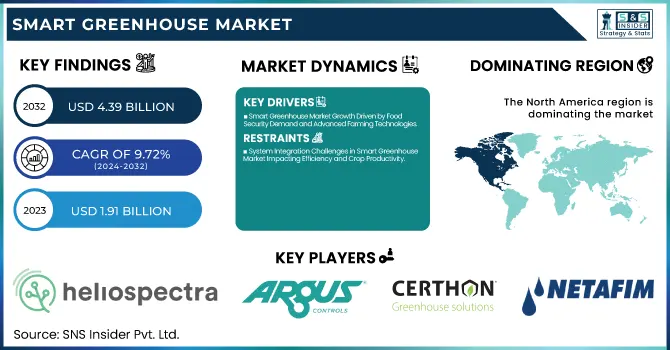

Smart Greenhouse Market Size & Trends:

The Smart Greenhouse Market Size was valued at USD 1.91 Billion in 2023 and is expected to reach USD 4.39 Billion by 2032 and grow at a CAGR of 9.72% over the forecast period 2024-2032. The growth of the Smart Greenhouse Market is driven by improvement in many key metrics. Operational metrics focus on maximizing energy efficiency, conserving water, and managing the climate for ideal performance. Technology-driven production and crop metrics highlight system robustness, which translates to better yield consistency, reduced crop cycles, and overall plant health.

To Get more information on Smart Greenhouse Market - Request Free Sample Report

Metrics used in Innovation & R&D–show the pace of advancements in LED lighting, AI-based monitoring, and sensors that can enhance productivity. On the other hand, automation & control system metrics monitor the adoption of IoT devices, drone-assisted irrigation, and remote monitoring systems, optimizing environmental regulation and minimizing the need for manual processes and thereby improving greenhouse efficiency and quality of produce output.

Smart Greenhouse Market Dynamics

Key Drivers:

-

Smart Greenhouse Market Growth Driven by Food Security Demand and Advanced Farming Technologies

The demand for food security is boosting the smart greenhouse market, along with the increasing requirement for automated farming solutions. However, smart greenhouses provide a controlled environment that can help improve yield, quality, and year-round production of crops which has crude importance in times when climate change is severely impeding conventional agriculture methods. With increasing numbers of global population and decreasing arable land, farmers are driven to use smart technologies to optimize the usage of water, fertilizers, and energy. Furthermore, the use of IoT, Artificial Intelligence monitoring systems, and highly-sensitized automation is transforming greenhouses with real-time remote monitoring and delivery of temperature, humidity, and lighting. This factor as well as the rising popularity of hydroponics and vertical farming further drive the growth of the market, as hydroponics and vertical farming are gaining momentum in urban regions with less space.

Restrain:

-

System Integration Challenges in Smart Greenhouse Market Impacting Efficiency and Crop Productivity

System integration is still one of the major intricacies in the smart greenhouse market. Smart greenhouse solutions frequently necessitate the integration of hardware elements such as sensors, HVAC systems, and irrigation controls with sophisticated software foundations. Meeting device compatibility, and then getting data to sync between the systems can prove to be a technical challenge, particularly for growers who may not have a great deal of technical aptitude. Also, dealing with maintaining and troubleshooting these interlinked systems can be difficult, which creates a risk of downtime that can affect crops and their harvests directly.

Opportunity:

-

Analytics and Cloud Integration Unlock Growth Opportunities in the Expanding Smart Greenhouse Market

Integration of analytics and cloud computing gadgets with intelligent greenhouse answers represents a primarily commercial enterprise possibility inside the market. These innovations give growers access to useful insights into their crops, anticipate trouble spots, and help automate irrigation cycles. Additionally, growth opportunities lie in government initiatives for sustainable agriculture and renewable energy integration. Several emerging economies are also adopting smart greenhouse technologies for food production, fuelling enormous opportunities for solution providers. As technology continues to progress, harnessing the power of AI, robotics, and machine learning in this growing sector will realize even more opportunities.

