Frontline Workers Training Market Report Scope & Overview:

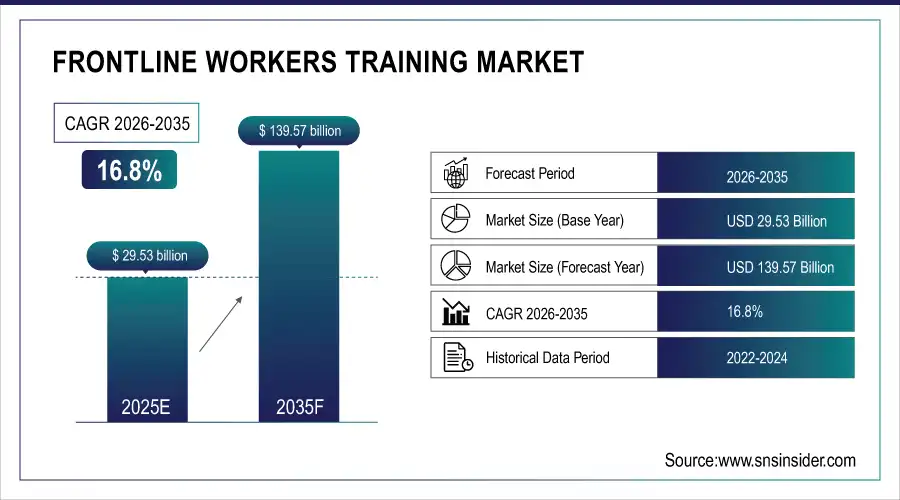

Frontline Workers Training Market size was valued at USD 29.53 billion in 2025 and is projected to reach USD 139.57 billion by 2035, at a CAGR of 16.8%.

Frontline workers training market growth is one of the leading driving factors for upskilling in organizations to enable operational efficiency, compliance, and retention of frontline workers. To provide scalable and efficient training, sectors like retail, healthcare, and logistics are embracing mobile, simulations through VR, and Artificial intelligence-driven platforms. The growing popularity of blended learning models that flexibly mix online, offline, and on-the-job approaches. The demand for market growth is also complemented by government regulations and safety mandates.

According to research, despite making up 80% of the workforce, frontline roles receive under 5% of training tech investment, though mobile use, soft skill focus, and real-time feedback adoption are rapidly increasing.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 29.53 Billion

-

Market Size by 2035 USD 139.57 Billion

-

CAGR of 16.8% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Frontline Workers Training Market - Request Free Sample Report

Frontline Workers Training Market Trends:

• Rapid adoption of mobile-first and microlearning platforms to support on-the-go training for frontline employees

• Growing integration of AI-driven personalization and analytics to track performance and learning outcomes in real time

• Increasing use of gamification and immersive technologies such as AR/VR to boost engagement and knowledge retention

• Expansion of role-based and industry-specific training content tailored to retail, healthcare, logistics, and manufacturing sectors

• Rising partnerships between enterprises, technology providers, and government bodies to support large-scale workforce upskilling initiatives

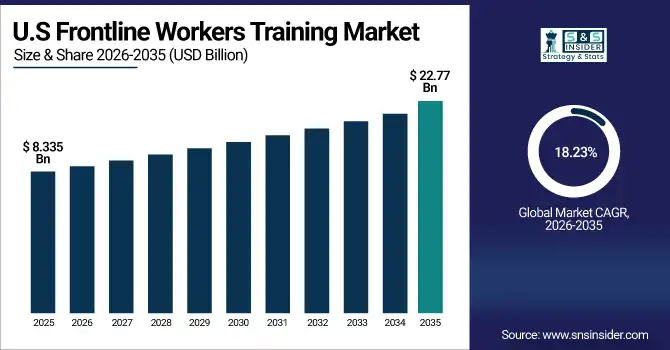

The U.S Frontline Workers Training Market was valued at USD 8.335 billion in 2025 and is projected to reach USD 22.77 billion by 2035 with a CAGR of 18.23% during the forecast period of 2026-2035. U.S. holds a large share in the market owing to a strong emphasis on digital transformation and workforce development. Stringent regulatory compliance from end-use segments like healthcare, retail, logistics, and manufacturing has also made a stronghold on the market. With a plethora of sophisticated tech infrastructure, the country is well-established on the path of quickly adapting AI-based learning platforms, mobile training applications, and immersive solutions such as AR/VR. The increasing demand for employee retention, safety training, and optimization of performance, as well as investment from government and corporations to address skill gaps and improve frontline workforce productivity, are key drivers.

