Froth Flotation Equipment Market Report Scope & Overview:

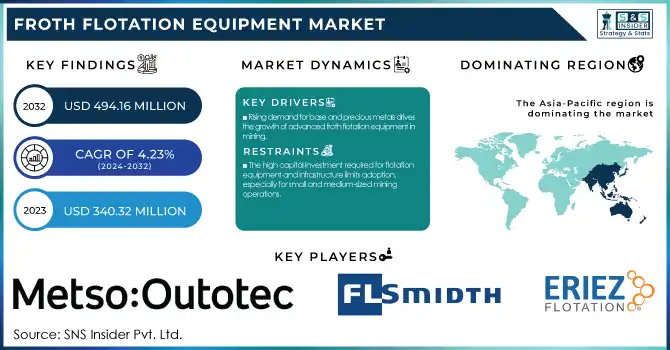

The Froth Flotation Equipment Market Size was estimated at USD 340.32 million in 2023 and is supposed to arrive at USD 494.16 million by 2032 with a growing CAGR of 4.23% over the forecast period 2024-2032. This report uniquely explores production volume trends and utilization rates of froth flotation equipment across key regions, highlighting operational efficiency benchmarks and downtime analysis. It examines the adoption of emerging technologies, such as AI-driven process optimization, and regional export-import dynamics shaping the global supply chain. Additionally, the study delves into sustainability-driven innovations, including the rising adoption of bio-based flotation reagents and energy-efficient designs, providing a forward-looking perspective on the industry's technological evolution.

To Get more information on Froth Flotation Equipment Market - Request Free Sample Report

Froth Flotation Equipment Market Dynamics

Drivers

-

The rising demand for base and precious metals, driven by industrialization and renewable energy needs, is fueling the growth of advanced froth flotation equipment in mining operations.

The increasing demand for minerals and metals, including base metals such as copper, lead, and zinc, as well as precious metals like gold and silver, is significantly driving the growth of the froth flotation equipment market. Therefore, demand for froth flotation equipment is increasing, mineral & metal demand is also increasing, such as base metals like copper, lead, zinc, and precious metals like silver & gold, which contributes to increasing the growth of the froth flotation equipment market. To meet the increasing demand for raw materials, mining activities have escalated alongside the rapid industrialization, urbanization, and infrastructure growth in emerging economies. Moreover, the growing use of electric vehicles (EVs) and renewable energy technologies has increased the need for critical minerals such as lithium and rare earth elements, thus enhancing the market. Higher efficiency, automation and sustainability in froth flotation systems are becoming the norm. The process is characterized by the analysis of the current system process, the introduction of new floatation reagents (biological floatation reagents, automation) with the dual goal of minimizing environmental impact while also improving overall hydration, the transition to eco-friendly processes, and the adoption of the Internet of Things to streamline processes. With the global expansion of mining operations, the froth flotation equipment market is likely to grow steadily in the coming years.

Restraint

-

The high capital investment required for flotation equipment and infrastructure limits adoption, especially for small and medium-sized mining operations.

The high initial investment costs associated with froth flotation equipment pose a significant barrier to adoption, particularly for small and medium-sized mining operations. Establishing a flotation system involves a considerable investment (in advanced equipment, infrastructure, and automation technology). Moreover, expenses associated with installation, regulatory compliance, and operator training add to the financial implications. Small-scale mining operations have difficulties finding financing or justify investing, given the uncertainty of returns and the volatility of mineral prices. Additionally, the upkeep and running costs associated with flotation machinery, such as energy usage and reagent expenses, contribute to the financial burden. Large corporations can disperse these costs more easily through economies of scale, while smaller players will typically look to alternative separation methods and utilize equipment to minimize costs. This leads to a fundamental limitation of the market spread, especially in the underdeveloped world where the financial flow and technology access are highly gravitational.

Opportunities

-

The integration of AI and IoT in flotation systems enhances real-time monitoring, automation, and efficiency while reducing costs and resource consumption.

