Emulsifiers Market Report Scope & Overview:

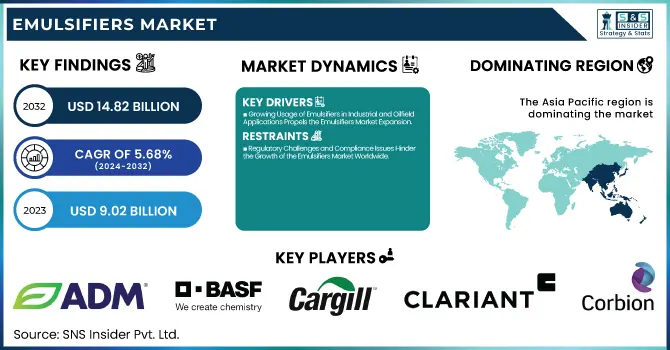

The Emulsifiers Market Size was valued at USD 9.02 Billion in 2023 and is expected to reach USD 14.82 Billion by 2032, growing at a CAGR of 5.68% over the forecast period of 2024-2032.

To Get more information on Emulsifiers Market - Request Free Sample Report

The emulsifiers market is expanding rapidly, driven by demand in food, cosmetics, and pharmaceuticals. Our report explores key raw materials like lecithin, monoglycerides, and polysorbates, assessing their availability and sourcing challenges. Fluctuations in raw material prices impact production costs, making price trends a critical factor. Trade policies and tariffs shape global supply chains, influencing competitiveness and regional market dynamics. As sustainability gains importance, the report examines the environmental impact of emulsifier production and the shift toward bio-based alternatives. Investment and funding trends reveal how mergers, acquisitions, and R&D investments are fueling market growth. This comprehensive analysis provides valuable insights for industry players navigating opportunities and challenges in the evolving emulsifiers market.

Emulsifiers Market Dynamics

Drivers

-

Growing Usage of Emulsifiers in Industrial and Oilfield Applications Propels the Emulsifiers Market Expansion

Beyond the food, cosmetics, and pharmaceutical industries, emulsifiers are witnessing a rising demand in industrial and oilfield applications. In oil drilling operations, emulsifiers play a crucial role in stabilizing oil-water mixtures, enhancing lubrication, and improving the efficiency of drilling fluids. The increasing investments in oil exploration and extraction activities worldwide have significantly contributed to the expansion of emulsifier applications in the oil and gas sector. Industrial emulsifiers are also extensively used in metalworking, paints, coatings, and construction chemicals, where they aid in improving product stability, dispersion, and overall performance. The demand for emulsifiers in these industries is driven by the need for high-performance additives that enhance the durability and effectiveness of industrial formulations. Additionally, the shift towards eco-friendly and biodegradable emulsifiers has further accelerated their adoption in industrial applications. Manufacturers are focusing on developing emulsifiers that reduce environmental impact while maintaining efficiency in high-performance applications. Moreover, stringent regulations governing the use of chemical additives in industrial sectors have led to an increased demand for bio-based emulsifiers. As industrial activities continue to expand globally, the demand for versatile and high-quality emulsifiers in non-food applications is expected to grow, contributing significantly to market expansion. The ongoing research in enhancing emulsifier formulations to meet industry-specific requirements will further drive market growth, positioning emulsifiers as essential components in industrial and oilfield applications.

Restraints

-

Regulatory Challenges and Compliance Issues Hinder the Growth of the Emulsifiers Market Worldwide

The emulsifiers market faces significant regulatory challenges due to stringent compliance requirements imposed by food safety authorities and environmental agencies. Different regions have distinct regulations regarding the usage of emulsifiers in food, cosmetics, pharmaceuticals, and industrial applications. In the food sector, emulsifiers must meet safety standards set by organizations such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). Regulatory restrictions on certain synthetic emulsifiers, including polysorbates and mono- and diglycerides, have posed challenges for manufacturers, requiring them to reformulate their products with alternative ingredients. Similarly, cosmetic emulsifiers must comply with regulations from agencies such as the Cosmetics Regulation (EC) No 1223/2009 in Europe, limiting the use of specific chemical emulsifiers due to potential health risks. Furthermore, environmental regulations restricting petroleum-based and non-biodegradable emulsifiers have increased compliance costs for manufacturers. The need for extensive testing, documentation, and certification processes before market approval creates significant hurdles for new emulsifier formulations. As a result, companies are forced to invest heavily in research and development to develop regulatory-compliant emulsifiers, delaying product launches and increasing production costs. The evolving regulatory landscape continues to challenge the industry, making it difficult for manufacturers to maintain cost-effectiveness while adhering to compliance requirements.

