Infrared Imaging Market Report Scope & Overview:

Get More Information on Infrared Imaging Market - Request Sample Report

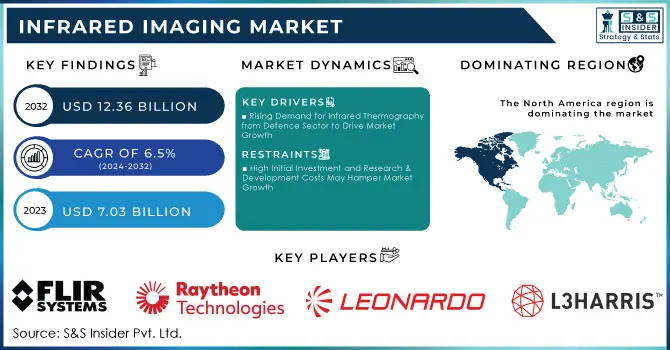

The Infrared Imaging Market Size was valued at USD 7.03 Billion in 2023 and is expected to reach USD 12.36 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Infrared imaging is increasingly becoming a critical growth driver in the healthcare industry, primarily because of the increase in the adoption of infrared thermography for non-invasive diagnostic applications. This technology is now increasingly used for the identification of inflammation, tumors, and circulatory issues, which significantly increases early disease detection and enhances patient outcomes. It, therefore, increases awareness about the advantages of earlier disease detection. The defence sector is also a significant participant in the infrared imaging market. Military applications of infrared cameras in surveillance, reconnaissance, and target acquisition primarily employ these cameras to get enhanced operational effectiveness, especially during lowlight conditions. Rising geopolitical tension and continued increase in defence budgets within many countries have led to substantial demand for advanced infrared imaging systems. The U.S. Department of Defence, military infrared imaging Department of Defence is expected to grow a CAGR of 10.3% through the next years emerging as a robust focus on modernization initiatives by armed forces across the world. Apart from this, the total market in infrared imaging was estimated to reach almost USD 9.6 billion in 2028, showing that it is growing expansively into the industrial, automotive, and consumer electronic sectors.

Infrared Imaging Market Dynamics

Key Drivers:

-

Rising Demand for Infrared Thermography from Defence Sector to Drive Market Growth

Most of the surveillance and targeting missions take place at night and therefore, research and development on military and defence highly focus on IR wavelengths. The military uses infrared technology through applications such as night vision goggles, missile guidance systems, and aerial Forward Looking Infrared (FLIR) scanners. The growing military and defence markets for infrared imaging technology will spur the global infrared imaging market in the years to come.

For example, LightPath Technologies, Inc., a US-based company manufacturing optical and infrared specialty products, has won a contract worth USD 2.5 million to provide advanced infrared optics for one of the world's most critical military programs. The program under question employs the state-of-the-art optics provided by the company in infrared imaging and threat detection, which further speaks to its importance to all the arms of the U.S. military. Additionally, L3Harris Technologies has constructed a new cutting-edge facility worth USD 110 million in Waterdown, Ontario, Canada, to meet the surge in demand for its electro-optical and infrared imaging technologies of WESCAM MX-Series. These are intelligence, surveillance, reconnaissance, and target acquisition systems intended to be operated on different air, land, and sea platforms and, hence underpin the increasing application of advanced IR imaging technologies in military activities.

Restrain:

-

High Initial Investment and Research & Development Costs May Hamper Market Growth

The main challenges to the infrared imaging market are high initial investments and R&D costs associated with infrared thermography technologies. The massive capital outlays required to acquire good-quality IR imaging equipment can be discouraging for most of the would-be users, the SMEs in particular. High-performance infrared cameras and sensors, extremely essential in allowing for accurate and reliable imaging of thermal scenes, cost very high, which limits its availability to a greater market. Thermal imaging cameras that have advanced abilities can range from USD 2,000 up to more than USD 30,000, depending on their specifications and capabilities. This financial restriction may prohibit SMEs from investing in infrared thermography systems that could stunt the market. In addition, more R&D is also required to enhance IR imaging technology in terms of resolution, sensitivity, and performance.

