Microserver Market Report Scope & Overview:

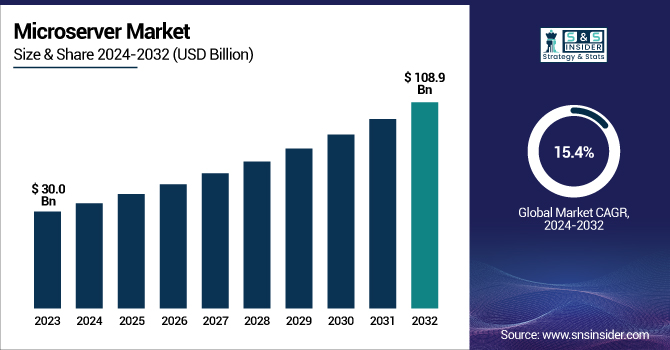

The Microserver Market Size was valued at USD 30.0 billion in 2023 and is expected to reach USD 108.9 billion by 2032 and grow at a CAGR of 15.4% over the forecast period 2024-2032.

To Get More Information on Microserver Market - Request Sample Report

The microserver market is growing due to the increasing demand for compact, low-power consumption, and space-efficient servers. Microservers are essentially meant for lightweight computing applications and, therefore, particularly attractive for web hosting, cloud computing, and data centers. Increasing demand for low-power and space-efficient servers is being catalyzed by companies looking to deploy cloud and edge computing infrastructure. Microservers would be an ideal solution for organizations to deploy multiple servers in a compact space and bring down the overhead of operations. ARM-based processor development in microservers is a leading trend, providing an alternative to traditional x86 architecture-based structures. This aspect improves energy efficiency and enhances performance, allowing market penetration across industries.

Growing dynamic factors related to the microserver market include advancements in semiconductor technology and the increased adoption of HCI, or hyper-converged infrastructure. The emerging designs in processors, with more cores and threads integrated within, help microservers handle workloads much more complex with greater efficiency. Such HCI is a popular choice in today's enterprises that wish to simplify IT environments. In addition, microservers have flexibility and scalability, which indicates their affinity with HCI for more demand in the telecommunication, finance, and healthcare sectors.

Microservers have been on the map of recent advances of companies, manifesting how the microserver market evolves, befitting the needs of modern businesses. The most typical example in this regard is the fact that AMD unveiled EPYC processors, which are particularly optimized for cloud and high-performance computing. This implies that chip manufacturers are taking their products to increasingly finer-grained niches better suited to microserver applications. These processors offer a better core count and improved memory performance, which directly deals with the demand for more robust and energy-efficient solutions. On the other hand, for Intel, the focus has been on Atom, and most microservers use processors, balancing energy efficiency and the supply of performance for applications such as network management and storage services. In the data center segment, HPE was leading modular microserver systems that enable enterprises to adapt computing capacity based on real-time requirements, offering cost-cutting and agility benefits.

Demands in the area of edge computing also drive this demand because microservers are increasingly being deployed at the edge of networks for nearer-source processing of data, reducing latency and bandwidth use. Microservers can be particularly valuable for IoT and telecommunications industries. Another area in which companies use microservers is in creating more energy-efficient data centers. For example, from the supplier side, the availability of ARM-based microservers has helped data centers save power consumption and hence has attracted eco-friendly enterprises with a focus on green IT practices. Further growth in the adoption of 5G technology is growing the adoption of microservers as they support high data transmission rates as well as low latency needed in 5G infrastructures, which is critical for applications such as autonomous vehicles and smart cities.