Opportunities

-

Advancements in Nanotechnology Open New Avenues for High-Performance Emulsifier Applications

Nanotechnology is revolutionizing the emulsifiers market by enabling the development of high-performance emulsifiers with enhanced stability, dispersion, and bioavailability. Traditional emulsifiers often face limitations in achieving ultra-stable emulsions, especially in challenging applications such as pharmaceuticals, functional foods, and high-performance coatings. The integration of nanotechnology allows the creation of nanoemulsifiers that offer superior solubility, controlled release, and enhanced absorption properties. In the pharmaceutical industry, nanoemulsifiers are increasingly used to improve drug solubility and bioavailability, leading to more effective drug delivery systems. The cosmetics and personal care industry also benefits from nanotechnology-based emulsifiers, which enhance the stability and penetration of active ingredients in skincare and haircare formulations. Furthermore, nanoemulsions offer excellent performance in food products by providing improved texture and prolonged shelf life without compromising on clean-label requirements. Another key advantage of nanotechnology-driven emulsifiers is their ability to reduce the required dosage while maintaining superior performance, making them cost-effective for manufacturers. Researchers are also exploring biodegradable and bio-based nanoemulsifiers that align with sustainability goals, further expanding their application potential. Additionally, the growing demand for precision delivery systems in various industries is driving the adoption of nanostructured emulsifiers that offer targeted release capabilities. As regulatory bodies continue to evaluate the safety of nanomaterials, the industry is focusing on developing safe and regulatory-compliant nanoemulsifiers. With ongoing advancements in nanotechnology, emulsifier manufacturers can unlock new opportunities in diverse sectors, positioning nanoemulsifiers as a game-changing innovation in the market.

Challenge

-

Limited Consumer Awareness About the Functional Benefits of Emulsifiers Restricts Market Expansion

Despite the crucial role emulsifiers play in food, cosmetics, pharmaceuticals, and industrial applications, consumer awareness about their functional benefits remains limited. Many consumers perceive emulsifiers as chemical additives, leading to misconceptions about their safety and necessity in product formulations. The rise of clean-label and minimally processed food trends has further fueled skepticism around the use of emulsifiers, with some consumers actively seeking products that exclude them. This growing consumer preference for additive-free products poses a challenge for emulsifier manufacturers, as they must justify the inclusion of emulsifiers while addressing safety concerns. Misinformation about certain emulsifiers, such as mono- and diglycerides or polysorbates, has led to their avoidance, even though they play a crucial role in improving product stability and texture. Additionally, the lack of clear labeling and educational initiatives has contributed to misconceptions, limiting the market potential for emulsifiers. While industry players are focusing on developing natural and plant-based emulsifiers, the challenge remains in effectively communicating their benefits to consumers. Companies must invest in consumer education campaigns to highlight the importance of emulsifiers in enhancing product quality, extending shelf life, and supporting food safety. Transparency in ingredient sourcing, labeling, and manufacturing processes can help build consumer trust. Moreover, collaboration with regulatory bodies, food scientists, and consumer advocacy groups can help dispel myths and promote informed decision-making. Addressing consumer skepticism and increasing awareness about the functionality of emulsifiers is crucial for unlocking new growth opportunities in the market.

Emulsifiers Market Segmental Analysis

By Source

Bio-Based emulsifiers dominated the emulsifiers market in 2023 with a market share of 55.2%. The increasing preference for natural and sustainable ingredients across industries has driven the demand for bio-based emulsifiers. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have been encouraging the use of plant-derived emulsifiers due to their biodegradability and lower environmental impact. Organizations like the Roundtable on Sustainable Palm Oil (RSPO) have also been promoting sustainable sourcing of emulsifier raw materials, further boosting bio-based alternatives. In the cosmetics industry, L'Oréal and Unilever have committed to using sustainable emulsifiers, aligning with consumer demand for eco-friendly formulations. Additionally, the European Union’s Green Deal and Farm to Fork Strategy emphasize reducing synthetic additives in food, favoring natural emulsifiers such as lecithin and saponins, reinforcing the dominance of bio-based emulsifiers.

