Thermoelectric Module Market Size & Growth:

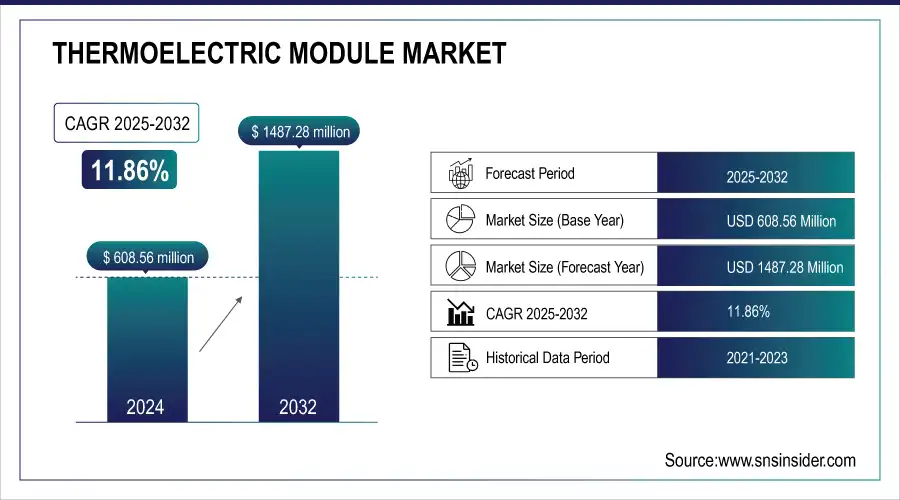

The Thermoelectric Module Market size was valued at USD 608.56 million in 2024 and is expected to reach USD 1487.28 million by 2032, growing at a CAGR of 11.86% over the forecast period of 2025-2032. Increasing demand for energy-efficient cooling and waste heat recovery, particularly in automotive and industrial applications, is expected to drive the market for thermoelectric modules during the forecast period along with advancements in materials such as SiGe and increased adoption within consumer electronics, medical devices, aerospace, and remote power generation applications.

To Get more information on Thermoelectric Module Market - Request Free Sample Report

One of the major driving factors for thermoelectric module market growth is an increasing emphasis on miniaturization and integration of thermal management solutions of all types in relatively small form factor electronic devices. The demand is also projected to expand in military-grade and harsh environment applications on account of increasing deployment of thermoelectric modules owing to their solid-state reliability and maintenance-free operation. With government investment in clean energy technologies and incentives for sustainable innovations stimulating research and development of new thermoelectric materials, next-generation thermoelectric technologies are on the rise. Also, the demand for efficient decentralized power and cooling systems is also being driven by growth in IoT and edge devices.

-

Over 65 million thermoelectric (Peltier) modules deployed worldwide, of which 23.4 million were integrated into smartphones, wearables, and VR devices.

Thermoelectric Module Market Trends

-

Rising demand for energy-efficient cooling and heating solutions is driving thermoelectric module adoption.

-

Increasing use in consumer electronics, automotive, and medical devices is boosting market growth.

-

Advancements in materials and nanotechnology are improving module performance and energy conversion efficiency.

-

Growing adoption in electric vehicles for battery thermal management is shaping industry trends.

-

Expansion of aerospace and defense applications is creating new opportunities.

-

Rising interest in waste heat recovery systems is fueling demand for thermoelectric solutions.

-

Collaborations between manufacturers, research institutes, and energy companies are accelerating innovation and commercialization.

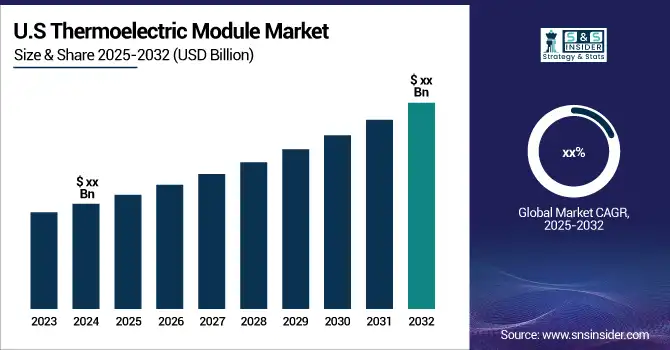

The U.S. Thermoelectric Module Market size is estimated to be valued at USD 69.68 million in 2024 and is projected to grow at a CAGR of 5.10%, reaching USD 103.43 million by 2032. The U.S. thermoelectric module market is driven by the growing consumer demand for energy‑efficient solutions in automotive, aerospace, and electronics, coupled with respective government efficiency initiatives, advancements in engineering materials (such as nanostructured Bi₂Te₃), and integration of waste heat recovery for improved operating efficiencies.

