LED Light Engine Market Size & Growth Trends:

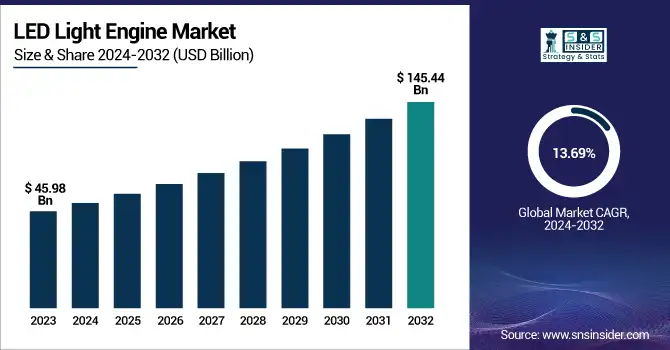

The LED Light Engine Market was valued at USD 45.98 billion in 2023 and is expected to reach USD 145.44 billion by 2032, growing at a CAGR of 13.69% over the forecast period 2024-2032. Rising product functionality and performance combined with increased competition among the manufacturers are motivating them to provide light engines with improved luminous output and energy savings. As space-saving designs become a necessity in modern applications, there is an increasing demand for compact solutions. One has to take lifecycle and sustainability metrics into consideration, which lies in durability and reduced impact on the environment.

To Get more information on LED Light Engine Market - Request Free Sample Report

Moreover, the integration of smart lighting is becoming more and more common for energy management, automation, and additional control functionalities both in commercial and residential places. The LED Light Engine market has progressed significantly in terms of energy efficiency and product performance in recent years, particularly in the U.S. Compact products are becoming vital in both home and commercial applications of the manufacturer's focus on compact designs. Smart lighting systems are also growing in popularity as they are implemented in homes and businesses, using more automated and energy-saving features. Sustainability continues to be another major driver as companies focus on longer lifecycles and reduced environmental impacts.

The U.S. LED Light Engine Market is estimated to be USD 13.25 Billion in 2023 and is projected to grow at a CAGR of 13.55%. Increased demand for smart city initiatives, government regulations for energy efficiency, and the shift toward cleaner solutions are driving the U.S. LED Light Engine market. LED Lighting is also being adopted by automotive and retail industries for its versatility and efficiency.

LED Light Engine Market Dynamics

Key Drivers:

-

Rising Demand for Energy-Efficient Lighting Solutions Drives Growth in the LED Light Engine Market

One of the major factors fueling the growth of the LED Light Engine market is the rising demand for energy-efficient lighting solutions. Due to the transition from traditional lighting systems to LED technology, governments around the world have introduced tighter energy-saving regulations and sustainability targets. Compared to traditional lighting, LED lights are more energy-efficient, longer-lasting, and, most importantly, low maintenance, which makes them a popular option for residential, commercial, and industrial use. Moreover, the advent of smart lighting systems that utilize LED technology to improve the energy efficiency of buildings and urban infrastructure is also expected to drive market growth further during the latter part of the forecast period. The increasing trend of urbanization and infrastructure development in emerging economies also drives the growth of the LED lighting solutions market.

Restrain:

-

Challenges in LED Light Engine Market Include Rapid Technological Advancements and Inconsistent Product Performance

The key challenge in the life of an LED Light Engine market is the rapidly growing and advancing technology which needs innovation and upgradation again and again. To remain competitive and meet changing consumer demand for energy-efficient and high-performance lighting, manufacturers must invest substantial resources in research and development. Companies have a high chance of predicting wrong market trends as the nature of LED technology is such that what is in today may be obsolete tomorrow, thereby incurring losses to companies. Finally, since quality cannot be ensured in an atomized market, it may lead to inconsistent product performance, adversely affecting consumer trust, and thereby delaying market uptake.

