Expanded Beam Cable Market Size Analysis:

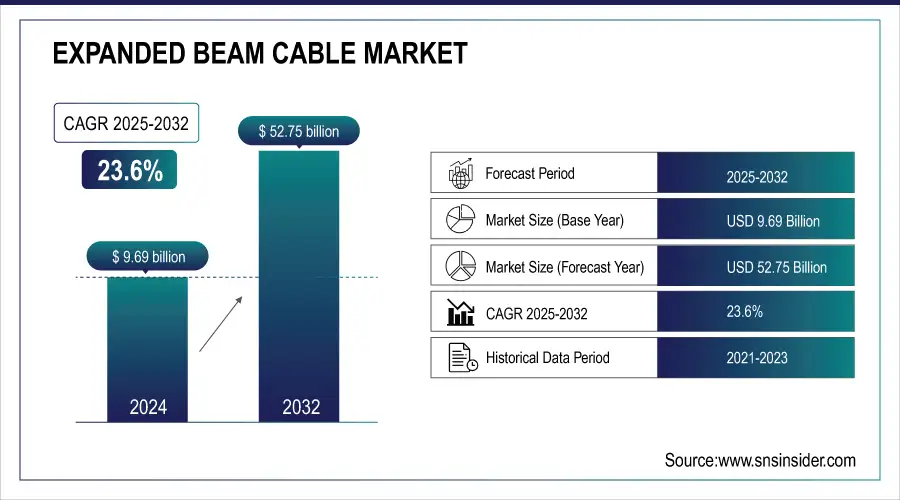

The Expanded Beam Cable Market Size was valued at USD 9.69 Billion in 2024 and is projected to reach USD 52.75 Billion by 2032, at a CAGR of 23.6% during 2025-2032.

The need for fast data transmission is quickly growing due to the increased use of cloud computing, streaming services, and other applications that require a lot of bandwidth. Expanded beam cables have a major benefit in this situation because they are able to transmit data over extended distances without distortion, which makes them well-suited for current communication requirements. Moreover, the increasing use of fiber optics in challenging conditions is boosting the demand for expanded beam cables, since they are more resistant to moisture, dust, and other substances that can cause damage, unlike regular copper cables. This characteristic makes them especially ideal for military and aerospace uses, where durability and resistance to contamination are vital. Additionally, the medical device industry is seeing an increasing need for expanded beam cables because of their compact size, flexibility, and compatibility with the human body.

Expanded Beam Cable Market Size and Forecast:

-

Market Size in 2024: USD 9.69 Billion

-

Market Size by 2032: USD 52.75 Billion

-

CAGR: 23.6% From 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025-2032

-

Historical Data: 2021-2023

Get More Information on Expanded Beam Cable Market - Request Sample Report

Key Expanded Beam Cable Market Trends:

-

Rising reliance on expanded beam fiber optic cables in mission-critical sectors such as defense, aerospace, oil & gas, and geophysics to ensure reliable communication in harsh environments.

-

Increasing demand for durable, dust- and moisture-resistant connectors capable of withstanding extreme temperatures and chemical exposure.

-

Growing adoption of advanced connector solutions like Neutrik’s FIBERFOX EBC25 and X-TREME EBC25 to enhance reliability in industrial and defense applications.

-

Expansion of subsea cable production facilities, such as Nexans’ 525kV HVDC subsea cables, to support electrification and offshore wind energy infrastructure.

-

Rising emphasis on high-performance, resilient fiber optic connectivity to maintain operational integrity in critical systems across multiple industries.

Expanded Beam Cable Market Growth Drivers:

-

Growing demand for essential applications in crucial missions.

The increasing use of fiber optic technology in different sectors is greatly increasing the need for expanded beam cables, especially in critical activities. Industries like defense, military, aerospace, and geophysics rely extensively on fiber optics for crucial communication and operations in difficult settings. Industries such as military communications, oil and gas exploration, medical devices, robotics, and energy production need dependable connectivity options that can endure tough environments, such as dust, moisture, extreme temperatures, and chemical exposure. In these challenging environments, the most important aspect is the durability and strength of fiber optic cables and connectors.

-

Connectivity Innovations Fueling Growth in the Expanded Beam Cable Market

The ongoing development of connectivity solutions, like Neutrik's broadening of its HMA multimode connector system range, plays a crucial role in driving growth in the expanded beam cable market. The release of the FIBERFOX EBC25 and FIBERFOX X-TREME EBC25 by Neutrik showcases the growing need for durable and dependable fiber optic connectors that can meet the strict standards of different sectors. These connectors are created for crucial tasks in industries such as industrial, defense, and civil engineering, where maintaining consistent performance is crucial. The durable structure of the FIBERFOX EBC25, along with its jam-nut setup, highlights improvements that guarantee improved dependability in difficult conditions, aligning directly with the demand for larger beam cables.