Thermoelectric Module Market Growth Drivers:

-

Thermoelectric Modules Drive Efficiency in Electronics Vehicles Industry and Emissions Reduction Through Advanced Thermal Management

Key driver of global thermoelectric module market trends is the need for energy efficient thermal management in consumer electronics, automotive, medical, and industrial applications. With electronics extending into almost every aspect of our life and getting smaller yet more powerful, there is little room for failure but plenty for heat generation; thermoelectric modules would be the obvious choice for cooling as they are solid-state devices and more reliable with a compact form factor. Another major driver growth is driven by the rising adoption of electric and hybrid vehicles, because automotive thermal modules are used in battery thermal management and cabin climate control. Moreover, those global efforts to reduce greenhouse gas emissions are driving industries to implement technologies that recover waste heat, where thermoelectric modules have a pivotal role.

-

In 2024, over 750 GWh of EV batteries were deployed globally about 100 GWh in the U.S., a 40% increase from 2022 underscoring the need for compact, reliable thermal solutions like thermoelectric modules

Thermoelectric Module Market Restraints:

-

Low Efficiency and Thermal Degradation Limit Thermoelectric Modules in Power Generation and Harsh Environment Applications

Thermoelectric module market are primarily constrained by lower conversion efficiency of present materials, especially in case of power generation applications. While this can be enhanced, commercially available modules transmit only a fraction of heat into electricity, thus ruling them out across a broad spectrum of large-scale energy recovery. Moreover, the performance of thermoelectric modules usually degrades in such extreme temperature cycling conditions, which can limit their application under varying temperature conditions that can be present in industrial or outdoor use.

Thermoelectric Module Market Opportunities:

-

Next Generation Thermoelectric Materials Unlock Growth in Sustainable Energy IoT Aerospace and Off Grid Applications

There are large opportunities to develop next-generation thermoelectric materials like silicon-germanium and skutterudites that have greater efficiency across a wider range of temperatures. This may further help the market in gaining significant growth over the future as well as across regions prefer sustainable decentralized energy systems to the other solutions, like IoT, aerospace, and off-grid renewable power systems, emerging application is also to extend the market perspective.

-

Yb-filled CoSb₃ skutterudites achieved record thermoelectric figures of merit peak ZT of ~1.35 at 873 K and an average ZT of 0.95 between 300–873 K in early 2024

Thermoelectric Module Market Challenges:

-

Integration and Standardization Challenges Hinder Thermoelectric Module Adoption Sustainability and Scalability Across Modern Applications

The biggest challenge is incorporating thermoelectric modules into existing systems while maintaining performance and requiring minimal redesign. As an example, the size and power output of a thermoelectric module can hinder their applicability out in the field at a high output power level. Further, the lack of module standardization in design and manufacturing practices, is still iterating, which creates further challenges for interoperability and mass adoption. Long-term sustainability of the end-of-life module process is also a major concern as the use of rare or complex materials in the modules presents challenges both in environmental impact and in recyclability.

Thermoelectric Module Market Segment Analysis

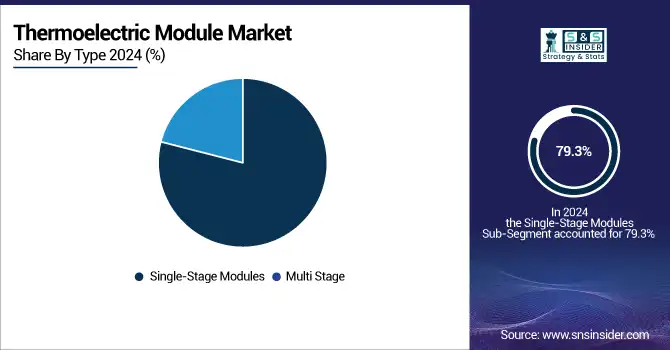

By Type, Single-stage thermoelectric modules dominated the market, Multi-stage thermoelectric modules are projected to grow at the fastest CAGR

In 2024, the global market share of single-stage thermoelectric modules stood at a significant 79.3%, owing to their frequent utilization in applications with moderate temperature differentials. Due to their low price, small form factor, and ideal application fields (consumer electronics, automotive seat cooling, and small-scale medical devices), those modules are preferred for many of such applications. The simple integration, along with stable functionality in low and mid-range temperature systems, has made them the first choice among different end-user industries.

