High-Density Interconnect Market Size Analysis:

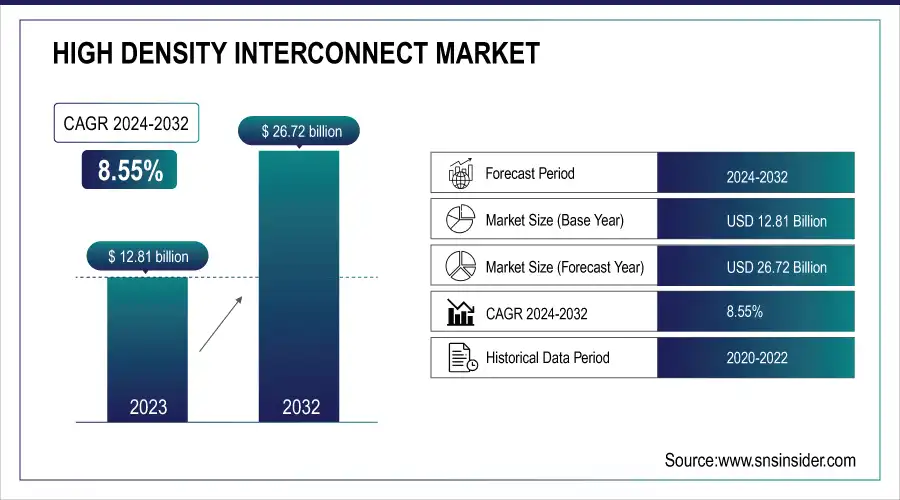

The High Density Interconnect Market was valued at USD 12.81 billion in 2023 and is expected to reach USD 26.72 billion by 2032, growing at a CAGR of 8.55% over the forecast period 2024-2032.

HDI is showing excellent growth due to the continuation of growing fab-level capacity utilization trends (especially in Asia) as manufacturers continue to scale to meet needed requirements. The increasing complexity of Layers trends signifies the use of advanced multi-layers in various devices within small spaces. Hyperdense interconnection (HDI) PCBs are essential components in 5G infrastructure. The rapid growth of HDI in AI hardware and edge computing will further accelerate the development of fast, efficient processing, efficient thermal management, and compact form factors in current electronics. The U.S. High-Density Interconnect (HDI) Market is experiencing strong growth in 2024 due to a rise in demand for advanced consumer electronics, 5G infrastructure, and Wearable Technology. America is one of the highest consumers of electronics, with an average household using around 28 electronic devices, from smartphones and tablets to smart home systems. This increase in the use of electronic devices raises the demand for small-size, high-performance HDI PCBs. Moreover, the implementation of 5G networks and the growing penetration of wearable devices establish sustainability for advanced HDI solutions in the U.S.

To Get more information on High-Density Interconnect Market - Request Free Sample Report

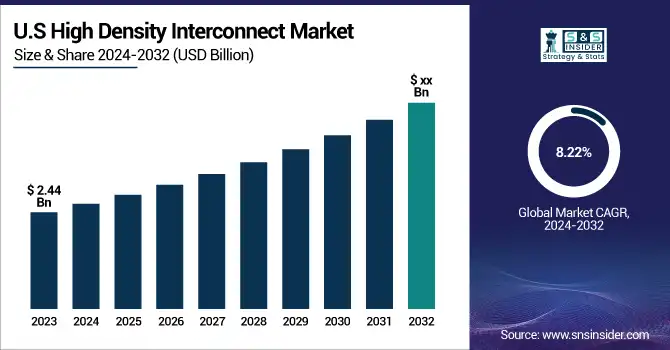

The U.S. High Density Interconnect Market is estimated to be USD 2.44 Billion in 2023 and is projected to grow at a CAGR of 8.22%. The U.S. HDI market is anticipated to flourish owing to the dominance of the country in defense electronics, increased R&D in semiconductor innovation, and government measures to localize the manufacturing of critical components. Moreover, with the growing demand for secure, high-reliability PCBs from military, medical, and industrial automation sectors, HDI adoption will further accelerate.

High Density Interconnect (HDI) Market Dynamics

Key Drivers:

-

Rising Demand for Compact High-Performance Devices Fuels Growth of High Density Interconnect PCB Market

High-Density Interconnect (HDI) market is influenced positively by demand for small-size and high-performance electronic devices. Consumer-oriented devices in the form of smartphones, tablets, and wearable tech are driving the shift to HDI PCBs to benefit from their superior electrical performance, lower profile, and lighter weight. Moreover, the deployment of the 5G technology is boosting the need for HDI in the telecommunications infrastructure as it utilizes high-frequency PCBs with the least amount of signal loss. The automotive sector represents another very significant driver as multilayer HDI boards are required to serve the expanding use of advanced driver-assistance systems (ADAS), infotainment units, and electric vehicle (EV) control modules.

