Hip Replacement Market Report Scope & Overview:

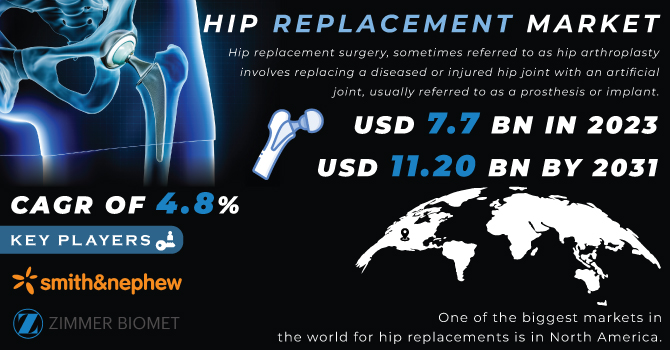

The Hip Replacement Market Size was valued at USD 7.7 Bn in 2023 and is expected to reach USD 11.20 Bn by 2031 and grow at a CAGR of 4.8% over the forecast period of 2024-2031.

Hip replacement surgery, sometimes referred to as hip arthroplasty, involves replacing a diseased or injured hip joint with an artificial joint, usually referred to as a prosthesis or implant. When various non-surgical treatments have failed to sufficiently relieve hip pain and impairment, it is typically undertaken. Where the femur (thigh bone) meets the pelvis, a ball-and-socket joint called the hip is formed. The femoral head, which is the ball element of the joint and is positioned at the top of the femur, and the acetabulum, which is located in the pelvis, are both given these names. The injured femoral head and the diseased cartilage in the acetabulum are removed during a hip replacement procedure and replaced with prosthetic parts.

Get More Information on Hip Replacement Market - Request Sample Report

The prosthetic hip joint normally comprises of a plastic, metal, or ceramic socket that replaces the injured acetabulum and a metal or ceramic ball that serves as the replacement for the femoral head. Using bone cement or osseointegration, in which the implant generates bone and fuses to it, the prosthesis can be fastened to the bone.

In order to reach the hip joint during hip replacement surgery, the surgeon creates an incision on the side or back of the hip. The replacement parts are implanted and secured in place after the harmed bone and cartilage are removed. The patient is subsequently transferred to a recovery area after the incision has been stitched up.

Market Dynamics

Driver

-

The rising cases of osteoarthritis.

-

The awareness of the high-quality life for the patients suffering from the adverse physical condition.

The results of hip replacement surgery can significantly alter a person's general quality of life. People can engage in activities including walking, climbing stairs, exercising, and engaging in leisure activities again thanks to pain relief, improved mobility, and function restoration. This may result in a more rewarding, active, and joyful way of life.

Restrain

-

The risk associated with the surgery.

Infection, blood clots, anaesthesia issues, blood vessel or nerve injury, joint dislocation, and prosthesis failure are some of the hazards associated with hip replacement surgery, as are those associated with any surgical operation. Although these dangers are quite minor, surgeons take measures to reduce them.

Challenge

The Pre-health conditions can create issues for the patients in terms of recovery, or any other adverse effects.

Opportunity

The rising technological advancement in the healthcare industry and the rising investments for the same.

Impact of Russia-Ukraine War:

It may be difficult to obtain the medical devices, implants, and materials required for hip replacement surgery if the conflict affects trade routes or causes trade restrictions. This may cause delays or restrictions when carrying out the processes.

Conflict conditions may cause healthcare workers to leave the impacted areas. The availability of specialised surgeons and healthcare professionals with training in hip replacement surgery may be impacted by this loss of competent staff. Healthcare staff and resources may be shifted during times of conflict to treat war-related injuries and provide emergency care. When resources are devoted to urgent and essential situations, elective treatments like hip replacements may experience delays or capacity limitations.

Impact of Recession

As people and governments limit their budgets, healthcare spending frequently declines during recessions. As a result, healthcare systems may experience financial difficulties, which could have an impact on the accessibility and availability of hip replacement surgeries. Due to resource constraints, hospitals and healthcare facilities may need to put vital treatments ahead of elective procedures.

In areas where healthcare is publicly funded, a recession may result in increasing demand when supplies are scarce. Longer waiting periods for elective procedures, such as hip replacements, may arise from this. Patients' quality of life and functional capacities may be impacted by delays in receiving essential surgical procedures.

Key Market Segmentation

By Procedure

-

Total Replacement

-

Partial Replacement

-

Revision & Hip Resurfacing

By End-User

-

Hospitals & Ambulatory Surgery Centers

-

Orthopedic Clinics

-

Others

Regional Analysis:

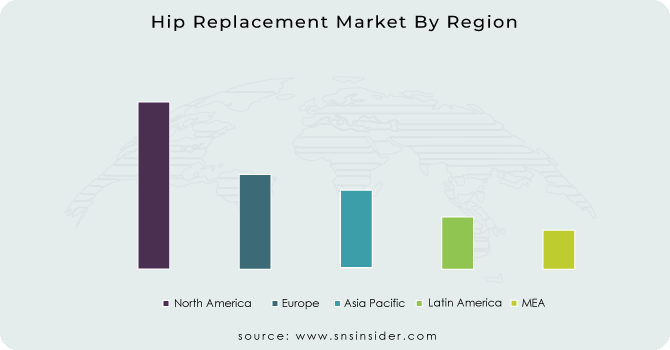

One of the biggest markets in the world for hip replacements is in North America.

Due to its significant ageing population, high rate of osteoarthritis, and sophisticated healthcare system, the United States makes a significant contribution. Zimmer Biomet, and Stryker Corporation are important participants in this market. The market is expanding as a result of technological developments such the utilisation of minimally invasive procedures and cutting-edge materials.

Due to reasons such a sizable ageing population, rising healthcare costs, and an improved healthcare infrastructure, the hip replacement industry is expanding quickly in the Asia-Pacific area.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players:

The major players are Zimmer Biomet, DePuy Synthes Companies, Smith & Nephew, Stryker, Exactech, Conformis, MicroPort Scientific Corporation, B. Braun Melsungen AG, Gruppo Bioimpianti and others.

DePuy Synthes Companies-Company Financial Analysis

Recent Development:

Zimmer Biomet: Exclusive Multi-Year Co-Marketing Agreement for the HipInsightTM Mixed Reality System for Total Hip Replacement is Announced by Zimmer Biomet and Surgical Planning Associates.

Stryker: The launch of Insignia Hip Stem at the American academy of Orthopaedic Surgeons.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.7 Bn |

| Market Size by 2031 | US$ 11.20 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Procedure (Total Replacement, Partial Replacement, Revision & Hip Resurfacing) • By End-User (Hospitals & Ambulatory Surgery Centers, Orthopedic Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Zimmer Biomet, DePuy Synthes Companies, Smith & Nephew, Stryker, Exactech, Conformis, MicroPort Scientific Corporation, B. Braun Melsungen AG, Gruppo Bioimpianti |

| Key Drivers | • The rising cases of osteoarthritis. • The awareness of the high-quality life for the patients suffering from the adverse physical condition. |

| Market Restraints | • The risk associated with the surgery. |