In-Mold Electronics Market Size & Trends:

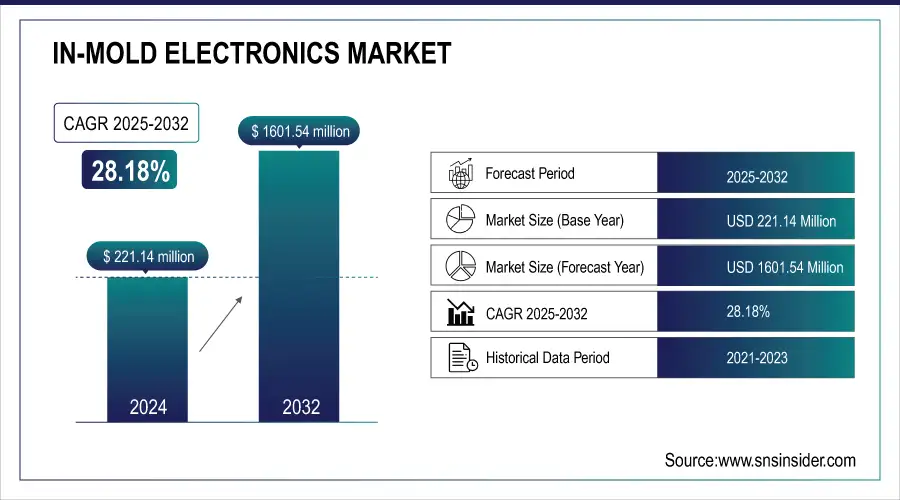

The In-Mold Electronics Market size was valued at USD 283.45 million in 2025 and is expected to grow at 28.18% CAGR to reach USD 2065.61 million by 2033.

In-mold electronics market trends are shifting toward the integration of multifunctional surfaces with capacitive touch, lighting, and sensors. Growing demand for smart, space-saving designs is accelerating adoption in automotive and electronics sectors. Increasing demand for lightweight, compact and durable electronic components in automotive, consumer electronics and healthcare end use industries will drive the market for In-Mold Electronics over the projected timeframe. IME is an innovative technology that allows embedded molded 3D surfaces with integrated printing electronics, touch controls and lighting, reducing part count and increasing design flexibility. Market growth is also driven by the transition to smart interfaces and minimal product designs. Furthermore, the development of conductive inks and flexible substrates contributes to scalability and low-cost manufacturing, which will further speed up the adoption of this industry.

To Get more information on In-Mold Electronics Market - Request Free Sample Report

Companies using IME have reported up to 50% reduction in part count, which translates to lower assembly time, reduced weight, and improved recyclability of end products.

Modern vehicles now include over 100 sensors per car, many of which are integrated into seamless HMI panels enabled by IME technology. This shift supports lighter components and fewer mechanical interfaces.

Market Size and Forecast: 2025E

-

Market Size in 2025 USD 3.58 Billion

-

Market Size by 2033 USD 19.52 Billion

-

CAGR of 23.6% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

In-Mold Electronics Market Trends:

-

Increasing adoption of compact, lightweight, and durable in-mold electronic interfaces across automotive, consumer electronics, and healthcare industries.

-

Growing use of touch-based HMIs, smart dashboards, and integrated lighting in automotive interiors.

-

Rising deployment of advanced conductive materials such as silver-nanowire transparent inks for enhanced durability and optical performance.

-

Expansion of in-mold electronics into new applications including smart home appliances, wearable medical devices, and industrial control panels.

-

Strong focus on sustainability, with additive printing, green inks, and recyclable or biodegradable substrates gaining traction.

