Hydrogen Detection Market Size & Growth Trends:

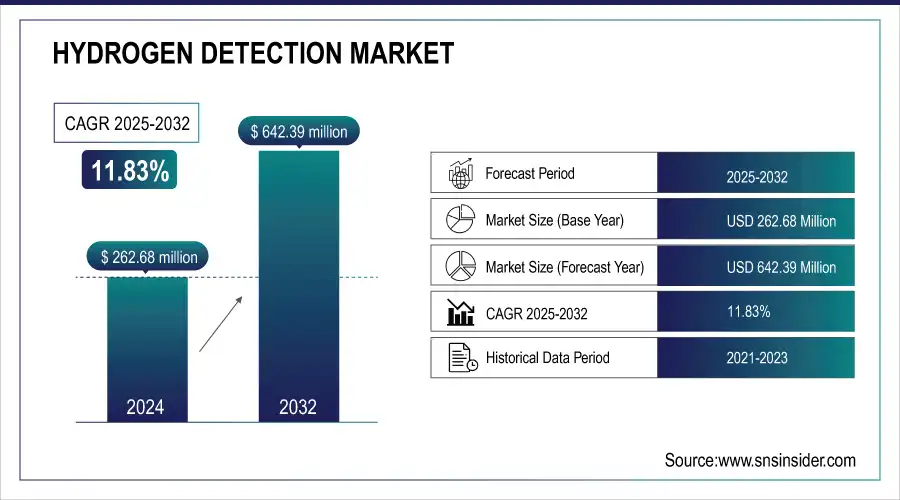

The Hydrogen Detection Market Size was valued at USD 262.68 million in 2024 and is expected to reach USD 642.39 million by 2032, growing at a CAGR of 11.83% from 2024-2032. This report features relevant information about adoption rates, technology developments, regulation effects, investment trends, and cost compositions. Growing demand for hydrogen energy and safety considerations propel market growth. Advances in technology enhance detection system efficiency and reliability, and toughened safety measures promote market adoption.

To Get more information on Hydrogen Detection Market - Request Free Sample Report

Investments in hydrogen infrastructure and detection techs also continue to grow, further propelling market growth. The breakdown in costs shows a key emphasis on innovative sensor technologies, which affects market dynamics.

Market Size and Forecast:

-

Market Size in 2024: USD 262.68 Million

-

Market Size by 2032: USD 642.39 Million

-

CAGR: 11.83% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Hydrogen Detection Market Key Players

-

Rising demand for hydrogen safety systems with the global shift toward hydrogen as a clean energy source.

-

Increasing adoption of hydrogen sensors in fuel cell vehicles (FCVs) to ensure leak detection and passenger safety.

-

Growing installation of hydrogen detection systems in industrial facilities such as refineries, chemical plants, and power generation units.

-

Advancements in sensor technology (MEMS, optical sensors, catalytic sensors) enabling faster and more accurate detection.

-

Rising emphasis on regulatory compliance and safety standards driving adoption in storage and transportation infrastructure.

-

Expansion of hydrogen fueling stations globally, creating significant demand for reliable leak detection systems.

-

Integration of hydrogen sensors with IoT, AI, and real-time monitoring platforms for predictive safety management.

Hydrogen Detection Market Growth Drivers

-

Rising Hydrogen Adoption Boosts Demand for Advanced Detection Systems in Clean Energy Applications

The growth of hydrogen use as a clean source of energy across industries such as transportation, electricity generation, and manufacturing is pushing demand for credible detection systems. As the pace of the world's efforts in decarbonizing gathers speed, hydrogen is becoming increasingly popular as a cleaner energy source than traditional fossil fuels. Protection in manufacturing, warehousing, and shipping has taken the highest priority, which in turn has pushed the investment towards newer hydrogen sensing technologies. Further, the extensive development of hydrogen infrastructure such as fueling stations and industrial usage creates the requirement for accurate and efficient leak-detecting technologies. The strong regulatory guidelines further increase the requirement for constant monitoring systems, thus protecting the functioning as well as regulatory compliance. All these factors are jointly driving the uptake of hydrogen detection technologies in different industries.