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in flotation systems is revolutionizing mineral processing by enabling real-time monitoring, automation, and predictive analytics. AI-powered algorithms sift and analyze enormous datasets generated by flotation circuits to optimize inputs such as reagent dosage, air flow, and froth stability that result in both higher quality separation and improved recovery rates. Internet of Things (IoT) enabled sensors help in the continuous monitoring of parameters, like pH, pulp density, and bubble type; thus, allowing modifying the operation based on real-time analytics. By trialing predictive maintenance, machine learning reduces human intervention, minimizes operational expenditure, and increases the equipment's life cycle by anticipating maintenance before failures happen. Moreover, AI-driven predictive modeling helps mining companies manage the variability of ore and operate optimally. These systems not only help maximize profitability, but also improve sustainability by minimizing waste, energy, and water consumption in flotation. With the industry moving towards digital transformation, the implementation of AI and IoT in flotation processes is predicted to increase, allowing efficiency and competitiveness for mineral processing.

Challenges

-

The shortage of skilled personnel in developing regions hampers efficient operation, maintenance, and adoption of advanced froth flotation systems.

The shortage of a skilled workforce is a significant challenge in the froth flotation equipment market, particularly in developing regions where technical expertise is scarce. It needs expertise in areas of process optimization, reagent selection, and equipment troubleshooting for operating and maintaining flotation systems. But poorly trained operators will result in inefficient operations, longer downtimes, and lower recovery rates. This has been a challenge for many mining and processing companies that resulted in resorting to expensive tutorial or expatriate work. Moreover, as flotation technology is evolving with automation and digitalization, the need for highly-skilled technicians is growing, which is exacerbating the skills shortage. The lack of trained personnel not only reduces operational efficiency, but is also impeding the deployment of revolutionary flotation systems. To tackle this challenge, there is a need to invest more in vocational training programs, industry-academic partnerships and on-site technical training to create a skilled workforce that can effectively manage the state-of-the-art flotation processes.

Froth Flotation Equipment Market Segmentation Analysis

By Type

The Cell-to-Cell Flotation segment dominated with a market share of over 62% in 2023, as it is more efficient for the recovery of valuable minerals and provides better control of the flotation circuits. Flotation equipment of this kind has independent cell operations, addressing the higher material loss challenge and promoting better recovery rates. Market dominance is further ensured by its widespread adoption in mineral processing industries; particularly in metallurgical and mining industries. Furthermore, the Cell-to-Cell Flotation also provides greater versatility, allowing it to work more effectively with several types of ores such as base metal, precious metal, or industrial minerals. This segment is appeased due to mining activities and requirement powerful technologies for minerals extraction in prominent areas globally.

By Application

The mineral and ore processing segment dominated with the market share of over 64% in 2023, driven by the mining industry's increasing demand for efficient extraction methods. Froth flotation plays a crucial role in separating valuable minerals like copper, gold, and iron from ore, improving yield and reducing processing costs. Industries are increasingly using flotation technology to recover the majority of what they can from lower-grade deposits as high grade ores run out. Moreover, improved flotation reagents and machinery also improve efficiency and hence cement the position of this segment. Expanding investment in mining projects and increasing consumption of metals by industry, such as construction and electronics, further support growth of the market, which ensures mineral and ore processing remains the single largest market for the froth flotation technology.

Froth Flotation Equipment Market Regional Outlook

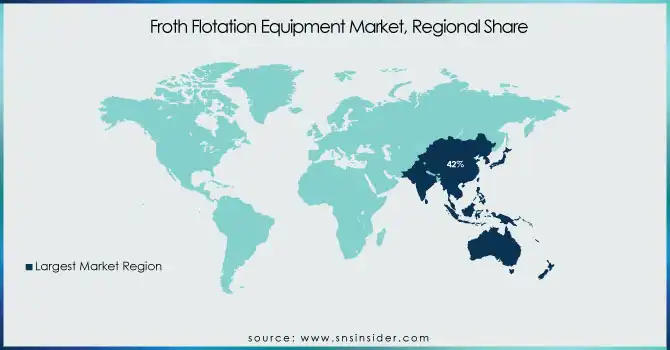

Asia-Pacific region dominated with a market share of over 42% in 2023, due to its thriving mining industry and high demand for minerals and metals. Countries like China, India, and Australia play a significant role in driving market growth, as they are major producers of base metals, rare earth elements, and industrial minerals. Region is benefiting from large scale mining activities, rising investment in mineral processing facilities and government initiatives supporting the mining sector. The continued demand for metals is also being driven by the fast pace of industrialization and the movement of people to urban areas and thus, the market for flotation equipment with high efficiency is strengthened. Moreover, innovations in automation and energy-efficient flotation technologies are on the rise, maximizing mineral extraction productivity and sustainability. These aspects are cumulatively making Asia-Pacific retain the top position in this market.

