Functional Safety Market Size & Overview:

Get More Information on Functional Safety Market - Request Sample Report

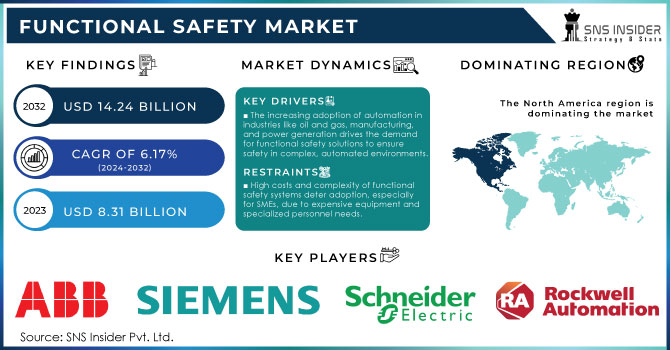

The Functional Safety Market size was valued at USD 8.31 billion in 2023 and is now anticipated to grow to USD 14.24 Billion by 2032, displaying a compound annual growth rate (CAGR) of 6.17% during the forecast Period 2024-2032.

The Functional Safety Market is experiencing growth, largely driven by the expanding use of automation and the increasing focus on regulatory compliance across industries like automotive, oil and gas, pharmaceuticals, and manufacturing. Major investments are being funneled into functional safety systems to meet stringent safety standards and ensure risk mitigation in these high-stakes environments. The rapid rise in autonomous vehicles and electric cars, along with the adoption of Industry 4.0 practices, is fueling demand for robust functional safety systems, particularly in areas such as Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies. These technologies require precise and reliable safety mechanisms, further accelerating the market’s expansion.

The key trend driving growth is the integration of functional safety systems with AI and IoT to enable predictive maintenance, real-time safety monitoring, and enhanced operational efficiency. The development of cloud-based safety solutions is also gaining momentum, allowing for more scalable and cost-effective safety management. In the automotive and industrial sectors, advancements in safety-critical software are proving essential for managing complex systems in autonomous vehicles and automated factories.

Integrating advanced technologies like AI and automation into functional safety systems can be complex and costly. Ensuring continuous compliance with evolving safety standards such as IEC 61508 and ISO 26262 also demands ongoing investment and expertise. Smaller companies may struggle with both the high costs and the lack of specialized knowledge needed to implement these systems effectively. Despite these challenges, the market’s growth trajectory remains strong due to its essential role in ensuring safe operations.

On September 11, 2024: Omnex Inc. announced the launch of Omnex Safe Secure Sustain (Omnex S3), an independent, accredited certification body. The new entity will provide global certifications for automotive functional safety, SOTIF (Safety of the Intended Functionality), and cybersecurity processes.

MARKET DYNAMICS

DRIVERS

-

The increasing adoption of automation in industries like oil and gas, manufacturing, and power generation drives the demand for functional safety solutions to ensure safety in complex, automated environments.

The increasing adoption of automation across industries such as oil and gas, manufacturing, and power generation significantly drives the demand for functional safety solutions. Automation enhances operational efficiency by streamlining processes and reducing human intervention, which is crucial in environments where precision and reliability are paramount. However, the integration of advanced automation technologies introduces complexities that elevate safety risks. In oil and gas, for example, automated systems control critical processes like drilling and refining, where any malfunction could lead to catastrophic consequences. Similarly, in manufacturing and power generation, automation controls intricate machinery and processes that demand rigorous safety protocols to prevent accidents and ensure smooth operations. As these industries increasingly rely on automated systems, the need for functional safety solutions, such as emergency shutdown systems (ESD), fire and gas detection systems (FGS), and high-integrity pressure protection systems (HIPPS), becomes more pronounced. These solutions are designed to monitor, detect, and mitigate potential hazards, thereby safeguarding personnel, equipment, and the environment. Consequently, the complexity of automated systems necessitates robust functional safety measures to manage and mitigate risks, driving the market for these critical safety solutions.

-

The rise of Industrial IoT (IIoT) drives demand for functional safety systems that can address new risks in cybersecurity and operational safety while enhancing industrial efficiency.

The rise of Industrial IoT (IIoT) is significantly boosting the demand for advanced functional safety systems. As IIoT (Industrial Internet of Things) technology integrates more devices and systems into industrial processes, it introduces new complexities and potential risks related to cybersecurity and operational safety. Functional safety systems are crucial in this context, as they are designed to manage and mitigate these risks by ensuring that industrial operations remain safe and reliable. These systems enhance operational efficiency by providing real-time monitoring, predictive maintenance, and automated responses to potential hazards. They help prevent costly downtime and accidents by addressing vulnerabilities in the cyber realm and ensuring that safety protocols are consistently followed. Consequently, the growing adoption of IIoT underscores the need for robust functional safety solutions to protect both the physical infrastructure and data integrity of industrial environments, ultimately fostering safer and more efficient industrial operations.

RESTRAIN

-

The high initial cost and complexity of implementing functional safety systems, especially for SMEs, can deter adoption due to expensive equipment, integration, and specialized personnel requirements.