Frontline Workers Training Market Growth Drivers:

-

Increased Digital Transformation Across Enterprises Enhances Adoption of Scalable Training Solutions for Frontline Workforce

The increasing digital transformation wave across industries has drastically fueled the technology-powered training platforms for frontline workers. Enterprises have started investing in mobile learning apps, AR/VR learning modules, and AI-powered content to offer seamless and on-demand training at scale. It's driven specifically by a need to keep distributed and high-turnover workforces skilled, compliant, and engaged. Recent trends display a mixture of real-time performance analytics and gamification of learning platforms to increase user engagement and retention of skills. Driven by the need for scalable, efficient, and measurable training outputs, this trend is only set to expand into sectors such as retail, healthcare, and logistics.

Frontline Workers Training Market Restraints:

-

High Cost of Customized Training Programs and Limited Budgets in SMEs Restrict Broader Implementation Scope.

The huge investment involved in developing and delivering training programs to address individual needs continues to be a significant limitation, particularly for SMEs. The additional costs attached to tailor-made content development, technology incorporation, and continuous support services heighten the cost associated with them, making the complete training solution unaffordable and out of reach. Additionally, there is insufficient infrastructure or internal resources to manage these systems in many of these SMEs.

Frontline Workers Training Market Opportunities:

-

Rising Focus on Upskilling Frontline Workers to Improve Retention and Operational Efficiency Creates Growth Avenues.

As skill shortages continue to swell and attrition rises, organizations are turning their attention to upskilling staff as a way of attaining job satisfaction and reducing turnover. This is particularly more important for frontline jobs, as noted by the direct impact of skill shortages on business performance, safety, and customer experience. Currently, this includes everything from corporate partnerships with training platform providers to establish role-specific learning paths, microlearning modules, and on-the-job skill enhancement programs. An increase in funding support for workforce development, much of it government-backed, has driven the growth of upskilling, as well.

Frontline Workers Training Market Segment Analysis:

By Offering

Solution segment held the largest revenue share, which accounted for 67.46% in 2025, owing to the increasing adoption of integrated training platforms that offer scalable and individualized learning experiences. Based on this, Cornerstone, a few months ago, announced its AI-powered platform, with real-time performance tracking and a mobile-first focus for frontline roles, and ticking off all other boxes for performance management. Thereafter, the same with Oracle following. Such as Real-time skill-based learning and compliance training, Oracle Learning Cloud, and Axonify microlearning platform.

Digital training solutions reduce per-employee training costs by 30–50% compared to traditional in-person methods for frontline roles

The Services segment is expected to grow at the highest CAGR of 21.14% during the forecast period. Instead, organizations are outsourcing to specialized training service providers like Beekeeper AG and Anthology Inc., which provide targeted training modules as well as ongoing support for frontline roles. This expansion in purpose within this sector suggests that with all the complexities increasing in frontline operations, organizations are reaching outside of the company for expertise in training delivery, workforce engagement, and compliance, to help drive efficiencies for both cost and time.