Market Dynamics:

Drivers:

-

Rising Adoption of Edge Computing Solutions Drives Growth in the Microserver Market

An increase in the usage of edge computing solutions across industries is one of the major growth drivers for the microserver market. Edge computing, which allows processing data closer to its point of origin, is gaining immense traction due to the rapidly growing piles of data from IoT devices, smart applications, and 5G networks. Microservers with a small form factor, energy efficiency, and designed capacity for distributed workloads are ideal for edge environments. These reduce latency because most data can be processed locally at the edge and need not be sent to centralized data centers. Real-time applications like autonomous vehicles and industrial automation along with healthcare monitoring form a big portion of its requirements. The industry's continued adoption of edge computing for improving performance and reducing network congestion will create a growing demand for microservers. This trend is primarily prevalent in sectors like telecommunications, smart cities, and manufacturing, where such speed and efficiency are critical.

-

Increasing Popularity of Cloud-Based Services and Data Center Expansion Fuels Demand for Microservers

The rapid expansion of cloud computing services and the need for scalable data centers are two major growth drivers for the microserver market. This occurs as people around the world continue shifting the operations of their businesses to cloud platforms, seeking adaptability, scalability, and cost-effectiveness. Micro-servers are pre-tuned packages to handle a specific amount of traffic, thus they can afford large-scale deployment within a data center and are just the right fit for cloud service providers. Their energy-efficient architecture allows data centers to reduce the operational costs required to keep a high-performance setup up and running. Furthermore, SaaS and IaaS solutions must be supported by highly agile infrastructure; microservers support it. With the increasing spending by companies on cloud deployment in line with the growth of the hybrid cloud model, the demand for microservers will increase in unison.

Restraint:

-

Limited Processing Power of Microservers Acts as a Restraint for High-Performance Applications

One of the constraints of the microserver market is that they have low processing ability, which forces them not to be the most desirable choices for any applications of high-performance computing. Although microservers are optimized for light tasks, they lack more powerful computable resources necessary to enable heavier tasks, like supercomputing, big data analytics, or AI computations. This restriction makes them only suitable for certain industries and use cases where computing needs are not as demanding. Organizations that require a lot of processing power, especially in scientific computing, financial modeling, and complex machine learning operations, may prefer a more powerful server deployment, such as a traditional server with additional resources, to support intense computation. This makes the microserver market somewhat limited to specific niche applications in high-performance categories.

Opportunity:

-

Rising Demand for Energy-Efficient and Environmentally Friendly Data Centers Presents Opportunities in the Microserver Market

The high growth opportunity for the microserver market is because of the growing concern for sustainability and energy efficiency in data center operations. Data centers are gigantic power consumers, and hence growingly, enterprises are seeking solutions that not only reduce their carbon footprint but also the operational costs. Microservers, being low-power consumers and efficient performance, happen to be perfectly relevant for efficiency-conscious data centers. They allow companies to scale out their server infrastructure without increasing energy consumption dramatically. That is particularly relevant since regulations related to energy use and environmental influence are tightening up. Microservers need to be driven by the adoption of renewable energy-powered data centers with the need for a more sustainable IT infrastructure.

Challenge:

-

Balancing Performance and Cost Efficiency Remains a Challenge for Microserver Adoption

One of the major challenges in the microserver market is finding an appropriate balance of performance and efficiency in terms of cost. Because microservers are quite more cost-effective and energy-efficient compared with other kinds of servers, limited computation power, and non-scalability might not become a good fit for many industries or applications. Companies that need to maximize the efficiency of IT infrastructure have to balance the cost savings against limited computation power and scalability. The challenge for business adoption, then, is mainly on the assertion side, with the argument that the workloads of businesses can be handled sufficiently by microservers without compromising too much on performance. Another reason for the challenge in business adoption is the TCO, or total cost of ownership, including maintenance, support, and eventual scalability; many organizations find it difficult to justify sizeable investments in large-scale configurations of microserver solutions. Increased technological access, including lowered inertia relative to performance improvements, is, however important in addressing the above challenges to wider business adoption.

