Geospatial Imagery Analytics Market Report Scope & Overview:

Get More Information on Geospatial Imagery Analytics Market - Request Sample Report

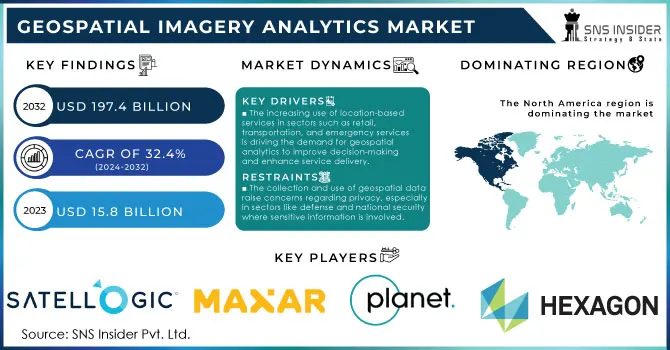

Geospatial Imagery Analytics Market size was valued at USD 15.8 Billion in 2023 and is expected to grow to USD 197.4 Billion by 2032 and grow at a CAGR of 32.4% over the forecast period of 2024-2032.

The geospatial imagery analytics market has grown substantially, owing to a number of driving factors including the investment from governments across the globe on various geospatial technologies for better decision making. From urban planning to defence operations, more than 40% of government departments use geospatial data, according to the U.S. Geological Survey (USGS). This dependency has further increased the need for analytical platforms that provide comprehensive geospatial information. Indian Government Geospatial investments saw an increase of more than 25% under its National Geospatial Program announced in February 2023 focusing on environment and urban infrastructure. The European Union has also intensified efforts in the geospatial analytics domain, where the European Space Agency (ESA) recently completed several Copernicus missions to deliver access to reliable Earth observation data for agriculture, disaster control, and climate research. In addition, the U.K. government's Geospatial Commission accented how geospatial analytics is central to its vision of digitized public services, estimating a £11 billion annual contribution to the economy through its geospatial market by 2025. So it not only takes place in the developed world but is also reaching developing countries in Africa and Southeast Asia where geospatial imagery analytics are being used to monitor deforestation; manage water resources and improve urban planning. These developments have increased the demand for geospatial analytics technologies significantly, which will in turn drive the growth of this market.

The geospatial imagery analytics market is experiencing significant growth due to the utilization of big data and artificial intelligence (AI) to enhance geospatial imagery analytics solutions, as well as intense competition among market players. Additionally, the market is being propelled by increasing income levels and advancements in analytics technologies. Furthermore, the demand for geospatial imagery analytics for national security and safety, along with the rising need for small satellites, will contribute to the market's growth rate.

Moreover, the expansion of 5G networks and the proliferation of Internet of Things (IoT) devices will create favorable opportunities for the growth of the geospatial imagery analytics market. Numerous technological advancements are being introduced in the field of image and video analytics, greatly facilitating the daily operations of companies. As a result, there is a growing anticipation for an increased demand in geospatial imagery analytics. This particular branch of analytics utilizes time and location data obtained from satellites, Unmanned Aerial Vehicles (UAVs), and Geographic Information Systems (GIS) to enhance traditional data processes.

Market Dynamics

Drivers

-

The increasing use of location-based services in sectors such as retail, transportation, and emergency services is driving the demand for geospatial analytics to improve decision-making and enhance service delivery.

-

Advanced AI and ML technologies enable more accurate and efficient geospatial imagery analysis, leading to greater adoption in sectors like agriculture, defense, and urban planning.

-

Governments globally are focusing on smart city initiatives, where geospatial imagery analytics plays a crucial role in optimizing infrastructure, traffic management, and environmental monitoring.

The increasing use of AI and ML for image analytics is one of the major factors driving growth of Geospatial Imagery Analytics Market. The use of AI and ML technologies in geospatial data has transformed the sector, allowing for an unprecedented level of accuracy and real-time interpretation of vast amounts of satellite, aerial, and drone images. As a result, AI algorithms build upon the speed and precision needed to identify patterns, changes, and anomalies from geospatial data that are critical for applications ranging from agriculture to defence to urban planning. As an example, AI-enabled geospatial analytics in agriculture also helps in monitoring crop health and yield as well as optimal use of water. As per the World Economic Forum (2023), AI technology in agriculture can yield up to 67% higher crop yields and a lower environmental footprint.

In urban planning, AI-based geospatial analytics helps in Urban planning Infrastructure Planning, and traffic flow optimization. According to the Smart Cities Council, cities such as Singapore and Amsterdam are deploying AI-based geospatial analytics systems to improve traffic management systems and reduce congestion by over 15%. In the defense sector, AI-powered satellite imagery aids in surveillance, reconnaissance, and threat detection. The U.S. Department of Defense has invested heavily in AI-based geospatial tools to improve battlefield awareness and predictive modeling. AI and ML synthesis of geospatial data at speed and scale is accelerating the adoption of both across a suite of sectors, increasing innovation efficiency in decision-making.

