Patient Engagement Solutions Market Size & Trends

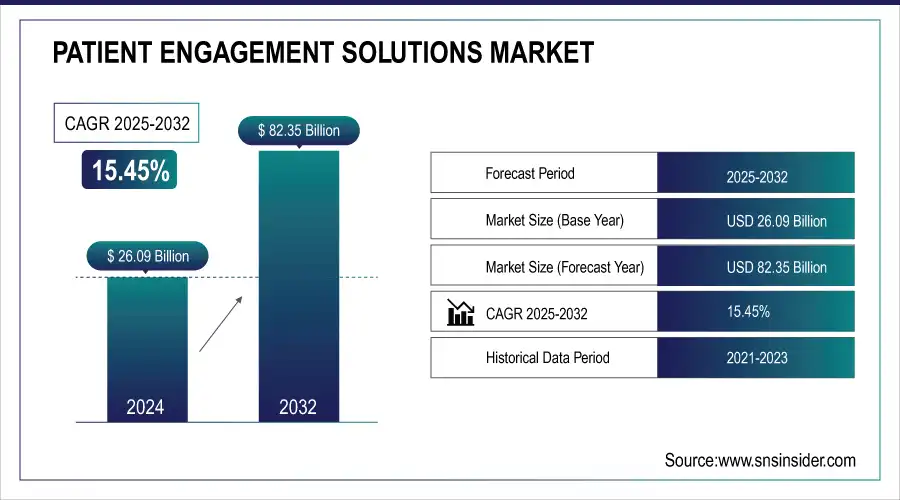

The Global Patient Engagement Solutions Market was valued at USD 26.09 Billion in 2024 and is expected to reach USD 82.35 billion by 2032, growing at a CAGR of 15.45% over the forecast period 2025-2032.

The global patient engagement solutions market is witnessing robust growth, fueled by increasing adoption of digital health technologies and the shift towards patient-centered care models. These solutions, which include mobile health applications, patient portals, wearable devices, and remote patient monitoring (RPM) systems, empower patients to actively participate in their healthcare while improving communication with providers.

Get more information on Patient Engagement Solutions Market - Request Sample Report

Studies indicate that 60% of healthcare providers have observed improved treatment adherence and better clinical outcomes after implementing patient engagement platforms. For instance, tools like Epic Systems’ MyChart app enable patients to access medical records, schedule appointments, and receive medication reminders, resulting in enhanced patient satisfaction rates. Similarly, Abbott’s FreeStyle Libre, a glucose monitoring device, has revolutionized diabetes management by providing real-time health data, improving compliance, and reducing complications.

Government initiatives and healthcare policies are also driving the adoption of patient engagement tools. Programs like the Chronic Care Management (CCM) initiative incentivize healthcare providers to use RPM technologies and engagement solutions to enhance care quality and reduce costs. The incorporation of AI-powered solutions further elevates the market by offering personalized insights, health education, and real-time assistance to patients. For example, AI chatbots can answer queries, deliver medication reminders, and provide tailored health recommendations. Despite challenges such as data security concerns and the digital divide, innovations in interoperable systems and stronger regulatory frameworks are addressing these barriers. The growing integration of wearable health technology with engagement platforms is setting the stage for transformative advancements in healthcare delivery.

Market Size and Forecast:

-

Market Size in 2024: USD 26.09 Billion

-

Market Size by 2032: USD 82.35 Billion

-

CAGR: 15.45% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Patient Engagement Solutions Market Trends

-

Growing adoption of AI-driven patient engagement solutions enabling personalized care and automated support.

-

Increasing integration of telehealth and remote patient monitoring (RPM) for continuous care outside clinical settings.

-

Rising emphasis on value-based care driving solutions that improve adherence and reduce readmissions.

-

Expansion of omnichannel, mobile-first platforms enhancing patient accessibility and engagement.

-

Demand for interoperability and EHR integration to streamline clinical workflows and data sharing.

-

Focus on analytics and real-world outcomes to demonstrate ROI and optimize care strategies.

-

Emphasis on health equity and accessibility through multilingual support and inclusive digital experiences.

Patient Engagement Solutions Market Growth Drivers

-

The patient engagement solutions market is propelled by a combination of technological advancements, evolving healthcare delivery models, and the growing emphasis on patient empowerment.

One of the primary drivers is the increasing demand for value-based care, where healthcare providers focus on delivering better patient outcomes rather than fee-for-service models. This shift has heightened the need for tools that improve communication, foster collaboration, and ensure adherence to treatment plans.

The rise of artificial intelligence (AI) and machine learning (ML) technologies has further transformed patient engagement solutions by enabling predictive analytics, personalized health insights, and proactive interventions. AI-driven chatbots and virtual assistants are becoming integral to providing patients with real-time support, medication reminders, and tailored educational content. Moreover, the surge in the adoption of Internet of Things (IoT) devices and wearable technology is another key driver. These devices allow real-time health monitoring and seamless integration with patient engagement platforms, empowering patients to manage chronic conditions like diabetes and hypertension more effectively.