Restrain:

-

Complex Manufacturing Challenges and Quality Variations Hinder the Growth of High Density Interconnect PCB Market

The major restraint for the growth of the High-Density Interconnect (HDI) market is the complexity of the manufacturing of multilayer HDI-based Printed Circuit Boards (PCBs). The higher the number of layers is, the higher the chances of a design error that is triggered by the potential of highly accurate fabrication processes for these boards. At these denser configurations, concerns like signal integrity, thermal management, and interconnection reliability take center stage, often needing nuanced engineering and testing methodologies. Moreover, without a standard process across all manufacturing techniques, there may be a variation in quality and how the product performs, especially if there are multiple suppliers across regions.

Opportunity:

-

Expanding Medical Aerospace and IoT Applications Unlock New Growth Opportunities for High Density Interconnect Market

There are considerable growth prospects from the growing medical electronics and aerospace industries where miniaturization with precision, and reliability are a necessity. HDI technology for implantables, diagnostic imaging systems, and portable monitoring tools are some examples. Additionally, the transition towards Industry 4.0 and connected devices powered by IoT is creating new opportunities for HDI to penetrate industrial automation. The increasing electronics manufacturing base across emerging economies in Asia Pacific and Latin America, along with growing investments in infrastructure and automotive innovation present additional opportunities. Flexible and rigid-flex HDI PCBs are also a budding area suitable to meet the needs of next-generation applications.

Challenges:

-

Shortage of Skilled Workforce and Supply Chain Issues Challenge High Density Interconnect Market Expansion

One of the biggest constraints in the HDI market is the lack of skilled workforce and technical expertise especially in emerging economies With advancements and complexity in the technology, the demand for deep expertise in HDI Design, materials, and manufacturing is increasing. In addition, the expanding application areas such as automotive, aerospace, and medical are subject to stringent regulatory and performance standards, which place additional challenges on the HDI PCB manufacturers. A second issue is the supply chain reliability of many advanced materials and components, particularly as global disruptions continue. For most of the players in the industry, ensuring scalability coupled with accuracy and constant performance is still the key challenge.

High Density Interconnect Market Segment Analysis

By Product

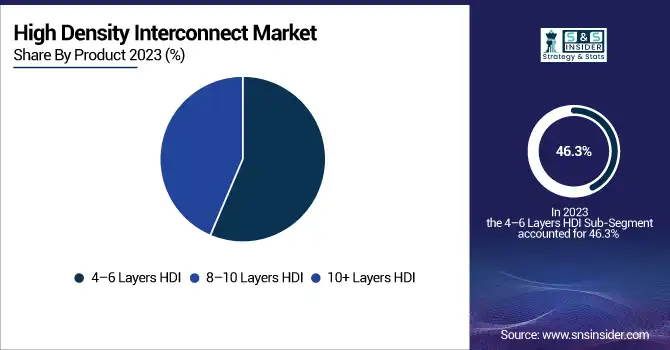

The 4–6 Layers HDI segment accounted for the largest market share of nearly 46.3% in the High Density Interconnect (HDI) Market in the year 2023. High-end consumer electronics including smartphones, tablets, and wearables are mostly adopting this technology, dominating this growth due to features including low cost, size, and high performance. The mix of features with efficiency makes these HDI boards the most preferred choice for mid-range projects in high-volume production.

The 10+ Layers HDI segment is projected to have the highest CAGR during 2024-2032. It occupies a space that has been growing with the rise of advanced, high-performance applications across automotive, aerospace, defense, and data center verticals. It provides the scope for advanced circuit designs with improved signal integrity and higher data transmission features, which is ideal for mission-critical as well as high-frequency environments. Emerging technologies such as AI, EVs, and 5G infrastructure will drive the growth of 10+ layer HDI solutions moving ahead.

By Application

Communication devices and equipment captured the maximum revenue share of 33.1% in 2023 of the High Density Interconnect (HDI) market. This is due to the evolution of mobile technologies, the increasing adoption of 5G smartphones, and the need for faster data transmission. The small footprint, high signal integrity, and complexity of designs enabled by HDI PCBs make them a popular choice for communication infrastructure like smartphones, routers, and network switches.

Automotive Electronics is also anticipated to be the fastest-growing segment with the highest CAGR from 2024 to 2032. The rise is also a result of more electronics in today's vehicles, from electric vehicles (EVs) and driver-assistance systems (ADAS) to infotainment systems. The development of HDI technology can realize small-volume, lightweight, and high-performance circuitry, vital for the evolution of vehicle intelligence and safety. With the movement of the automotive industry towards driver support, and connected and autonomous vehicles, the need for HDI will increase significantly.

By End User

Consumer Electronics held the largest share of 38.4% of the global High-Density Interconnect (HDI) market in 2023. They have this leadership position largely because of the huge worldwide appetite for small, high-power electronic devices like smartphones, tablets, laptop computers, game consoles, and wearables. These markets require miniaturization, improved electrical performance, and reduced space consumption that utilize High-Density Interconnect (HDI) PCBs, making HDI PCBs ideal for consumer electronics manufacturers to deliver thinner, lighter, and more powerful products.