Multi-stage thermoelectric modules are anticipated to deliver the fastest CAGR between 2025–2032, as a result of increasing need for accurate temperature regulation in both high and extreme temperature applications. We can see multi-stage modules are increasingly finding applications in industries like aerospace, defense, scientific instrumentation, and laser systems due to their superior cooling capability. They can be used where high-temperature differentials can be achieved, making them suitable for advanced and mission-critical applications where robust growth opportunities lie ahead.

By Technology, Bismuth Telluride (Bi₂Te₃) dominated the market, Silicon Germanium (SiGe) is projected to grow at the fastest CAGR

In 2024, the largest segment is Bismuth Telluride (Bi₂Te₃) with 72.6% of the global thermoelectric module overall share. This substance remains the gold standard for thermoelectric cooling and low-temperature power generation applications because efficiently near-room temperatures. Widely used Bi₂Te₃ modules across consumer electronics, medical devices, and industrial equipment. They remain an attractive candidate for both large-scale and portable applications due to their proven manufacturing processes, high material availability and favorable balanced thermoelectric performance.

Silicon Germanium (SiGe) is projected to register highest CAGR during the forecast period, due to its high temperature performance. SiGe RF bus-line modules are receiving growing interest in presence of space exploration, automotive exhaust heat recovery and other hostile environment power generation applications. Thus, SiGe represents a unique candidate for future thermoelectric applications as they are extremely thermally stable preserving their structure while still exhibiting thermoelectric functionality under the higher temperature thermoelectric regimes.

By Functionality, Cooling segment dominated the market, Power generation segment is projected to grow at the fastest CAGR

The global thermoelectric module market is massively competitive, with the cooling segment being highly prominent by making up nearly two-thirds (63.4%) of the total market in 2024, fueled by the demand for cooling applications in consumer electronics, medical devices, and industrial equipment. Solid-state thermoelectric cooling modules are favored because of their compact footprint, silent operation, and reliability. The demand has been driven by applications such as thermal management in wearable electronics, portable coolers, optical sensors, and telecom systems. Cooling modules have gained traction across mission-critical environments due to ease of integration and their ability to provide accurate temperature control.

Power generation segment is expected to experience the highest CAGR of power generation from 2025 to 2032, driven by growing global energy harvesting and waste heat recovery initiatives. They are used more frequently in vehicle exhaust systems, remote sensing devices, and off-grid power applications using thermoelectric generators. Thermoelectric modules can directly convert waste heat into electricity which leads to a huge growth opportunity for thermoelectric modules as industries around the world look for ways to meet decarbonization goals and improve energy efficiency.

By Application, Consumer electronics dominated the market, Automotive segment is projected to grow at the fastest CAGR

The global thermoelectric module market was led by consumer electronics, which accounted for 28.83% of the market share in 2024, due to the growing adoption of thermoelectric cooling solutions in smartphones, wearables, portable refrigerators, and other small-size devices. Thermoelectric modules are a perfect match because as electronic components shrink and gain power, there is an increased need for cooling that is efficient, silent and requires no maintenance. Due to their intrinsic solid-state design and since they can deliver localized cooling without any moving parts, thermoelectric have found widespread applications in personal and handheld electronic devices where space is at a premium and reliability is paramount.

Automotive segment is estimated to register the fastest CAGR from 2025 to 2032 attributing to increasing utilization of thermoelectric module in electric & hybrid vehicles. They have an important application for battery thermal management, seat cooling/heating, and waste heat recovery systems. Given the increased rates of electric vehicle manufacturing and tightening energy efficiency requirements, this development will drive thermal reliability into a new phase of demand in vehicles.

