Machine Tools Market Report Scope & Overview:

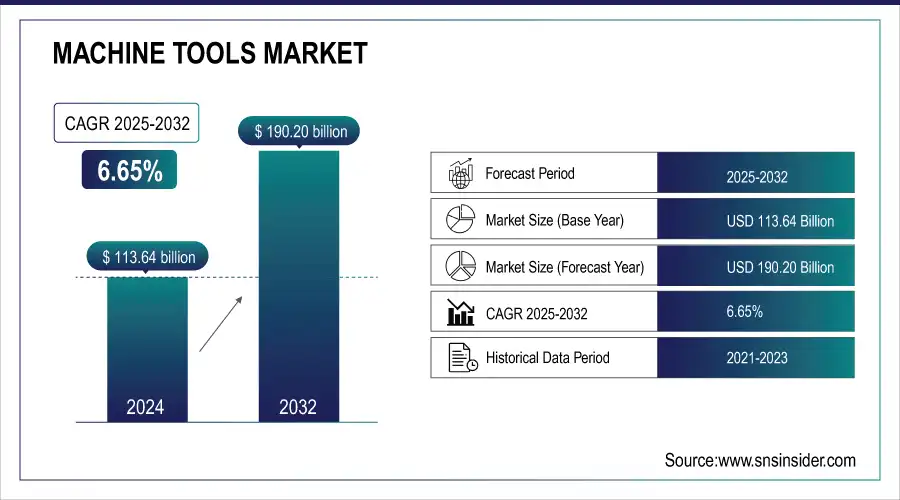

The Machine Tools Market was valued at USD 113.64 billion in 2025E and is expected to reach USD 190.20 billion by 2033, growing at a CAGR of 6.65% from 2026-2033.

The machine tool market is rapidly evolving, driven by automation, digitalization, and Industry 4.0 integration. Smart, connected machines enable real-time monitoring, predictive maintenance, and enhanced operational efficiency. Sustainability is shaping the sector, with electric and hybrid machines reducing energy consumption and waste. Additive manufacturing and 3D printing complement traditional machining, enabling complex designs and faster production. Global adoption of industrial robots surpassed 3 million units in 2024, reflecting automation growth. Rising demand in aerospace, automotive, and healthcare, particularly in China and India, along with investments in eco-friendly, high-precision, and hybrid machine tools, is fueling market expansion worldwide.

Market Size and Forecast

-

Market Size in 2025E: USD 113.64 Billion

-

Market Size by 2033: USD 190.20 Billion

-

CAGR: 6.65% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To get more information on Machine Tools Market - Request Free Sample Report

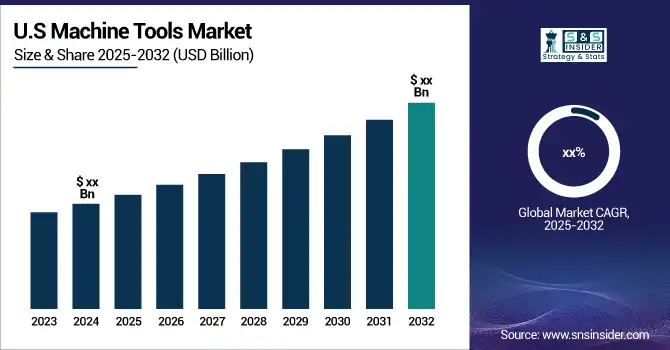

The U.S. Machine Tools market size was valued at an estimated USD 42.80 billion in 2025 and is projected to reach USD 71.90 billion by 2033, growing at a CAGR of 6.1% over the forecast period 2026–2033. Market growth is driven by rising demand for precision machining across key industries such as automotive, aerospace, defense, and industrial manufacturing. Increasing adoption of CNC machines, automation, and smart manufacturing technologies to improve productivity and accuracy is accelerating market expansion. Additionally, investments in domestic manufacturing, reshoring initiatives, and advancements in digital machine tools and Industry 4.0 integration further strengthen the growth outlook of the U.S. machine tools market during the forecast period.

