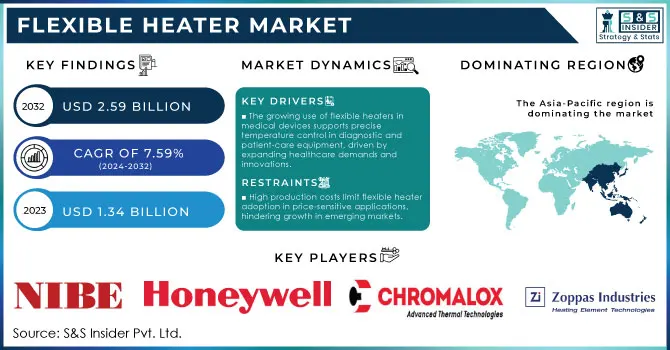

Flexible Heater Market Key Insights:

The Flexible Heater Market Size was valued at USD 1.34 Billion in 2023 and is now anticipated to grow at USD 2.59 Billion by 2032, displaying a compound annual growth rate (CAGR) of 7.59% during the forecast Period 2024-2032.

To Get More Information on Flexible Heater Market - Request Sample Report

The Flexible Heater Market is experiencing substantial growth driven by the increasing demand for energy-efficient, lightweight, and customizable heating solutions across a range of industries. Flexible heaters, which offer versatile heating solutions, are widely used for temperature regulation in critical applications such as aerospace, automotive, medical devices, and electronics. The electronics sector plays a significant role in this market, accounting for approximately 25% of flexible heater sales. These heaters are used for heating sensitive components like circuits, sensors, and battery packs, where precise temperature control is crucial for performance and safety.

Flexible heaters are used in medical devices such as incubators, diagnostic equipment, and patient warming devices, where maintaining a consistent temperature is crucial for patient care. The rise of e-commerce has further propelled market growth, with online sales platforms seeing an annual growth rate of 12-14%. This trend reflects the growing demand for easily accessible, customizable heating solutions, catering to both businesses and individual customers. These statistics underscore the expanding role of flexible heaters in modern industries, where precision, efficiency, and adaptability are key.

| Type of Flexible Heater | Description | Commercial Products |

|---|---|---|

| Polyimide Flexible Heaters | Lightweight and thin heaters made from polyimide, known for high flexibility, are used in applications requiring compact heating solutions. | Kapton Heater by Honeywell, Polyimide Heater by Omega |

| Silicone Rubber Heaters | Durable heaters with high flexibility and resistance to moisture and chemicals, ideal for harsh environments. | Watlow Silicone Rubber Heater, Chromalox SRM Series |

| Mica Heaters | Thin heaters with excellent thermal conductivity, used where space is limited and high watt density is required. | Omega Mica Heaters, Tempco Mica Heaters |

| Polyester Heaters | Economical and flexible heaters often used in low-temperature applications like warming plates and battery heating. | Epec Polyester Heater, Minco Polyester Heater |

MARKET DYNAMICS

DRIVERS

- The growing use of flexible heaters in medical devices supports precise temperature control in diagnostic and patient-care equipment, driven by expanding healthcare demands and innovations.

Flexible heaters are increasingly utilized in the medical device sector, especially for diagnostic and patient-care equipment, due to their ability to maintain precise and optimal temperatures essential for effective performance. In applications like blood analyzers, dialysis machines, respiratory equipment, and warming blankets, flexible heaters help ensure stability and accuracy, which are critical for patient safety and treatment efficacy. With the healthcare industry experiencing rapid growth and innovation driven by advancements in technology, increased healthcare spending, and an aging population the need for devices that support consistent temperature regulation is becoming more pronounced. The World Health Organization estimates that the global population aged 60 years and over is expected to nearly double by 2050, intensifying demand for medical treatments and devices that improve patient outcomes.

The role of flexible heaters is expanding as the healthcare sector adopts increasingly sophisticated equipment, especially with the rise of remote and home-based care. Innovations in diagnostic tools that require controlled heating elements, such as portable ultrasound and point-of-care testing devices, also fuel the demand for flexible heating solutions. These heaters offer the advantage of being lightweight and adaptable to various shapes, ensuring they can be integrated into diverse medical applications. Furthermore, the growing emphasis on accuracy and safety in healthcare settings underscores the need for flexible heaters that provide efficient, reliable temperature control, making them indispensable in modern medical device manufacturing.

- The growing production of electric vehicles (EVs) drives the demand for flexible heaters to regulate battery temperatures, prevent energy loss in cold climates, and improve battery efficiency.

The rise in electric vehicle (EV) production is significantly boosting the demand for flexible heaters, as these devices play a crucial role in managing battery temperature and enhancing efficiency. In colder climates, battery performance can suffer due to lower temperatures, leading to decreased energy output and reduced driving range. Flexible heaters address this by maintaining optimal battery temperatures, preventing energy loss and ensuring reliable performance even in extreme weather. They are also lightweight and easily adaptable to the intricate shapes of battery packs, making them ideal for EV applications where space and weight are at a premium.

