Flexible Paper Packaging Market Key Insights:

The Flexible Paper Packaging Market size was valued at USD 69.27 billion in 2023 and is estimated to reach USD 117.25 billion by 2031, and is expected to grow at a CAGR of 4.02% over the forecast period of 2024-2031.

Rising demand for sustainable and green packaging solutions is a major driver of the flexible packaging paper market as it shows high market acceptance and creates potential growth opportunities for manufacturers.

Get More Information on Flexible Paper Packaging Market - Request Sample Report

Global market researchers and stakeholders are working together to solve the challenges of the flexible paper packaging market and meet the demands of various end-use industries such as food, consumer goods, pharmaceuticals, and personal care products.

Various food and beverage manufacturers are turning to flexible packaging to improve consumer convenience and experience. In addition, pouches are in high demand across the region due to their cheapness and convenience. In addition to convenience, other features such as sustainability, food safety and reduction of food waste also influence the choice of flexible packaging in different areas of the food industry. The availability of alternatives like plastic in the market could hamper market growth. The paper provides a lower barrier to oxygen, light and microorganisms than other packaging materials such as plastic. As a result, the shelf life of food is shortened when stored in paper packaging.

The packaging industry has undergone a major transformation in recent years due to an increasing number of start-ups worldwide, and the launch of various categories of food and non-food products. Governments are also raising awareness of the benefits of eco-friendly, lightweight and recyclable packaging paper and flexible packaging paper that is harmless to the environment. The growing trend of using Sustainable Pharmaceutical Packaging solution is driving the flexible packaging paper market.

There is a growing awareness of the negative environmental impacts of using various hazardous substances for packaging purposes. Environmentally conscious consumers demand eco-friendly and durable packaging materials. Consumers around the world are increasingly interested in biodegradable and recyclable packaging paper. As a result, manufacturers in the flexible paper packaging market are ramping up their production capacities to meet the demands of various end-use industries around the world.

There is a rapid shift towards promoting sustainable packaging items over conventional plastics. This is mainly due to the growing popularity of sustainability among people around the world. Flexible packaging will revolutionize the entire packaging industry in terms of sustainability, especially considering the disposal of conventional packaging materials creates large amounts of waste and negatively impacts the environment. This has enabled many manufacturers around the world to develop creative strategies to minimize the amount of packaging waste and consistently use flexible packaging in their products.

MARKET DYNAMICS

KEY DRIVERS:

-

The Flexible Paper Packaging Market is driven primarily by cost efficiency and increased product shelf life

Compared to traditional packaging materials such as plastics and metals, flexible paper packaging has advantages for its cost-effectiveness. Flexible paper packaging is designed to provide excellent barrier properties, thereby extending shelf life by protecting products from moisture, oxygen, and light. This prolongation of the shelf life helps to reduce product waste and improves customer satisfaction. The cost of production and transport is often lower, which makes it an attractive option for manufacturers and retailers.

-

Rise of the e-commerce sector is giving a boost to the market.

-

Rising awareness about sustainable packaging.

RESTRAIN:

-

The growth of the market will be hampered by multiple-layer packaging with different combination layers.

Paper is a more biodegradable alternative than plastic and can be easily recycled. However, it is often disposed of in landfills, where the rate of deterioration slows and it takes up more space than the equivalent weight of plastic. Additionally, paper-based flexible packaging is often laminated with materials such resin, plastic or aluminum, making it difficult for recycling.

OPPORTUNITY:

-

Branding possibilities to encourage the use of flexible paper packaging

Flexible paper packaging, without limiting it to the width of a label, allows for strong impact graphics and superior quality branding that enables businesses to market in 360 degrees. Moreover, the printing partner specialising in digital printed flexible packaging may be able to help achieve images, preciseness, photo quality and graphics. The manufacturer can provide all the necessary regulatory information and has plenty of room to show off benefits, features or eyecatching graphics in flexibly printed paper packaging.

-

The growing adoption of machine friendly packaging solutions.

-

Increasing demand for flexible packaging in emerging nations.

CHALLENGES:

-

Sourcing sustainable and high quality paper materials may be a challenge

Logistical and cost challenges are likely to be encountered in ensuring a consistent supply of materials that meet environmental standards and comply with customer expectations. Sourcing material often leads to deforestation which is a major environmental concern.

IMPACT OF RUSSIAN UKRAINE WAR

The packaging industry is under pressure from raw material shortages and high energy costs.

Energy prices have risen in response to Russia's invasion of Ukraine, especially in countries that import large amounts of natural gas from Russia. In Germany, for example, the cost per kilowatt-hour on the power exchange increased 600% year-on-year from 10 cents to 30 cents in 2022. Russia's invasion of Ukraine has adversely affected the supply of packaging raw materials across Europe. Given that Ukraine and Russia are major suppliers of timber and their exports alone are worth more than €12 billion. 20 % of Pulp wood is supplied by Russia globally. 40% of the natural gas and oil consumed in Europe comes from Russia. As a result, gasoline prices in Europe have risen sharply since the conflict began.

Countries that are most dependent on Russia for energy supplies, such as Germany, Italy and Scandinavian countries, would be most at risk if Russia decides to withhold resources, relying on supplies of paper and cardboard. It may affect companies that are involved in flexible paper packaging.

Furthermore, trade disruptions have caused delays in the supply of raw materials which is ultimately affecting production. Trade disruptions have also caused less demand for the flexible packaging.