Hydrogen Detection Market Restraints

-

Competition from Alternative Technologies and High Costs Limit the Adoption of Hydrogen Detection Systems

Competition from other detection technologies, e.g., infrared and ultrasonic sensors, may potentially rival hydrogen-specific systems. Although hydrogen detection systems have specialized features, there exist technologies with similar or even more widely applicable detection capacities in certain instances. Furthermore, the exorbitant cost of implementing sophisticated sensors might deter adoption, especially among small businesses. Technological constraints in terms of precision, sensitivity, and longevity in extreme environments also limit the efficiency of certain detection systems. The absence of global standardization of hydrogen detection technologies across sectors also prevents mass adoption. Furthermore, the integration of these systems into current infrastructure is complicated, involving expensive and time-consuming adjustments. Finally, limited knowledge of the significance of hydrogen detection in some industries hinders market penetration.

Hydrogen Detection Market Opportunities

-

Technological Advancements and Expanding Infrastructure Drive Growth Opportunities in the Hydrogen Detection Market

The merging of hydrogen detection systems with IoT and smart technologies presents opportunities for more efficient, automated, and real-time monitoring solutions. As hydrogen infrastructure grows, such as refueling stations and production facilities, the demand for robust detection systems increases. Government spending on clean energy initiatives, coupled with increasing safety regulations in industries such as oil & gas and transportation, also drive the demand. Furthermore, technological innovation in sensor precision, miniaturization, and increased sensitivity offer opportunities for enhanced detection ability. Developing markets, particularly in developing countries, provide high growth opportunities as industrialization rises. The synergy of these elements is developing a dynamic landscape for hydrogen detection technologies, putting the market on track for high growth in the next few years.

Hydrogen Detection Market Challenges

-

High Costs, Integration Challenges, and Reliability Issues Hinder Growth in the Hydrogen Detection Market

The upfront expense of installing hydrogen detection systems, such as custom sensors, can be exorbitant for most companies. The high cost usually discourages usage, especially in small companies with fewer financial resources. Moreover, hydrogen sensors can be subject to reliability concerns in extreme conditions, including temperatures or chemical exposure, and hence be less effective in certain uses. It is also difficult to integrate these systems into current industrial infrastructures and may involve drastic changes, adding to the cost. The absence of universally recognized standards for hydrogen detection technology brings about inconsistencies and regulatory complications. In addition, several industries remain uninformed about hydrogen leak risks, delaying market growth and inhibiting broad adoption of detection solutions.

Hydrogen Detection Market Segment Analysis

By Implementation

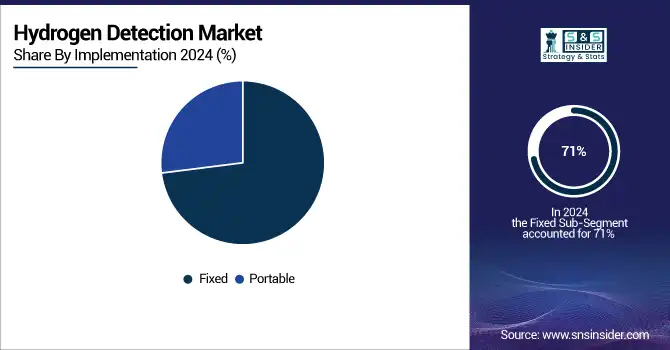

The Fixed segment led the Hydrogen Detection Market with the largest revenue share of approximately 71% in 2023 because it has extensive use in industrial environments where constant, real-time detection of hydrogen leaks is important for safety. Fixed systems are generally deployed in high-risk locations like hydrogen production plants, refueling stations, and manufacturing facilities, where they offer continuous monitoring and assured detection, which makes them the first choice for large-scale operations that value safety and regulatory compliance.

The Portable segment is anticipated to grow at the fastest CAGR of approximately 13.67% during the forecast period of 2024-2032 as a result of the rising demand for mobile, on-the-go detection solutions across industries. Portable hydrogen detectors are flexible, user-friendly, and cost-effective, making them perfect for maintenance and inspection work. The rising concern for hydrogen safety hazards and the requirement for portable solutions to inspect confined spaces and temporary installations are fueling the rapid growth of this segment.

By End Use

The Oil & Gas industry led the Hydrogen Detection Market with the largest revenue share of approximately 32% in 2023 on account of the exigent demand for safety in hydrogen storage, transport, and refining operations. The oil and gas sector is deeply engaged in hydrogen manufacturing, storage, and sales, which necessitates ongoing detection of possible hydrogen leaks to avoid accidents. Harsh regulatory specifications and the elevated safety hazards involved in hydrogen necessitate reliable detection systems for this industry.

