Global Human Microbiome Market Overview:

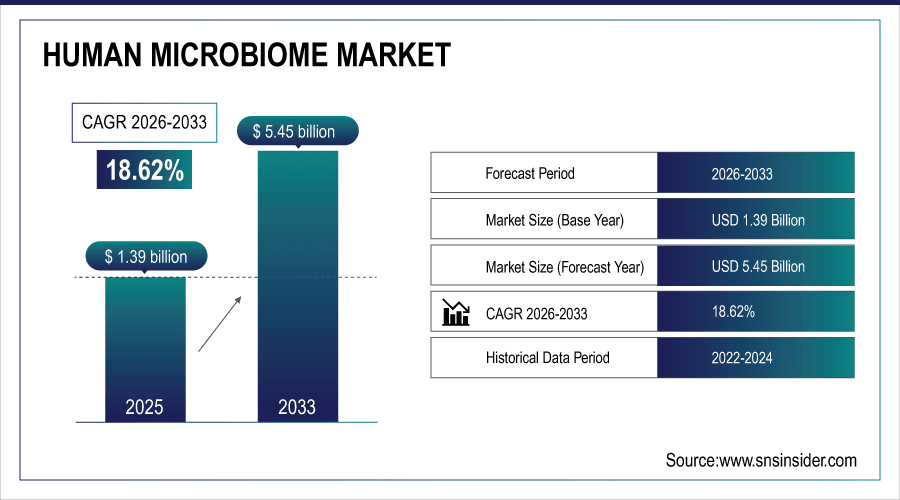

The Human Microbiome Market is valued at USD 1.39 billion in 2025 and expected to reach USD 7.66 billion by 2035, growing at a CAGR of 18.62%.

The market for the human microbiome is centered on products and technologies that utilize the microbial community's influence as therapies, diagnostics and nutritional requirements. In 2025, 7.8 million of microbiome-based tests and therapies has been used globally, with adoption of products such as probiotics contributing around half to it (46%). Hospitals and clinics accounted for 39% of end-user demand. Rising incidence of obesity, diabetes, and autoimmune diseases along with developments in genomics and personalized nutrition is fueling market growth.

Obesity and gastrointestinal disorders collectively contributed 37% of disease-related demand in 2025, reflecting the high clinical focus on metabolic and digestive health.

To Get More Information On Human Microbiome Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.39 Billion

-

Market Size by 2035: USD 7.66 Billion

-

CAGR: 18.62% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Human Microbiome Market Trends:

-

More than 12,000 peer-reviewed studies were published in 2025 on the global microbiome. The rapid pace with which science is gaining new insight and understanding warranted a mention.

-

There are more than 2,300 clinical studies currently exploring microbiome-based therapies for conditions including metabolic, autoimmune and infectious diseases.

-

The number of probiotic and prebiotic product introductions globally reached 1200 in 2025, highlighting demand for functional foods.

-

Genomics and sequencing 45% research programs for precision diagnostics, drug discovery in 2025.

-

Over 600 hospitals and research institutions will have incorporated microbiome-based products into therapeutic offerings by 2033.

U.S. Human Microbiome Insights:

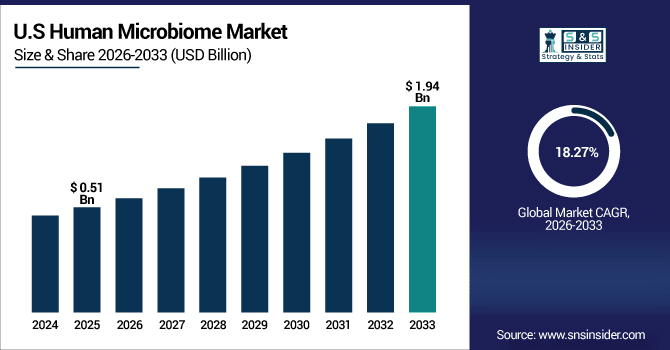

The U.S. Human Microbiome Market is valued at USD 0.51 billion in 2025 and expected to reach USD 1.94 billion by 2035 at a CAGR of 18.27%. Therapeutics and diagnostics lead the market, with probiotics and personalized nutrition growing rapidly, driven by gut health awareness, biotechnology investments, and increasing clinical trials.

Human Microbiome Market Growth Drivers:

-

Advancements in Genomic Technologies Propel Development of Precision Microbiome Therapies and Diagnostics.

The Human Microbiome Market growth is significant, fueled by advancements in genomic technologies. In 2025, more than all libraries had in store the world's microbiome was sequenced, permitting to identify of new therapeutic targets. There were also about 320 new microbiome patents submitted that year, indicating activity in both diagnostics and therapeutics. Europe and Asia contributed to 58% of global microbiome research collaborations, demonstrating inter-regional investment and focus on applications in precision medicine.