IMPACT OF ONGOING RECESSION

Businesses typically find themselves in financial trouble during a recession and seek cost-cutting strategies. Price pressure on packaging materials, including flexible packaging, can arise as companies negotiate lower prices with their suppliers or look for alternative, cheaper packaging solutions. This can affect the profitability of flexible packaging manufacturers.

Companies often look for ways to innovate and increase operational efficiency during downturns. This could lead to the creation of more affordable packaging options and the introduction of greener and more sustainable materials into the flexible packaging market. To reduce costs and stay competitive, manufacturers can explore new technologies and approaches.

Businesses typically find themselves in financial trouble during a recession and look for ways to cut costs. Price pressure on packaging materials, including flexible packaging, can arise as companies negotiate lower prices with their suppliers or look for alternative, cheaper packaging solutions. This can affect the profitability of companies producing flexible packaging.

KEY MARKET SEGMENTATION

By Paper Type

-

Kraft Paper

-

Parchment Paper

-

Sulfite Paper

-

Greaseproof Paper

-

Glassine Paper

By Packaging Type

-

Pouches

-

Wraps

-

Bags & Sacks

-

Sachet

-

Cartons

-

Lids

-

Envelopes

-

Others

By Embellishing Type

-

Hot Coil

-

Cold Coil

-

Others

By Printing Technology

-

Rotogravure

-

Digital Printing

-

Flexography

-

Others

By Distribution Channel

-

Retail

-

E-commerce

By End Use

-

Food & Beverages

-

Pharmaceutical

-

Agriculture

-

Personal Care

-

Healthcare

-

Consumer Goods

-

Others

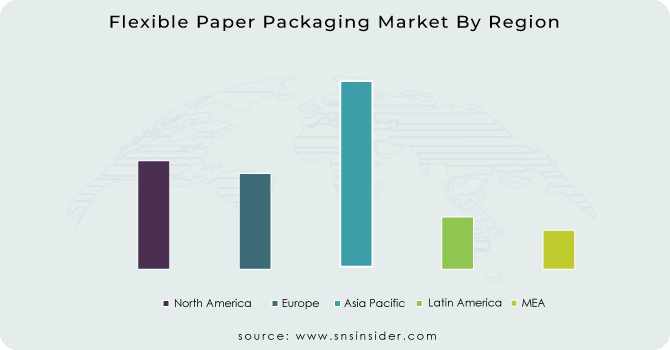

REGIONAL ANALYSIS

Asia Pacific region is the dominating region for the flexible paper packaging market and will continue to dominate the market over the forecast period. This is because of the increasing demand for flexible packaging. In Asia Pacific region, China is leading with highest market share due to low cost of labor, easy availability of raw materials along with better infrastructure for production.

Due to increasing awareness about climate change and a rising demand for Sustainable Packaging Solutions, the flexible sheet paper packaging market in North America has been growing steadily. In this region, the main contributors to market growth are the United States and Canada. Factors such as a growing demand for eco-friendly packaging, strict regulation of plastics and an increasing e-commerce sector are driving the market in this region.

The flexible paper packaging market has experienced considerable growth in Europe. Eco-friendly packaging solutions have been adopted by European countries, such as Germany, France and the United Kingdom, which has led to a growing demand for Flexible Paper Packaging. Additionally, The growth of the market has been further fuelled by a focus on reducing plastic waste and promoting recycling.

Latin America is witnessing a growing demand for flexible paper packaging, driven by changing consumer lifestyles, the increasing retail sector, and the rising preference for sustainable packaging. Major markets in this region are Brazil, Mexico and Argentina. The Latin American packaging sector has been undergoing a transition towards eco-friendly solutions and offers opportunities to flexible paper manufacturers.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

The Major Players are International Paper, Amcor plc, DS Smith, Mondi, WestRock Company, Stora Enso, Coveris, Sonoco Products Company, Huhtamaki OYJ, Sabert and other players.

WestRock Company-Company Financial Analysis

RECENT DEVELOPMENTS

-

Huhtamaki OYJ, In order to provide packaging manufacturers with protection, affordability and full recyclability, Huhtamaki is launching three new flexible, mono-packaging solutions made from paper, polyethylene and polypropylene.

-

Heinzel, at the UPM Steyrermhl plant, produces kraft paper for flexible packaging.

-

In the United Kingdom, PepsiCo is trialing a novel outer packaging for its Walkers Baked crisps multi-pack made from recycled paper.

| Report Attributes | Details |

| Market Size in 2023 | US$ 117.25 Bn |

| Market Size by 2031 | US$ 69.27 Bn |

| CAGR | CAGR of 4.02% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Paper Type (Kraft Paper, Parchment Paper, Sulfite Paper, Greaseproof Paper, Glassine Paper) • By Packaging Type (Pouches, Wraps, Bags & Sacks, Sachet, Cartons, Lids, Envelopes, Others) • By Embellishing Type (Hot Coil, Cold Coil, Others) • By Printing Technology (Rotogravure, Digital Printing, Flexography, Others) • By Distribution Channel (Retail, E-commerce) • By End Use (Food & Beverages, Pharmaceutical, Agriculture, Personal Care, Healthcare, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | International Paper, Amcor plc, DS Smith, Mondi, WestRock Company, Stora Enso, Coveris, Sonoco Products Company, Huhtamaki OYJ, Sabert |

| Key Drivers | • The Flexible Paper Packaging Market is driven primarily by cost efficiency and increased product shelf life • Rise of the e-commerce sector is giving a boost to the market. • Rising awareness about sustainable packaging. |

| Market Restraints | • The growth of the market will be hampered by multiple-layer packaging with different combination layers. |