Fluoroscopy Imaging Systems Report Scope & Overview:

Get More Information on Fluoroscopy Imaging Systems Market - Request Sample Report

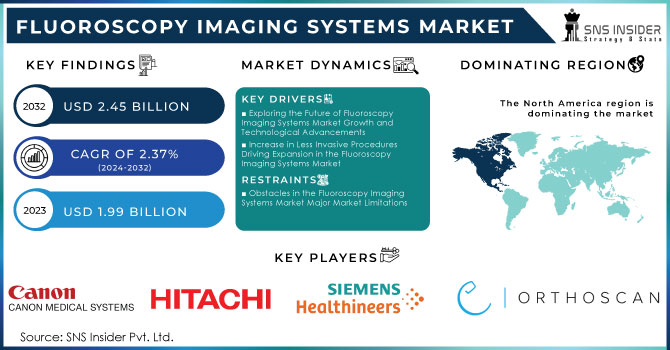

The Fluoroscopy Imaging Systems Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 2.45 billion by 2032 and grow at a CAGR of 2.37% over the forecast period 2024-2032.

The fluoroscopy imaging systems market is anticipated to witness a robust growth as demand for real time imaging has been increasing in diagnosis and therapeutic procedures. Advances such these are helping to accelerate expansion, allowing for higher quality image output with lower radiation exposure — hence better patient safety through innovation (as seen in digital fluoroscopy). The increase in the number of chronic diseases, the rise in the population aged 60 and above years old, and the improvement of healthcare facilities across developing countries have also contributed to market growth. The market is buoyed by significant support from various governments worldwide to boost healthcare systems and facilitate the uptake of state-of-the-art imaging technologies in hospitals. Therefore, regulatory agencies such as the FDA and EMA play a vital role in ensuring these products are safe and effective which has an effect on market trends. The market is supported by the incorporation of high-end software and advanced 3D imaging technologies in fluoroscopy systems allows for accurate diagnosis. The fluoroscopy imaging systems market is anticipated to prosper as developments continue and investment expands in healthcare, the industry which it caters.

It is also experiencing a move towards energy efficiency, caused by increasing operational expenses and environmental worries. A recent study conducted at University Hospital Basel emphasizes the considerable opportunity for saving costs and improving the environment by making strategic operational changes, such as shutting down interventional imaging systems during non-working hours. The research showed that powering down unused systems could decrease energy usage by almost 145,000 kilowatt hours per year and lower electricity expenses by around USD 38,000, highlighting the significant economic and ecological benefits of enhanced energy control. This trend is gaining more importance as healthcare providers try to reduce the environmental impact of radiology equipment. The results emphasize the importance of energy-saving technologies and operational procedures in the fluoroscopy imaging systems sector. As the market grows, implementing energy-efficient strategies matches the larger objectives of sustainability and cost savings in healthcare. Incorporating these methods can improve the attractiveness of advanced fluoroscopy systems by providing better diagnostic abilities as well as lowering operational expenses and environmental footprint. The link between market expansion and energy efficiency efforts in healthcare shows an increasing focus on sustainable practices, leading to more innovation and the use of energy-efficient fluoroscopy imaging technologies.

Market Dynamics

Drivers

- Exploring the Future of Fluoroscopy Imaging Systems Market Growth and Technological Advancements

