Thales Group, Giesecke+Devrient, IDEMIA, Diebold Nixdorf, HID Global, Watchdata Technologies. |