InGaAs Photodiode Sensor Market Size:

Get more information on InGaAs Photodiode Sensor Market - Request Sample Report

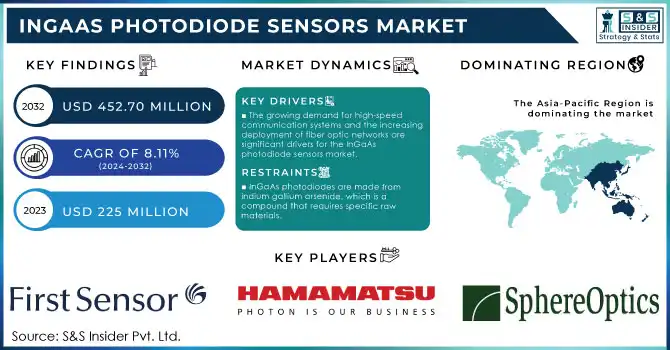

The InGaAs Photodiode Sensors Market Size was valued at USD 225 Million in 2023 and is expected to reach USD 452.70 Million by 2032 and grow at a CAGR of 8.11% over the forecast period 2024-2032.

The InGaAs photodiode sensor market is experiencing significant growth, driven by its unique capabilities and diverse applications across industries. These sensors, renowned for their ability to operate in the infrared spectrum, play a pivotal role in telecommunications, particularly in fiber-optic networks. They excel in detecting and converting optical signals into electrical ones with high precision, which is critical for high-speed data transmission in long-haul and metro networks. With the global surge in 5G infrastructure, the demand for InGaAs photodiodes in this sector is expanding rapidly. As of 2023, there were approximately 1.9 billion 5G subscriptions worldwide, with North America leading with a 32% 5G adoption rate double the global average. This growth underscores the increasing need for broadband connectivity and reinforces the role of InGaAs photodiodes in the evolution of next-generation networks.

In the defense and aerospace sectors, InGaAs photodiode sensors are vital for advanced technologies such as laser range finding, missile guidance, and target tracking. Their sensitivity to faint light signals in the SWIR spectrum makes them indispensable for night vision systems, surveillance, and reconnaissance operations. Additionally, these sensors are widely used in satellite systems for Earth observation, enhancing imaging capabilities for environmental monitoring and disaster management.

InGaAs Photodiode Sensors Market Dynamics

Drivers

-

The growing demand for high-speed communication systems and the increasing deployment of fiber optic networks are significant drivers for the InGaAs photodiode sensors market.

InGaAs photodiodes are extensively utilized in fiber optic communication for their outstanding performance in the infrared spectrum, allowing for high-speed data transmission across long distances. These sensors can detect light between 900 and 1700 nm, making them perfect for fiber optic communications using these wavelengths for fast data transmission. The increasing worldwide need for fast internet and mobile data, combined with the emergence of 5G technology, has increased the demand for advanced photodetectors like InGaAs photodiodes. With the expansion of telecommunication networks, InGaAs photodiodes play a crucial role in maintaining the strength and effectiveness of optical communication systems. The demand for fiber optics in telecommunications is constantly growing due to their superior performance compared to copper cables in terms of bandwidth and distance. InGaAs photodiodes assist in transforming optical signals to electrical signals, facilitating efficient data transmission via fiber optic cables. The rise in fiber optic network installations, fueled by the demand for faster internet, better connectivity, and the introduction of 5G networks, is anticipated to drive an increase in the need for InGaAs photodiodes. Moreover, fiber optic communication plays a vital role in linking distant regions and enabling the widespread availability of internet services worldwide, a major trend in developed and developing countries.

-

The healthcare sector is more and more embracing InGaAs photodiodes for their capacity to sense light in the near-infrared range, which proves valuable in medical tasks.

These sensors are crucial for advanced imaging systems used in different medical procedures, improving diagnostic precision and patient results. InGaAs photodiodes are perfect for non-invasive imaging as they can operate in the near-infrared spectrum, a feature that is becoming more popular for its ability to lower the risks linked to traditional diagnostic approaches. In OCT, high-resolution imaging of tissues is made possible by InGaAs photodiodes, assisting doctors in early disease diagnosis. These sensors are essential to devices that monitor blood oxygen levels, playing a vital role in continuously monitoring patient health, especially in critical care settings. With advancements in healthcare, there is a growing trend towards non-invasive and more accurate diagnostic technologies, in which InGaAs photodiodes are essential. The rise in personalized medicine, the growing number of chronic diseases, and progress in medical research are increasing the need for high-performance photodiodes such as InGaAs in medical imaging technologies.