The Automotive segment is anticipated to grow at the fastest CAGR of roughly 13.71% during the period 2024-2032 owing to the increasing use of hydrogen fuel cell cars. With hydrogen cars gaining popularity as a clean mode of transportation compared to conventional fuel-based vehicles, the demand for hydrogen detection systems is on the rise to provide safety in fuel storage, refueling stations, and vehicle systems. The increased investment in hydrogen infrastructure and the necessity for safety measures in the automotive sector drive this segment's high growth rate.

By Detection Range

The 0-1,000 ppm segment led the Hydrogen Detection Market with the largest revenue share of approximately 41% in 2023 because it is used extensively in commercial and industrial applications where the concentration of hydrogen is generally low to moderate. The range is most suitable to detect hydrogen leaks in settings including laboratories, factories, and fueling stations. The requirement for accurate detection at these levels, along with the need for regulatory compliance for safety, has rendered the 0-1,000 ppm segment the market-leading option.

The 0-5,000 ppm segment is anticipated to register the fastest CAGR of around 12.95% during the forecast period of 2024-2032 owing to the rising use of hydrogen in bigger-scale industries like energy, oil, and gas. With rising production, storage, and transportation of hydrogen in these industries, the detection of increased levels of hydrogen becomes essential. The need for strong detection systems that can properly measure higher ppm levels in these environments is propelling this segment's fast growth.

By Technology

The Electromechanical segment dominated the Hydrogen Detection Market with the largest share of revenue amounting to roughly 35% in 2023 because it has a solid application in the delivery of good and precise hydrogen detection in diversified industries. Electromechanical sensors are more commonly used owing to their documented durability, simpleness of installation, and little maintenance needs. These sensors are suitable for permanent installation in safety-critical applications like hydrogen production, storage, and refueling stations where safety is of paramount concern and compliance with regulations must be ensured.

MEMS segment is predicted to register the fastest CAGR of approximately 15.29% during 2024 to 2032 because of their small size, low power needs, and sensitivity, which render them suitable for portable and combined hydrogen detection devices. MEMS sensors are also increasingly being applied in applications requiring real-time, mobile, and affordable monitoring systems, especially automotive, aerospace, and consumer electronics industries, where energy and space efficiency are most important.

Hydrogen Detection Market Regional Analysis

Asia Pacific Hydrogen Detection Market Insights

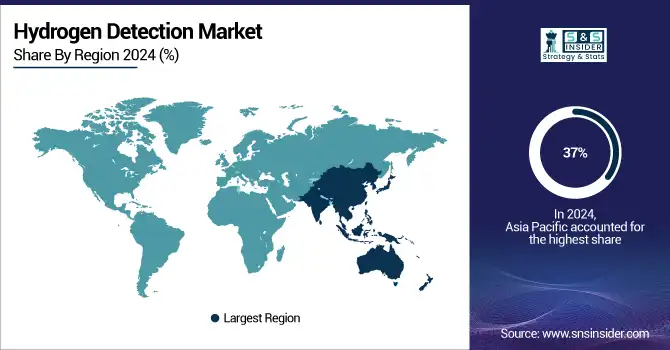

The Asia Pacific region led the Hydrogen Detection Market with the largest revenue share of approximately 37% in 2023 because the region is fast adopting hydrogen as a source of clean energy. Japan, South Korea, and China are making huge investments in hydrogen infrastructure such as production, storage, and transport systems. The increasing industrialization, government support for sustainable energy initiatives, and growing safety standards in sectors like oil, gas, and manufacturing have contributed significantly to the market dominance in this region.

Need any customization research on Gaming Hardware Market - Inquiry Now

North America Hydrogen Detection Market Insights

North America is anticipated to grow at the fastest CAGR of approximately 13.43% during the period 2024-2032, owing to high investments in hydrogen energy and fuel cell technology. The U.S. and Canada are developing hydrogen production and infrastructure development as a component of their sustainability strategies. Increasing emphasis on hydrogen as a substitute fuel, especially in transportation and industrial sectors, combined with favorable government policies and advancements in technology, is driving the market growth of the region.

Europe Hydrogen Detection Market Insights

Europe remains at the forefront of the hydrogen detection market in 2024, driven by strong policy support for hydrogen as a clean energy alternative. The EU’s hydrogen strategy, coupled with investments in hydrogen infrastructure and refueling stations, is significantly boosting demand for hydrogen sensors and monitoring systems. The growing adoption of hydrogen in transportation, power generation, and industrial manufacturing sectors further strengthens Europe’s position as a leader in deploying advanced hydrogen safety technologies.