Challenges:

-

Skilled Labor Shortage and Security Risks Challenge Smart Greenhouse Adoption and Operational Stability

A big challenge is the need for expert high-skilled labor to supervision and manage smart image of greenhouses systems. The new automation tools, sensors from IoT, and AI-oriented solutions require a specialized level of technical knowledge from the workforce. This skill gap can inhibit adoption in areas with agricultural practices that are still largely traditional. In addition, environmental factors like bad weather, power failure, or system cost may prevent the greenhouse from operating properly which can lead to a high loss of crops. Another development is data security when systems are connected to clouds, hackers can try to access the greenhouse control systems and other sensitive agricultural data. Addressing these challenges will take more meaningful investment in simple-to-use technology, effective training programs, and strong institutional cybersecurity.

Smart Greenhouse Market Segments Analysis

By Type

Hydroponics was the most prominent smart greenhouse type with a 56.4% market share in 2023. The reason for this dominance is that it produces the maximum yield of crops, with very little water and space. Due to high control of nutrients, pH level, and environment, Hydroponic systems have faster growth and high productivity. The ascendancy of consumer demand for pesticide-free, organic fruits, and vegetables has also been a factor in driving the adoption of hydroponic greenhouses.

Non-hydroponics systems are projected to register the fastest CAGR from 2024-2032. The growth of these farms is facilitated by the fact that they generally have lower setup complexity than aquaponics, making them more accessible to both traditional farmers and small-scale growers. However, non-hydroponic systems are being embraced in some areas, where water savings are not as important and soil cultivation practices are still commonplace. This awareness in consideration of the advantages of smart greenhouse technology will increase overall, across traditional farming disciplines, in non-hydroponics adopting elements, which will enable non-hydroponics adoption to accelerate.

By Material Type

Polyethylene led the smart greenhouse market, with a share of 61.8% in 2023. Polyethylene continues to lead this segment due to its low cost, low weight, and good UV resistance making it well suited as as greenhouse coverings. The reason for its use in commercial and small-scale setups as well is due to its flexibility and easy installation. Polyethylene sheets also serve as effective diffusers of light, ensuring an even growth of all plants.

Polycarbonate is anticipated to have the highest CAGR between 2024 and 2032. Polycarbonate is a preferred material for modern greenhouses as it offers better durability, impact resistance, and insulation than fiberglass. The capacity to retain heat offers good energy efficiency and helps to lower running costs. Continued adoption of new materials, especially polycarbonate, by growers to improve crop yield with extended growing seasons will create lucrative opportunities for the polycarbonate market over the next few years.

By Offering

In 2023, hardware dominated the smart greenhouse market, garnering 73.8% of the total smart greenhouse market share. The high demand for key components like HVAC systems, LED grow lights, irrigation systems, and sensors generates this dominance. These hardware components are essential to providing and maintaining an optimal environment, creating efficiencies as resources are used, as well as upgrading crop yields. In addition to this, hardware investments in smart greenhouse setups were also driven by the increasing uptake of automation tools.

From 2024 to 2032, software & services are expected to grow at the fastest rate. Determinants are also prompting the adoption of advanced greenhouse management platforms including the rising need for data-driven analyses, predictive analytics, and remote assessment of plants grown in greenhouses. They help growers monitor environmental conditions, automate irrigation, and use resources more efficiently. With growing interest among farmers for precision farming tools, there will be a potently high growth rate for the software & services segment.

By Component

The HVAC systems in the smart greenhouse market in 2023 accounted for the highest share of 42.9% of the total smart greenhouse market share. The HVAC system is, therefore, the most significant component in maintaining the greenhouse and, thus, is expected to maintain its dominance. HVAC systems significantly improve plant growth because they control a stable environment which is essential for crops, particularly in places with harsh weather. They are critical for large-scale commercial greenhouses because of their ability to control airflow, minimize heat stress, and improve air quality.