By Product Type

Lecithin dominated the emulsifiers market in 2023 with a market share of 30.9%. Its extensive use in food, pharmaceuticals, and personal care industries has made it the leading emulsifier type. Derived from soybeans, sunflower seeds, and eggs, lecithin is widely accepted as a natural and safe emulsifier. The U.S. Department of Agriculture (USDA) and the European Food Safety Authority (EFSA) classify lecithin as a safe food additive, leading to its widespread adoption. Multinational food companies like Nestlé and Mondelez International have integrated lecithin into their chocolate and bakery products due to its effective emulsification and clean-label appeal. Additionally, the American Oil Chemists’ Society (AOCS) has been conducting studies on lecithin’s functional properties, highlighting its superior performance in stabilizing oil-in-water emulsions. The rising demand for plant-based and allergen-free alternatives has further propelled lecithin’s dominance in the emulsifiers market.

By Physical State

Liquid emulsifiers dominated the emulsifiers market in 2023 with a market share of 57.4%. Their higher solubility, ease of incorporation into formulations, and superior stability in various applications have contributed to their widespread use. Liquid emulsifiers are preferred in the food and beverage industry for products like margarine, dressings, and dairy alternatives due to their ability to create smooth and consistent textures. The Food and Agriculture Organization (FAO) has highlighted the growing role of liquid emulsifiers in improving food processing efficiency. Additionally, the U.S. Environmental Protection Agency (EPA) has been regulating the use of synthetic solid emulsifiers, prompting manufacturers to shift toward liquid-based, plant-derived alternatives. Companies like Cargill and ADM have been expanding their portfolios of liquid emulsifiers to meet the increasing demand in cosmetics, pharmaceuticals, and industrial applications, reinforcing the dominance of this segment.

By Application

Cosmetics & Personal Care dominated the emulsifiers market in 2023 with a market share of 38.7%. The increasing consumer preference for natural and multifunctional emulsifiers in skincare, haircare, and makeup products has significantly driven this segment’s growth. Regulatory bodies such as the Cosmetic Ingredient Review (CIR) and the European Chemicals Agency (ECHA) have been advocating for the use of bio-based emulsifiers in personal care products, further accelerating demand. Leading cosmetics brands like Estée Lauder, Procter & Gamble, and L'Oréal have been incorporating plant-derived emulsifiers such as glyceryl stearate and polyglyceryl esters to enhance product performance while maintaining clean-label formulations. The rise in vegan and cruelty-free beauty trends, supported by organizations like The Vegan Society and PETA, has also contributed to the increased adoption of sustainable emulsifiers in cosmetics. Furthermore, government-backed initiatives promoting eco-friendly ingredients in personal care products have reinforced the dominance of this segment in the emulsifiers market.

Emulsifiers Market Regional Outlook

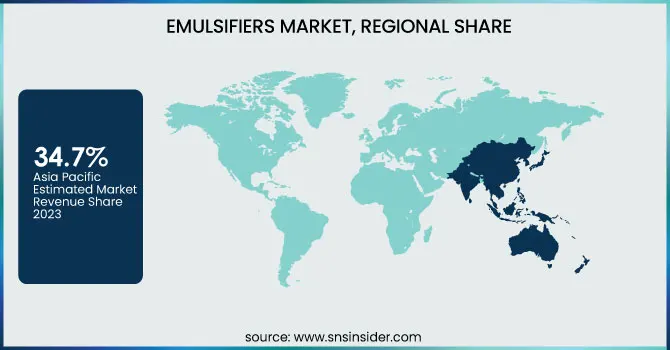

Asia Pacific dominated the emulsifiers market in 2023 with a market share of 34.7%. The region's stronghold is attributed to the rapid expansion of food processing, cosmetics, and pharmaceutical industries, coupled with rising consumer awareness of functional ingredients. Countries like China, India, and Japan lead the emulsifiers market due to their robust manufacturing capabilities and growing domestic demand. China, as the world’s largest food processing hub, has witnessed increased adoption of lecithin and mono- and diglycerides in bakery, confectionery, and dairy applications, with companies like Wilmar International and Riken Vitamin Co., Ltd. playing a significant role. In India, the personal care sector is flourishing, with demand for natural emulsifiers surging due to brands like Hindustan Unilever and Patanjali shifting towards bio-based formulations. Meanwhile, Japan’s advanced pharmaceutical industry extensively utilizes emulsifiers for drug formulations, supported by government-backed R&D initiatives. Additionally, the Association of Southeast Asian Nations (ASEAN) has implemented policies favoring sustainable emulsifier production, further propelling regional dominance.