Expanded Beam Cable Market Restraints:

-

Challenges in the Expanded Beam Cable Market from an Economic Perspective

The increased beam cable market is encountering major economic obstacles mainly because of the high costs associated with manufacturing and implementation. The manufacture of these specific cables requires high-quality materials and advanced technologies to guarantee durability and efficiency in challenging conditions. The need for top-notch materials increases production costs, hindering market expansion. Industry reports show that the total cost of producing expanded beam cables can be significantly higher than traditional fiber optic cables, which may not be as attractive to organizations on a budget.

Expanded Beam Cable Market Segment Analysis:

By Connector Type

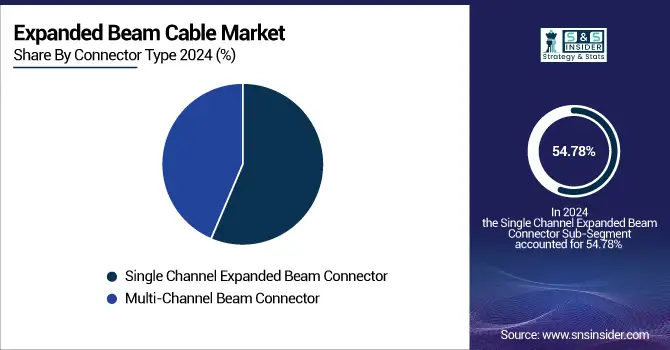

In the expanded beam cable market, the Single Channel Expanded Beam Connector dominated with a significant revenue share of 54.78% in 2024. This connector type is favored for its simplicity and effectiveness in delivering reliable, high-speed data transmission across various industries. Companies like Neutrik have enhanced this segment with their FIBERFOX Single Channel Connector, designed for rugged applications in telecommunications and broadcasting. This connector features advanced sealing mechanisms that provide protection against environmental contaminants, ensuring optimal performance in harsh conditions. Similarly, TE Connectivity has developed the Single Channel Expanded Beam Connector tailored for defense and aerospace applications, emphasizing durability and lightweight design to meet stringent military specifications.

By Technology

Single Mode technology held the biggest share of revenue at 44.44% in 2024 in the expanded beam cable market, mainly because of its excellent performance in transmitting data over long distances with minimal signal loss. Corning Incorporated and other companies have played a key role in developing single-mode fiber technology, with Corning recently introducing its Ultra-Low Loss (ULL) single-mode fibers that improve signal quality for long-distance communication. Furthermore, TE Connectivity unveiled its new Expanded Beam Fiber Optic Connector which utilizes single-mode technology to enhance reliability in challenging conditions, making it perfect for defense and industrial use cases. Moreover, the introduction of the Single-Mode Expanded Beam Connector by Amphenol has transformed connectivity options for the aerospace and military industries, providing enhanced resilience to environmental conditions.

Expanded Beam Cable Market Regional Analysis:

North America Expanded Beam Cable Market Insights

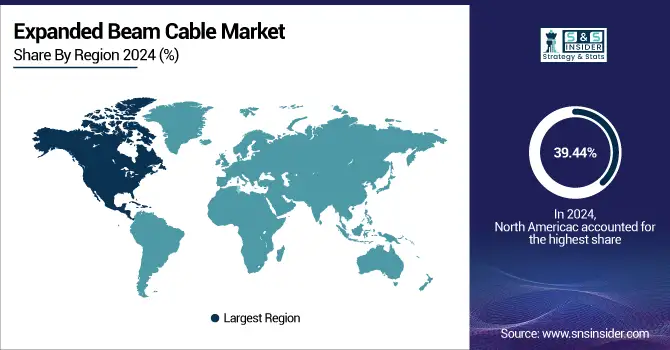

In 2024, North America held a significant portion of the expanded beam cable market with a revenue share of 39.44%, mainly due to the United States' strong focus on investment in advanced communication technologies and critical infrastructure. The region's focus on industries like defense, aerospace, and telecommunications has increased the need for advanced connectivity solutions. Key players in the industry such as Corning Incorporated and OFS (a Furukawa Company) are at the forefront of advancements in this field. Corning has recently introduced the Optical Fiber Connector, designed for high-performance tasks in challenging conditions to guarantee dependable data transmission for essential operations. Moreover, Amphenol broadened its range of products by launching new Single Channel Expanded Beam Connectors, specially crafted to fulfill the strict demands of industrial and military uses, improving longevity and effectiveness. The U.S. government's efforts to improve telecommunications infrastructure and boost broadband connectivity are driving market growth, supported by investments in renewable energy and smart grid technologies.

