Portable Gaming Console Market Size & Growth:

The Portable Gaming Console Market size was valued at USD 15.23 billion in 2025 and is expected to reach USD 36.29 billion by 2035, growing at a CAGR of 9.07% over the forecast period of 2026-2035.

Portable Gaming Console Market trends are shifting toward hybrid and cloud-based devices, with growing demand for cross-platform compatibility and immersive gameplay. Shifting consumers trend towards durable gaming on the go, coupled with the compact size of advanced hardware performance and battery life is expected to drives the growth of Portable Gaming Console Market. Users stay hooked with its hybrid consoles, integration of cloud gaming services, and also, with an exhaustive game library. In addition, internet penetration as well as roll-out of 5G and digital distribution channels are several factors that further expected to support the market growth.

Portable Gaming Console Market Size and Forecast:

-

Market Size in 2025: USD 15.23 Billion

-

Market Size by 2035: USD 36.29 Billion

-

CAGR: 9.07% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Portable Gaming Console Market - Request Free Sample Report

Key Trends in the Portable Gaming Console Market:

-

Rising demand for handheld gaming devices driven by the popularity of casual, mobile, and on-the-go gaming experiences.

-

Increasing adoption of high-performance processors and advanced graphics capabilities to support console-quality gaming in portable form factors.

-

Growing focus on energy-efficient chipsets and optimized battery management to extend gameplay duration.

-

Rapid expansion of cloud gaming and game streaming services enabling high-end gaming experiences on portable consoles.

-

Integration of advanced display technologies, haptic feedback, and immersive audio to enhance user experience.

-

Higher investment by gaming companies in exclusive content, cross-platform compatibility, and ecosystem development.

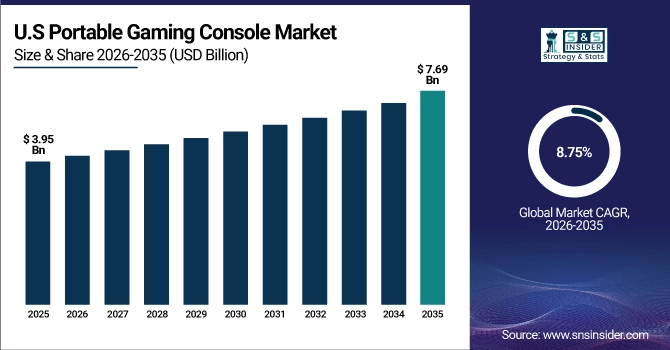

The U.S. Portable Gaming Console Market size was valued at USD 3.95 billion in 2025 and is expected to reach USD 7.69 billion by 2035, growing at a CAGR of 8.75% over the forecast period of 2026-2035. The U.S. portable gaming market is expanding as demand for hybrid and handheld consoles (like the Switch and the Steam Deck), widespread 5G and broadband access, established digital game ecosystems, and greater engagement with more portable and on-the-go gameplay from younger, more digital-native generations continue to drive interest.

Portable Gaming Console Market Drivers:

-

Hybrid Consoles and Cloud Gaming Fuel Demand for High Performance Portable Gaming Experiences Worldwide

The increasing demand for flexible on-the-go gaming experience alongside improvements in hardware features such as high-performance processors, longer battery life, and advanced display technologies like OLED are some of the drivers for global portable gaming console market. The trend for hybrid console segment, enabling handheld and docked gameplay option, is driving the market growth as well. At the same time, the inclusion of cloud gaming services and online multiplayer capabilities massively boosted user engagement, along with the rising internet penetration and 5G rollout that stoked the flames for connectivity and performance expectations.

As of mid‑2025, 106 global providers offer mobile cloud gaming services, increasing accessibility on handheld consoles

Portable Gaming Console Market Restraints:

-

Battery Limitations and Heat Management Challenge Performance and Portability in Next Generation Gaming Consoles

Even with the most portable gaming consoles, the biggest dilemma is how battery performance deteriorates as hardware power requirements rise. High-end hardware such as GPUs, displays with high refresh rates, and better processors can also shorten the battery life of laptops, compromising the gaming experience when users are travelling or playing for long periods Thermal management is also still an issue due to the compact designs making it hard to dissipate heat for extended sessions, or when playing graphically intensive games.