Restraints

-

The cost of acquiring satellite or aerial imagery and setting up the necessary infrastructure for data processing remains high, limiting adoption, especially among small and medium-sized enterprises (SMEs).

-

The collection and use of geospatial data raise concerns regarding privacy, especially in sectors like defense and national security, where sensitive information is involved.

Data privacy and security concerns are a major restraining factor for the growth of the geospatial imagery analytics market. Geospatial data is having sensitive information for example about infrastructure, critical transportation networks, and even personal locations, which can be misused if not handled carefully. The advent of this data collection and processing leads to unauthorized access issues, and data breaches directly in sectors such as defense, urban surveillance, and national security. The growing reliance on satellite imagery and drone technology for information gathering makes this even more difficult as these represent macro-level data collection that is likely in breach of privacy statutes. This predictive use of geospatial provides multiple layers of complexity to its adoption as organizations have to navigate through a myriad of legal frameworks and compliance requirements for the secure handling of geospatial data. Further challenges arise from public and government scrutiny over the ethical use of location-based data, which could delay market uptake in some regions or industries.

Segment Analysis

By Imaging Type

The image segment held the largest share 67% in the geospatial imagery analytics market in 2023. This was because it enabled high-resolution, detailed visual data. Governments and organizations are increasingly using image-based geospatial analytics to track changes in land use and infrastructure development, as well as environmental degradation. For instance, in 2023, the Earth Observation System (EOS) retrieved tremendous imagery data from NASA, which proved essential in climate modeling and analysis of urban sprawl, indicating that satellite imagery is important for analytics. Image-based geospatial data is also used by the U.S. Department of Defense in monitoring and managing global military operations. According to their report in 2023, there was a recorded 30% increase in geospatial image analysis programs. Furthermore, high-resolution imaging from satellites and drones now plays an important role in disaster management and prevention, urban planning, and agricultural monitoring. This widespread use of image-based data analytics, driven by advancements in satellite imaging technology, has positioned this segment as the dominant force in the market.

By Application

The disaster management segment accounted for the leading share in the market because of the significant importance of geospatial imagery analytics and its crucial role in responding to natural and man-made disasters. In 2023, the UN Office for Disaster Risk Reduction (UNDRR) registered a sharp increase in using geospatial analytics in preparedness for disasters; it predicts that geospatial systems will reduce economic loss from disasters by up to 30% in affected countries. For example, immediately following the disastrous earthquakes in Turkey and Syria in February 2023, governments employed geospatial analytics to receive real-time knowledge of damage and resource use to inform relief. In addition, the Indian Space Research Organisation as well as several national space agencies are now working progressively to apply geospatial imagery to monitor and predict the onset of natural disasters like floods, landslides, and wildfires. Governments would be able to expedite their responses and provide the most appropriate distribution of resources in reducing human and economic damages using geospatial data. This growing demand for using geospatial analytics in disaster management applications has led to substantial growth in this segment of the market.

By End User

In 2023, the defense & security segment accounted for the largest share of the geospatial imagery analytics market, as governments and corporations make significant investments in national security and surveillance. Across the world, governments are investing money into geospatial imagery for use in border monitoring, risk assessment and military planning. In 2023 US Department of Defense invested USD 25 billion into implementing geospatial analytics in defense strategy. On the other hand, in China, to strengthen military intelligence and surveillance abilities, the Chinese government extensively invested in geospatial analytics through its BeiDou Navigation Satellite System, which accounted for more than 35% of the overall demand from the defense industry. This increased dependency on geospatial analytics in various applications such as military operations, border control, and intelligence has made the defense and security sector the largest contributor to this market.

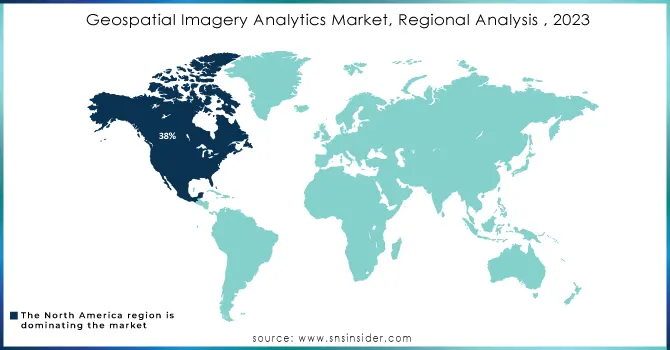

Regional Insights

The geospatial imagery analytics market was led by North America in 2023, and accounted for 38% of the overall market share. The U.S. government's significant investments in satellite programs and defense initiatives, while NASA has maintained Earth observation projects, making this region the industry leader. Significantly, increased use of geospatial analytics by the Canadian government particularly for environmental monitoring and public safety also contributing to North America’s leading position. The exponential growth in data volumes, coupled with advancements in AI and big data technologies, has created a fertile ground for this industry. Moreover, the escalating concerns surrounding data integrity and the mounting demand for valuable insights have further propelled the market's expansion across the region.