Key Market Segments

By Offering

The Hardware segment dominated the microserver market and accounted for a market share of more than 45% in 2023. The principal reason for this dominant market share is the growing need for energy efficiency and space-saving server hardware in data centers and cloud infrastructures. Companies, in such efforts, have been looking to invest in optimized hardware components such as processors, storage units, and networking equipment to cut costs and optimize operational efficiency. Intel and AMD are capitalizing on the innovations that have been done on microserver processors while HPE, Dell, and others keep on churning out modular designs to allow for scalability and flexibility in hardware configurations.

By Processor Type

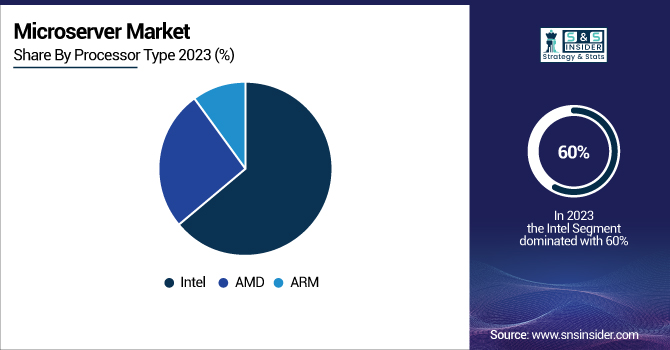

In 2023, Intel dominated the microserver market and accounted for around 60% of the revenue share. This is because its Xeon and Atom processors are widely used in micro server deployments due to good performance and power efficiency, and the capability to handle both cloud and edge workloads. Long serving as the leader in the server market through continuous innovation in multi-core architectures, making Intel's processors the first choice for enterprise-level data centers and cloud computing environments, companies such as Alibaba Cloud and Amazon Web Services have integrated Intel processors into microserver infrastructures continuing to keep raising demand for Intel-based solutions.

By Organization Size

In 2023, large enterprises dominated and accounted for more than 50% of the revenue share in the microservers market. Large organizations, including those in the fields of telecom, cloud service, and finance, need scalable and high-performance servers to cope with gigantic amounts of data. Increasingly, organizations deploy microservers as a strategic move to reduce operational costs while expanding their server capacity. Firms such as Google and Microsoft continue to invest in microserver architectures, which are helping fuel expansion in this area so far, the cloud services and data centers of these companies are underpinning growth in this segment.

By Application

The data center segment dominated and accounted for the largest share at about 40% of the total in 2023. Microservers offer a cost-effective means to meet increasing data traffic and storage requirements, as more and more data centers expand worldwide. Innovations like microservers are being adopted by leading cloud service providers such as AWS, Google Cloud, and Microsoft Azure in their data centers to ensure optimal performance while minimizing energy consumption and reducing space. It is becoming much stronger in hyperscale data centers, where the demand for dense, scalable server solutions continues to increase.

Regional Analysis

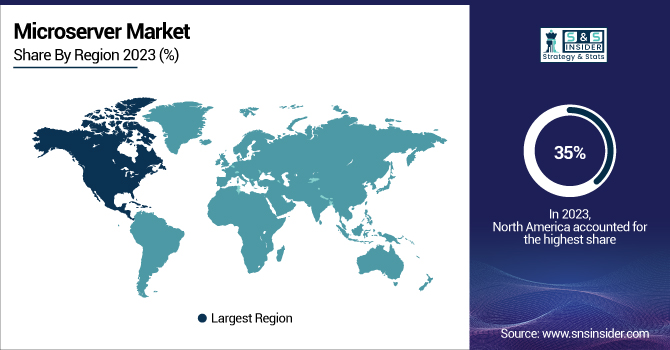

In 2023, the North American region dominated the microserver market and accounted for more than 35% of the market. This is largely due to the market leadership of the big cloud service providers and data center companies such as Amazon Web Services, Google Cloud, and Microsoft Azure that incorporated microserver technology in their operations for improved efficiency and cost-effectiveness. In addition to the above drivers, the established IT infrastructure within the region and early adoption of advanced technologies such as edge computing and IoT support massive adoption of microservers. Moreover, sizeable investments by the U.S. government in a sustainable data center solution and 5G infrastructure have further propelled the region's position in the microserver market.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest growing region in the microserver market with an estimated CAGR of about 15%. The growth is being driven by the increasing demand for cloud services, edge computing, and the expansion of data centers in regions including China, India, and Japan. The Internet of Things devices, smart city initiatives, and 5G deployments are creating the need for microservers with distributed workloads and low latency in this region. The very heavy investments made by top companies in China, such as Alibaba Cloud and Tencent, into microserver-based infrastructure to support the growth of their cloud and data center offerings also drive growth in the region.