Restraints

-

InGaAs photodiodes are made from indium gallium arsenide, which is a compound that requires specific raw materials.

The availability of these materials can sometimes be limited due to geopolitical factors, supply chain disruptions, or fluctuations in market demand. In regions where these raw materials are scarce, the cost of production for InGaAs photodiodes may rise, further hindering their widespread use. The dependence on rare earth elements and specific raw materials for the production of InGaAs photodiodes makes the supply chain susceptible to disruptions. Any shortage or price increase in raw materials could significantly impact the cost and availability of these photodiodes. This constraint is particularly concerning for manufacturers that rely on stable supply chains and affordable raw materials to keep production costs under control.

InGaAs Photodiode Sensors Market Segmentation

by Type

The single-element segment dominated the market in 2023 with over 30% market share, due to their simplicity, high sensitivity, and broad utility across the near-infrared (NIR) spectrum (900–1700 nm). These photodiodes are highly effective in converting light into electrical signals with minimal noise, making them indispensable in applications such as optical communication, spectroscopy, and laser rangefinding. Their reliability and cost-effectiveness drive adoption in industrial and scientific fields. For instance, companies like Thorlabs utilize single-element PIN photodiodes in spectroscopy systems for material analysis, while Finisar Corporation employs them in optical communication systems for high-speed data transmission.

The avalanche segment is projected to become the fastest-growing segment during 2024-2032, due to its ability to amplify weak optical signals with internal gain, providing exceptional sensitivity for demanding applications. These photodiodes are increasingly utilized in high-speed optical networks, quantum communication, and low-light imaging, as well as in emerging technologies like LiDAR systems and 3D mapping. For example, First Sensor integrates APDs in medical imaging systems for advanced diagnostics, Excelitas Technologies uses them in LiDAR for autonomous vehicles, and Sony incorporates them into high-resolution 3D cameras for AR/VR applications.

by Application

The telecommunication segment led the market with over 40% market share in 2023 in the InGaAs photodiode sensors market. InGaAs photodiodes are very efficient in optical communication systems because they can detect infrared light, which is crucial for transmitting large amounts of data over long distances. These sensors are essential for efficient high-speed data transmission in both long-haul and metropolitan area networks (MANs), minimizing signal loss. For instance, II-VI Incorporated offers photodiodes for use in telecommunication applications, specifically for high-speed communication systems, optical fiber networks, and wavelength-division multiplexing (WDM) systems.

The security segment is expected to experience rapid growth rate during 2024-2032 in the InGaAs photodiode sensors market, especially in night-vision systems, surveillance cameras, and infrared imaging technologies. The sensitivity of InGaAs photodiodes to infrared light makes them perfect for detecting low-light situations and improving security in areas with poor visibility. For example, FLIR Systems, which is now part of Teledyne, is a top firm that utilizes InGaAs photodiodes in its infrared cameras for security and surveillance purposes, such as perimeter surveillance and border security.

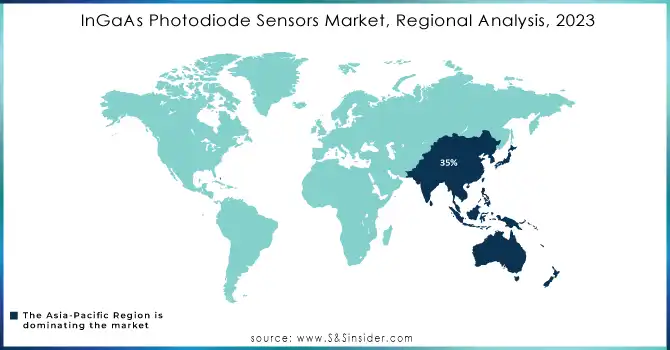

InGaAs Photodiode Sensors Market Regional Analysis

Asia-Pacific dominated in 2023, holding a 35% market share in the InGaAs photodiode sensors market. This dominance can be attributed to the strong manufacturing base in countries like China, Japan, and South Korea, which are leaders in electronics, telecommunications, and semiconductor production. The demand for InGaAs photodiodes in APAC is fueled by the region's growing industrial automation, telecommunications infrastructure, and research sectors. Companies such as Hamamatsu Photonics, Toshiba, and ON Semiconductor have a significant presence in APAC, driving the market’s growth.

