Healthcare Finance Solutions Market Size & Overview

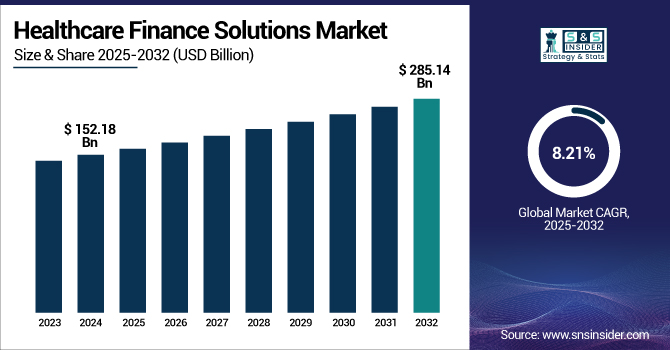

The Healthcare Finance Solutions Market size is projected to grow from USD 152.18 billion in 2024 to USD 285.14 billion by 2032, at a CAGR of 8.21% during the forecast period 2025-2032. The healthcare finance solutions market is growing rapidly owing to the growing healthcare spending, high demand for high-technology medical equipment, and an increase in the number of outpatient care centers.

To Get more information on Healthcare Finance Solutions Market - Request Free Sample Report

The U.S. healthcare finance solutions market size was valued at USD 51.94 billion in 2024 and is expected to reach USD 95.54 billion by 2032, growing at a CAGR of 7.96% over the forecast period of 2025-2032. The U.S. maintains its lead in the North American healthcare finance solutions market in terms of share due to its sophisticated healthcare infrastructure, high capital expenditure on medical technology, and extensive use of financial services for equipment and facility growth. The availability of key financial providers and continuous digital transformation further enhances its leading position.

The increasing cost of chronic diseases in the U.S. is largely contributing to the expansion of the Healthcare Finance Solutions Market.

The CDC states that 6 out of 10 adults in the U.S. have at least one chronic condition, such as asthma, heart disease, or diabetes, requiring prolonged, intense, and often costly care. With nearly 90% of healthcare expenditures going toward treating chronic and mental illness, healthcare providers are facing pressure to invest in next-generation care delivery models, technologies, and infrastructure to deal with these intricate needs. This presents an expanding need for agile financial solutions to pay for everything from prescription medication management systems to home healthcare gear.

Furthermore, the increasing expense of health insurance premiums, which increased by 42% over the last decade, highlights the larger economic burden on individuals and healthcare providers alike. The imperative for enhanced access to care, cost-effectiveness, and operational resilience is leading providers to seek out structured financing solutions. Some of these involve equipment leasing, project financing, and working capital options, allowing providers to invest in chronic care management platforms, digital health platforms, and patient support initiatives without overusing internal funds, hence driving the healthcare finance solutions market globally.

Healthcare Finance Solutions Market Dynamics

Drivers:

-

Digital Transformation in Healthcare Driving the Market Growth

The digital transformation in healthcare is a key driver for the healthcare finance solutions market growth, as healthcare providers are increasingly embracing technologies such as electronic health records (EHRs), telemedicine platforms, artificial intelligence (AI), and machine learning (ML). These technologies demand high upfront investment in IT infrastructure, software, and data security systems. With healthcare organizations evolving to increase operational efficiency, better patient outcomes, and adapt to changing regulations, there is an increasing need for financing products to facilitate these digital improvements.

-

Rising Healthcare Expenditures Propel the Market Growth

One of the key drivers of the healthcare finance solutions market trends is the constant increase in global healthcare expenditure. With aging populations, increased rates of chronic diseases, and demands for new-fangled treatments, providers must meet the expenses of expensive medical devices, upgrading infrastructure, and technology. Such capital-intensive requirements tend to outweigh the available operating budgets of clinics, hospitals, and diagnostic centers. To fill this funding gap, healthcare suppliers are looking to specialized funding options, such as leasing, loans, and project-based finance, that provide more financial optionality, maintain cash flow, and facilitate the timely acquisition of necessary assets.

For instance, according American Medical Association,

Hospital and physician services were two of the biggest health spending categories between 2014 and 2023, with an average annual growth rate of 5.3% each. Clinical services and prescription medications, on the other hand, grew at average annual rates of 6.6% and 5.7%, respectively.

Personal health care spending increased by 9.4% in 2023, the largest annual growth since 1990. Hospital care increased by 10.4%, whereas prescription drug spending increased by 11.4%. Additionally, the growth rates for clinical services and physician services were 7.0% and 7.6%, respectively, which was a considerable rise over 2022.