Machine Tools Market Trends

-

Rising demand for precision manufacturing and automation is driving the machine tools market.

-

Growing adoption across automotive, aerospace, electronics, and metalworking industries is boosting market growth.

-

Integration of CNC, robotics, and IoT technologies is enhancing efficiency, accuracy, and production speed.

-

Expansion of smart factories and Industry 4.0 initiatives is fueling demand for advanced machine tools.

-

Focus on reducing operational costs and improving product quality is shaping market trends.

-

Advancements in additive manufacturing and hybrid machining are opening new application opportunities.

-

Collaborations between equipment manufacturers, technology providers, and end-users are accelerating innovation and deployment.

Machine Tools Market Growth Drivers:

-

The escalating global demand for vehicles and aircraft significantly boosts the need for advanced machine tools in the aerospace and automotive industries, as these tools are essential for producing high-precision components.

The increasing demand from the automotive and aerospace industries is a key driver for the machine tools market. Both sectors rely heavily on advanced machine tools to manufacture high-precision components, which are essential for maintaining quality, safety, and performance standards. In the automotive industry, global vehicle production reached approximately 92 million units in 2022, with electric vehicle (EV) sales accounting for over 14%. As EV production continues to rise, so does the demand for specialized machine tools capable of handling components such as battery packs, electric drivetrains, and lightweight materials like aluminum. CNC machines are essential in ensuring the precision needed for these parts, with the automotive sector utilizing around 25% of machine tools globally.

Similarly, the aerospace industry relies on machine tools for manufacturing complex parts. In 2023, global air travel demand rose by over 30% compared to the previous year, driving a surge in aircraft production. This increase led to heightened demand for advanced machine tools to fabricate components from materials like titanium and carbon composites, which are essential for modern, fuel-efficient aircraft. The aerospace sector, known for its stringent quality requirements, demands ultra-precise machining capabilities, often pushing the technological boundaries of machine tools.

-

Technological advancements, including automation, CNC, and IoT integration, enhance machine tools' efficiency, precision, and productivity, driving market growth.

Technological advancements have significantly transformed the machine tools market by enhancing efficiency, precision, and productivity through the integration of automation, Computer Numerical Control (CNC), and the Internet of Things (IoT). Automation in machine tools allows for the seamless operation of machinery with minimal human intervention, leading to faster production cycles and reduced labor costs. CNC technology plays a crucial role in this evolution by enabling precise control of machining processes, allowing for the creation of complex geometries and intricate designs with high accuracy. This precision not only minimizes material wastage but also improves the overall quality of the end products.

Moreover, the incorporation of IoT in machine tools has revolutionized how industries monitor and manage production. IoT-enabled machines can collect and transmit real-time data regarding their performance, which helps in predictive maintenance and reducing downtime. This connectivity allows manufacturers to optimize production schedules and enhance workflow efficiency. The synergy of these technologies supports the trend towards smart manufacturing, where data-driven decisions lead to improved operational effectiveness. As a result, companies are increasingly investing in advanced machine tools that incorporate these technologies, driving market growth.

Machine Tools Market Restraints:

-

The high cost of advanced machine tools, particularly those with cutting-edge technology, poses a major obstacle for small and medium-sized enterprises (SMEs) in their adoption.

The high initial capital investment required for advanced machine tools serves as a notable barrier for small and medium-sized enterprises (SMEs) looking to modernize their manufacturing processes. Advanced machine tools, particularly those equipped with cutting-edge technologies such as CNC (Computer Numerical Control), automation, and IoT (Internet of Things) integration, often come with substantial price tags. For SMEs, which typically operate on tighter budgets compared to larger corporations, this upfront cost can be prohibitive.