The increasing penetration of smartphones and internet connectivity has also expanded access to mobile health applications and telehealth platforms, particularly in underserved areas. These tools bridge the gap between patients and providers, enabling consistent engagement and reducing healthcare disparities. Lastly, regulatory frameworks and government initiatives, such as incentivizing providers for adopting remote patient monitoring (RPM) solutions, play a pivotal role in accelerating market adoption. These factors collectively position patient engagement solutions as a cornerstone of modern healthcare, driving demand and innovation in the market.

Patient Engagement Solutions Market Restraints

-

Data Privacy and Security Concerns

The adoption of patient engagement solutions is often hindered by growing concerns over data breaches and unauthorized access to sensitive patient information. Compliance with stringent regulations, such as HIPAA and GDPR, adds complexity to solution implementation, particularly for smaller healthcare providers.

-

Digital Divide and Limited Accessibility

The unequal access to technology, including limited internet connectivity and low digital literacy in certain populations, creates barriers to the widespread adoption of patient engagement solutions, particularly in rural and underserved areas.

Patient Engagement Solutions Market Segment Analysis

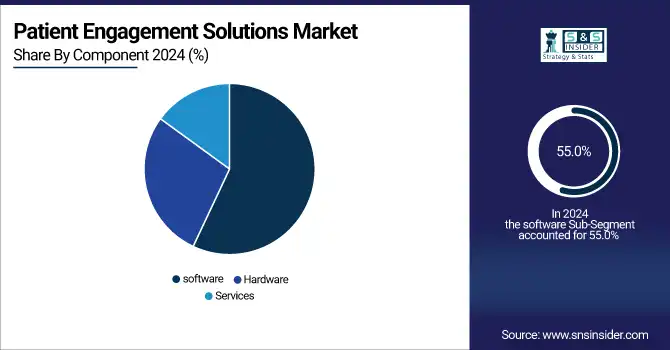

By Component

The software segment emerged as the largest contributor to the patient engagement solutions market in 2024, holding around 55.0% of the market share. This dominance is primarily due to the widespread adoption of patient portals, mobile health applications, and data analytics tools that streamline communication and engagement between patients and healthcare providers. Software solutions facilitate critical functionalities such as real-time health tracking, secure data sharing, medication reminders, and appointment scheduling. These tools not only enhance operational efficiency for healthcare providers but also empower patients to actively participate in their care. The increasing focus on personalized medicine and population health management further bolsters the demand for advanced software platforms, cementing their market dominance.

The services segment is anticipated to grow at the fastest pace in the coming years, driven by the rising demand for implementation, training, and maintenance services associated with sophisticated patient engagement platforms. As healthcare providers increasingly adopt digital tools, expert services are crucial for ensuring seamless integration with existing systems, compliance with regulatory standards, and user adaptability. Additionally, the ongoing need for software upgrades, analytics consulting, and troubleshooting further fuels this segment’s growth. The shift toward outsourcing non-core activities to service providers also contributes significantly, enabling healthcare organizations to focus on delivering optimal patient care.

By Deployment Mode

In 2024, cloud-based deployment models dominated the patient engagement solutions market, accounting for approximately 60.0% of the market share. Cloud solutions offer numerous advantages, including scalability, cost-effectiveness, and ease of deployment, making them an ideal choice for healthcare providers of all sizes. These platforms facilitate secure data storage, real-time collaboration, and seamless access to patient information from remote locations. With the increasing adoption of telehealth services, remote patient monitoring (RPM), and AI-driven analytics, cloud-based systems have become the backbone of modern patient engagement. Additionally, the low upfront cost of cloud platforms makes them more accessible, particularly for small and medium-sized healthcare providers, ensuring their sustained dominance in the market.

The cloud segment is also the fastest-growing deployment mode, driven by the rising integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) devices. These technologies leverage the scalability and flexibility of cloud platforms to deliver personalized care and real-time health insights. Moreover, the growing focus on data interoperability and the need to comply with stringent healthcare regulations are accelerating the shift toward cloud-based models, ensuring their rapid growth trajectory.

By Functionality

The health tracking and insights segment accounted for approximately 40.0% of the market share in 2024, making it the most dominant functionality. This is largely attributed to the widespread use of wearable devices, mobile health applications, and RPM tools that allow patients to monitor their health metrics in real-time. Metrics such as blood pressure, heart rate, glucose levels, and physical activity are captured seamlessly, enabling proactive management of chronic conditions. These insights not only empower patients but also provide healthcare providers with actionable data to tailor treatment plans. The rising prevalence of lifestyle diseases, coupled with growing awareness about preventive healthcare, further reinforces the dominance of this segment.

The communication segment is poised to grow at the fastest rate due to the increasing adoption of telehealth services, secure messaging platforms, and AI-powered chatbots. These solutions enhance patient-provider interaction, ensuring timely support, education, and follow-ups. The pandemic-induced shift toward virtual healthcare has amplified the demand for robust communication tools, as they enable consistent engagement regardless of geographical barriers. The integration of AI for personalized communication and the growing reliance on omnichannel platforms for patient interactions are key factors driving the rapid growth of this segment.