Genomics-based microbiome research accounted for nearly 42% of global studies in 2025, highlighting its critical role in market expansion.

Human Microbiome Market Restraints:

-

Complex Regulatory Frameworks and High Research Costs Hinder Rapid Commercialization of Microbiome-Based Products.

High research costs and complex regulatory requirements remain key barriers to Human Microbiome Market growth. In 2025, nearly 38% of early-stage startups failed to advance clinical trials because of lack of funding or expertise, versus about 12% for established companies. Innovation is impeded by restricted availability of dedicated labs, trained bioinformaticians and cutting-edge sequencing technologies. Strict approval processes, intellectual property barriers and regional variation in regulations also hinder product commercialization and impede market proliferation even as demand grows for microbiome-based therapeutics and diagnostics.

Human Microbiome Market Opportunities:

-

Integration of Personalized Nutrition and Microbiome-Based Therapeutics Presents Vast Growth Potential in Healthcare and Wellness.

The integration of personalized nutrition and microbiome-based therapeutics is creating significant growth opportunities. By 2025, more than 1,800 personalized microbiome interventions were initiated worldwide for metabolic diseases, gastrointestinal disorders and autoimmune diseases. Accelerated by the new era of sequencing and analytics, this number is anticipated to reach over 4,200 programs by 2033. The leading research institutions in North America and Europe represent approximately 65% of work in progress. Thus, indicating strong market potential and early adoption trends.

Personalized microbiome interventions are projected to expand rapidly, with over 4,200 programs expected by 2033, driving healthcare innovation.

Human Microbiome Market Segmentation Analysis:

-

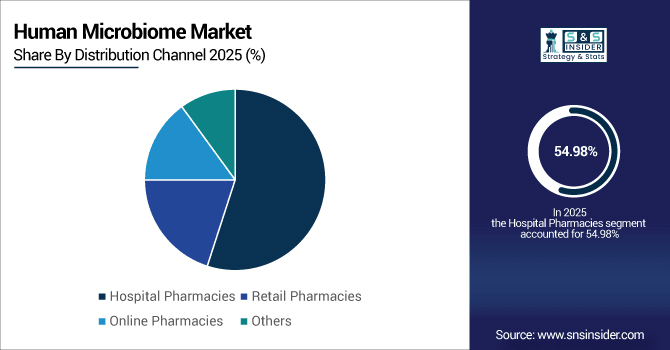

By Distribution Channel, Hospital Pharmacies contributed the highest market share of 54.98% in 2025, while Online Pharmacies are expected to grow at the fastest CAGR of 20.35%.

-

By Product, Drugs held the largest market share of 39.12% in 2025, while Probiotics are expected to grow at the fastest CAGR of 20.34%.

-

By Application, Therapeutics accounted for the largest share of 81.85% in 2025, while Diagnostics are anticipated to grow at the fastest CAGR of 19.95%.

-

By Disease, Gastrointestinal Disorders held the largest share of 34.75% in 2025, while Autoimmune Disorders are expected to grow at the fastest CAGR of 20.05%.

-

By Technology, Genomics contributed the highest market share of 44.98% in 2025, while Metabolomics is forecasted to expand at the fastest CAGR of 20.12%.

-

By End User, Hospitals & Clinics held the largest share of 49.92% in 2025, while Pharmaceutical & Biotechnology Companies are anticipated to grow at the fastest CAGR of 20.20%.

By Distribution Channel, Hospital Pharmacies Lead While Online Pharmacies Expand Rapidly:

In 2025, hospital pharmacies yielded the highest supply channel with more than 1,200 microbiome-based therapeutic and diagnostic products distributed globally. Online pharmacies are growing quickly, with sales of 450 exclusive product listings in 2025 poised to hit 1,200 by 2035 thanks to proliferation in e-commerce channels, direct-to-consumer advertising and growing consumer demand for convenient access to probiotics as well as personalized nutrition and microbiome-focused health solutions on a global scale.'

By Product, Drugs Lead While Probiotics Expand Rapidly:

By 2025, drugs became the major product in the human microbiome market and were generated from more than 620-developed microbiome based therapeutic formulations worldwide for gastrointestinal tract and metabolic diseases. The strong growth of probiotics with 1,200 new establishments in 2025 is expected to surpass 3,000 by 2035 based on growing health consciousness consumers using gut-health preventive healthcare and personalized nutrition plans globally which addresses North America, Europe, Asia-Pacific.