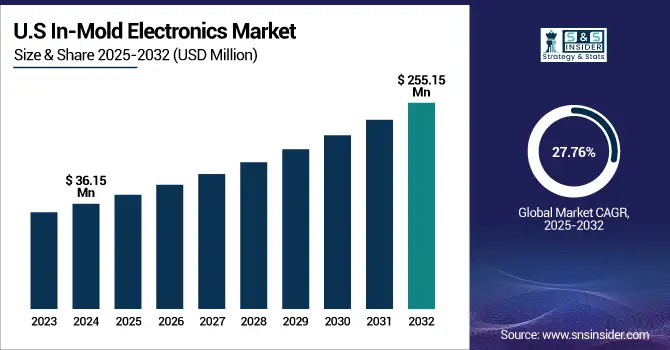

The U.S. in-mold electronics market size was valued at USD 36.15 million in 2025 and is expected to reach USD 255.15 million by 2033, growing at a CAGR of 27.76% over the forecast period of 2026-2033. The U.S. development of the In-Mold Electronics market is driven by the high demand for lightweight, compact, and smart interfaces for automotive, healthcare, and consumer devices, innovations in materials, sustainability targets, and solid market support manufacturing.

In-Mold Electronics Market Growth Drivers:

-

Rising Demand for Compact and Smart Interfaces Boosts in Mold Electronics Adoption Across Major Industries

The global in-mold electronics market growth is driven by the rising requirement of light-weight, compact and sturdy electronic interfaces especially in automotive, consumer electronics and healthcare sectors. IME provides a way to place printed electronics, lighting, and tactile controls directly into molded 3D surfaces, eliminating the need for components and a touchscreen, and maximizing design flexibility. High demand from the automotive industry for cutting-edge touch-based human-machine interfaces (HMIs) and intelligent dashboards is a key driver for expansion. Furthermore, increasing requirement for environment friendly and visually attractive products in various sectors drives the adoption.

Leading manufacturers are deploying silver-nanowire transparent ink coatings for vehicle HUDs and heater elements, offering >90% transparency and enhanced durability versus traditional etched components

In-Mold Electronics Market Restraints:

-

Lack of Standard Testing and Repair Challenges Restrict in Mold Electronics Adoption in Regulated Sectors

An important restraint for global in-mold electronics market is the unavailability of standardized testing and validation methods for IME components that can hamper mass adoption in regulated sectors including automotive and health care. This also makes it difficult to repair or recycle these surfaces when an embedded component fails due to the complex integration of electronics inside the molded surfaces.

In-Mold Electronics Market Opportunities:

-

Emerging Technologies and Sustainability Driving in Mold Electronics Expansion Across Diverse High Growth Application Areas

Manufacturers can take advantage of progress around conductive inks, flexible substrates, and 3D forming technologies that can help scale production, while driving down cost barriers. IME use case is continuing to grow beyond traditional markets with emerging applications in smart home appliances, wearable medical devices and industrial control panels. Global market potential is bolstered by an increased emphasis on sustainability and recyclable electronics.

Additive printing methods using green inks and biodegradable films can reduce energy usage by up to 5× compared to traditional PCB manufacturing and simplify end-of-life recycling.

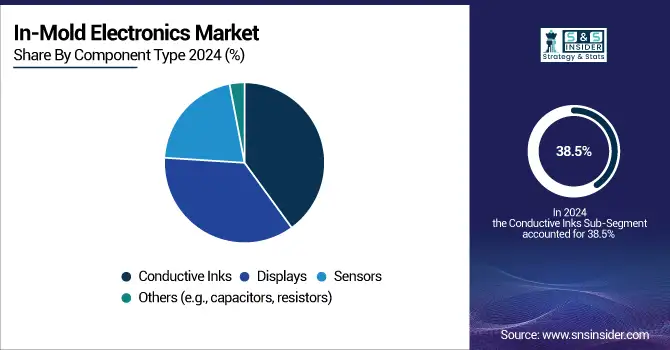

In-Mold Electronics Market Segment Analysis:

By Component Type

Conductive Inks accounted for a leading share of at least 38.5% in the demand for in-mold electronics by component in 2025. A key part of this leadership comes from their ability to make printed circuits that become touch sensitive, or to illuminate molded and embedded light within surfaces. The ability of devices to be integrated into 3D forms and compatibility with many flexible substrates help facilitate applications for automotive dashboards, smart appliances, and medical devices. During 2026-2033, sensors are predicted to experience the highest growth rate as smart surfaces rise in popularity and the need for real-time interaction and feedback increases. This is driving up R&D on molded electronics and making them more dynamic and intelligent greatly impacting their increasing use in wearables, healthcare diagnostics, and automotive HMI panels.