Investing in these sophisticated machines not only requires significant financial resources for the tools themselves but also entails additional expenses related to installation, training, maintenance, and potential facility upgrades. These factors can stretch an SME's financial capabilities, leading to hesitation in adopting newer technologies. As a result, many SMEs may opt for older, less efficient machinery that does not offer the same level of precision or productivity, ultimately hindering their competitiveness in an increasingly automated market. Moreover, the inability to invest in advanced machinery can limit SMEs' capacity to innovate and respond to market demands, putting them at a disadvantage compared to larger firms that can easily absorb such costs.

Machine Tools Market Segment Analysis

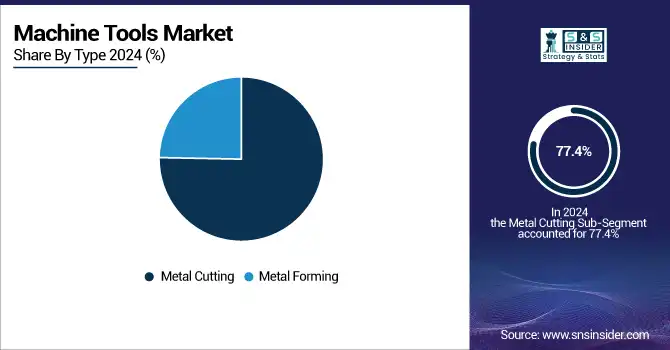

By Type, Metal cutting machines dominated the market in 2025 with over 77.4% share.

In 2025, the metal cutting type segment dominated the market over 77.4%. This segment is composed of various machines such as machining centers, turning machines, grinding machines, milling machines, and eroding machines. These machines are critical for removing excess material from workpieces, shaping them to meet precise specifications. Metal cutting machines, including drilling, gear cutting, lathe, and grinding machines, are essential tools in industries like automotive, aerospace, and manufacturing. They are widely used to enhance productivity, precision, and efficiency in metalworking processes. Technological advancements in machine tools, such as automation and computer numerical control (CNC) systems, have increased demand for these machines, driving innovation and improving output quality. Additionally, the rise of Industry 4.0 has fostered the integration of advanced systems into metal cutting, further enhancing operational efficiency and reducing downtime across industrial sectors.

By Technology, Computer Numerical Control (CNC) technology led the market in 2025 with over 86.2% share.

The Computer Numerical Control (CNC) segment dominated the market share over 86.2% in 2025, underscores its critical role in modern manufacturing. CNC machines, governed by precise computer programming, are essential for producing intricate and high-quality components. Their versatility spans multiple applications, including milling machines, lathes, and laser cutters. The increasing demand for automation and precision in industries such as automotive, aerospace, and electronics has fueled their adoption. CNC machines offer superior accuracy, reduced labor costs, and higher production speeds, making them indispensable for complex manufacturing tasks. This technological shift has led to enhanced efficiency in mass production, enabling industries to meet growing demands while maintaining consistency and minimizing errors. As industrial automation and Industry 4.0 trends evolve, the reliance on CNC technology continues to surge, transforming traditional manufacturing processes.

By End-Use, The automotive segment held the largest share in 2025 at over 41.9%.

The automotive segment dominated the market share over 41.9% in 2025. This is due to the growing demand for precision in producing automotive components. Machine tools are essential in the industry, especially for metal cutting and crafting small machine parts. These tools provide enhanced accuracy, reliability, and operational efficiency, making them indispensable for manufacturing processes. While various production methods are employed in the automotive sector, machine tools offer distinct advantages in high-volume production, contributing to cost-effectiveness and consistency. As vehicle designs evolve, the need for more advanced, precise components increases, driving the adoption of machine tools across automotive manufacturers. Additionally, the push towards electric vehicles and innovations in hybrid models has further emphasized the importance of precise machining technologies.