Do You Need any Customization Research on Microserver Market - Enquire Now

Key Players

-

Acer Inc. (Acer Cloud Technology, Acer Microserver)

-

Advanced Micro Devices, Inc. (AMD EPYC Processors, AMD Ryzen Embedded Processors)

-

ARM Ltd. (ARM Cortex-A Processors, ARM Neoverse Platform)

-

Dell Inc. (Dell PowerEdge Microservers, Dell VxRail)

-

Fujitsu (Fujitsu PRIMERGY Microserver, Fujitsu SPARC M10 Server)

-

Hewlett Packard Co. (HPE ProLiant MicroServer Gen10 Plus, HPE Apollo)

-

IBM (IBM Power Systems, IBM BladeCenter)

-

Intel Corporation (Intel Xeon D Processors, Intel Atom C Processors)

-

Marvell Technology (Marvell ThunderX Processors, Marvell Octeon Processors)

-

MiTac International Corporation (MiTac Microserver Solutions, MiTac H-Series Microserver)

-

Penguin Computing, Inc. (Penguin Computing Altus Microservers, Penguin Computing Relion Servers)

-

Quanta QCT (Quanta Microserver, QuantaGrid D52G-1U)

-

Tilera Corporation (Tilera TILE-Gx Processors, Tilera iMesh Solutions)

-

Cavium, Inc. (Cavium ThunderX Processors, Cavium Octeon Processors)

-

Boston Limited (Boston Microserver Solutions, Boston Server Racks)

-

Super Micro Computer, Inc. (Supermicro SuperServer, Supermicro MicroBlade)

-

Lenovo Group Limited (Lenovo ThinkSystem Servers, Lenovo Flex System)

-

Huawei Technologies Co., Ltd. (Huawei FusionServer, Huawei TaiShan Servers)

-

Inspur Group (Inspur NF5280M5 Server, Inspur TS Microservers)

-

Nvidia Corporation (NVIDIA DGX Systems, NVIDIA RTX Servers)

-

Hardware Manufacturers in the Microserver Market

-

Intel Corporation

-

Advanced Micro Devices, Inc.

-

ARM Ltd.

-

Dell Inc.

-

Hewlett Packard Co.

-

-

Cloud Service Providers in the Microserver Market

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

IBM Cloud

-

Alibaba Cloud

-

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 30.0 Billion |

| Market Size by 2032 | US$ 108.9 Billion |

| CAGR | CAGR of 15.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Offering (Hardware, Software, Service {Consulting services, Installation and support services, Professional services}) •By Processor Type (Intel, AMD, ARM) •By Organization size (Small & Medium Enterprises, Large Enterprises) •By Application (Media Storage, Data Center, Data Analytics, Cloud Computing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hewlett Packard Co., ARM Ltd., Intel Corporation, Quanta QCT, Penguin Computing, Inc., IBM, Acer Inc., Tilera Corporation, Advanced Micro Devices, Inc., Marvel Technology, Dell Inc., Fujitsu, MiTac International Corporation and other key players |

| Key Drivers | • Rising Adoption of Edge Computing Solutions Drives Growth in the Microserver Market • Increasing Popularity of Cloud-Based Services and Data Center Expansion Fuels Demand for Microservers |

| RESTRAINTS | • Limited Processing Power of Microservers Acts as a Restraint for High-Performance Applications |