Latin America (LATAM) Hydrogen Detection Market Insights

Latin America is gradually adopting hydrogen detection technologies, supported by emerging clean energy programs and pilot hydrogen projects in countries such as Brazil and Chile. The region’s growing focus on renewable energy integration, combined with plans for green hydrogen exports, is creating opportunities for the installation of detection and monitoring systems in energy facilities and transport infrastructure. Although still at a nascent stage, LATAM is expected to witness steady growth as safety becomes a priority in hydrogen adoption.

Middle East & Africa (MEA) Hydrogen Detection Market Insights

The Middle East & Africa is increasingly focusing on hydrogen as part of its energy transition strategies, with nations such as Saudi Arabia, the UAE, and South Africa launching large-scale green hydrogen projects. This expansion drives demand for hydrogen detection systems across production, storage, and transportation facilities to ensure safety and regulatory compliance. As MEA positions itself as a global hydrogen export hub, investment in advanced leak detection and monitoring solutions is expected to accelerate significantly

Hydrogen Detection Market Competitive Landscape

Honeywell

Honeywell is a global technology leader offering advanced industrial solutions, with a strong focus on clean energy and hydrogen safety technologies.

-

In January 2025, Honeywell showcased its advanced hydrogen solutions at the Hyvolution 2025 event in Paris, highlighting its contributions to the hydrogen economy with innovative technologies for clean energy.

Drager

Dräger is a Germany-based safety and medical technology company recognized for its hydrogen detection systems and comprehensive safety solutions across industries.

-

In 2024, Dräger introduced its advanced hydrogen detection solutions as part of its clean energy portfolio, focusing on enhancing safety for hydrogen applications in energy, transportation, and industrial sectors.

Hydrogen Detection Market Key Players

-

Teledyne Technologies (Hydrogen Sensor, Gas Detection Systems)

-

Honeywell International (Hydrogen Gas Detector, Searchpoint Hydrogen Detector)

-

Figaro Engineering (TGS Series Sensors, Gas Detection Modules)

-

H2Scan Corporation (Hydrogen Leak Detector, Hydrogen Sensor)

-

NevadaNano (MPS Hydrogen Sensor, Molecular Property Spectrometer)

-

Hydrogen Sense Technology (H2S Detector, Hydrogen Gas Sensors)

-

Membrapor (Hydrogen Sensor, Gas Detector)

-

Makel Engineering (Hydrogen Leak Detector, Gas Analyzer)

-

Archigas (Gas Sensor, Hydrogen Analyzer)

-

MSA Safety (ALTAIR Hydrogen Detector, Hydrogen Sensor)

-

Draeger (X-am 5000, DrägerSensor H2)

-

Riken Keiki (RKI Gas Detectors, H2 Gas Detectors)

-

RKI Instruments (GX-6000, GX-2009)

-

Industrial Scientific (GasBadge Pro, Ventis Pro Series)

-

City Technology (Hydrogen Sensor, Gas Detector Modules)

-

Teledyne Gas and Flame Detection (Detective+ Series, GasAlertMicro 5)

-

Crowcon Detection Instruments (Gas-Pro, T4 Multigas Detector)

-

Sensidyne (GasBadge Pro, Hydrogen Sensor)

-

GfG Instrumentation (G460, G700 Series)

-

Det-Tronics (X3301, Flame Detector)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 262.68 Million |

| Market Size by 2032 | USD 642.39 Million |

| CAGR | CAGR of 11.83% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Implementation (Fixed, Portable) • By Technology (Electromechanical, Catalytic, MOS, Thermal conductivity, MEMS) • By Detection Range (0 - 1,000 ppm, 0 – 5,000 ppm, 0 – 20,000 ppm, > 0 – 20,000 ppm) • By End Use (Oil & Gas, Automotive, Chemicals, Metal & Mining, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Teledyne Technologies, Honeywell International, Figaro Engineering, H2Scan Corporation, NevadaNano, Hydrogen Sense Technology, Membrapor, Makel Engineering, Archigas, MSA Safety, Draeger, Riken Keiki, RKI Instruments, Industrial Scientific, City Technology, Teledyne Gas and Flame Detection, Crowcon Detection Instruments, Sensidyne, GfG Instrumentation, Det-Tronics. |