The fluoroscopy imaging systems market is experiencing significant growth due to the increasing prevalence of chronic conditions like cardiovascular diseases, gastrointestinal disorders, and musculoskeletal injuries. Fluoroscopy, crucial for accurate diagnosis and treatment, is now a fundamental aspect of contemporary medical care. The increasing number of older people around the world highlights the importance of diagnostic imaging for treating chronic conditions such as heart disease, arthritis, and cancer. The growing importance of fluoroscopy is highlighted in minimally invasive procedures in various fields such as cardiology, orthopedics, oncology, and urology. Significant market potential is seen in procedures like angiography, spinal surgeries, and tumor ablations that rely on fluoroscopic guidance. Technological advancements, favorable healthcare policies, and increasing healthcare costs are boosting the market's growth by driving the use of fluoroscopy systems. Particularly, the move towards point-of-care imaging options, including portable fluoroscopy systems, handheld devices, and mobile C-arm units, aligns with the changing needs of healthcare professionals, particularly in emergency situations, outpatient surgery facilities, and distant areas. These advancements improve the ability to be carried, adaptability, and ease of use. Moreover, the increasing favoritism towards minimally invasive surgical methods, which provide benefits such as quicker recuperation, shorter hospital visits, and decreased complication rates, also drives the fluoroscopy industry. The increasing popularity of fluoroscopy is largely due to its crucial role in providing real-time imaging and guidance during medical procedures. Within the larger scope of medical imaging, techniques like ultrasonography, x-rays, CT scans, and nuclear medicine play a vital role in the diagnosis and treatment of diseases. The World Health Organization (WHO) is currently collaborating with partners to enhance diagnostic imaging services in low-income areas and improve medical imaging training, specifically emphasizing patient safety. This worldwide initiative to enhance and broaden imaging services corresponds with the increasing need for advanced fluoroscopy systems, underscoring the market's important contribution to modern healthcare.

- Increase in Less Invasive Procedures Driving Expansion in the Fluoroscopy Imaging Systems Market

The increase in minimally invasive procedures is a major driver of the fluoroscopy imaging systems market. Less invasive methods, characterized by smaller cuts and improved imaging for accurate direction, are gaining popularity due to their many benefits like faster healing, reduced risks, and shorter hospital visits. Fluoroscopy systems play a vital role in these procedures by providing live imaging for accurate guidance and performance. Fluoroscopy is commonly used in angiography procedures to visualize blood vessels and is essential for diagnosing and treating vascular problems. Coronary angiography is an illustration of a procedure that has become widely used in treating heart disease, involving the use of fluoroscopy to visualize the coronary arteries. The American Heart Association reports that approximately 7.9 Billion angiography procedures are performed annually in the United States, underscoring the high demand for fluoroscopy systems in cardiology. Improvements in medical technology, enhancing the functionalities of fluoroscopy systems, are also driving the shift towards less invasive methods. Improvements such as digital fluoroscopy, higher imaging quality, and advanced software integration are further boosting the growing popularity of these procedures. The rise in popularity of minimally invasive methods is anticipated to result in a greater need for fluoroscopy imaging systems, underscoring their crucial role in modern surgical procedures

Restraints

- Obstacles in the Fluoroscopy Imaging Systems Market Major Market Limitations

Although the fluoroscopy imaging systems market is experiencing strong growth, various obstacles are hindering its expansion. A major obstacle is the expensive fluoroscopy systems and maintenance, making them unaffordable for smaller healthcare facilities and those in low-income areas. The expenses include both the initial cost and continuous expenses for system maintenance, updates, and training. Additionally, another limitation is the risk of radiation exposure from fluoroscopic procedures. While modern systems aim to reduce radiation, fluoroscopy still carries health risks for patients and healthcare workers if not managed correctly due to its inherent nature. The necessity of following radiation safety protocols is emphasized by the IAEA, but many institutions face challenges in complying with these practices due to logistical and financial reasons (IAEA Radiation Protection).Moreover, an increasing worry surrounds the environmental effects of fluoroscopy systems. The energy usage and e-waste produced by these systems add to the overall problem of sustainability in the environment. Healthcare facilities face additional complexity in reducing their carbon footprint due to disposing and recycling old systems and components (Environmental Protection Agency (EPA)).These constraints in the market emphasize the importance of continuous innovation and strategic planning in tackling the financial, safety, and environmental issues linked to fluoroscopy imaging systems.