Opportunity:

-

Opportunities in Retrofit Installations Outdoor Lighting and Smart City Applications Drive LED Light Engine Market Growth

The market is expected to provide significant opportunities in retrofit installations and outdoor lighting applications. It places retrofitting events with old lighting systems within the LED technology, allowing businesses and governments to cut down on energy bills and maintenance with minimal capital cost. An outstanding opportunity for growth due to urbanization, the growing trends of smart cities, and increasing security concerns are some of the factors driving the market for outdoor lighting. In addition, advanced technologies like human-centric lighting, connected lighting systems, and smart city applications are offering new opportunities for innovation and market growth. These drivers are anticipated to propel the market growth over the next decade.

Challenges:

-

Supply Chain Challenges and Slow Adoption of LED Lighting Technology Hinder Market Growth Opportunities

Another obstacle is the dependency on the primary source of LED manufacturing, such as the rare-earth elements and the semiconductors. Variability in supply and cost from these raw materials threatens production and causes supply chain bottlenecks, destabilizing the market. Additionally, the slow adoption of advanced LED lighting technologies in lesser developed countries is an additional factor that constrains market penetration. Despite their significant advantages, the shift from conventional lighting systems is often slow in areas where access to technology is limited, or the policy environment is yet to catch up to energy-saving objectives.

LED Light Engine Industry Segment Analysis

By Product Type

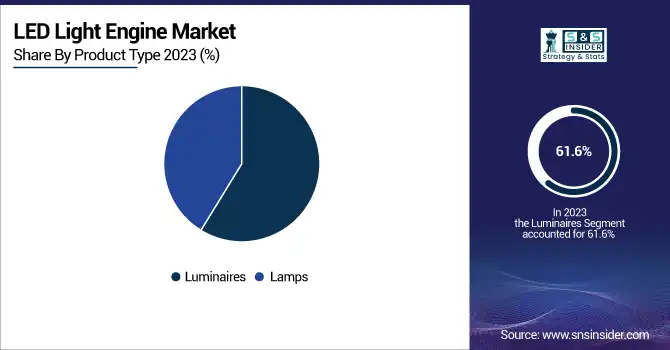

Luminaires accounted for a major share of 61.6% of the global LED Light Engine market in 2023. The reason behind this dominance is the increasing need for energy-efficient and attractive-looking lighting solutions for commercial spaces and residential areas. Luminaires, such as fixtures, downlights, panel lights, and ceiling lights, are often associated with various applications, including smart lighting systems and commercial infrastructure. This makes them a significant segment in the market as they can be integrated into all types of new builds due to their versatility.

Lamps will register the highest CAGR from 2024 to 2032. The rise in retrofit installations, where traditional systems are integrated with lamps, is even adding to this growth. The popularity of LED lamps for home and commercial use is driven by their low cost, easy installation, and energy efficiency. Moreover, energy-saving bulbs which are expected to drive the adoption of LED lamps are likely to receive government incentives.

By Installation Type

New Installations held the majority of 69.6% share of the LED Light Engine market in 2023. This is mostly due to the continuous construction of new residential, commercial, and industrial buildings, accompanied by the installation of new lighting systems into modern building architecture. New installations stand to gain significantly from the rising focus on energy-efficient buildings and penetration of smart lighting technology. Increasing energy efficiency regulations by the government further paved the way for the smooth adoption of LED lights in new infrastructures.

Over the period from 2024 to 2032, the Retrofit Installations are projected to grow with the fastest CAGR. This growth is driven by the rising emphasis on replacing old lighting systems with energy-efficient LED solutions. There are several advantages of retrofit installations as they provide an economical solution to improve energy efficiency, decrease maintenance costs, and reduce energy consumption without replacing entire systems. Furthermore, sustainability and energy-efficient retrofit projects in the residential, commercial, and industrial sectors are the primary efforts.

By End Use

The Indoor Lighting segment held 58.5% of the LED Light Engine market in 2023. This dominance has been aided by the high requirement of energy saving and longer-life lighting solutions for residential, commercial & office spaces. Indoor lighting systems, ceiling light, downlight, and recessed lighting systems provide comfort, eye-appeal, and save energy. Indoor lighting still constitutes the largest share of the global market, even as more energy-conscious consumers are opting for LED lighting.