On the other hand, the Asia-Pacific region growing with the highest-CAGR during the forecast period 2024–2032. The geospatial technology market is experiencing rapid growth due to the growing government initiatives in India, China, and Japan for the utilization of geospatial data for smart city projects, disaster management and environmental conservation. This includes the USD 1.2 billion initiative announced by the Indian government to expand its geospatial data infrastructure in 2023, as well as the provision of critical geospatial data for national security, infrastructure development and environmental monitoring provided by China's BeiDou satellite system. This expansion of geospatial capabilities has positioned Asia-Pacific as the fastest-growing region in the market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Key Service Providers/Manufacturers:

-

Satellogic Inc. (Aleph-1 Constellation, Satellogic’s High-Resolution Multispectral Imagery)

-

Maxar Technologies (WorldView-3, GeoEye-1)

-

Planet Labs PBC (PlanetScope, SkySat)

-

Hexagon AB (ERDAS IMAGINE, Luciad Portfolio)

-

Airbus Defence and Space (Pleiades Neo, SPOT 6/7)

-

Esri (ArcGIS, ArcGIS Image for ArcGIS Online)

-

Orbital Insight (GO Platform, Orbital Insight’s Geospatial Analytics)

-

BlackSky Global (Spectra AI, BlackSky Monitoring)

-

L3Harris Technologies (ENVI, Geospatial eXploitation Products - GXP)

-

Capella Space (Capella Synthetic Aperture Radar, Capella Console)

Key Users of Geospatial Imagery Products:

-

U.S. Department of Defense

-

NASA

-

European Space Agency (ESA)

-

Indian Space Research Organisation (ISRO)

-

United Nations Office for Disaster Risk Reduction (UNDRR)

-

Google Earth

-

World Food Programme (WFP)

-

United Nations Environment Programme (UNEP)

-

Ministry of Defence, UK

Recent News & Developments

-

In February 2023, The U.S. Geological Survey (USGS) announced a new Landsat mission to provide high-resolution geospatial data for environmental monitoring, disaster management, and climate research. It aims to improve geospatial imagery analytics for public access.

-

Quant Data & Analytics, a product-based organization specializing in data products & enterprise business solutions for the real estate and retail sector, announced a collaboration with Satellogic Inc. in August 2023. This collaboration aims to enhance property technology solutions across Saudi Arabia and the Gulf region.

-

On April 2023, Astraea the spatiotemporal data and analytics platform announced an innovative new ordering service allowing customers to rapidly scale their access to best-in-class commercial satellite imagery from the industry's leading providers such as Planet Labs PBC.

-

April 2023: European Space Agency Sentinel-7 satellite for Earth monitoring deforestation, urban development natural disasters It will capitalize on the momentum behind geospatial analytics in Europe and internationally.

| Report Attributes | Details |

| Market Size in 2023 | USD 15.8 Billion |

| Market Size by 2032 | USD 197.4 Billion |

| CAGR | CAGR of 32.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Imaging Type (Video, Image) • By Deployment Mode (Cloud, On-premises) • By Collection Medium (Geographic Information System (GIS), Satellite Imagery, Others) • By Application (Weather Conditions Monitoring, Disaster Management, Urban Planning/Development, Natural Resource Exploration, Others) • By End-user (Defense & Security, Healthcare, Retail & Logistics, Government, Banking, Financial Services & Insurance (BFSI), Mining/Manufacturing, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Satellogic Inc., Maxar Technologies, Planet Labs PBC, Hexagon AB, Airbus Defence and Space, Esri, Orbital Insight, BlackSky Global, L3Harris Technologies, Capella Space |

| Key Drivers | •The increasing use of location-based services in sectors such as retail, transportation, and emergency services is driving the demand for geospatial analytics to improve decision-making and enhance service delivery. •Advanced AI and ML technologies enable more accurate and efficient geospatial imagery analysis, leading to greater adoption in sectors like agriculture, defense, and urban planning •Governments globally are focusing on smart city initiatives, where geospatial imagery analytics plays a crucial role in optimizing infrastructure, traffic management, and environmental monitoring. |

| Market Restraints | •The cost of acquiring satellite or aerial imagery and setting up the necessary infrastructure for data processing remains high, limiting adoption, especially among small and medium-sized enterprises (SMEs). •The collection and use of geospatial data raise concerns regarding privacy, especially in sectors like defense and national security, where sensitive information is involved. |