By Material Type

The Polycarbonate Films segment held the largest share in the In-Mold Electronics market, globally, contributing 48.3% of the total share in 2025, and is anticipated to witness the fastest CAGR during the forecast period, owing to its high-performance and lightweight features. Due to their superior toughness, high heat resistance, optical clarity, and ease of thermoforming, the automotive control panel, consumer electronics, automotive exteriors, and medical devices will dominate them. They can help manufacture flexible multi-layer printing and more complex 3D shapes allowing a higher degree of design freedom and the integration of functional electronics. As demand for multifunctional surfaces that are sleek and lightweight increases polycarbonate films continue to find traction across different end-use industries, thus driving scalable and sustainable IME applications.

By Application

Automotive Control Panels accounted for a substantial 42.4% of the in-mold electronics market share in 2025. Analysts attributed this dominance to the increasing adoption of touch-sensitive dashboards, ambient lighting, and multifunctional controls of vehicles. IME technology allows automotive manufacturers to meet the demand for advanced human-machine interfaces (HMIs) with sleek, lightweight, and space-saving designs that contribute to improved aesthetics and reduced component complexity. The fastest growing segment in terms of CAGR is expected to be wearable devices as increasing consumer demand for precision, compact, flexible, and portable electronic devices for health-tracking and fitness-tracking purposes is expected to drive the demand. The IME enables electronics to be integrated into lightweight and curved shapes, which is ideal for next-generation smartwatches, fitness bands, and medical wearables.

By End-Use Industry

In 2025, the share of the Automotive sector accounted for the highest, with 51.4% of the in-mold electronics market. The leadership is fueled by the growing adoption of capacitive touch controls, ambient lighting, and flexible printed electronics within vehicle interiors. IME technology are ideal solutions that complement the automotive industry's moves to reduce components, boost fuel economy with lightweight materials, and provide stylish, built-to-order interfaces for infotainment and control systems. Due to increasing demand for compact, flexible, and non-invasive medical devices, the Healthcare sector will grow at the highest CAGR. IME empowers the next-generation healthcare solutions such as wearable health monitors, diagnostic patches and intuitive medical equipment, with improved patient comfort, continuous data tracking and critical form factors.

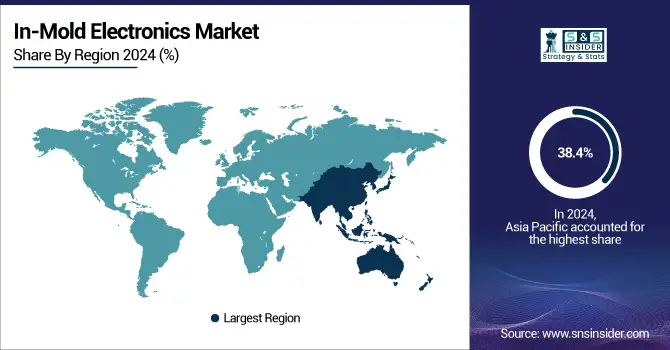

In-Mold Electronics Market Regional Analysis:

Asia Pacific In-Mold Electronics Market Insights

In 2025, Asia Pacific led the In-Mold Electronics market with 38.4 % share and is expected to witness the fastest CAGR of 28.70 % during the forecast period of 2026-2033 due to the presence of major electronics manufactures, fast industrialization, and growing custom for adapted applied sciences in industries such as automotive, consumer electronics and healthcare that enhances this territorial authority. Many countries including China, Japan, and South Korea are pouring money into smart manufacturing and printed electronics infrastructure. Moreover, the ongoing government policies in favor of this sector along with growing R&D activities across the Asia pacific region reinforce its lead, which is accelerating its high pace growth in IME.

Get Customized Report as per Your Business Requirement - Enquiry Now

The enormous growth of China electronics manufacturing sector, growing automotive demand for wearables, and aggressive investments in flexible and printed electronics innovations has resulted in China capturing significant share of the overall market in Asia Pacific region.