Get Customized Report as per Your Business Requirement - Enquiry Now

By Mode of Training

In 2025, the Online segment held the largest frontline workers training market share, accounting for approximately 41.40% in terms of revenue, primarily attributed to the increasing necessity for flexible and scalable learning to accommodate distributed frontline teams. Cloud-based learning tools, mobile apps, and AI-based personalization have further improved online training capabilities for many companies, including Adobe Inc. Adobe Captivate, Google Classroom, Captivate Google Classroom. The Blended Training segment, fastest growth of 20.20% CAGR, for the prediction duration, though backed by its middle way between productivity and actual training. Firms are heading towards hybrid learning, which combines virtual with experiential on-ground modules. Axonify and Cornerstone offer new blended functionality, including mobile learning, instructor-led, and gamified assessment. It works seamlessly for verticals that need pairing soft skill learning with domain expertise, healthcare, retail, etc., and has begun to be well-accepted in the market due to increased retention benefits, addressing varied learning needs, and real-time feedback.

By Deployment

The Cloud segment held the 59.50% revenue share of the market, attributed to its scalability, lower cost of infrastructure, and deployment ease. Top providers such as Microsoft and Oracle have rolled out large-scale, cloud-based training platforms designed for frontline roles. But the new integrations of Microsoft Viva Learning and Oracle Learning Cloud with other enterprise tools eliminated the need for having the learning management systems sync in real-time, also making it easier to access remotely, to make it more ready for users meeting business needs. On-premises segment is slated to register the fastest CAGR of 20.25% % driven by data privacy issues, Compliance, and Customization. Industries like government, defense and financial services prefer on-premises solutions for greater control and security. Highly customizable on-premises platforms from brands like PTC and Adobe are tailored to their unique organizational structure. Recent advancements enable secure offline training and full data control, ideal for organizations with strict compliance needs despite higher costs.

By Application

The Performance Management has the largest market share of 30.61% in 2025, driven by an increasing demand among organizations for optimization of workforce, productivity, and real-time feedback systems. Firms like Oracle and Cornerstone are taking it further, giving tools that demonstrate employee performance effectiveness, align learning with business metrics, and supply individual development journeys. These platforms identify skill gaps and training needs, making retail and logistics ideal for performance-based training that enhances accountability, efficiency, and workforce development. The Risk & Compliance Management segment fastest CAGR of 20.60%, owing to the increasing focus on workplace safety and legal compliance, and the stringent regulations. The necessity for mandatory training is very apparent in the healthcare, manufacturing, and BFSI sectors that are subject to certain regulations. Frontline Workers Training Market Companies like Axonify and iTacit have added compliance modules, features to assist with automating updates, and tools to get your organization audit-ready at the click of a button.

By Skillset Type

Technical & Functional skills, the market was led by a total of 17.87% revenue share, as companies had to serve the required skills to run effectively. Simulation-based training tools and software tutorials have been developed by PTC, Adobe, and several other tool-building companies. These tools support firsthand practice to prepare for precision and job readiness. The functional workforce in sectors therefore, faces the biggest investment priorities in upskilling, as technology and digitization of frontline tasks rapidly redefine core functional areas to deliver superior efficiency, product quality, and equipment safety. The Customer Focus & Relationship Building segment is expected fastest growth, by registering a CAGR of 18.80% over the forecast period, owing to the influence of frontline workers on customer experience. There are training modules to enhance empathy, communication, and customisation of your service are also being used in the retail and hospitality verticals. Beekeeper AG and Anthology Inc. have introduced tools for simulating customer interactions and measuring how effectively engagement is being assessed. With customer experience a key differentiator, businesses invest in relationship-based training to boost loyalty, reduce churn, and enhance service delivery.

By Vertical

The BFSI segment held the maximum market share of 33.04% in 2025, due to the stringency of compliance in terms of both regulation and customer service, along with the requirement for real-time secure training. In this segment, investments are made in employee development as the frontline workers training market industry looks to support the transparency of operational performance, customer satisfaction, and regulatory compliance.

For instance, banks and insurance companies in this industry employ Oracle and Adobe platforms to train frontline workers regarding new regulations, fraud detection, and customer relations.