Patient Engagement Solutions Market Regional Analysis

North America Patient Engagement Solutions Market Insights

North America dominated the market, holding the largest share in 2024, owing to the advanced healthcare infrastructure, high technology adoption, and a strong focus on improving patient outcomes through digital solutions. The U.S. leads this region, with substantial investments in telehealth, remote monitoring, and patient-centric applications. The implementation of HITECH Act and Affordable Care Act (ACA) has also played a significant role in driving the adoption of patient engagement platforms. The high demand for patient portals, mobile health apps, and cloud-based solutions further accelerates market growth in this region.

Need any customization research on Patient Engagement Solutions Market - Enquiry Now

Europe Patient Engagement Solutions Market Insights

Europe followed closely, with countries like the UK, Germany, and France embracing digital health solutions to enhance patient care. The European market is characterized by a growing focus on patient-centered care models and the widespread adoption of digital health technologies. Regulatory frameworks, such as the GDPR, ensure that patient data is handled securely, fostering trust in digital platforms. The increasing investment in telehealth and remote monitoring solutions in Europe further supports the market’s expansion.

Asia Pacific Patient Engagement Solutions Market Insights

Asia-Pacific is the fastest-growing region due to a rise in healthcare digitization, improving healthcare access, and increasing patient awareness in countries like China, India, and Japan. The growing adoption of wearable devices and mobile health applications, along with a shift toward preventive healthcare, is driving demand for patient engagement solutions. Furthermore, rising healthcare expenditure and government initiatives supporting digital health technologies fuel growth in the region.

Patient Engagement Solutions Market Competitive Landscape

RadiantGraph

Radiant Graph is a U.S.-based patient engagement platform offering AI-driven solutions and integrated digital tools for healthcare providers.

-

In October 2024, RadiantGraph secured USD 11 million in Series A funding. This announcement follows the company’s recent integration with AWS, Google Cloud, Databricks, and Snowflake, highlighting its expanding capabilities and commitment to delivering scalable, data-driven patient engagement solutions.

NHS

The National Health Service (NHS) in the U.K. provides comprehensive patient communication and engagement frameworks across public healthcare systems.

-

In October 2024, the NHS rationalized its USD 360 million Patient Communication and Engagement Solutions 2 framework from nine lots down to six. Launched in 2021, this revised contract emphasizes digital communication tools, including patient portals and smartphone applications for managing digital documents and healthcare data efficiently.

Zappix

Zappix is a digital patient engagement solutions provider focused on automating patient intake and communication processes.

-

In August 2024, Zappix secured a new healthcare client to enhance its digital outreach and intake services, aiming to improve operational efficiency and reduce manual intervention in the healthcare system.

PriMALE Health

PriMALE Health is a men’s health and wellness clinic leveraging digital and AI-driven tools to enhance patient care and operational efficiency.

-

In April 2024, PriMALE Health introduced the eClinicalWorks Cloud EHR, Sunoh.ai Medical AI Scribe, and healow Patient Engagement Solutions to enhance patient acquisition and streamline clinical operations, supporting better patient outcomes through technology-enabled care.

Patient Engagement Solutions Market Key Players

-

Cerner Corporation (Oracle)

-

Cerner Millennium

-

Cerner Patient Portal

-

-

-

NextGen Patient Portal

-

NextGen Mobile App

-

-

-

MyChart

-

EpicCare

-

-

Allscripts Healthcare, LLC

-

Allscripts FollowMyHealth

-

Allscripts Patient Flow

-

-

-

McKesson Patient Services

-

RelayHealth

-

-

ResMed

-

AirView

-

myAir

-

-

Koninklijke Philips N.V.

-

Philips HealthSuite

-

Philips CareSage

-

-

Klara Technologies, Inc.

-

Klara

-

-

CPSI

-

GetWellNetwork

-

-

Experian Information Solutions, Inc.

-

Experian Health

-

-

athenahealth, Inc.

-

athenaCommunicator

-

athenaCollector

-

-

Solutionreach, Inc.

-

Solutionreach

-

-

IBM

-

IBM Watson Health

-

-

MEDHOST

-

MEDHOST Patient Portal

-

-

Nuance Communications, Inc.

-

Nuance Dragon Medical One

-

-

Veradigm

-

Veradigm Engage

-

-

Merative

-

Merative Patient Engagement

-

-

Orion Health

-

Orion Health Engage

-

-

Oneview Healthcare

-

Oneview Patient Engagement Platform

-

-

MEDITECH

-

MEDITECH Patient and Family Portal

-

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 26.09 billion |

| Market Size by 2032 | US$ 82.35 billion |

| CAGR | CAGR of 15.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment Mode (On-premise, Cloud) • By Functionality (Communication, Health Tracking and Insights, Biling and Payments, Administrative, Others) • By End User (Providers, Payers, Patients) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Experian Information Solutions, Inc., athenahealth, Inc., Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc., Veradigm, Merative, Orion Health, Oneview Healthcare, MEDITECH |