North America In-Mold Electronics Market Insights

The in-mold electronics market in North America is gaining traction as there is a huge demand for advanced user interfaces spanning on automotive, consumer electronics and healthcare sectors. The presence of key industry players, prevalent smart technology adoption, and strong R&D infrastructure are propelling the growth of the market in this region. IME is also supported through advances in printed electronics (PE) technologies and sustainable materials. Rising focus on light weight, integrated control systems in vehicles and appliances also positively influences regional market growth.

North American IME market was dominated by the U.S., owing to its high level of manufacturing capabilities, strong automotive industry, and leading position in technology, especially related to smart interfaces and embedded electronics.

Europe In-Mold Electronics Market Insights

Due to the high automotive manufacturing in the region, along with growing focus toward adoption of smart home technologies and increased requirement for sustainable design products, Europe is expected to hold significant share in the in-mold electronics market. Several of the leading OEMs and Tier 1 suppliers interested in lighter weight, touch enabled interior systems are in the region. Moreover, rising demand for energy-efficient solutions and stringent environmental regulations necessitate IME for implementations in different applications. The continued research and development and innovation around printed electronics also reinforces the growth trend in the European market.

Latin America (LATAM) and Middle East & Africa (MEA) In-Mold Electronics Market Insights

Latin America and the Middle East & Africa are other developing regions in the landscape of In-Mold Electronics solutions, but the adoption in these markets has been occurring gradually primarily due to the rise of consumer electronics and automotive industries. Though these regions are challenged by infrastructure and technology disadvantages at the moment, urbanization and the growth of demand for smart, energy-efficient goods, in addition, offer future expansion possibilities. Governments and private companies are starting to invest in advanced manufactured and of electronics innovation. With increasing awareness and accessibility to IME technologies, these two regions would play an equally significant role in global market expansion.

In-Mold Electronics Market Key Players:

The Major Players in the In-Mold Electronics Market are

- TactoTek

- DuPont

- Tekra

- DuraTech Industries

- Molex

- Nissha

- Yamaha Fine Technologies

- TE Connectivity

- LG Innotek

- Butler Technologies

- Gunze

- Nagase America

- Samsung Electro-Mechanics

- Panasonic Industry

- Toray Industries

- 3M

- Eastman Kodak

- Advent Materials

- Neotech AMT

- ClickTouch

Competitive Landscape for In-Mold Electronics Market:

DuPont is a global materials science leader providing advanced conductive inks, films, and coatings that enable in-mold electronics by integrating printed circuitry into 3D molded surfaces for automotive, consumer, and industrial interfaces, improving design flexibility, weight reduction, and functionality in next-generation electronic products.

-

In September 2024, DuPont showcased its silver nanowire technologies at the SID Vehicle Displays & Interfaces event highlighting transparent heaters, smart/surface-embedded IME films, EMI shielding, and IR-reflective layers for automotive and displays.

DuraTech Industries is a U.S. manufacturer of custom in-mold structural electronics (IMSE) and in-mold electronics (IME) solutions that integrate printed conductive inks with molded 3D surfaces for advanced human-machine interfaces across automotive, appliance, medical, and industrial markets, enhancing durability, design flexibility, and performance.

-

In February 2025, DuraTech unveiled a newly redesigned website, enhancing presentation of its IMSE and printed‑electronics capabilities, with updated resources, case studies, and expanded information about their solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 283.45 Million |

| Market Size by 2033 | USD 2065.61 Million |

| CAGR | CAGR of 28.18% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Conductive Inks, Displays, Sensors, and Others (e.g., capacitors, resistors)) • By Material Type (Polycarbonate Films, Polyester Films, and Others (e.g., thermoplastics)) • By Application (Lighting, Wearable Devices, Automotive Control Panels, and Home Appliances) • By End-Use Industry (Automotive, Consumer Electronics, Healthcare, and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | TactoTek, Dupont, Tekra, DuraTech Industries, Molex, Nissha, Yamaha Fine Technologies, TE Connectivity, LG Innotek, Butler Technologies, Gunze, Nagase America, Samsung Electro-Mechanics, Panasonic Industry, Toray Industries, 3M, Eastman Kodak, Advent Materials, Neotech AMT, ClickTouch. |