The high initial cost and complexity of implementing functional safety systems can be a significant barrier to adoption, particularly for small and medium-sized enterprises (SMEs). These systems often require expensive equipment and sophisticated technology, which can strain the financial resources of SMEs. Additionally, integrating these systems into existing operations can be complex, demanding specialized knowledge and skills that may not be readily available within the organization. The need for specialized personnel to manage and maintain these systems further adds to the cost. For many SMEs, these financial and operational hurdles can be prohibitive, leading them to delay or forego the adoption of functional safety systems despite their benefits. This deterrent effect underscores the need for cost-effective solutions and support structures to facilitate broader implementation, especially among smaller enterprises.

KEY MARKET SEGMENTATION

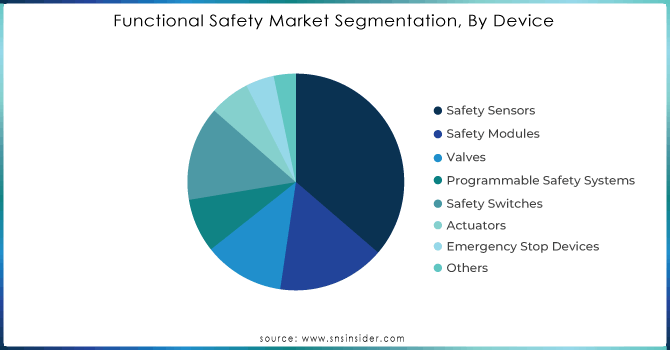

By Device

The safety sensors device dominated the market with a share of 36.3% in 2023. The Safety sensors are crucial in the functioning of functional safety market and devices which includes backup component so if one fails then another takes over the functioning, preventing productivity losses from closure. Thereby, making a dominating device in this segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Industry

The Power Generation Industry dominated the market with a share of 45% in 2023. The importance of performing proactive maintenance on the power generation industry makes one of the pioneers of functional safety systems. The efficiency of the turbines and generators has a huge impact on the power plants' overall productivity. Therefore, making a dominating industry of usage of functional safety systems.

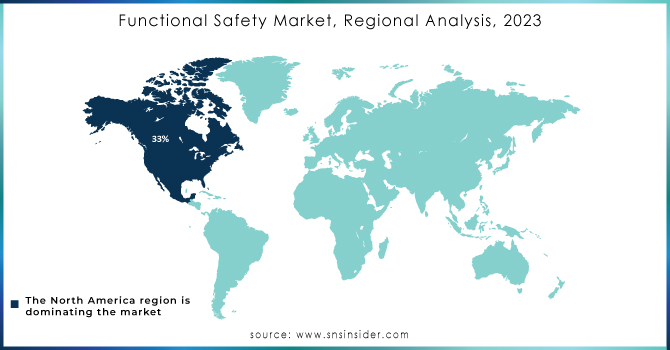

REGIONAL ANALYSES

North America region dominated the market with a share of 33% in 2023, with the growth of AI and ML applications across various industries is helping in the growing the demand for functional safety solutions which can ensure safety and reliability under complex environments. The use of AI and ML in functional safety is helping increase operational efficiency and reducing risks among various sectors like manufacturing, automotive, and healthcare, helping maintain dominance over the market.

Key Players

The major key players are Siemens AG, ABB Ltd., General Electric Co., Schneider Electric SE, Rockwell Automation inc., Honevwell International inc., HIMA Paul Hildebrandt GmbH, Endress+Hauser Management AG, Omron Corporation, Yokogawa Electric Corporation, DEKRA Group and others.

RECENT DEVELOPMENT

In October 2023: Rockwell Automation Inc. launched the latest services, systems, hardware, and industrial software and announced plans to showcase them at the Automation Fair 2023 at the Boston Convention and Exhibition Center. The event exhibited functional safety products such as FLEX 5000 I/O, GuardLogix L85ES controller, and 432ES GuardLink EtherNet/IP Adapter.

In April 2023: OMRON Corporation launched the NX502 automation & programmable safety systems and the NX-EIP201 EtherNet/IPTM units globally. These controllers offer advanced information and safety control. They utilize OMRON's advanced information processing and large capacity memory to reduce resource disposal losses and shorten lead times when changing production lines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.31 Billion |

| Market Size by 2032 | US$ 14.24 Billion |

| CAGR | CAGR of 6.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (Safety Sensors, Safety Modules, Valves, Programmable Safety Systems, Safety Switches, Actuators, Emergency Stop Devices, Others) By Systems (Emergency Shutdown Systems, Fire & Gas Monitoring Controls, Turbomachinery Controls Systems, Burner Management Systems, High Integrity Pressure Protection Systems, Distributed Control Systems, Supervisory Control and Data Acquisition Systems) By Industry (Oil & Gas, Power Generation, Chemicals, Food & Beverages, Pharmaceuticals, Automotive, Railways, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, ABB Ltd., General Electric Co., Schneider Electric SE, Rockwell Automation inc., Honevwell International inc., HIMA Paul Hildebrandt GmbH, Endress+Hauser Management AG, Omron Corporation, Yokogawa Electric Corporation, DEKRA Group |

| Key Drivers | • The increasing adoption of automation in industries like oil and gas, manufacturing, and power generation drives the demand for functional safety solutions to ensure safety in complex, automated environments. • The rise of Industrial IoT (IIoT) drives demand for functional safety systems that can address new risks in cybersecurity and operational safety while enhancing industrial efficiency. |

| Restraints | • The high initial cost and complexity of implementing functional safety systems, especially for SMEs, can deter adoption due to expensive equipment, integration, and specialized personnel requirements. |