Portable Gaming Console Market Opportunities:

-

Emerging Markets and Advanced Technologies Unlock New Growth Avenues for Portable Gaming Console Manufacturers Globally

Emerging markets with expanding youth populations and digital infrastructure offer untapped growth potential for portable gaming device manufacturers. Opportunities also lie in developing cross-platform compatibility, subscription-based cloud gaming models, and AI-enhanced gaming experiences that personalize gameplay, improve accessibility, and broaden consumer reach.

Over 95% of internet users in the Philippines played video games in 2023, most on mobile devices demonstrating the scalable potential of handheld consoles in demographics with strong youth penetration

Portable Gaming Console Market Challenges:

-

Fragmented Gaming Ecosystems and Component Shortages Challenge Innovation and Accessibility in Portable Console Market

Another restraint is the fragmentation of gaming ecosystems, where cross-platform compatibility and seamless game migration remain inconsistent across devices and publishers. Furthermore, supply chain disruptions and delays in critical component availability especially semiconductors can slow product innovation cycles. Lastly, digital rights management (DRM) and online authentication requirements can hinder accessibility in regions with unstable internet connections.

Portable Gaming Console Market Segmentation Analysis:

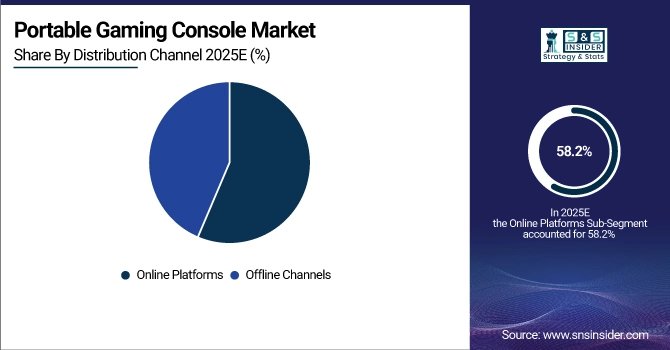

By Distribution Channel, Online Platforms Dominate Market with 58.2% Share in 2025 and Record Fastest Growth

The Online distribution channel dominated the portable gaming console market in 2025, accounting for approximately 58.2% of total sales, and is expected to maintain its lead while growing at the fastest CAGR during 2026–2035. Growth is driven by increasing consumer preference for digital purchases, faster content delivery, and convenient access to expansive game libraries. The rise of cloud gaming services, frequent digital promotions, and growing trust in online payment systems further strengthen the dominance of e-commerce platforms and brand-owned digital storefronts.

By Console Type, Hybrid Consoles Dominate Portable Gaming Console Market with 41.7% Share in 2025, Cloud-Based Consoles to Record Fastest Growth

The Hybrid console segment held a dominant share of approximately 41.7% of the global portable gaming console market in 2025, driven by its ability to function seamlessly as both handheld and docked gaming systems. Hybrid devices offer unmatched flexibility, allowing users to transition between portable and home gaming experiences without compromising performance. Leading products such as the Nintendo Switch and Valve Steam Deck have set industry benchmarks by combining powerful hardware with a versatile design, appealing to a wide demographic ranging from casual gamers to core gaming enthusiasts.

The Cloud-based gaming console segment is expected to witness the fastest growth over the forecast period from 2026 to 2035, supported by rising 5G penetration, expansion of cloud infrastructure, and increasing demand for hardware-light, streaming-based gaming experiences. These consoles reduce the need for frequent hardware upgrades while enabling access to high-quality games across devices, accelerating their adoption among tech-savvy consumers.

By Connectivity, Wi-Fi Enabled Consoles Dominate Market with 44.7% Share in 2025, Cellular-Enabled Consoles to Record Fastest Growth

The Wi-Fi enabled segment accounted for approximately 44.7% of the portable gaming console market share in 2025, owing to its reliable high-speed connectivity for game downloads, content streaming, and online multiplayer gaming. Wi-Fi remains the most accessible and widely available connectivity option globally, making it the preferred choice among both casual and dedicated gamers. The affordability and widespread availability of home and public Wi-Fi networks further reinforce its dominant position.

The Cellular-enabled consoles (4G/5G) segment is projected to experience the fastest growth during 2026–2035, driven by increasing 5G deployment and rising demand for uninterrupted gaming on the move. Expansion of mobile network infrastructure, particularly in urban and emerging markets, is expected to further support the adoption of cellular-connected portable gaming devices.