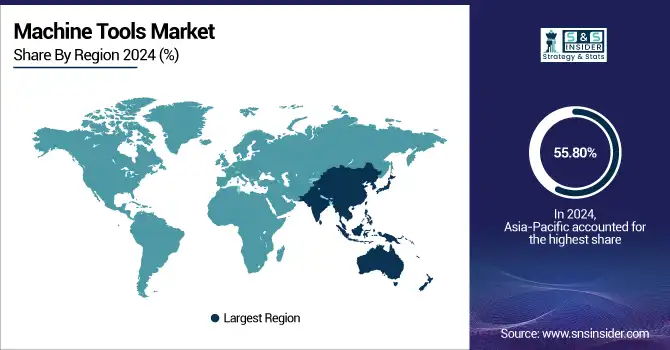

Machine Tools Market Regional Analysis

Asia Pacific Machine Tools Market Insights

In 2025, the Asia Pacific region dominated the market share over 55.80% of the market. This dominance is largely driven by surging automotive production and increased budgets for defense and commercial aircraft manufacturing. Precision is critical for automotive components to meet stringent quality and safety standards, which, in turn, fuels demand for machine tools. China, a major player in the region, is expected to experience a robust 7.0% compound annual growth rate (CAGR) in its machine tools market. This growth is supported by advancements in manufacturing technologies like automation and smart manufacturing, alongside rising demand in industries such as automotive, aerospace, and electronics. In 2022, China's vehicle production increased by 3%, with over 26 million units manufactured, according to the China Association of Automobile Manufacturers (CAAM).

Need any customization research on Machine Tools Market - Enquiry Now

North America Machine Tools Market Insights

North America's machine tools market is poised for notable growth due to the expanding electric vehicle (EV) industry. Factors such as the presence of leading automakers like General Motors, Nissan, Tesla, and Ford, combined with the region's advanced infrastructure for EV production, create robust demand for machine tools used in vehicle manufacturing. High consumer disposable income also drives the shift towards EVs, boosting the need for precision tools required in automotive component production. Additionally, government incentives for sustainable transportation and the growing trend towards automation in manufacturing processes are further propelling the machine tools sector in the region.

Europe Machine Tools Market Insights

Europe’s machine tools market is driven by advanced manufacturing, automation, and Industry 4.0 adoption. Countries like Germany, Italy, and France lead in precision machining, supported by strong automotive, aerospace, and industrial sectors. Increasing demand for smart, energy-efficient, and sustainable machines, coupled with investments in digitalized production and predictive maintenance technologies, is boosting growth. Technological advancements, skilled workforce, and robust industrial infrastructure further strengthen Europe’s position as a key hub for high-performance machine tool adoption.

Middle East & Africa and Latin America Machine Tools Market Insights

The Machine Tools market in the Middle East & Africa and Latin America is growing due to rising industrialization, infrastructure development, and manufacturing investments. Adoption of automation, CNC machinery, and energy-efficient solutions is increasing across automotive, aerospace, and construction sectors. Governments are promoting industrial modernization and skill development, while emerging industries drive demand for high-precision and sustainable machine tools. Technological advancements and foreign investments further support market expansion in these regions.

Machine Tools Market Competitive Landscape:

Lincoln Electric Holdings, Inc. (2024)

Lincoln Electric, founded in 1895 and headquartered in Cleveland, Ohio, is a global leader in welding products, automation, and robotic solutions. The company designs and manufactures welding equipment, consumables, and advanced automated systems for industrial applications. Lincoln Electric emphasizes innovation in manufacturing automation, supporting efficiency, precision, and scalability for automotive, aerospace, and industrial production through advanced robotics, AGVs, and integrated manufacturing execution systems.

-

April 2024: Lincoln Electric acquired RedViking, a private automation system integrator in Plymouth, Michigan. RedViking specializes in advanced AGVs, mobile robots, specialized assembly systems, dynamic test systems, and proprietary MES software.

AMADA MACHINERY CO., LTD. (2023)

AMADA, founded in 1946 and headquartered in Kanagawa, Japan, is a leading manufacturer of metalworking machinery and automation solutions. The company provides high-precision sheet metal fabrication equipment, including laser cutting, bending, punching, and welding systems. AMADA focuses on innovative, high-speed, and energy-efficient machinery that enhances productivity and quality in industrial manufacturing, supporting industries ranging from automotive to aerospace with integrated and smart production technologies.