Segment Analysis

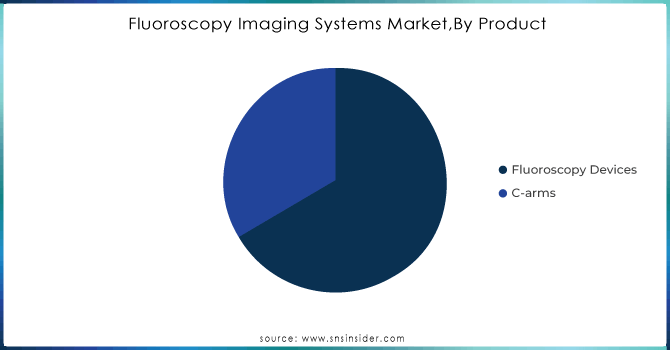

By Product

Based on Product,Fluoroscopy devices dominate the fluoroscopy imaging systems market, accounting for 67% of the market revenue in 2023. This control demonstrates their essential function in offering live imaging for a range of medical uses, from diagnostic tests to intricate surgical interventions. The reason why the market favors fluoroscopy devices is due to their advanced imaging abilities that allow for accurate guidance in procedures like angiography, spinal surgeries, and minimally invasive interventions. Top companies are leading the way in innovation in this field, improving the features and efficiency of fluoroscopy systems. As an example, GE Healthcare has launched the "Allia IGS 7" fluoroscopy system, blending cutting-edge imaging technology with artificial intelligence (AI) to enhance image quality and lower radiation exposure. The artificial intelligence in this system improves images in real-time and automatically optimizes doses, leading to improved patient results and operational efficiency (GE Healthcare). In the same way, Siemens Healthineers created the "Artis Pheno," an advanced fluoroscopy system with high-quality imaging and modern software for efficient workflow coordination. This system has capabilities such as 3D imaging and technologies that reduce doses, improving accuracy and lowering radiation exposure for both patients and operators (Siemens Healthineers). The growth of the fluoroscopy devices segment is being propelled by advancements that improve diagnostic accuracy, enhance procedural outcomes, and tackle radiation safety challenges. With the continual progression of technology, the fluoroscopy devices sector is predicted to uphold its top market status, thanks to continual improvements enhancing their vital role in current medical imaging.

Need any customization research on Fluoroscopy Imaging Systems Market - Enquiry Now

By End User

Based on End Users, Hospitals and specialty clinics hold the lead in the fluoroscopy imaging systems market as the biggest end-users, securing 45% of the market share in 2023. This large portion highlights the vital role played by these institutions in employing fluoroscopy for various diagnostic and interventional procedures. Hospitals and specialty clinics use fluoroscopy imaging systems for their advanced real-time imaging capabilities, which are crucial for procedures like angiography, spinal interventions, and minimally invasive surgeries. The increased need in these environments is caused by the requirement for accurate imaging to assist in surgical procedures, detect vascular conditions, and perform thorough patient assessments. Advancements in fluoroscopy technology have a significant influence in these healthcare settings. An example would be the "Azurion" series by Philips Healthcare, which includes advanced image processing and user-friendly touchscreen controls to improve fluoroscopic procedures' effectiveness and precision. This system smoothly blends into hospital operations, offering clear imaging and immediate guidance for various interventional procedures (Philips Healthcare). Furthermore, the Ziehm Imaging "Ziehm Vision RFD" mobile fluoroscopy system provides hospitals with increased flexibility and portability. These systems are created to quickly set up in different clinical environments like operating rooms and emergency departments, enhancing accessibility and workflow efficiency (Ziehm Imaging).The current focus in fluoroscopy systems within hospitals and specialty clinics is on enhancing image quality, minimizing radiation exposure, and improving integration with hospital information systems. These developments guarantee healthcare providers can provide accurate, secure, and effective care, strengthening the crucial role of hospitals and specialty clinics in boosting the growth of the fluoroscopy imaging systems market.