Thermoelectric Module Market Regional Analysis

Asia Pacific Thermoelectric Module Market Insights

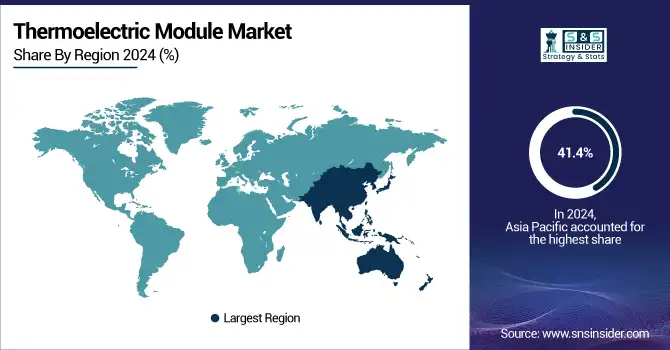

Asia Pacific held a 41.4% of the global thermoelectric module market share in 2024 due to the rapid pace of industrialization; high-volume electronics manufacturing; and strong demand arising from the automotive and consumer electronics sectors. The region has also developed a strong supply chain for thermoelectric materials and components, coupled with extensive public and private R&D investments. The global demand for thermoelectric modules has been further driven by rising adoption of electric vehicles, increased emphasis on energy efficient cooling systems, and the growing expansion of data centers. The existence of large-scale semiconductor fabrication and advanced electronics assembly facilities also accelerates deployment of miniaturized thermal management solutions. All of these elements put this region as a leader in production as well as user end of thermoelectric module to maintain the market' dominance.

The growing electronics manufacturing base in China, the increasing EV production, supporting initiatives of the government for clean energy, and the expansive R&D for advanced materials is expected to make China the largest dominating market for Asia Pacific thermoelectric module.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Thermoelectric Module Market Insights

The global thermoelectric module market in North America is anticipated to grow at the highest CAGR of 12.4% during the projection period (2024 to 2032), owing to the rapid adoption of sophisticated thermal management systems in automotive, aerospace, defense, and healthcare applications. The region has seen increasing adoption of electric and hybrid vehicles, as well as a rise in interest in waste heat recovery technologies to enhance energy efficiency. Sound institutional support in terms of government funding for clean energy R&D, as well as a mature technological base further accelerate the path of market expansion. Furthermore, growing penetration in consumer electronics and medical devices is further establishing the foothold in the region during the forecast period.

U.S. Thermoelectric Module Market Insights

The U.S. holds the largest share in the North America Thermoelectric Module market because of its enhanced R & D capabilities, overall presence of key players, high adoption rate of EV and substantial investment in energy-efficient technologies.

Europe Thermoelectric Module Market Insights

Europe is one of the slowly growing regions in the thermoelectric module market due to the rising penetration of sustainable technologies and stringent energy efficiency policies. The strong incentives for carbon footprint reduction in the region are driving the adoption of thermoelectric modules in automotive, industrial, and aerospace applications. Material science improvements and high investments in electric mobility and renewable energy systems are also fuelling demand. In addition, several automotive OEMs and research institutions are boosting innovation and integration of advanced thermoelectric solutions in a variety of applications.

Middle East & Africa and Latin America Thermoelectric Module Market Insights

The thermoelectric module industry in Latin America and the Middle East & Africa is still at a nascent stage, though steady growth is expected as these regions experience industrial growth, infrastructure development and awareness towards energy-efficient technologies. Applications for communications, medical devices and remote power generation are continually increasing demand, especially in off-grid and rugged settings. This lower awareness and lack of technological access is keeping most of these regions at bay from adopting these solutions right now, however, continued investments in renewable energy and cooling solutions are likely to open a new avenue for growth in the outline of the forecast period.

Thermoelectric Module Market Competitive Landscape:

Phononic

Phononic, founded in 2009, is a leading innovator in solid-state cooling and heating technologies, making a significant impact in the thermoelectric module market. The company develops advanced thermoelectric solutions that replace traditional mechanical systems with energy-efficient, compact, and reliable alternatives. Its modules are widely used in refrigeration, healthcare, optoelectronics, and telecom applications. Phononic’s focus on sustainability and performance positions it as a key player driving next-generation thermal management solutions.

-

2025: Phononic opened a wholly owned APAC headquarters in Thailand, enhancing its supply chain and scaling thermoelectric devices and integrated cooling solutions for LiDAR, HVAC, and data center applications across Asia-Pacific.

