Inhalable Drug Delivery Systems Market Size & Overview:

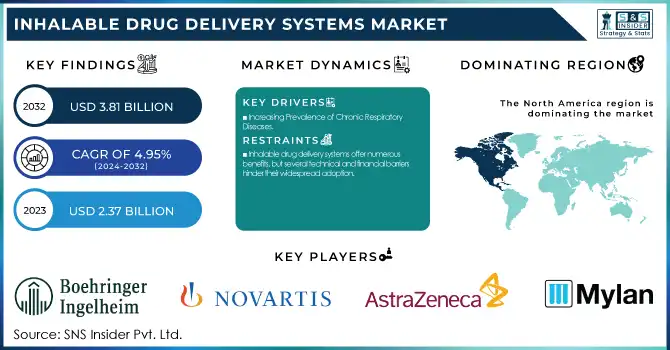

The Inhalable Drug Delivery Systems Market was valued at USD 2.37 billion in 2023 and is expected to reach USD 3.81 billion by 2032 with a growing CAGR of 4.95% over the forecast period of 2024-2032.

To Get more information on Inhalable Drug Delivery Systems Market - Request Free Sample Report

The inhalable drug delivery systems market is experiencing remarkable growth, driven by the rising prevalence of respiratory conditions and ongoing technological advancements. According to the Global Burden of Disease Study in 2023, over 350 million people worldwide are affected by asthma, and COPD is responsible for an estimated 3.23 million deaths annually. This underscores the urgent demand for effective, targeted therapies, with inhalable drug delivery systems emerging as crucial solutions for managing these chronic diseases.

Innovations in inhaler technology are significantly enhancing the performance of inhalable therapies and improving patient adherence. A prime example is Boehringer Ingelheim’s Respimat Soft Mist Inhaler, which ensures more efficient medication delivery directly to the lungs. Clinical evidence suggests this system improves drug deposition, leading to better outcomes for COPD and asthma patients. Also, Novartis' Breezhaler offers an advanced dry powder inhaler optimized for precision and user-friendliness, providing consistent and reliable doses for managing asthma and COPD.

Integrating nanotechnology into inhalable drug delivery is another key trend propelling market growth. Recent studies show that nanoparticle-based formulations can significantly improve drug bioavailability, enhancing their effectiveness while minimizing side effects. One notable example is the development of liposomal budesonide, a sustained-release formulation for asthma management that reduces dosing frequency. Additionally, the use of nanocarriers to deliver insulin through inhalation is gaining traction, offering a non-invasive alternative to injectable insulin for diabetes management.

The increasing focus on respiratory infections, particularly in the aftermath of the COVID-19 pandemic, has further accelerated the development of inhalable antiviral therapies. Inhalable remdesivir has been tested for treating COVID-19 by enabling targeted drug delivery directly to the lungs, reducing systemic exposure and side effects. This breakthrough has paved the way for future developments in inhalable treatments for respiratory infections, further expanding the potential of inhalable drug delivery systems.

Inhalable Drug Delivery Systems Market Dynamics

Drivers

-

Increasing Prevalence of Chronic Respiratory Diseases

The rising global burden of chronic respiratory diseases such as asthma, COPD, and other pulmonary conditions is a major driver of the inhalable drug delivery systems market. According to recent studies, millions of people worldwide are suffering from these diseases, leading to an increased demand for targeted, efficient treatments. Inhalable drug delivery systems offer a significant advantage by providing direct medication delivery to the lungs, allowing faster and more effective relief. Additionally, these systems are non-invasive, improving patient compliance compared to traditional oral medications or injectable therapies. The ability to manage these conditions with precision pushes healthcare professionals to adopt inhalable drug delivery methods, fueling their growth in the global market. As the prevalence of respiratory disorders continues to rise, the demand for these systems is expected to surge, driving market expansion.