This demand is tied closely to the rapid expansion of the EV industry. In 2023, global EV sales surged by over 55% compared to the previous year, and as more countries enforce stricter emissions regulations, EV adoption is set to rise further. Major automakers are also investing heavily in EV production, with projections indicating that electric cars could make up nearly 40% of all new vehicles sold by 2030. Consequently, the need for flexible heaters in EVs is growing in parallel, as automakers aim to enhance battery performance and reliability. This trend underscores the importance of flexible heating solutions in the evolving EV landscape, positioning flexible heaters as a critical component in the future of sustainable transportation.

RESTRAIN

- High production costs of flexible heaters, driven by advanced materials and custom designs, limit their adoption in price-sensitive applications and hinder growth, especially in emerging markets.

The production of flexible heaters, particularly those made with advanced materials like polyimide, silicone, and polyester, can incur significant costs. These high production costs stem from several factors, including the specialized raw materials required, the complexity of the manufacturing process, and the need for precision engineering. Advanced materials, while offering superior durability and performance, often come at a premium price. For example, polyimide heaters, which are known for their heat resistance and flexibility, are more expensive than traditional metal-based heating solutions. Additionally, customization options tailoring flexible heaters to meet specific dimensions or performance criteria further increase production expenses.

The high cost of production becomes a barrier in price-sensitive applications, particularly in emerging markets where cost-efficiency is a crucial factor. In these regions, businesses and consumers may prefer more affordable alternatives, limiting the widespread adoption of flexible heaters. Industries that could benefit from the performance advantages of flexible heaters, such as automotive, aerospace, and healthcare, might opt for traditional heating methods or lower-cost solutions due to budget constraints. Furthermore, the need for advanced manufacturing technologies and skilled labor to produce high-quality flexible heaters can further elevate operational costs. This combination of expensive materials, intricate production processes, and limited affordability in developing economies slows down market penetration and hampers the growth of flexible heaters in these areas. Consequently, while the technology offers superior advantages, its cost remains a significant hurdle for broader adoption, especially in cost-conscious regions.

KEY SEGMENTATION ANALYSIS

By Type

Silicone rubber-based heaters segment dominated the market share over 42%. These heaters are widely used in industries such as automotive, aerospace, medical devices, and electronics, where high performance under varying conditions is essential. They are particularly valued for their ability to withstand extreme temperatures, both high and low, making them ideal for applications that require consistent and reliable heating. Silicone rubber heaters can be molded into various shapes and sizes, making them suitable for use in complex or compact designs. Their resistance to moisture, chemicals, and mechanical stress further enhances their appeal across diverse sectors. With growing demand for reliable heating solutions in advanced applications, silicone rubber-based heaters continue to be the preferred choice, especially in critical environments where high durability and performance are non-negotiable.

By Distribution Channel

The direct segment dominated the market share by over 58% in 2023. This segment includes industries such as aerospace, automotive, and medical devices, where specific, customized, and high-performance flexible heaters are required. Direct sales allow manufacturers to maintain control over product quality, pricing, and customer relationships. The market for direct distribution is particularly growing due to the increasing demand for tailored solutions, as these industries often require precise specifications and quick delivery times. Manufacturers are focusing on enhancing their direct customer engagement through online platforms, direct sales representatives, and dedicated support services, ensuring customer loyalty and a strong competitive edge.

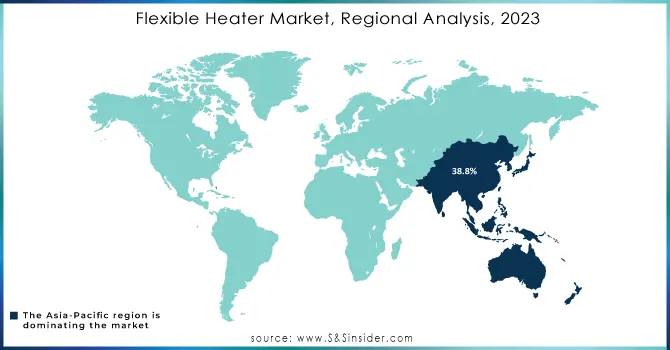

KEY REGIONAL ANALYSIS

The Asia-Pacific (APAC) region dominated the market share at over 38.8% in 2023, driven by rapid industrialization, increasing demand for energy-efficient heating solutions, and substantial growth in the electronics and automotive sectors. Countries like China, Japan, and India are key players in the region, with a growing emphasis on infrastructure development and advanced manufacturing. The presence of several global manufacturing hubs has contributed to the regional dominance. Additionally, the expanding consumer electronics market, particularly for products like flexible heaters used in wearables and smartphones, bolsters the market in APAC.