By Application, Therapeutics Lead While Diagnostics Expand Rapidly:

Therapy was the first industrial application in 2025, where more than 2,800 clinical trials were implemented worldwide for both autoimmune and metabolic and gastrointestinal diseases. Diagnostics are growing at pace, with over 2300 tests and trials of microbiome-based apps in 2025 due to increase to over 5100 by 2035, driven by developments in sequencing technology and bioinformatic tools and on the global rise for early disease detection to precision medicine solutions.

By Disease, Gastrointestinal Disorders Lead While Autoimmune Disorders Expand Rapidly:

Gastrointestinal was the largest disease segment treated with more than 1,050 therapeutic and diagnostic agents in development worldwide. The field of autoimmune is currently witnessing a substantial growth in terms of clinical microbiome studies, this number has jumped from 450 clinical trials in 2025 to an estimated 1,150 by the year 2035 led by research in inflammatory and autoimmune diseases along with growing biotechnology companies and academic institutions around the world investing heavily.

By Technology, Genomics Leads While Metabolomics Expands Rapidly:

Genomics had driven the majority of microbiome research in 2025, with more than 1,500 projects applying it to sequencing and biomarker discovery. The metabolomics technology is a growing field and around 1,050 academic researchers in 2025 may reach to 2,600 till 2035 are fuelled with emerging analytic solutions on high throughput profiling of the metabolites in addition to its rising usage in diagnostics, therapeutics as well as personalized nutrition beyond key healthcare markets.

By End User, Hospitals & Clinics Lead While Pharma & Biotech Expand Rapidly:

The prime end users in 2025 were hospitals and clinics with more than 1,400 microbiome-based therapeutic and diagnostic programs being used globally. Plentiful refurbished pharmaceuticals and biotech Growing, with 650 active R&D programs in 2025 expected to growing over 1,600 by 2035 This is driven by clinical trials, new drug discovery increases, strategic partnerships around precision medicine and personalized health.

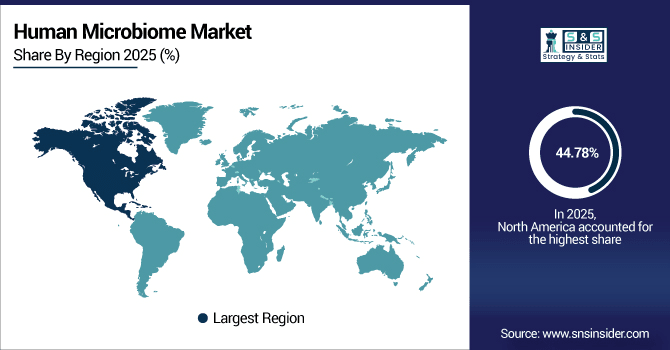

Human Microbiome Market Regional Insights:

North America Market Insights:

North America accounted for 44.78% of the global Human Microbiome Market in 2025, with over 1,350 active microbiome-based clinical trials conducted across the region. The market is mostly driven by therapeutic and diagnostic uses, although it is rapidly being joined by probiotics and personalized nutrition. Growing awareness about gut health, investments in biotechnology research and development infrastructure are significantly increasing demand. Considering innovative drugs, precision medicine efforts and industry-academia alliance, the market is estimated to grow steadily by 2035.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Market Insights:

More than 1,350 microbiome-related clinical trials took place in the U.S. in 2025, covering therapeutics, diagnostics and probiotics. Adoption is being fuelled by growing awareness of gut health, investment in biotechnology and personalised nutrition programmes. Rising investments in cutting-edge research facilities, along with partnerships with academic institutions, will further drive the demand for laboratories and facilitate stable market growth until 2035.

Asia-Pacific Market Insights:

The Asia-Pacific Human Microbiome Market is projected to grow at a CAGR of 19.89% during 2026–2035. More than 1,050 microbiome-based clinical studies and research programs were ongoing in China, Japan, India and Australia as of 2025 with a focus on therapeutics, diagnostics and probiotics. Increases in gut health awareness and biotechnological investment, along with personalized nutrition initiatives, and the development of research forsulin-based products have extended R&D infrastructure that will facilitate advances for innovation, clinical adoption, and regional market expansion through 2035.

China Market Insights:

China is the largest Asia-Pacific Human Microbiome market, which had conducted more than 480 microbial studies by 2025. Increased demand for therapeutics, diagnostics and probiotics, a growing biotech investment ecosystem and government support of healthcare innovation are some drivers. Rising clinical trials, personalized nutrition programs, and research partnerships will continue spurring market growth through 2035.

Europe Market Insights:

In 2025, Europe conducted over 820 microbiome-based clinical studies, led by Germany, the UK, and France. The market is influenced by factors such as increasing demand for therapeutics, diagnostics and probiotics, growing biotechnology investments and good academic-industry collaboration. Growing clinical trials, personalised nutrition programs and enabling regulatory policies supporting innovations would be the main contributors for the growth of this market in Europe with a modest position during 2026-2035.