According to the U.S. Department of Defence, it claims that massive R&D investments are required to cope with growing requirements from technology and to sustain both defensive and commercial leadership. The higher prices of commodities could be due to increased research and development expenses and the infusion of new technology. Traditional cooled infrared detectors Traditional cooled infrared detectors are more sensitive and efficient compared to their uncooled peers; however, they cost much more. This means that these factors are going to restrain the market from growing during the forecasted period.

Infrared Imaging Market Segmentation Overview

By Technology Type

The Uncooled Infrared Imaging segment is the dominant one in the infrared imaging market and is further estimated to grow at the highest CAGR of 6.71% during the forecast period 2024-2032. The advantages of this technology are its low cost, compactness, and user-friendliness, and it has many applications, such as security, surveillance, and monitoring of industrial sites.

The Cooled Infrared Imaging segment will also have a considerable market share. Cooled thermographic cameras include an image sensor with a cryogenic cooler incorporated into it that reduces the temperature of the sensor to cryogenic temperatures. It is also important to reduce the sensor temperature since this yields a reduction of heat-induced noise to a point below that of the captured scene signal. The growing need for thermal imaging to enhance CCTV environments will further boost growth in this segment.

By Wavelength Type

This LWIR segment is an area market leader and expected to grow immensely with a 32% market share in the forecast period, given the widespread usage of surveillance, homeland security, object detection, and other scientific & industrial applications. Long-Wave Infrared, commonly abbreviated as LWIR, is a subset of the infrared band in the electromagnetic spectrum covering a wavelength range of 8 to 14 microns.

The SWIR segment is also forecasted to have the highest CAGR in the estimated period of 2024 to 2032, mainly because the quality control and product inspection technologies are further gaining traction. It falls into a wavelength range of 1.4 to 3 microns; therefore, SWIR imaging is also a plus in itself as it works outside the visible spectrum and thus offers better imaging, especially in challenging environments.

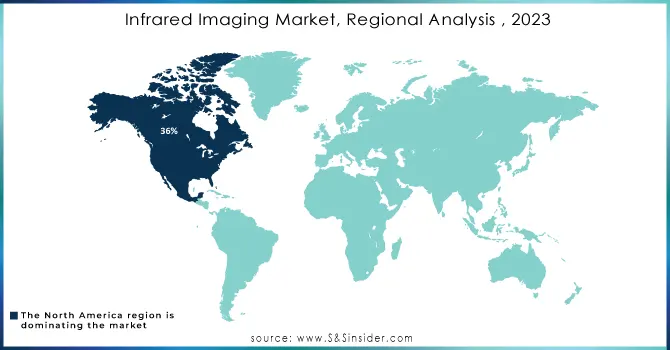

Regional Analysis

North America led with 36% of the market share. Growth is in response to several major OEMs being located in this region and the mergers that are continuously happening. For Instance, Teledyne Technologies Incorporated, an American company whose focus has been making digital imaging products and instrumentation, concluded the acquisition of FLIR Systems in a deal worth approximately USD 8.2 billion. This acquisition further enhanced the capabilities and geographical presence of Teledyne in the North American market. FLIR Systems, Inc. is a U.S.-based company that designs and manufactures thermal imaging cameras and sensors.

Asia Pacific is one of the biggest markets in the infrared camera market. It is also likely to be the most rapidly growing region in terms of market share during the forecast period. The growth is highly rapid due to large-scale industrialization and rapid infrastructure development. China, Japan, India, and South Korea are among the biggest countries driving up demand for infrared cameras across the manufacturing and construction industries.

According to the Stockholm International Peace Research Institute, military expenditure in Asia has increased. Examples include China and India, which are the world's biggest military spenders. USA was for the first time in 25 years the largest arms supplier to Asia and Oceania. The USA still had the highest share of the states' arms imports in the region with 34 percent compared to Russia's 19 percent and China's 13 percent. India was the world's largest arms importer. Its arms imports grew by 4.7 percent between 2014–18 and 2019–23. Russia remained India's largest supplier of arms: even if it accounted for only 36 percent of India's imports in these five years, it was the first time since 1960–64 that sales from Russia (or the Soviet Union before 1991) had totalled less than half of India's arms imports.