Need any customization research on Expanded Beam Cable Market - Enquiry Now

Asia Pacific Expanded Beam Cable Market Insights

In 2024, the Asia-Pacific region emerged as the fastest-growing market for expanded beam cables, propelled by rapid industrialization and significant investments in telecommunications infrastructure. Countries like China, India, and Japan are leading this growth, with governments implementing initiatives to enhance digital connectivity and expand broadband access. For instance, China Telecom has launched major projects to upgrade its fiber optic network, incorporating advanced expanded beam technology to improve transmission efficiency and resilience in harsh environments. Furthermore, Molex has introduced its Expanded Beam Connector System, designed specifically for aerospace and defense applications, underscoring the increasing demand for these connectors in critical communication systems. Sumitomo Electric Industries has also rolled out expanded beam cable solutions tailored for high-performance requirements in challenging conditions, particularly benefiting the renewable energy sector. The region's focus on developing smart cities and embracing the Internet of Things (IoT) is further driving the demand for reliable fiber optic solutions.

Europe Expanded Beam Cable Market Insights

The Europe expanded beam cable market is experiencing steady growth, driven by increasing adoption in defense, aerospace, oil and gas, and industrial automation sectors. The region’s emphasis on reliable, high-performance connectivity in harsh environments supports demand for robust fiber optic solutions. Ongoing technological advancements, combined with investments in energy transition projects such as offshore wind farms, are further boosting market expansion. Strong regulatory standards and growing digitalization also reinforce Europe’s position in the expanded beam cable market.

Latin America (LATAM) and Middle East & Africa (MEA) Expanded Beam Cable Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) expanded beam cable market is growing due to rising demand for durable connectivity in defense, oil & gas, mining, and energy sectors. Harsh environmental conditions such as dust, heat, and moisture drive the adoption of robust fiber optic solutions. Increasing infrastructure development, offshore exploration, and military modernization initiatives further fuel market expansion, positioning these regions as emerging opportunities for expanded beam cable adoption.

Expanded Beam Cable Companies are:

-

Harting Technology Group

-

Smiths Interconnect (Smith Group Plc)

-

Tech Optics

-

Warren & Brown Networks

-

Radiall

-

Bel Fuse Inc.

-

Foss Fiberoptics

-

3M Company

-

Sumitomo Electric Industries Ltd.

-

Molex

-

Amphenol

-

Avago Technologies

-

OFS Fitel

-

L-com Global Connectivity

-

General Electric (GE)

-

Corning Optical Communications

-

Phoenix Contact

Competitive Landscape for Expanded Beam Cable Market:

Neutrik is a leading provider of professional connectivity solutions, recognized for its innovation in rugged fiber optic technology within the expanded beam cable market. The company’s FIBERFOX series, including HMA and EBC25 connectors, is designed to withstand harsh environments while ensuring reliable, high-speed data transmission. With a strong presence in defense, industrial, and broadcast sectors, Neutrik emphasizes durability, precision, and performance, addressing the increasing demand for resilient expanded beam fiber optic connectivity worldwide.

-

In March 2022, NEUTRIK (Liechtenstein) launched their new FIBERFOX Expanded Beam Fiber Optic Connectors, created to meet MIL-DTL-83526 requirements for rugged settings. These connections use fiber optic terminations that do not require physical contact, and are sealed with IP68 behind a ball lens coated with anti-reflective material.

Amphenol FSI (U.S.), a division of Amphenol Corporation, is a key player in the expanded beam cable market, specializing in fiber optic connectors and assemblies designed for extreme environments. The company delivers rugged, reliable connectivity solutions for aerospace, defense, industrial, and communication applications. Leveraging advanced engineering and global manufacturing capabilities, Amphenol FSI provides high-performance expanded beam connectors that ensure durability, low-maintenance operation, and superior optical performance, supporting mission-critical applications where reliability and resilience are essential.

-

In November 2021, Amphenol FSI (US) unveiled its proactive response to the updated M28876 optical fiber connector standards. The company announced that the M28876 connectors will now come in either Black Hard Anodized PTFE or SnZn, instead of cadmium/CR+6.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.69 Billion |

| Market Size by 2032 | USD 52.75 Billion |

| CAGR | CAGR of 23.6% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Lens size (8 mm, 25 mm, 0 mm, 5 mm, Others) • By Technology (Single Mode, Multi-Mode, Hybrid) • By Connector Type (Single Channel Expanded Beam Connector, Multi-Channel Beam Connector) • By Single vs Multi-Channel Connector (Rack & Panel, Panel Mount Connectors, In-Line Circular, Quick-Disconnect, Others) • By Application (Military Communications, Oil & Gas, Medical, Robotics, Energy & Power, Broadcast Systems, Manufacturing & Industrial, Geophysical Exploration, Marine Operations, Military/ Aerospace, Commercial aerospace, Space flight, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | TE Connectivity Ltd., Harting Technology Group, Smiths Interconnect, Neutrik, Tech Optics, X-Beam Tech, Warren & Brown Networks, Radiall, Bel Fuse Inc., Foss Fiberoptics, 3M Company, Sumitomo Electric Industries Ltd., Molex, Amphenol, Avago Technologies, OFS Fitel, L-com Global Connectivity, General Electric (GE), Corning Optical Communications, Phoenix Contact. |