Unipolar Transistor Market Size & Trends:

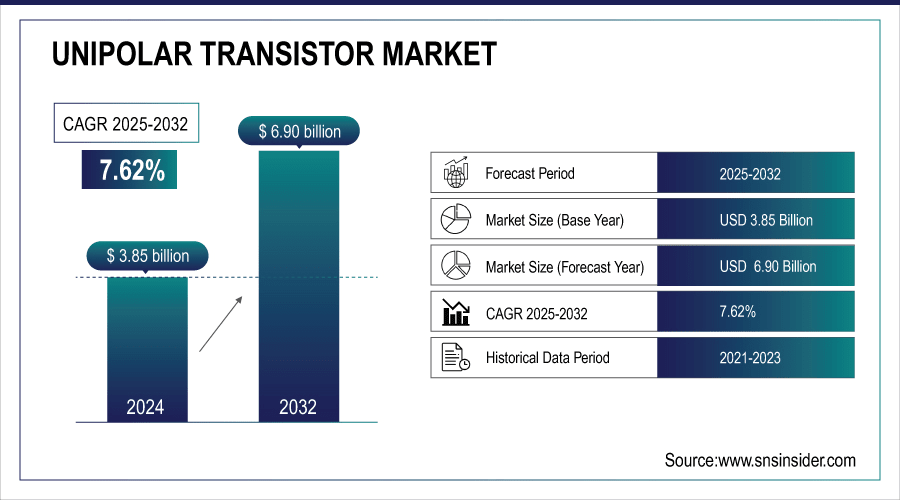

The Unipolar Transistor Market size was valued at USD 3.85 billion in 2024 and is expected to reach USD 6.90 billion by 2032 and grow at a CAGR of 7.62% over the forecast period of 2025-2032.

The global market includes a comprehensive unipolar transistor market analysis including segmentation, regions, technology trends, competitive landscape & investment trends impacting growth. Continued growth is fueled by demand for power-efficient electronic products, ranging from electric vehicles (EVs) and industrial automation and manufacturing equipment to a wide array of consumer devices. Due to the improvements in power semiconductor technologies, mainly MOSFETs and IGBTs, the market is experiencing a solid growth in different sectors. Together, these factors ensure stable growth, making unipolar transistors a key element in modern electronic and power management systems globally.

For instance, compact transistor designs reduced module size by 25%, enabling lighter electronic devices.

To Get more information on Unipolar transistor market - Request Free Sample Report

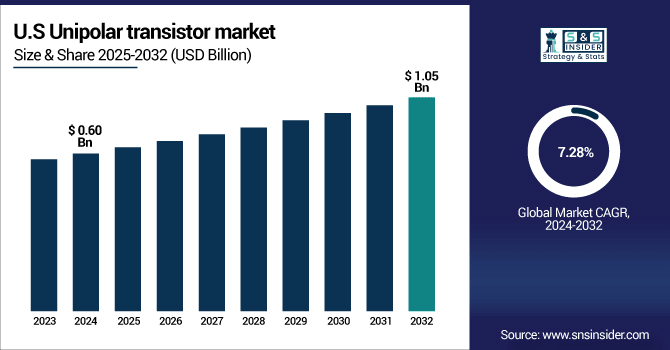

The U.S. Unipolar transistor market size was USD 0.60 billion in 2024 and is expected to reach USD 1.05 billion by 2032, growing at a CAGR of 7.28 % over the forecast period of 2025–2032.

The U.S. market is experiencing vigorous growth driven by the increasing adoption of power electronics in electric vehicles, renewable energy systems, and high-tech consumer electronics. Ample R&D investments and a large semiconductor manufacturing base have steered the country in this direction along with government efforts to promote chip manufacture in the local premises. In addition, growing footage by the defense, aerospace, and telecommunications sectors strengthens the leadership role of the U.S. polo depicted by the critical driver of the global up-transistor technology.

For instance, advanced transistors reduce electromagnetic interference by up to 50%, enhancing system stability.