By End User, Casual Gamers Dominate Market with 33.8% Share in 2025, 18–35+ Adult Segment to Record Fastest Growth

In 2025, the Casual gamers segment held a dominant share of approximately 33.8% of the portable gaming console market, supported by strong demand for user-friendly interfaces, affordable devices, and entertainment-focused gaming content. Casual gamers favor portable consoles for short play sessions and convenience, making them well-suited to mobile-centric lifestyles. The availability of diverse game genres, including puzzle, simulation, and adventure titles, continues to drive engagement across urban and digitally connected populations.

The 18–35+ adult segment is expected to register the fastest CAGR over 2026–2035, fueled by growing interest in immersive, high-performance gaming experiences. These demographic exhibits strong purchasing power, high digital adoption, and increasing engagement with multiplayer and cross-platform gaming ecosystems, making it a key growth driver for the market.

Portable Gaming Console Market Regional Insights:

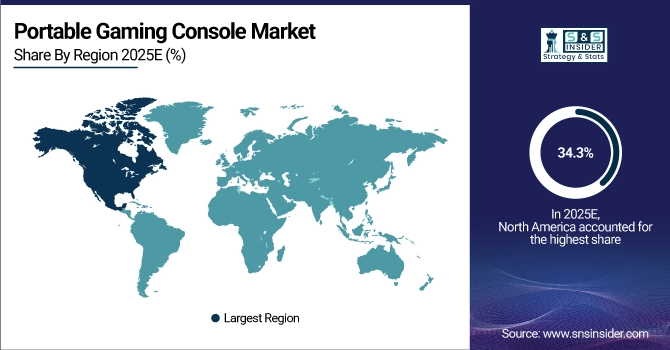

North America Dominates Portable Gaming Console Market in 2025

In 2025, North America accounted for approximately 34.3% of the global portable gaming console market, driven by advanced digital infrastructure, high disposable income levels, and a deeply rooted gaming culture. The region benefits from widespread adoption of hybrid consoles, early acceptance of cloud gaming platforms, and a large base of tech-savvy consumers. Continuous hardware innovation, strategic partnerships, and increasing interest in mobile-first entertainment experiences further support North America’s dominant position in the market.

The United States leads the North American portable gaming console market, supported by strong consumer spending, early technology adoption, and a well-established ecosystem of game developers, content creators, and cloud gaming service providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the Fastest-Growing Region in the Portable Gaming Console Market

The Asia-Pacific region is projected to witness the fastest CAGR in the portable gaming console market from 2026 to 2035, fueled by rapid expansion of the middle-class population, increasing smartphone and internet penetration, and a large youth demographic with growing interest in gaming. Government investments in digital infrastructure and connectivity improvements are further accelerating market growth. Additionally, the rising popularity of multiplayer and cloud-based gaming experiences, particularly in urban centers, is driving demand for portable gaming consoles across the region.

Japan dominates the Asia-Pacific portable gaming console market, supported by its strong gaming heritage, presence of leading console manufacturers, advanced technological infrastructure, and sustained consumer demand for hybrid and handheld gaming devices.

Europe Portable Gaming Console Market Insights, 2025

Europe represents a significant share of the portable gaming console market, driven by a well-established gaming culture, high penetration of consumer electronics, and increasing adoption of hybrid consoles. The region benefits from widespread broadband connectivity, growing demand for cross-platform and cloud gaming, and a thriving indie game development ecosystem that enhances content diversity. Additionally, rising eco-conscious consumer preferences are influencing demand for energy-efficient gaming devices.

Germany, the United Kingdom, and France lead the European market, supported by strong digital retail channels and highly engaged gaming communities.

Middle East & Africa and Latin America Portable Gaming Console Market Insights

The Middle East & Africa (MEA) and Latin America regions are emerging as promising markets for portable gaming consoles, driven by expanding youth populations, improving internet connectivity, and increasing smartphone penetration. In Latin America, countries such as Brazil and Mexico are witnessing rising demand due to urbanization and growing interest in mobile entertainment. Meanwhile, the MEA region is gaining momentum through investments in digital infrastructure, government-backed technology initiatives, and increasing engagement in e-sports and social gaming platforms.

Portable Gaming Console Market key Players:

-

Nintendo Co., Ltd.