North America is expected to be the fastest-growing region in the InGaAs photodiode sensors market during 2024-2032. The region is experiencing rapid technological advancements and increasing investments in research and development. This is driven by the expanding demand for InGaAs photodiodes in diverse sectors, including telecommunications, aerospace, healthcare, and industrial applications. North America also benefits from the presence of key market players, such as Hamamatsu Photonics, Excelitas Technologies, and First Sensor, which are contributing to innovation and the development of new applications.

Need any customization research on InGaAs Photodiode Sensor Market - Enquiry Now

Key Players

The major players in the InGaAs Photodiode Sensors Market are:

-

First Sensor (InGaAs PIN Photodiode, InGaAs APD)

-

Hamamatsu Photonics K.K. (S1226-18BQ, G11159-01)

-

Kyoto Semiconductor Co., Ltd. (PSX-1000, PSX-1500)

-

Laser Components GmbH (PDA12-IR, PDB-C-L)

-

OSI LaserDiode (SLD-3030, SLD-4010)

-

SphereOptics GmbH (InGaAs Diode, Multi-Pin InGaAs Photodiode)

-

Teledyne Judson Technologies (TJT) (InGaAs APD, InGaAs PIN Photodiode)

-

Voxtel, Inc. (Voxtel APD-100, InGaAs Photodiode)

-

Centronic (IR Photodiodes, PIN Photodiodes)

-

Edmund Optics Inc. (InGaAs Photodiode, InGaAs PIN Photodiode)

-

Everlight Americas Inc. (IR Photodiodes, APD Arrays)

-

Excelitas Technologies Corp. (Photon Counting Module, InGaAs Photodiode)

-

CMC Electronics (InGaAs Avalanche Photodiode (APD))

Suppliers of Raw Materials/Components:

-

II-VI Incorporated

-

Osram Opto Semiconductors

-

JDS Uniphase

-

Mitsubishi Electric

-

Sumitomo Electric

-

Sharp Corporation

-

Samsung Electronics

-

Nihon Inter Electronics Corporation

-

Philips

-

Infineon Technologies

Recent Development

-

October 2023: Hamamatsu Photonics created and produced a novel near-infrared area image sensor. It enhances speed and dynamic range significantly, being up to twice as high as current hyperspectral camera products.

-

January 2024: CMC Electronics, a pioneering leader in advanced sensing solutions, is proud to announce the debut of its revolutionary InGaAs Avalanche Photodiode (APD). Expertly designed to elevate sensing and ranging capabilities, our latest APD is tailor-made for eye-safe laser range finding and scanning LiDAR applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 225 Million |

| Market Size by 2032 | USD 452.70 Million |

| CAGR | CAGR of 8.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multi-Element Array, PN, PIN, Avalanche, Single-Element InGaAs PIN) • By Application (Telecommunication, Security Segments, Research Segments) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | First Sensor, Hamamatsu Photonics K.K., Kyoto Semiconductor Co., Ltd., Laser Components GmbH, OSI LaserDiode, SphereOptics GmbH, Teledyne Judson Technologies (TJT), Voxtel, Inc., Centronic, Edmund Optics Inc., Everlight Americas Inc., Excelitas Technologies Corp. |

| Key Drivers | • The growing demand for high-speed communication systems and the increasing deployment of fiber optic networks are significant drivers for the InGaAs photodiode sensors market. • The healthcare sector is more and more embracing InGaAs photodiodes for their capacity to sense light in the near-infrared range, which proves valuable in medical tasks. |

| RESTRAINTS | • InGaAs photodiodes are made from indium gallium arsenide, which is a compound that requires specific raw materials. |