Unipolar Transistor Market Dynamics:

Key Drivers:

-

Rising Demand for Power-Efficient Electronics Across Automotive, Consumer Devices, and Renewable Energy Applications is Driving the Market Expansion Globally

One of the key drivers for the unipolar transistor market is the growing demand for power efficient electronics, which is motivating semiconductor industries to provide high performance, low-power electronic devices. MOSFETs and IGBTs are essential for effective energy conversion in electric vehicles, renewable energy inverters, and portable consumer devices. This shift minimizes energy loss, boosts efficiency, and aligns with global sustainability objectives. The demand will further rise due to increasing adoption of various IoT-enabled devices and wearables, and industrial automation systems, making unipolar transistors an important component for energy savings in several end-use applications globally and keeping wearer operational efficiency improvement on track.

For instance, latest MOSFETs and IGBTs achieve over 95% energy conversion efficiency in EVs and inverters.

Restraints:

-

High Manufacturing Costs and Complex Fabrication Processes Limit Adoption and Accessibility for Small and Medium-Sized Enterprises

Unipolar transistors, especially IGBTs and high-performance MOSFETs, have a complex manufacturing process with high associated fabrication, testing, and packaging costs. On top of that, the costs are escalated by a requirement of exotic raw materials, such as silicon carbide (SiC) and gallium nitride (GaN). The abundance of capital allows larger companies to soak up all the cream represented by high profit margins, leaving the smaller companies not only not able to compete, but also without new manufacturing technology to help them be more competitive. Consequently, the market is concentrated in some of the major global semiconductor players which in turn slow the uptake wider in the market and reduce the competitiveness of small and emerging enterprises.

Opportunities:

-

Expansion of 5G Networks and IoT Devices Boosts Demand for High-Performance Unipolar Transistors in Communication and Consumer Electronics

The unipolar transistor market is experiencing opportunities in the process of establishing 5G infrastructure globally and growing number of use cases for IoT devices. FETs are well suited for fast switching, RF, and power applications as they require less power and have high-frequency operation that such applications demand. Consumer applications such as smartphones, wearables, and smart home devices employ unipolar transistors to achieve higher efficiency prospective for longer battery life. Likewise, advanced switching devices need to be deployed to provide stable connectivity for 5G base stations and telecom infrastructure too. The integration of communication and consumer technologies leads to strong demand that drives tremendous growth opportunities for transistor manufacturers globally.

For instance, compact transistor modules reduce circuit footprint by 25%, enabling smaller, lighter IoT devices.

Challenges:

-

Rapid Technological Advancements and Short Product Lifecycles Create Pressures on Companies to Invest Continuously in R&D and Innovation

With increasing interest in higher efficiency, miniaturization and integration into next generation applications including EVs, 5G and IoT, unipolar transistor technologies are evolving at a rapid pace. Fast R&D, an upgrade of manufacturing lines, and an acceleration of innovation are now the orders of the day for those companies that want to stay in the game and be successful. But the quick obsolescence and short life cycles raises development risk and costs. Those that cannot keep up will lose market share. The ongoing demand for next-gen designs is putting even greater pressure on smaller players who struggle to maintain the growth needed to mitigate the ever-shifting customer and industry expectations.

Unipolar Transistor Market Segmentation Analysis:

By Device Type

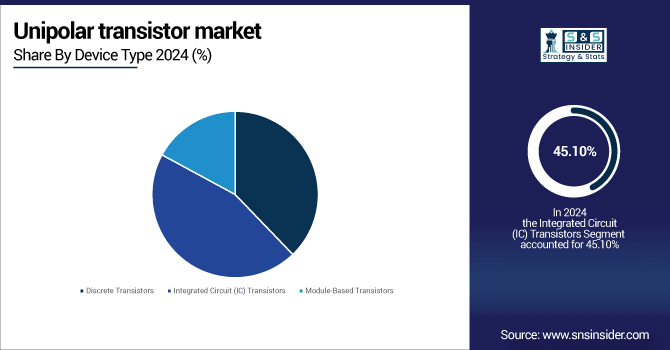

In 2024, Integrated Circuit (IC) Transistors dominated the Unipolar Transistor Market, having a revenue share of 45.10%, which can be attributed to high IC integration in the fields of consumer electronics, computing, and telecommunications. For compactness, affordability, and the integration of sophisticated circuits, the high-density integration of IC transistors has been a staple product from Texas Instruments. Integrated circuit transistors remain the predominant answer, as miniaturization, performance, and cost reduction remains critical in modern electronic device manufacturing globally.