-

Sony Interactive Entertainment LLC

-

Microsoft Corporation

-

Valve Corporation

-

Logitech International S.A.

-

Razer Inc.

-

AYANEO (AYN Technologies)

-

GPD (GamePad Digital)

-

Anbernic

-

Powkiddy

-

Blaze Entertainment (Evercade)

-

Lenovo Group Limited

-

ASUS (Republic of Gamers)

-

Acer Inc.

-

Analogue, Inc.

-

Retroid (GoRetroid)

-

Pimax Innovation Inc.

-

One Netbook (ONEXPLAYER)

-

Xiaomi Corporation

-

Tencent Holdings Ltd.

Competitive Landscape of Portable Gaming Console Market:

Nintendo Co., Ltd.

Nintendo Co., Ltd. is a Japan-based global leader in video game hardware and software, renowned for its innovative portable and hybrid gaming consoles. The company is credited with pioneering handheld gaming with products like the Game Boy and Nintendo DS, and has continued its leadership with the Nintendo Switch series. Nintendo specializes in creating engaging, family-friendly gaming experiences, integrating versatile hardware with an extensive game library. Its role in the portable gaming console market is pivotal, driving adoption across casual and core gamers worldwide.

-

In 2024, Nintendo expanded its Switch lineup with enhanced OLED and performance models, integrating improved battery life, display quality, and hybrid functionality to strengthen its leadership in portable gaming.

Sony Interactive Entertainment LLC

Sony Interactive Entertainment LLC is a U.S.-based subsidiary of Sony Group Corporation, offering portable and handheld gaming experiences primarily through the PlayStation Portable (PSP) and PlayStation Vita series. The company focuses on high-performance graphics, immersive gameplay, and connectivity with the PlayStation ecosystem. Sony plays a key role in the portable gaming console market by delivering premium devices that integrate advanced multimedia capabilities, online services, and cross-platform compatibility for dedicated gamers.

-

In 2024, Sony continued to enhance its portable gaming offerings by integrating PlayStation Remote Play and cloud gaming features, allowing players to stream console-quality games on compatible handheld devices.

Microsoft Corporation

Microsoft Corporation is a U.S.-based technology and gaming giant, offering portable gaming experiences primarily through cloud streaming on Xbox consoles and mobile devices. The company specializes in integrating hardware, software, and cloud services to provide high-quality gaming experiences on the go. Microsoft’s role in the portable gaming console market is growing, driven by Xbox Cloud Gaming (xCloud) and its Game Pass ecosystem, enabling gamers to access full console experiences without the need for dedicated handheld hardware.

-

In 2024, Microsoft expanded its portable gaming reach by improving xCloud performance, enhancing device compatibility, and adding new titles to Game Pass for on-the-go play.

Valve Corporation

Valve Corporation is a U.S.-based video game developer and digital distribution company, known for its Steam gaming platform and innovative portable consoles like the Steam Deck. The company focuses on delivering high-performance portable gaming experiences with PC-quality hardware, extensive game libraries, and customizable software. Valve plays a significant role in the portable gaming console market by bridging PC gaming and handheld experiences, appealing to hardcore and enthusiast gamers seeking flexibility and performance.

-

In 2024, Valve upgraded the Steam Deck with improved battery life, enhanced graphics, and optimized SteamOS support for seamless access to the full Steam library on a portable device.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 15.23 Billion |

| Market Size by 2035 | USD 36.29 Billion |

| CAGR | CAGR of 9.07% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Console Type (Handheld Only Consoles, Hybrid Consoles, Cloud-Based Gaming Consoles, and Retro/Reissued Consoles) • By Connectivity (Wi-Fi Enabled Consoles, Cellular-Enabled Consoles (4G/5G), Bluetooth Integration, and Offline/Standalone Consoles) • By End User (Casual Gamers, Hardcore/Professional Gamers, Children & Teenagers, and Adults (18–35+ Age Group)) • By Distribution Channel (Online Platforms, and Offline Channels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nintendo, Sony Interactive Entertainment, Valve, ASUS, Lenovo, AYN Technologies, Logitech G, Razer, GPD, One-Netbook, Anbernic, Powkiddy, AOKZOE, Retroid, Hyperkin, Playdate, Evercade, Tencent Games, Qualcomm, Alienware. |