Restraints:

-

Regulatory and Compliance Complexities Impede the Market Growth

One of the most important restraints in the healthcare finance solutions market analysis is the intricate and changing regulatory environment across various regions. Financial institutions and healthcare providers need to manage stringent compliance mandates around patient data protection, delivery of healthcare services, and standards for financial reporting. These complexities have the potential to delay approval for financing, restrict innovation in financial products, and raise operating expenses for lenders and borrowers alike. As regulations further constrict, particularly in surrounding digital health and cross-border transactions, market growth may be stifled, especially in developing markets with decreased regulatory certainty.

Healthcare Finance Solutions Market Segmentation Analysis

By Equipment Type

In 2023, the decontamination equipment segment dominated the healthcare finance solutions market by equipment type, with a 28.56% share in 2024, driven mainly by increased global awareness of infection control and hygiene in the wake of the COVID-19 pandemic. Hospital financial management solutions increased spending on sterilization equipment, washers, disinfectors, and supporting infrastructure to comply with tighter safety standards and regulatory compliance. Due to the significant initial investment in decontamination technologies, most providers resorted to financing options to balance budgets while maintaining compliance and patient safety, significantly fueling the demand for financial support in this segment.

The IT equipment segment is poised to witness the fastest growth rate during the forecast period driven by the continued digitalisation process in healthcare. Growing adoption of electronic health records (EHRs), telemedicine platforms, cybersecurity systems, and data analytics tools has created a pressing demand for IT infrastructure upgrades. Since these technologies involve high capital outlay and periodic upgrade expenses, healthcare providers are increasingly using financing models to implement and expand IT solutions cost-effectively, placing this segment in a rapid growth trajectory.

By Facility Type

In 2024, the hospitals & health systems segment dominated the healthcare finance solutions market share with 24.13% due to their enormous scale of operation needs, huge volumes of patients, and ongoing demand for cutting-edge medical technology. These institutions consistently undertake high-cost capital-intensive projects, including infrastructure upgrades, equipment purchases, and digitalization. As a result, hospitals and health systems are central purchasers of full-service financial solutions, such as project finance, equipment leasing, and corporate lending, solidifying their market leadership.

The outpatient surgery centres segment is projected to be the fastest-growing segment due to the international trend toward cost-saving and patient-focused care. Technological improvements in minimally invasive procedures, shorter recovery times, and positive reimbursement policies have boosted demand for ambulatory surgery services. To meet heightened patient expectations and expand service capacity, these centers are making investments in new technology and facility expansion, frequently with the help of flexible capital solutions, fueling aggressive growth in this segment during the forecast period.

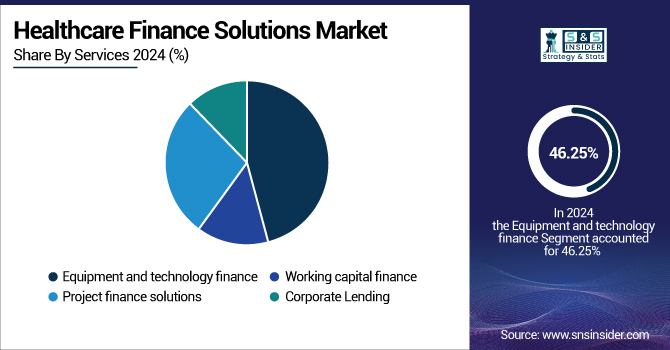

By Services

The equipment and technology finance segment dominated the healthcare finance solutions market in 2024 with a 46.25% share, primarily due to the ever-present demand for cutting-edge medical equipment in hospitals, imaging centers, and outpatient facilities. The capital-intensive purchases of diagnostic imaging equipment, surgical gear, and healthcare IT platforms pushed providers to seek structured financing solutions. Equipment financing offered flexibility, structured payment, and the ability to upgrade to new technologies. Therefore, it became the most used service among healthcare organizations that wanted to remain clinically competitive and operationally efficient.

The corporate lending segment will experience the most significant growth during the forecast period, fueled by growing demand for large-scale capital injections to finance mergers, acquisitions, expansions, and infrastructure growth. As healthcare systems diverge and converge, many organizations are using corporate loans to restructure debt, finance long-term strategic initiatives, and fund cash flow. Increasing collaboration between healthcare enterprises and financial institutions is also driving access to tailored corporate lending solutions, fostering growth in this segment.