Regional Analysis

In the year 2023, North America dominated the fluoroscopy imaging systems market with a 41% market share. The region's leading position is due to its advanced healthcare facilities, widespread use of modern medical advancements, and substantial investments in research and development. The presence of leading medical device manufacturers in the United States, along with a growing demand for minimally invasive procedures, is key in driving the market. Leading the way in innovation in fluoroscopy imaging systems are companies like GE Healthcare, Siemens Healthineers, and Philips Healthcare, who have introduced new products to improve imaging precision, reduce radiation exposure, and enhance procedural outcomes. For instance, the "OEC Elite CFD" system by GE Healthcare, released in North America, combines sophisticated fluoroscopic features with a small design, making it suitable for both hospital and outpatient clinic settings. This system provides better image quality and dose efficiency, crucial for complex procedures like orthopedic surgeries and cardiovascular interventions. Also, Siemens Healthineers has unveiled the "Cios Alpha," a portable C-arm system equipped with a flat-panel detector that provides high-quality images and accommodates a wide variety of surgical procedures. The rise of innovation in North America is boosted by the introduction of AI-powered fluoroscopy systems like Philips Healthcare's "Azurion with FlexArm," improving procedural flexibility and enhancing imaging angles in surgeries (Philips Healthcare). The progress in technology, along with positive reimbursement policies and a growing emphasis on minimally invasive methods, further establish North America's dominance in the worldwide fluoroscopy imaging systems market.

In the fluoroscopy imaging systems market, the Asia-Pacific region held the second-largest portion of the market in 2023, representing 24% of the total global market share. The significant portion of the market is influenced by the region's quickly developing healthcare facilities, rising medical tourism, and growing incidence of chronic illnesses which necessitate advanced diagnostic imaging. Nations such as China, Japan, and India are leading the way in this expansion, making substantial contributions with their investments in healthcare and technological progress. China's focus on improving healthcare facilities has resulted in the widespread use of fluoroscopy systems, developed by local companies such as Mindray and Neusoft Medical Systems, offering affordable and groundbreaking imaging solutions. Japan, which is renowned for its technology capabilities, is still pushing the boundaries with companies such as Canon Medical Systems releasing state-of-the-art fluoroscopy systems that use artificial intelligence to improve image quality and procedural effectiveness. At the same time, India's healthcare industry is experiencing rapid expansion due to rising interest in less invasive medical techniques, as multinational corporations such as Siemens Healthineers and GE Healthcare are increasing their presence and range of products in the nation. Government efforts to enhance healthcare accessibility and affordability are reinforcing the expansion of this region, solidifying Asia-Pacific's position as a significant participant in the worldwide fluoroscopy imaging systems market.

Key Players

The Major Players are Canon Medical Systems Corporation., Hitachi Medical Systems, Siemens Healthineers, Koninklijke Philips NV, GE HealthCare, Ziehm Imaging GmbH, Shimadzu, Orthoscan Inc., Hologic Inc, Carestream Health & Others Players

Recent Developments

-

In July of 2023, a multipurpose fluoroscopic table with new features called Zexira i9 digital X-ray RF system was introduced by Canon Medical Systems. It is a digital X-ray RF system that comes with all the necessary features to fulfill clinical requirements.

-

In October 2021, Siemens Healthineers revealed the initial placement of LUMINOS Lotus Max at Long Island Jewish Valley Stream in the United States.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.99 Billion |

| Market Size by 2032 | USD 2.45 Billion |

| CAGR | CAGR of 2.37 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural Language Processing (NLP), Machine Learning (ML), Others) • By Application (Medical Record Mining, Medical Imaging Analysis, Medicine Development, Emergency Assistance, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon Medical Systems Corporation., Hitachi Medical Systems,Siemens Healthineers, Koninklijke Philips NV,GE HealthCare,Ziehm Imaging GmbH,Shimadzu,Orthoscan Inc.,Hologic Inc,Carestream Health & Others |

| Key Drivers | • Exploring the Future of Fluoroscopy Imaging Systems Market Growth and Technological Advancements • Increase in Less Invasive Procedures Driving Expansion in the Fluoroscopy Imaging Systems Market |

| RESTRAINTS | • Obstacles in the Fluoroscopy Imaging Systems Market Major Market Limitations |