Germany Market Insights:

As an important European Human Microbiome market, Germany will be home to more than 320 microbiome-related clinical trials in 2025. Advanced research facilities, high government budget for biotech & medical sector, increased requirement of personalized medicine and growing academic industry collaboration are some of the major factors that make Germany most dominating country in European Human Microbiome Market.

Latin America Market Insights:

The Latin America Human Microbiome Market conducted over 230 microbiome-based clinical studies in 2025, with Brazil, Mexico, and Argentina leading research and therapeutic development. Gains will be bolstered by increasing probiotics and diagnostics demand, growing biotech investment, government backing for health care innovation, and heightened cooperation with academic and pharmaceutical institutions to help drive market growth through 2035.

Middle East and Africa Market Insights:

The Middle East & Africa Human Microbiome Market conducted over 120 microbiome-based clinical studies in 2025. Market growth is stimulated by increasing demand for therapeutics and probiotics, growing biotechnology investments, government support in healthcare innovation, gaining momentum from array of advanced research facilities and ongoing collaborations with the academia as well as pharmaceutical sectors is fuelling a continuous market expansion throughout the region.

Human Microbiome Market Competitive Landscape:

Seres Therapeutics is a leader in microbiome-based therapeutics, focusing on gut health. In 2025, the company ran more than 320 clinical trials worldwide for microbiome therapies, such as Vowst, the world’s first oral microbiota-based treatment for recurrent C. difficile infections. With over 8,500 patients studied in these trials, and now operating the world's largest microbiome therapeutic platform based on clinical programs across multiple areas of disease, Seres retains industry-leading market leadership and continues to expand and transform the development of live biotherapeutic products.

-

In May 2025, Seres presented expanded biomarker data from its SER-155 Phase 1b study, supporting microbiome-based therapeutics for gut health.

Ferring Pharmaceuticals strengthened its microbiome presence by acquiring Rebiotix, a pioneer in live biotherapeutic products. Ferring’s Rebyota treatment was given to more than 6,200 patients in clinical programs in North America and Europe in 2025. The business managed 215 active microbiome research programs and worked with a number of academic institutions, further solidifying its market leadership in FMT and therapeutic microbiome solutions.

-

In April 2025, Ferring expanded manufacturing capacity for Rebyota and ADSTILADRIN®, addressing rising demand for microbiome therapies.

Nestlé Health Science expanded into the microbiome market by acquiring rights to Vowst from Seres Therapeutics in 2024. By 2025, Nestlé had developed -Microbiome-microbiome-based nutrition and therapies with a total of 12 products on the shelves across Europe and Asia and treating over 4,500 patients in clinical or commercial programs. We continue to invest strategically in R&D and collaborations with biotech startups and research institutes allowing us to remain an industry leader in microbiome health solutions.

-

In July 2025, Nestlé reported growth in its microbiome product portfolio, including Vowst and probiotics, across Europe and Asia.

Human Microbiome Market Key Players:

-

Seed Health

-

Finch Therapeutics

-

Vedanta Biosciences

-

4D pharma

-

Synlogic

-

Assembly Biosciences

-

Eligo Bioscience

-

Locus Biosciences

-

Microba Life Sciences

-

Viome Life Sciences

-

MaaT Pharma

-

BioGaia

-

ExeGi Pharma

-

Infant Bacterial Therapeutics

-

Biohm Health

-

Pendulum Therapeutics

-

Second Genome

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.39 Billion |

| Market Size by 2035 | USD 7.66 Billion |

| CAGR | CAGR of 18.62% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Probiotics, Prebiotics, Diagnostic Devices, Drugs, Others) • By Application (Therapeutics, Diagnostics, Personalized Nutrition & Wellness, Research & Development, Others) • By Disease (Obesity, Diabetes, Autoimmune Disorders, Cancer, Infectious Diseases, Gastrointestinal Disorders, Others) • By Technology (Genomics, Metabolomics, Proteomics, Transcriptomics, Others) • By End User (Hospitals & Clinics, Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Seres Therapeutics, Ferring Pharmaceuticals, Nestlé Health Science, Seed Health, Finch Therapeutics, Vedanta Biosciences, 4D pharma, Synlogic, Assembly Biosciences, Eligo Bioscience, Locus Biosciences, Microba Life Sciences, Viome Life Sciences, MaaT Pharma, BioGaia, ExeGi Pharma, Infant Bacterial Therapeutics, Biohm Health, Pendulum Therapeutics, Second Genome |