The Outdoor Lighting segment is anticipated to grow at the fastest CAGR between 2024 and 2032. This is due to the growing need for energy-efficient outdoor lighting fixtures for public, street, security, and commercial applications with longer lives. The continuous progress of smart cities and the growing focus on sustainable urban infrastructure are driving the adoption of LED lighting for outdoor usage. Also, the development of outdoor lighting systems with features like smart lighting for control and energy optimization is propelling the growth of this segment steadily.

LED Light Engine Market Regional Analysis

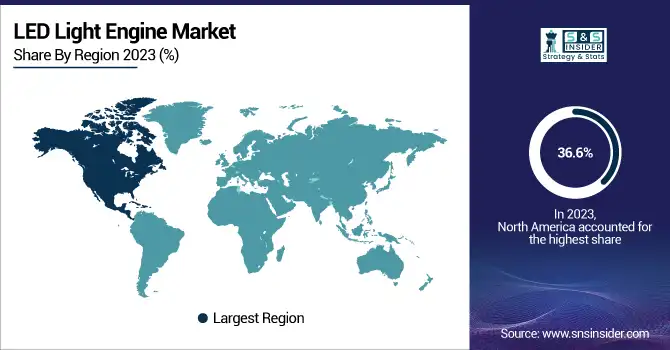

The LED Light Engine market in North America held the largest share in 2023, contributing to 36.6% of the total market volume. The dominance is backed by the high demand for energy-efficient lighting mostly in the residential and commercial sector along with the energy-conserving regulatory policies. Still, the U.S. and Canada have been leaders in adopting efficiency technologies as top-down government incentives such as the Energy Star program and green building standards such as LEED have been put into place. For example, the U.S. government is implementing numerous energy-saving programs to retrofit LED lighting solutions for federal buildings to operate more energy-efficiently and reduce annual operation costs.

Asia Pacific is expected to witness the fastest CAGR during the forecast period of 2024 to 2032. China and India are among the leaders in the adoption of LED technology in both residential and commercial applications. For example, in China, the government has initiated extensive measures to encourage LED lighting through the Green Lighting program that encourages replacing incandescent bulbs with LEDs. Furthermore, the increasing inclination towards smart cities in Asia Pacific such as Japan and South Korea is increasing the demand for high-end outdoor and street lighting systems, making this region a rapidly growing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the LED Light Engine Market are:

-

Philips (LUMILEDS LED Light Engine)

-

OSRAM (OSRAM OSLON LED)

-

Cree (Cree XLamp XP-G3 LED)

-

General Electric (GE LUXO LED Light Engine)

-

Nichia (NICHIA NVSW219B LED)

-

Seoul Semiconductor (WICOP LED)

-

Samsung Electronics (Samsung LM301B LED)

-

LG Innotek (LG Innotek LED Light Engine)

-

Everlight Electronics (Everlight LED Light Engine)

-

Broadcom (Broadcom HLMP-LED)

-

Lite-On Technology (Lite-On LED Light Engine)

-

Lumileds (LUXEON 3030 2D LED)

-

Cree Wolfspeed (Cree LED Light Engine)

-

Bridgelux (Bridgelux Vero Series LED)

-

Epistar (Epistar LED Light Engine)

Recent Trends

-

In April 2024, Philips launched the Ultinon Pro7000 LED signaling bulbs, offering superior brightness and enhanced visibility for safer driving. These bulbs provide instant illumination, and a long lifespan, and are available in multiple color options for various vehicle applications.

-

In November 2024, LG Innotek's Nexlide A+ automotive lighting module won the CES 2025 Innovation Award for its advanced design and enhanced brightness. The module features surface light source technology, offering a slimmer, more efficient lighting solution for vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 45.98 Billion |

| Market Size by 2032 | USD 145.44 Billion |

| CAGR | CAGR of 13.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Lamps, Luminaires) • By Installation Type (New Installations, Retrofit Installations) • By End Use (Indoor Lighting, Outdoor Lighting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips, OSRAM, Cree, General Electric, Nichia, Seoul Semiconductor, Samsung Electronics, LG Innotek, Everlight Electronics, Broadcom, Lite-On Technology, Lumileds, Cree Wolfspeed, Bridgelux, Epistar |