Module-Based Transistors is likely to have the highest CAGR expanding at a rate of 8.13% during the period of 2024–2032, due to increasing demand for electric vehicles, renewable energy inverters, and industrial applications. Due to their potential to provide high power efficiency, good thermal stability, and extended life, they are well-matched for large power management applications. With its enhanced levels of innovation, Infineon Technologies is reinvigorating growth globally in all major power module transistor solutions with adoption in EV powertrains and grid connected renewable systems.

By Application

Switching Devices accounted to 31.79% in revenue share in 2024 owing to the vital function of Switching devices in digital logic circuits, processors, and communication systems. They are critical components for fast computing and networking devices, or for computing devices of any kind, offering high-speed operation, low power loss and compactness. The ability to switch on and off characterizes transistors as switches, which is the foundation for transistor applications that range from those in data centers and smartphones to those in telecom systems that Intel Corporation enables with advanced transistor switching technologies.

Power Conversion is expected to grow with highest CAGR of 8.25% during 2024–2032, owing to the swift evolution of renewable energy, electric vehicle (EV) charging systems, and industrial automation. Power conversion boosts efficiency, small size, and saved energy losses in high-load systems by using transistors. Power conversion transistors have also been a focus of innovation at ON Semiconductor (e.g., through products developed to suit EVs and renewable grids), making the segment among the most lucrative by the forecast period.

By Technology

The Unipolar Transistor Market revenue was dominated by the Field Effect Transistor (FET) having a revenue share of 55.21% in 2024, owing to their key application in integrated circuit (IC) for processors, memory and consumer electronics. Due to their high input impedance, high speed switching and low energy consumption, they are widely used in digital and analog devices. This leadership in FET technology reaffirms Samsung Electronics′ cutting-edge position in next-generation electronics and communication device development by ensuring consistent blocking capabilities and scalable characteristics.

Insulated Gate Bipolar Transistor (IGBT) is likely to have the highest growth rate during the forecast period of 2024-2032 by a CAGR of 7.87% owing to their significant applications in electric vehicle, renewable energy system and heavy industrial sectors. IGBTs permit high voltage and current power supply with little power loss in the power demanding power environment. As a pioneer in the development of advanced IGBT modules, Mitsubishi Electric's modules are now widely used in EV drivetrains, high-speed rail and solar inverters, promoting the growth of IGBT modules globally.

By End-User

Consumer Electronics generated the highest Unipolar Transistor Market share in 2024, accounting for 36.12%, due to the growing demand for smartphones, laptops, wearables and consumer appliances. So unipolar transistors are not optional if we want to increase the energy efficiency, reduce the heat and make small size devices. Transistor technologies are advanced by Sony to be utilized into a variety of different consumer devices, which as a segment remains the largest driver of global transistor demand.

Automotive is predicted to grow fastest at a CAGR of 9.04% during 2024–2032, driven by the global increase of Electric Vehicles (EVs), the identification of Advanced Driver Assistance Systems (ADAS), and the advancement of power electronics for mobility solutions. Unipolar transistors in EV powertrains, battery management, and safety-critical systems. Automotive remains the fastest growing segment with Tesla expanding the use of high-efficiency transistors across its EV platforms.

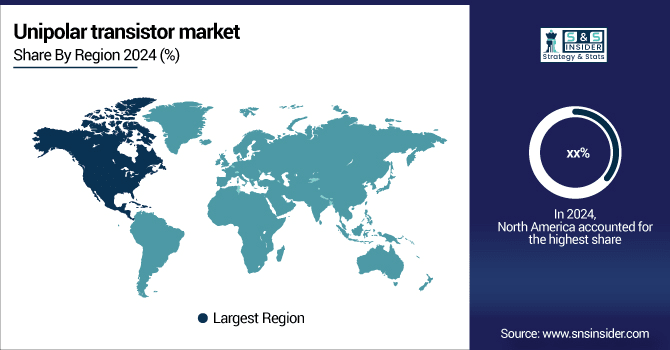

Unipolar Transistor Market Regional Insights:

The North America unipolar transistor market is propelled by the accelerated demand in electric vehicles, renewable power systems, and high-end consumer electronics. Growth is driven by solid semiconductor R&D, government plans to support domestic chip manufacturing, and the demand from aerospace and defense. Regional demand is led by the U.S. and shifts to clean energy applications are ensuring consistent growth across sectors in Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates North America due to advanced semiconductor manufacturing, strong R&D infrastructure, and high adoption of electronics across automotive, aerospace, and consumer sectors. Leading companies such as ON Semiconductor drive innovation, boosting Unipolar transistor market growth and technological leadership.

The Asia Pacific Unipolar Transistor Market accounted for the highest revenue share of 44.20% in 2024, and is anticipated to grow at the highest CAGR of 8.29% during the forecast period of 2024-2032, Asia Pacific is well-established semiconductor manufacturing hub with a huge demand for consumer electronics and also the presence of key players of the region being China, Japan, South Korea. This is further supported by rapid industrialization and large-scale adoption of electric vehicles. The already existing supply chain and commitment from the US government for chips bolsters its position further ahead of the curve in the global market.

-

China leads the Asia Pacific market owing to large-scale production, government support for electronics manufacturing, and growing domestic demand in automotive and consumer electronics. Companies such as BYD leverage cost-effective manufacturing and technological advancements, strengthening China’s unipolar transistor industry position.

Europe drives the unipolar transistor market due to its strong stance on industrial automation, automotive electronics, and renewable energy adoption. Germany and France are spending big on semiconductors research and development facilities (R&D) that encourage the use of high-performance transistors. Industry leaders, such as Infineon Technologies, will leverage sophisticated manufacturing processes to drive market expansion in compliance with environmental regulations and, at the same time, facilitate innovation in automotive, industrial and consumer electronics applications.

-

Germany dominates Europe’s unipolar transistor market due to its advanced semiconductor manufacturing, strong automotive and industrial electronics sectors, and robust R&D infrastructure. Companies such as Infineon Technologies drive innovation, boosting adoption and reinforcing Germany’s leadership in the regional market.

In the Middle East & Africa, the UAE dominates the unipolar transistor market, where industrial automation, renewable energy solar energy and infrastructure of electronics play a vital role in driving growth. Brazil leads in Latin America with growing automotive and consumer electronics sectors, increased semiconductor demand and strategic local/global company investments.

Unipolar Transistor Companies are:

Major Key Players in Unipolar transistor Market are Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics N.V., ON Semiconductor Corporation (onsemi), NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Vishay Intertechnology, Inc., Analog Devices, Inc., Broadcom Inc., Diodes Incorporated, Fairchild Semiconductor, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Rohm Semiconductor, Hitachi Power Semiconductor Device, Ltd., Littelfuse, Inc., Semikron Danfoss, Microchip Technology Inc. and Maxim Integrated and others.

Recent Developments:

-

In June 2024, Infineon introduced its new CoolGaN™ 700 V G4 transistor, enhancing power density and efficiency for industrial applications.

-

In September 2024, STMicroelectronics introduced a new generation of silicon carbide power technology tailored for next-generation EV traction inverters.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.85 Billion |

| Market Size by 2032 | USD 6.90 Billion |

| CAGR | CAGR of 7.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Discrete Transistors, Integrated Circuit (IC) Transistors and Module-Based Transistors) • By Application (Signal Amplification, Switching Devices, Voltage Regulation and Power Conversion) • By Technology (Bipolar Junction Transistor (BJT), Field Effect Transistor (FET) and Insulated Gate Bipolar Transistor (IGBT)) • By End-User (Consumer Electronics, Automotive, Industrial Automation, Telecommunications and Medical Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics N.V., ON Semiconductor Corporation (onsemi), NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Vishay Intertechnology, Inc., Analog Devices, Inc., Broadcom Inc., Diodes Incorporated, Fairchild Semiconductor, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Rohm Semiconductor, Hitachi Power Semiconductor Device, Ltd., Littelfuse, Inc., Semikron Danfoss, Microchip Technology Inc. and Maxim Integrated. |