North America is the fastest-growing region in the flexible heater market, propelled by strong demand for advanced heating solutions across a variety of sectors. The region's technological advancements and robust research and development activities have fostered innovation in flexible heating technologies. The healthcare and automotive industries in North America are increasingly adopting flexible heaters for applications such as medical devices and automotive seat heaters. Additionally, the rise of electric vehicles (EVs) is driving the need for flexible, efficient heating elements for battery management systems.

Do You Need any Customization Research on Flexible Heater Market - Inquire Now

KEY PLAYERS

Some of the major key players of Flexible Heater Market

-

NIBE Industrier AB - Provides a range of flexible heaters for various applications.

-

All Flex Flexible Circuits - Specializes in flexible circuit heaters with customizable options.

-

Honeywell International Inc. - Offers flexible heaters for industrial and consumer applications.

-

Chromalox - Known for industrial heating solutions, including flexible heaters.

-

Zoppas Industries S.P.A. - Manufactures flexible heaters for multiple industries, including automotive and medical.

-

Omega Engineering - Supplies flexible heaters designed for precise temperature control.

-

Watlow Electric Manufacturing - Produces flexible heaters suitable for a wide range of thermal applications.

-

Rogers Corporation - Focuses on advanced flexible heater solutions for critical applications.

-

Smith’s Group plc - Develops flexible heating technologies with robust and durable designs.

-

Minco Products, Inc. - Known for high-quality flexible heaters and other thermal management solutions.

-

Tempco Electric Heater Corporation - Provides a variety of flexible heaters for industrial use.

-

Durex Industries - Specializes in customized flexible heaters for specific industrial requirements.

-

Thermocoax - Offers innovative flexible heating solutions for high-temperature applications.

-

Therm-x of California - Known for advanced flexible heater designs for aerospace and semiconductor industries.

-

Heatron, Inc. - Develops flexible heating solutions with advanced materials and technology.

-

Holroyd Components Ltd. - Supplies a range of flexible heaters for industrial and medical markets.

-

Electricfor - Focuses on custom flexible heaters and other heating elements.

-

Spirax-Sarco Engineering plc - Offers industrial heating solutions, including flexible heater options.

-

Backer Hotwatt, Inc. - Specializes in flexible heaters designed for harsh environments.

-

Birk Manufacturing, Inc. - Known for high-quality flexible heaters used in medical, aerospace, and electronics applications.

Suppliers for Provides a range of flexible heaters including polyimide, silicone rubber, and more, catering to industrial, medical, and aerospace applications of Flexible Heater Market:

-

Watlow

-

Honeywell International Inc.

-

Therm-x of California

-

Heatron

-

Chromalox

-

Minco Products, Inc.

-

Birk Manufacturing, Inc.

-

Northeast Flex Heaters, Inc.

-

All Flex Flexible Circuits & Heaters

-

Omega Engineering

RECENT DEVELOPMENTS

-

In August 2023: Smiths Group plc, a prominent industrial technology company, revealed its acquisition of Heating & Cooling Products (HCP), a US-based manufacturer specializing in Heating, Ventilation & Air Conditioning (HVAC) solutions.

-

In October 2023: Watlow, a leading provider of advanced thermal management solutions, introduced the ASSURANT HT high-temperature heating jackets, designed to address the specific needs of semiconductor processing.

-

In August 2023: Honeywell introduced a new range of polyimide-based flexible heaters designed for high-temperature applications.

-

In September 2023: Chromalox unveiled a new series of silicone rubber heaters featuring enhanced flexibility and durability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.34 Billion |

| Market Size by 2032 | USD 2.59 Billion |

| CAGR | CAGR of 7.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Silicone Rubber-based, Polyimide-based, Polyester-based, Mica-based, Others) • By Distribution Channel (Direct, Indirect) • By Industry (Medical, Automotive, Food & Beverages, Electronics & Semiconductor, Aerospace, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NIBE Industrier AB, All Flex Flexible Circuits, Honeywell International Inc., Chromalox, Zoppas Industries S.P.A., Omega Engineering, Watlow Electric Manufacturing, Rogers Corporation, Smith’s Group plc, Minco Products, Inc., Tempco Electric Heater Corporation, Durex Industries, Thermocoax, Therm-x of California, Heatron, Inc., Holroyd Components Ltd., Electricfor, Spirax-Sarco Engineering plc, Backer Hotwatt, Inc., Birk Manufacturing, Inc. |

| Key Drivers | •The growing use of flexible heaters in medical devices supports precise temperature control in diagnostic and patient-care equipment, driven by expanding healthcare demands and innovations. •The growing production of electric vehicles (EVs) drives the demand for flexible heaters to regulate battery temperatures, prevent energy loss in cold climates, and improve battery efficiency. |

| RESTRAINTS | • High production costs of flexible heaters, driven by advanced materials and custom designs, limit their adoption in price-sensitive applications and hinder growth, especially in emerging markets. |