The Automotive end-use industry segment is projected to witness the highest CAGR during the period from 2024 to 2032. The gradual electrification of vehicles, such as the growing use of infotainment units, digital dashboards, battery management systems, and advanced driver-assistance systems (ADAS), is impacting the demand for multilayer, space-saving, and reliable HDI PCBs. As electric and autonomous vehicle adoption increasingly proliferates around the world, HDI technology is playing a vital role by providing safety, connectivity, and performance in today's automotive systems.

HDI Market Regional Outlook

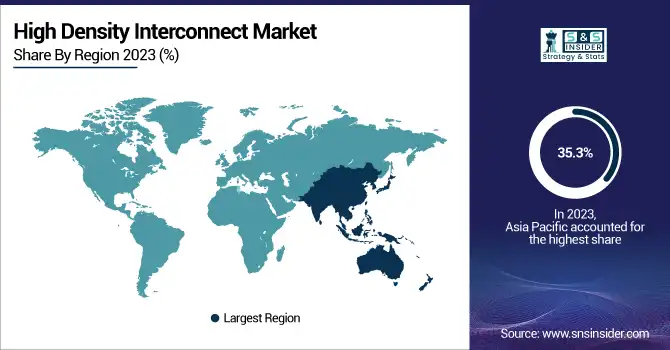

Asia Pacific led the HDI market with a 35.3% share of revenue in 2023, and the region is projected to witness the fastest CAGR during the forecast period. The top position in this region is fueled by the powerful ecosystem of electronics manufacturing across countries such as China, South Korea, Japan, and Taiwan. As TTM Technologies, Zhen Ding Tech, and Unimicron are among the world's top OEMs and PCB producers, High (or even Super) Density Interconnect (HDI) aren't easy, which explains also for this demand in those nations. Smartphone and consumer electronics manufacturing is dominated by China, which leverages its high-density interconnect (HDI) technology for miniaturization and high functionality. In South Korea, tech behemoths like Samsung Electronics and LG apply HDI PCBs for smartphones, tablets, and smartwatches. In Japan, firms such as Panasonic and Sony utilize HDI within automotive electronics and high-end imaging systems. Taiwan is also home to major SCM leaders in semiconductor and PCB manufacturing which further extends its regional strength. Moreover, the regional markets such as 5G, EVs, and IoT-enabled devices such as cellular will significantly create a massive push for the HDI applications to be more widely adopted over the forecast amount. Ongoing investments in R&D, talent attraction and retention, and intelligent manufacturing will continue to reinforce the position of Asia Pacific as the largest and fastest-growing HDI market in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the High Density Interconnect (HDI) Market are:

- TTM Technologies (Advanced HDI PCB)

- Unimicron Technology Corporation (HDI Substrate)

- AT&S – Austria Technologie & Systemtechnik AG (ECP® Technology)

- Compeq Manufacturing Co., Ltd. (6-Layer HDI PCB)

- Tripod Technology Corporation (HDI Multilayer Board)

- Zhen Ding Technology Holding Limited (Mobile HDI Board)

- Ibiden Co., Ltd. (Build-up HDI Substrate)

- Samsung Electro-Mechanics (Package Substrate for AP)

- Daeduck Electronics Co., Ltd.(HDI for Memory Module)

- Meiko Electronics Co., Ltd. (HDI PCB for Automotive)

- Viasystems (HDI Rigid-Flex Circuit)

- Shenzhen Kinwong Electronic Co., Ltd. (HDI PCB for Wearables)

- NCAB Group (High-Frequency HDI PCB)

- Multek (High-Speed HDI PCB)

- Fujikura Ltd. (Flexible HDI Circuit)

HDI Market - Recent Trends

-

In October 2024, TTM Technologies selected Syracuse, New York for a new USD 130 million facility to produce Ultra-HDI PCBs supporting U.S. national security, creating around 400 tech jobs. The plant will enhance domestic capabilities in aerospace and defense electronics.

-

In May 2024, Shenzhen Kinwong Electronic Co., Ltd. joined the High-Density Packaging User Group (HDP) to collaborate on advancing HDI PCB technologies. The move strengthens industry innovation through global R&D partnerships.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.81 Billion |

| Market Size by 2032 | USD 26.72 Billion |

| CAGR | CAGR of 8.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (4–6 Layers HDI, 8–10 Layers HDI, 10+ Layers HDI) • By Application (Automotive Electronics, Computer and Display, Communication Devices and Equipment, Audio/Audiovisual (AV) Devices, Connected Devices, Wearable Devices, Others) • By End User (Automotive, Consumer Electronics, Telecommunications, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TTM Technologies, Unimicron Technology Corporation, AT&S, Compeq Manufacturing Co., Ltd., Tripod Technology Corporation, Zhen Ding Technology Holding Limited, Ibiden Co., Ltd., Samsung Electro-Mechanics, Daeduck Electronics Co., Ltd., Meiko Electronics Co., Ltd., Viasystems, Shenzhen Kinwong Electronic Co., Ltd., NCAB Group, Multek, Fujikura Ltd. |