North America projected to be the fastest-growing region in the emulsifiers market during the forecast period, with a significant growth rate. This growth is driven by increasing demand for clean-label and organic emulsifiers in food, cosmetics, and pharmaceuticals. The United States leads the region, with major food manufacturers like General Mills and Kraft Heinz incorporating natural emulsifiers to cater to evolving consumer preferences. Additionally, the U.S. Food and Drug Administration (FDA) has been actively regulating synthetic emulsifiers, encouraging the shift toward bio-based alternatives. In Canada, the cosmetics industry is witnessing a surge in plant-derived emulsifier adoption, driven by brands like Lush and The Green Beaver Company. Meanwhile, Mexico’s booming processed food sector, supported by investments from companies like Grupo Bimbo, is fostering significant emulsifier demand. Government initiatives promoting sustainable ingredients and investments in research, particularly through organizations like the U.S. Department of Agriculture (USDA), further bolster the region’s rapid market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Archer Daniels Midland Company (ADM) (Lecithin, Mono- and Diglycerides)

-

BASF SE (Lutensol Nonionic Surfactants, Kolliphor Polyethylene Glycol Esters)

-

Cargill, Incorporated (Lecithin, Mono- and Diglycerides)

-

Clariant (Hostaphat Emulsifiers, Hostapon Surfactants)

-

Corbion (PURAC Esters, PATIONIC Glycerol Esters)

-

Croda International Plc (Tween Polysorbates, Span Sorbitan Esters)

-

DuPont (Danisco Lecithin, DIMODAN Distilled Monoglycerides)

-

Evonik Industries AG (TEGO Alkanol Emulsifiers, TOMAMINE Ethoxylates)

-

Ingredion Incorporated (N-CREAMER Starch-based Emulsifiers, PURITY GUM Stabilizers)

-

Kerry Group plc (ULTRALEC Lecithin, MYVEROL Distilled Monoglycerides)

-

Lasenor Emul S.L. (Lecithin, Mono- and Diglycerides)

-

Lonza Group (Glycerol Monostearate, Sorbitan Monostearate)

-

Lubrizol Corporation (CARBOWAX Polyethylene Glycols, Glucamate Emulsifiers)

-

Nouryon (ETHOMEEN Fatty Amine Ethoxylates, ARQUAD Quaternary Ammonium Compounds)

-

Palsgaard A/S (Emulpals Cake Emulsifiers, Palsgaard Lecithin)

-

Puratos Group (ACTIWHITE Egg White Replacers, SAPPHIRE Emulsifiers)

-

Riken Vitamin Co., Ltd. (RIKEMAL Emulsifiers, RIKEN Lecithin)

-

Stepan Company (STEPAN-MILD Surfactants, STEOL Anionic Surfactants)

-

Taiyo Kagaku Co., Ltd. (SUNSOFT Lecithin, SUNMULSION Emulsifiers)

-

Akkim Kimya (Akfat Emulsifiers, Akpol Emulsifiers)

Recent Developments

-

October 2024: BASF introduced its Emulgade Verde natural-based emulsifiers at the SEPAWA Congress in Berlin. These biodegradable emulsifiers, derived from renewable feedstocks, support sustainable personal care formulations with COSMOS and NATRUE approvals.

-

January 2024: Corbion sold its emulsifiers business to Kingswood Capital Management for $362 million, including two U.S. plants. The deal allows Corbion to focus on fermentation-based technologies while Kingswood strengthens its emulsifier portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.02 Billion |

| Market Size by 2032 | USD 14.82 Billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Bio-Based, Synthetic) •By Product Type (Lecithin, Ionic Emulsifiers, Fatty Acid-Based Emulsifiers, Ester-Based Emulsifiers, Alcohol-Based Emulsifiers, Others) •By Physical State (Solid, Liquid) •By Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Agrochemicals, Oilfield Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Palsgaard A/S, Stepan Company, Puratos Group, Riken Vitamin Co., Ltd., Corbion, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Kerry Group plc, BASF SE, Evonik Industries AG and other key players |