Healthcare Finance Solutions Market Regional Outlook

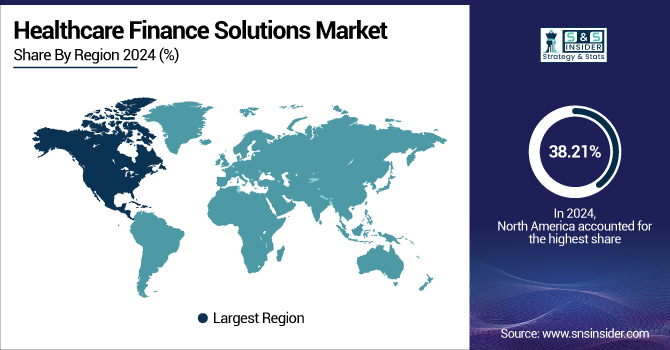

North America dominated the healthcare finance solutions market with a 38.21% share in 2024 due to its established healthcare infrastructure, large healthcare spending, and the prevalence of healthcare finance solutions companies with widespread coverage providing sophisticated financing solutions. The U.S., in particular, has a well-developed network of hospitals and outpatient care that often needs funding for upgrading diagnostic equipment, IT infrastructure, and facility expansion. Also, support from regulation of public-private partnerships, high use of digital health technologies, and robust reimbursement schemes help drive the high demand for tailored financial solutions.

For instance, according to NCBI, American hospitals are leading the digital revolution of healthcare, and other nations are only starting. For example, the United Kingdom has only recently encountered setbacks with its e-health programs, and Australian hospitals have just started to invest in the digitalization of their operations. At the level of the European Union, digital health is a key strategic priority, consistent with the European Strategic Plan 2019–2024 as presented by the European Commission.

Asia Pacific is expected to witness the fastest growth at 9.15% CAGR during the forecast period due to fast urbanization, growing healthcare investments, and an expanding middle class requiring better healthcare. China, India, and Southeast Asian countries are experiencing a boom in hospital construction, private clinic setup, and the use of the latest diagnostic tools, all demanding flexible financing solutions. Government programs to upgrade healthcare facilities and an increase in the involvement of international financial providers are driving market growth in this region.

Germany leads the European healthcare finance solutions market with its well-established healthcare infrastructure, robust public-private partnership, and significant healthcare expenditure. The country's strong healthcare network and continuous investment in the latest medical equipment drive demand for finance solutions to finance equipment purchasing, IT modernization, and infrastructure construction.

Europe's highly regulated yet pro-innovation finance system enables a variety of customized health financing structures. The availability of leading medical technology producers and specialized financial institutions further enhances its leadership role in the European market.

Latin America and the Middle East & Africa (MEA) regions are observing moderate growth in the healthcare finance solutions market during the short term. The growth is mainly attributed to the incremental enhancements in healthcare infrastructure, rising awareness regarding financial solutions, and expanding interest among private healthcare providers to update their facilities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Companies in the Healthcare Finance Solutions Market

The key healthcare finance solutions companies are Siemens Financial Services, GE Healthcare Financial Services, McKesson Corporation, Oracle Corporation, Optum, Conifer Health Solutions, Change Healthcare, Cerner Corporation, First American Healthcare Finance, HealthCare Finance Direct, and other players.

Recent Developments

-

August 2023 – McKesson Corporation, a diversified healthcare services leader, and Genpact, a global professional services company with expertise in digital transformation, announced the renewal of their strategic partnership. The new collaboration is designed to further transform McKesson's financial operations by applying automation and artificial intelligence (AI) to enhance efficiency and operational excellence.

-

October 2024 – Oracle Corporation announced significant new capabilities for its Oracle Health Data Intelligence platform. These new capabilities leverage the strong performance and security features of Oracle Cloud Infrastructure (OCI) and the most advanced artificial intelligence innovations available. The additions are intended to assist healthcare organizations with improving patient outcomes, optimizing financial results, and enriching data-driven decision-making across healthcare networks.

-

In 2025, GE HealthCare signed two long-term strategic enterprise agreements with Sutter Health in the U.S. and Nuffield Health in the U.K. The collaborations are designed to increase healthcare capacity, expand access to high-quality care, and drive growth for both GE HealthCare and customers. The announcement comes on the heels of a solid 2024, in which GE HealthCare launched approximately 40 innovations and signed more than 50 global strategic enterprise agreements, setting up a solid platform for future expansion.

Healthcare Finance Solutions Market Report Scope:

Report Attributes Details Market Size in 2024 USD 152.8 Billion Market Size by 2032 USD 285.14 Billion CAGR CAGR of 8.21% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Equipment Type (Diagnostic/Imaging Equipment, Specialist Beds, Surgical Instruments, Decontamination Equipment, IT Equipment)

• By Facility Type (Hospitals & Health Systems, Outpatient Imaging Centres, Outpatient Surgery Centres, Physician Practices & Outpatient Clinics, Diagnostic Laboratories, Urgent Care Clinics, Skilled Nursing Facilities, Pharmacies, Other Healthcare Providers)

• By Services (Equipment and Technology Finance, Working Capital Finance, Project Finance Solutions, Corporate Lending)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Siemens Financial Services, GE Healthcare Financial Services, McKesson Corporation, Oracle Corporation, Optum, Conifer Health Solutions, Change Healthcare, Cerner Corporation, First American Healthcare Finance, HealthCare Finance Direct, and other players.