Need Any Customization Research On Infrared Imaging Market - Inquiry Now

Key Players in Infrared Imaging Market

Some of the major players in the Infrared Imaging Market are:

-

FLIR Systems Inc. (FLIR One, FLIR T-Series)

-

Raytheon Technologies Corporation (AN/AAS-52 Infrared Targeting System, FLIR Systems)

-

Leonardo S.p.A. (Gabbiano TS, Mira)

-

L3Harris Technologies, Inc. (MX-Series, WESCAM)

-

Thales Group (Ground Master Radar, RBE2 Radar)

-

Northrop Grumman Corporation (AN/AAQ-28(V) LITENING Pod, Firebird)

-

Bae Systems (A-10 Warthog Infrared System, Infrared Imaging Systems)

-

Teledyne Technologies Incorporated (Teledyne FLIR, Teledyne Imaging)

-

Opgal Optronic Industries Ltd. (ThermoVision, SkyWatcher)

-

HGH Systèmes Infrarouges (SPYNEL, CYCLOPE)

-

Optics 1, Inc. (Infrared Night Vision Devices, MMR)

-

Sierra-Olympic Technologies, Inc. (VisiSight, Viper HD)

-

Wavelength Opto-Electronic (QWIP, LWIR Imaging Systems)

-

San Juan Optics, LLC (Products: Custom Infrared Optics, Imaging Systems)

-

SensIR Technologies (Portable Infrared Cameras, IR Thermometers)

-

Raptor Scientific (High-Performance Infrared Cameras, Spectral Imaging Systems)

-

AeroVironment, Inc. (Raven, Puma 3)

-

Mikron Infrared (MI Series Infrared Thermometers, NIR Systems)

-

Inframetrics, Inc. (IR Windows, Thermal Imaging Cameras)

-

Sierra Instruments (Infrared Analyzers, Gas Analyzers)

Recent Trends

-

In October 2024, Apple announced plans to begin mass production of its new AirPods, featuring an infrared (IR) camera sensor, in 2026. The integration of this technology aims to enhance spatial audio experiences and enable gesture controls. Analyst Ming-Chi Kuo reported that the IR cameras would allow for "in-air gestures" and better interaction with the Apple Vision Pro headset, further improving user experience. This innovation marks a significant advancement in Apple's wearable technology strategy.

-

In June 2024, ISRO initiated a mission focused on enhancing high-resolution thermal imaging technologies for climate and resource management. This project aims to improve the accuracy of environmental monitoring and assessment, allowing for better management of resources and responses to climate change. The advancements are expected to support various applications, including agriculture, forestry, and urban planning, ultimately aiding in sustainable development efforts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.03 Billion |

| Market Size by 2032 | US$ 12.36 Billion |

| CAGR | CAGR of 6.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vertical Type (Aerospace & Defense, Automotive, Healthcare, Industrial, Others) • By Application Type (Security & Surveillance, Monitoring & Inspection, Detection) • By Wavelength Type (Near-Infrared, Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR), Others) • By Technology Type (Cooled Infrared Imaging, Uncooled Infrared Imaging) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems, Inc., Raytheon Technologies Corporation, Leonardo S.p.A., L3Harris Technologies, Inc., Thales Group, Northrop Grumman Corporation, Bae Systems, Teledyne Technologies Incorporated, Opgal Optronic Industries Ltd., HGH Systèmes Infrarouges, Optics 1, Inc., Sierra-Olympic Technologies, Inc., Wavelength Opto-Electronic, San Juan Optics, LLC, SensIR Technologies, Raptor Scientific AeroVironment, Inc., Mikron Infrared, Inframetrics, Inc., Sierra Instruments |

| Key Drivers | • Rising Demand for Infrared Thermography from Defence Sector to Drive Market Growth |

| Restraints | • High Initial Investment and Research & Development Costs May Hamper Market Growth |