North America is experiencing rapid growth in the Froth Flotation Equipment Market, driven by several key factors. The region's advancements in mining technology have enhanced the efficiency and effectiveness of flotation processes, improving mineral recovery rates. Moreover, the increasing consumption of base metals such as copper, zinc, and lead to support industrial evolution and transition to cleaning energy have resulted in expansion of mining industries. Additionally, the region is viewing sustainable mineral processing is a potential driver for the market as strict environmental regulations are promoting the usage of energy-efficient and eco-friendly flotation equipment. The dominant players in the mining industry, coupled with the persistent investment in R&D will positively impact the expansion of the market, which is the reason behind the growth of North America's market for froth flotation equipment at the fastest pace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Froth Flotation Equipment Market

-

Metso Outotec (Flotation cells, flotation columns, automation solutions)

-

FLSmidth (Flotation cells, flotation columns, slurry pumps)

-

Eriez Flotation (Column flotation systems, spargers, flotation cells)

-

WEG Equipamentos Elétricos S.A. (Motors and drives for flotation equipment)

-

Process IQ Pty Ltd. (Flotation process control, real-time monitoring solutions)

-

GEA Minerals (Separation equipment, dewatering systems)

-

Boliden Mineral AB (Flotation circuits, mineral processing solutions)

-

JXSC Jiangxi Copper Corporation (Flotation machines, mineral processing plants)

-

Greyline Instruments Inc. (Ultrasonic level sensors for flotation tanks)

-

Endress+Hauser (Process automation, instrumentation for flotation)

-

Sandvik (Mining equipment, mineral processing solutions)

-

Foxboro (Schneider Electric) (Process control and automation systems)

-

Yokogawa Electric (Industrial automation, sensors for flotation processes)

-

Myntec (Flotation monitoring and optimization solutions)

-

Yantian Jingpeng Mining Technology (Flotation equipment, mining automation)

-

DELKOR (A Tenova Company) (Flotation cells, solid-liquid separation solutions)

-

Dorr-Oliver Eimco (A brand of FLSmidth) (Flotation machines, thickening solutions)

-

Shanghai Joyal Machinery Co., Ltd. (Flotation cells, mineral processing equipment)

-

Xinhai Mining Technology & Equipment Inc. (Flotation machines, gold flotation solutions)

-

Voith GmbH & Co. KGaA (Flotation deinking systems, fiber recovery solutions)

Suppliers for (Advanced flotation technologies, sustainable mining solutions, and large-scale industrial flotation cells) on the Froth Flotation Equipment Market

-

Metso Outotec

-

FLSmidth

-

Yokogawa Electric

-

Eriez Flotation

-

JXSC Mine Machinery Factory

-

Henan Mecru Heavy Industry Technology Co., Ltd

-

Jiangxi Well-tech International Mining Equipment Co., Ltd

-

Xinhai Mining Technology & Equipment Inc.

-

911Metallurgist

-

Naugra Lab Equipments

RECENT DEVELOPMENT

In December 2023: Metso launched the Spider Crowder upgrade to address challenges in large flotation cells. This innovation enhances froth management, ensuring higher equipment availability and operational efficiency in flotation processes. When combined with the Metso Center Launder, it boosts metallurgical performance, improves energy efficiency, and provides better process control, making flotation operations more reliable and effective.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 340.32 Million |

| Market Size by 2032 | USD 494.16 Million |

| CAGR | CAGR of 4.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Free-flow flotation, Cell-to-cell flotation) • By Application (Wastewater treatment, Paper Recycling, Mineral and ore processing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Metso Outotec, FLSmidth, Eriez Flotation, WEG Equipamentos Elétricos S.A., Process IQ Pty Ltd., GEA Minerals, Boliden Mineral AB, JXSC Jiangxi Copper Corporation, Greyline Instruments Inc., Endress+Hauser, Sandvik, Foxboro (Schneider Electric), Yokogawa Electric, Myntec, Yantian Jingpeng Mining Technology, DELKOR (A Tenova Company), Dorr-Oliver Eimco (A brand of FLSmidth), Shanghai Joyal Machinery Co., Ltd., Xinhai Mining Technology & Equipment Inc., Voith GmbH & Co. KGaA. |