-

October 2023: AMADA introduced a three-dimensional laser integrated system combining a blue laser and a fiber laser for high-speed, high-quality cutting, welding, and layered manufacturing. The machine was showcased at the “Amada Global Innovation Center” in Isehara, Kanagawa, in November.

Nidec Machine Tool Corporation (2024)

Nidec Machine Tool Corporation, founded in 1946 and headquartered in Japan, is a leading provider of machine tools and industrial automation solutions. The company manufactures high-performance machinery for automotive, robotics, and general manufacturing sectors, emphasizing precision, reliability, and productivity. Nidec focuses on expanding global manufacturing capacity and technological innovation to meet rising demand for advanced machine tools and support efficient, scalable production across diverse industrial applications.

-

2024: Nidec Machine Tool Corporation opened a new factory in Pinghu, China, covering approximately 66,000 square meters. The facility targets an output of 4 million units in its first year, scaling to 8 million by 2030, meeting growing demand in the automotive and robotics sectors.

KEY PLAYERS

Some of the major key players of Machine Tools Market

-

Amada Machine Tools Co., Ltd. (Laser Cutting Machines, Punching Machines)

-

CHIRON GROUP SE (Vertical Machining Centers, Horizontal Machining Centers)

-

DMG MORI CO., LTD. (CNC Lathes, CNC Milling Machines)

-

DN Solutions (Lathes, Machining Centers)

-

Georg Fischer Ltd. (Injection Molding Machines, CNC Machining Centers)

-

HYUNDAI WIA CORP (CNC Lathes, Machining Centers)

-

JTEKT Corporation (Ball Screws, Bearings)

-

Komatsu Ltd. (Excavators, CNC Machine Tools)

-

Makino (Vertical Machining Centers, Wire EDM Machines)

-

Okuma Corporation (CNC Lathes, CNC Machining Centers)

-

Hurco Companies, Inc. (CNC Machines, 5-Axis Machining Centers)

-

FANUC Corporation (Robots, CNC Control Systems)

-

Haas Automation, Inc. (CNC Lathes, CNC Vertical Machining Centers)

-

Mazak Corporation (Multi-Tasking Machines, Laser Cutting Machines)

-

Siemens AG (Drive Systems, CNC Controls)

-

Toshiba Machine Co., Ltd. (Injection Molding Machines, CNC Lathes)

-

Kia Motors Corporation (Automated Machining Systems, Robotic Solutions)

-

Mitsubishi Electric Corporation (CNC Controls, Laser Cutting Machines)

-

Yasda Precision Tools Co., Ltd. (High-Precision Machining Centers)

-

Biesse Group (Woodworking Machines, Stone Processing Machines)

List of Suppliers

-

DMG Mori

-

Mazak

-

Haas Automation

-

Okuma Corporation

-

Makino

-

Fanuc

-

Siemens

-

Hurco Companies, Inc.

-

Doosan Machine Tools

-

Emag GmbH & Co. KG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 106.55 billion |

| Market Size by 2033 | USD 189.44 billion |

| CAGR | CAGR of 6.65% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Metal Cutting, Machining Centers, Turning Machines, Grinding Machines, Milling Machines, Eroding machines, Others) (Metal Forming, Bending Machines, Presses, Punching Machines, Others) • By Technology (Computer Numerical Control (CNC), Conventional) By End-use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical Industry, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amada Machine Tools Co., Ltd., CHIRON GROUP SE, DMG MORI CO., LTD., DN Solutions, Georg Fischer Ltd., HYUNDAI WIA CORP, JTEKT Corporation, Komatsu Ltd., Makino, Okuma Corporation, Hurco Companies, Inc., FANUC Corporation, Haas Automation, Inc., Mazak Corporation, Siemens AG, Toshiba Machine Co., Ltd., Kia Motors Corporation, Mitsubishi Electric Corporation, Yasda Precision Tools Co., Ltd., Biesse Group. |