-

Technological Advancements in Inhaler Devices

Technological innovation in inhaler devices is another key factor contributing to the market's growth. Recent advancements have focused on improving the precision and efficiency of drug delivery. For example, the development of smart inhalers with integrated sensors allows for real-time monitoring of medication usage, ensuring better patient adherence and reducing errors. These devices can track doses, remind patients of missed doses, and provide data to healthcare providers for more personalized treatment plans. Moreover, advancements in dry powder inhalers and soft mist inhalers have made them more user-friendly and effective in delivering medications to the lungs. These innovations are making inhaler devices more efficient, reliable, and suitable for various patient populations, which is driving the adoption of inhalable drug delivery systems across healthcare settings.

-

Rising Demand for Personalized and Biologic Therapies

The growing interest in personalized medicine and biologic therapies is a significant driver in the inhalable drug delivery market. Personalized treatments, tailored to the unique genetic makeup and health conditions of individual patients, are gaining popularity in managing chronic respiratory diseases. Inhalable biologics, such as monoclonal antibodies, are proving to be highly effective for asthma and other respiratory conditions, fueling demand for advanced drug delivery systems. These biologics often require specialized inhalers to ensure accurate and effective delivery. As the healthcare industry shifts toward more customized treatments, the need for inhalable systems that can deliver biologics and other targeted therapies will continue to rise. This trend is also supported by advancements in diagnostic tools and the increasing availability of personalized healthcare data, making inhalable drug delivery systems an essential part of modern medical treatments.

Restraints

-

Inhalable drug delivery systems offer numerous benefits, but several technical and financial barriers hinder their widespread adoption.

The complexity of device design and operation presents challenges, particularly in developing markets where healthcare infrastructure may be lacking. Advanced inhalers, including smart devices and dry powder inhalers, involve substantial investments in research and development, resulting in higher costs for manufacturers and consumers. The maintenance and calibration of these sophisticated devices also add to the overall cost, making them less affordable for price-sensitive populations. Additionally, proper patient training is essential for effective use, and a lack of education can lead to adherence issues, further limiting the impact of these technologies. These factors contribute to affordability and accessibility challenges, restricting the market’s growth potential, especially in lower-income regions.

Inhalable Drug Delivery Systems Market Segmentation Insights

By Product Type

Metered Dose Inhalers dominated the inhalable drug delivery systems market in 2023, accounting for 45% of the market share. The widespread usage of MDIs drives this segment’s strong market position, their proven effectiveness in delivering precise doses of medication, and their ease of use for both healthcare providers and patients. MDIs are widely used in the management of chronic respiratory conditions such as asthma and COPD due to their reliability in delivering medication. They remain the preferred choice in hospital and home-care settings, maintaining their dominance in the market.

Dry Powder Inhalers are the fastest-growing product type in the inhalable drug delivery systems market throughout the forecast period. They offer several advantages, including no need for propellants and easier handling compared to MDIs. DPIs are expected to experience the most significant growth, driven by the rising preference for environmentally friendly and non-aerosol inhalation options. As DPIs are increasingly developed with improved accuracy and drug delivery capabilities, they have become more popular for managing chronic respiratory conditions, increasing their adoption in the market.

By Technology

Non-smart inhalers (including MDIs and DPIs) dominated the inhalable drug delivery systems market, holding 75% of the total market share in 2023. Healthcare providers and patients prefer these devices due to their long-established usage, reliability, and cost-effectiveness. They do not require digital connectivity, making them a simpler and more affordable option for treating asthma and COPD. Their widespread availability and familiarity contribute to their ongoing dominance in the market.

Smart Inhalers is anticipated to be the fastest-growing segment in the market over the forecast period. These devices incorporate digital technologies such as sensors and connectivity with mobile applications to enhance patient compliance by tracking medication usage and providing feedback. With the rise of connected healthcare solutions, smart inhalers are gaining popularity as they offer more personalized treatment options and improve medication adherence. Their integration into treatment plans is expected to increase significantly in the coming years, making them a key focus for future growth.

Inhalable Drug Delivery Systems Market Regional Analysis

North America dominated the inhalable drug delivery systems market, accounting for a 40% share due to the high prevalence of chronic respiratory diseases such as asthma and COPD. According to the American Lung Association, asthma affects approximately 25 million people in the U.S., and COPD is the third leading cause of death in the country. The region benefits from well-established healthcare systems, significant healthcare spending, and the presence of industry leaders like Boehringer Ingelheim and Novartis, who are pioneering advanced inhalable drug delivery solutions. Innovations like Boehringer Ingelheim’s Respimat Soft Mist Inhaler and Novartis' Breezhaler have significantly improved treatment delivery and patient adherence. Moreover, the adoption of smart inhalers, which provide real-time data on medication usage, is growing steadily.