-

2023: Phononic secured a strategic supply agreement with LiDAR specialist Luminar, delivering thermoelectric cooling modules and design services to meet stringent automotive performance, quality, and reliability standards.

Ferrotec

Ferrotec, founded in 1980, is a global leader in thermal management and thermoelectric solutions, serving diverse industries including electronics, automotive, and renewable energy. The company specializes in high-performance thermoelectric modules, liquid cooling systems, and precision temperature control devices. Ferrotec’s innovative solutions enhance energy efficiency, reliability, and compact design in critical applications. Its strong R&D capabilities and global presence position it as a key player in the thermoelectric module market.

-

2024: Ferrotec launched the TMC-series extended-life Peltier coolers, designed for rigorous thermal cycling applications (e.g., PCR testing), offering significantly increased module durability and reliability under stress.

TEC Microsystems

TEC Microsystems, founded in 1999, is a prominent player in the thermoelectric module market, specializing in high-performance, compact, and energy-efficient thermal solutions. The company develops advanced thermoelectric coolers for applications across electronics, medical devices, aerospace, and industrial sectors. TEC Microsystems’ focus on innovation, precision engineering, and reliability enables it to deliver scalable solutions that enhance thermal management, energy efficiency, and system performance in critical applications.

-

2024: TEC Microsystems unveiled an aluminum thermoelectric module with a 40 × 40 mm² footprint, achieving up to 500 W cooling capacity, marking its largest and most powerful TEC to date.

Laird Thermal Systems

Laird Thermal Systems, founded in 1971, is a key player in the thermoelectric module market, specializing in advanced thermal management solutions. The company designs and manufactures high-performance thermoelectric coolers, controllers, and integrated systems for electronics, optoelectronics, medical devices, and industrial applications. With a focus on innovation, miniaturization, and energy efficiency, Laird Thermal Systems delivers reliable, compact, and precise thermal solutions for demanding applications worldwide.

-

2024: Laird Thermal Systems introduced the OptoTEC MBX Series, ultra-compact micro thermoelectric coolers (as small as 1.5 × 1.1 mm and 0.65 mm thick), delivering up to 43 W/cm² and 82 °C temperature differential for optoelectronic devices.

-

2023: Laird Thermal Systems unveiled the OptoTEC MSX Series, micro multistage coolers integrated into optical packages (TO-Can, TO-39, etc.), offering up to 10% higher cooling capacity with tiny form factor and enhanced reliability.

-

2023: Rebranded as Tark Thermal Solutions, marking a new corporate identity reflecting its expertise in thermoelectric coolers, controllers, and thermal management innovation after ending its previous naming agreement.

Key Players

Some of the Thermoelectric Module Market Companies

-

Ferrotec

-

Laird Thermal Systems

-

II-VI (Coherent)

-

TEGPRO

-

KELK

-

TEC Microsystems

-

Crystal Ltd.

-

RMT Ltd.

-

Hi-Z Technology

-

Z-MAX

-

Thermonamic Electronics (Jiangxi) Corp. Ltd.

-

Kryotherm

-

TE Technology, Inc.

-

Phononic Inc.

-

Merit Technology Group

-

Thermion Company

-

Guangdong Fuxin Technology Co., Ltd.

-

Thermoelectric Cooling America Corporation (TECA)

-

Custom Thermoelectric, LLC

-

Micropelt GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 608.56 Million |

| Market Size by 2032 | USD 1487.28 Million |

| CAGR | CAGR of 11.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single-Stage Modules, and Multi Stage) • By Technology (Bismuth Telluride (Bi2Te3), Lead Telluride (PbTe), Silicon Germanium (SiGe), and Others) • By Functionality (Cooling, Heating, and Power Generation) • By Application (Consumer Electronics, Automotive, Healthcare, Industrial, Telecommunications, Aerospace and Defense, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ferrotec, Laird Thermal Systems, II-VI (Coherent), TEGPRO, KELK, TEC Microsystems, Crystal Ltd., RMT Ltd., Hi-Z Technology, Z-MAX, Thermonamic Electronics (Jiangxi) Corp. Ltd., Kryotherm, TE Technology, Inc., Phononic Inc., Merit Technology Group, Thermion Company, Guangdong Fuxin Technology Co., Ltd., Thermoelectric Cooling America Corporation (TECA), Custom Thermoelectric, LLC, Micropelt GmbH |