The healthcare segment is projected to grow with the fastest CAGR of 20.70%, owing to the growing workforce shortages, patient safety protocols, and compliance requirements. A module dedicated to the health-care sector is also available from Axonify, Cornerstone, and others, including need-to-know information on cleaning, bathing, transfer, and other measures to control infection and response protocols in case of emergency. The pandemic emphasized the need to train clinical and non-clinical staff in an agile and continuous manner.

Frontline Workers Training Market Regional Analysis:

North America Frontline Workers Training Market Insights

North America dominates the market share of 40.37%, due to the high adoption of digital, established enterprise infrastructure in developed economies, and an increasing focus on employee engagement and compliance. The focus of industries including healthcare, BFSI, and retail is to develop a frontline workforce through an AI-driven platform, mobile training, and a cloud-based enterprise solution. Demand is also stoked by government mandates as well as skill development programs.

The US leads the region due to its sophisticated ecosystem in technology, robust culture in compliance with regulations, and the increased investment in digital learning platforms across major verticals.

Europe Frontline Workers Training Market Insights

Europe is seeing stable growth driven by the demand for workforce upskilling, labor union protections, and the digital transformation of industries such as manufacturing and logistics. With a renewed focus on employee safety and operational efficiency, countries are turning to blended learning and multi-lingual training tools to cope with a diverse workforce.

Germany is the regional market leader due to its industrial scale, focus on vocational training, and early integrated digital training systems in frontline-heavy sectors.

Asia Pacific Frontline Workers Training Market Insights

Asia Pacific is the fastest-growing market, with a CAGR of 20.66%, due to rapid industrialisation, flourishing service sector, and increased focus on the productivity of labour. Countries with large frontline populations are seeing the rise of mobile-first training platforms and affordable learning technologies. Local governments, too, are initiating skill-building programs supported by labour market demands.

China dominates due to its large frontline base, increasing digitalization, and numerous scale, government-backed training and reskilling programmes across logistics, manufacturing, and healthcare.

Latin America (LATAM) and Middle East & Africa (MEA) Frontline Workers Training Market Insights

Emerging markets such as the Middle East & Africa and Latin America are recognizing the importance of investments in digital frontline training, particularly in the healthcare, retail, and manufacturing sectors. At the forefront of all such efforts are the UAE and Brazil, backed with their mass-scale government initiatives to create a push factor, smart infrastructure, and mobile-based solutions creating ready-to-go workforce upskilling solutions.

Frontline Workers Training Market Key Players:

The major key players of the Frontline Workers Training Market are Microsoft, Google LLC, Adobe Inc., PTC, Beekeeper AG, Anthology Inc., Oracle, Cornerstone, Axonify Inc., iTacit, and others.

Competitive Landscape for Frontline Workers Training Market:

Google plays a significant role in the frontline workers training market through cloud-based learning platforms, AI-driven analytics, and mobile-first tools. Leveraging Google Cloud, Workspace, and AI technologies, the company enables scalable, personalized, and data-driven training solutions that enhance workforce productivity, engagement, and real-time skill development across industries.

-

In September 2024, Google revealed that its Gemini AI will be integrated into the productivity suite Workspace and Frontline plans. The goal of this integration is to improve productivity and security for frontline workers.

Axonify Inc. is a leading provider of frontline workforce training solutions, offering mobile-first, AI-powered microlearning platforms. The company focuses on personalized learning, real-time performance analytics, and gamification to improve knowledge retention, operational efficiency, and employee engagement across retail, healthcare, manufacturing, and logistics sectors.

-

In March 2024, Axonify Inc. introduced a new set of frontline employee enablement tools that use gamified learning and AI-powered reinforcement to boost employee engagement, compliance, and operational performance via microlearning.

|

Report Attributes |

Details |

|---|---|

| Market Size in 2025 | USD 29.53 Billion |

| Market Size by 2035 | USD 139.57 Billion |

| CAGR | CAGR of 16.8% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Offering (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Microsoft, Google LLC, Adobe Inc., PTC, Beekeeper AG, Anthology Inc., Oracle, Cornerstone, Axonify Inc., iTacit, and others. |