In Europe, the market benefits from a high standard of healthcare and an aging population. According to Eurostat, nearly 20% of the European population is aged 65 or older, contributing to the increasing prevalence of respiratory diseases. Countries such as Germany, France, and the UK are witnessing a rise in the use of dry powder inhalers and metered-dose inhalers. Europe’s emphasis on eco-friendly healthcare solutions has also led to the rising adoption of DPIs, with companies like GlaxoSmithKline offering environmentally friendly inhaler options, contributing to the growing demand.

The Asia-Pacific region is experiencing rapid growth, driven by the rising prevalence of respiratory diseases and an expanding middle-class population. The World Health Organization reports that China and India are seeing significant increases in asthma and COPD cases. Governments in the region are heavily investing in healthcare infrastructure, improving access to treatments. China’s respiratory drug market, valued at USD 3.5 billion in 2020, is growing rapidly, with inhalable drug delivery systems becoming more accessible. Additionally, the cost-effectiveness of non-smart inhalers, such as those used for asthma management, is boosting their demand in countries like India, where affordability is a key concern.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

-

Respimat Soft Mist Inhaler

-

Spiriva Respimat

-

-

Novartis

-

Breezhaler

-

Ultibro Breezhaler

-

-

GlaxoSmithKline (GSK)

-

Ellipta

-

Ventolin

-

-

-

Symbicort Turbuhaler

-

Pulmicort

-

-

Merck & Co.

-

ProAir HFA

-

Pulmicort Flexhaler

-

-

Teva Pharmaceutical Industries

-

ProAir RespiClick

-

Qvar RediHaler

-

-

Mylan (now part of Viatris)

-

Aeroshot

-

Breztri Aerosphere

-

-

Hovione

-

Hovione Inhalation Products

-

-

Cipla

-

Cipla Respules

-

Seroflo

-

-

Respirics, Inc.

-

Respirics Inhalers

-

-

Vectura Group

-

Innovative Inhalation Formulations

-

Flutiform

-

-

Baxter International

-

Baxter Nebulizers

-

-

F. Hoffmann-La Roche Ltd

-

Pulmozyme

-

-

Chiesi Farmaceutici

-

Foster

-

Trimbow

-

-

Schering-Plough (now part of Merck)

-

Asmanex Twisthaler

-

Recent Developments

MannKind reported the top-line results from its Phase 4 INHALE-3 study in Oct 2024, comparing inhaled insulin with traditional delivery methods over 30 weeks. The results of the study are important to understand the effectiveness of inhaled insulin for the treatment of diabetes.

In April 2024, Bespak separated its business of inhaled and nasal drug delivery from Recipharm. This is the final major step in the strategy of focusing on core areas of Bespak, which would strengthen its position in the drug delivery sector.

In Jan 2023, VERO Biotech Inc. secured FDA approval for its newly developed third-generation tankless iNO delivery system. This highly innovative system has been designed specifically for use in neonatal intensive care and acute care hospitals as an advancement of respiratory treatment technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.37 Billion |

| Market Size by 2032 | USD 3.81 Billion |

| CAGR | CAGR of 4.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), Nebulizers, Soft Mist Inhalers (SMIs)] • By Technology [Smart Inhalers, Non-Smart Inhalers] • By Therapeutic Application [Respiratory Diseases, Infectious Diseases, Diabetes Management, Other Therapeutic Applications] • By End-User [Hospitals and Clinics, Home Care Settings, Ambulatory Surgical Centers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boehringer Ingelheim, Novartis, GlaxoSmithKline (GSK), AstraZeneca, Merck & Co., Teva Pharmaceutical Industries, Mylan (now part of Viatris), Hovione, Cipla, Respirics, Inc., Vectura Group, Baxter International, F. Hoffmann-La Roche Ltd, Chiesi Farmaceutici, and Schering-Plough (now part of Merck) |