LED grow lights are projected to register the fastest CAGR from 2024-2032. The increased adoption of these lights can be attributed to their energy efficiency, long lifetime, and the fact that they can provide specific light spectrums for each species of plant. This segment will grow at a fast pace owing to the multiple advantages it offers such as improved crop quality, shorter growth cycles, and low energy costs, which is pushing growers to opt for LED solutions.

By End Use

In 2023, commercial growers occupied the leading share of the smart greenhouse market, estimating the total share to about 57.3%. This dominance is propelled by large-scale agricultural operations backed by smart greenhouse technology to enhance crop yield, quality, and year-round production. This contributes to the market-leading position of commercial growers who are increasingly adopting automated systems, sensors, and climate control solutions for resource optimization and productivity improvement purposes.

The fastest CAGR during the forecast period 2024-2032 is expected to be in Research & educational institutes. There is an upward trend in investments in agricultural research, the development of sustainable farming methods, and improved cultivation techniques driving this segment's growth. Many institutes are using smart greenhouse setups to experiment with various crop types, develop more climate-resilient varieties, and study new farming methods. This segment is expected to grow considerably in the next few years as consumers are increasingly showing demand for sustainable agriculture.

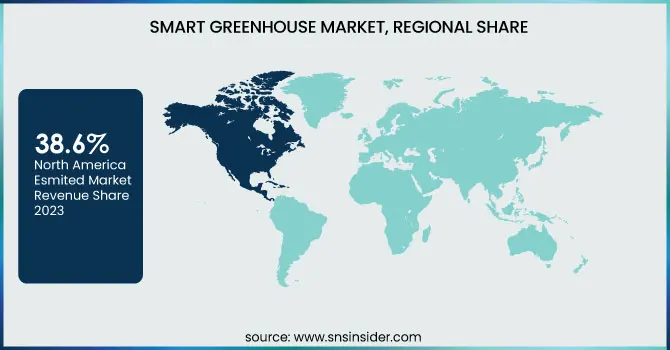

Smart Greenhouse Market Regional Outlook

North America is estimated to hold a market share of 38.6% in the smart greenhouse market in the year 2023. Factors like higher concentration in advanced agricultural technologies, augmented investment in controlled environment agriculture (CEA), and growing organic demand would drive this dominance in the region. North America with its- big-scale greenhouse that is relaxed through automated climate control, irrigating systems, and sensor-based monitoring, the United States and Canada play important roles. As a working example, AppHarvest is one of the largest U.S.-based agri-tech firms, and in the heart of Kentucky powers one of the largest smart greenhouse facilities in the country using AI-enhanced systems to help maximize crop output. In a similar vein, BrightFarms utilizes controlled environment methods to grow fresh, chemical-free greens sold closer to home.

The Asia Pacific region is anticipated to garner the highest CAGR during the forecast period of 2024-2032, owing to the growing population leading to rising food demand, and initiatives by governments in promoting smart agriculture. Greenhouse technologies are emerging at a rapid rate among nations such as China, Japan, and India to provide food security while minimizing reliance on conventional agriculture. In Japan, Spread Co., Ltd. operates sophisticated vertical farming facilities that employ intelligent greenhouse technologies to produce leafy greens. China will have to bring massive hydroponics and smart greenhouse solutions and new technology from companies such as SananBio will help get higher yields to satisfy the food needs of its cities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Greenhouse Market are:

-

Heliospectra AB (MITRA LED)

-

Argus Control Systems Ltd. (Titan Controls)

-

Rough Brothers Inc. (Greenhouse Systems)

-

Certhon (Greenhouse Automation)

-

Greentech Agro LLC (Growtainer)

-

Netafim (Drip Irrigation Systems)

-

LumiGrow Inc. (TopLight)

-

Hort Americas (Grow Lights)

-

Cultivar Ltd. (Smart Controller)

-

Nexus Corporation (Glazing Systems)

-

Priva (Climate Control Systems)

-

Autogrow Systems Ltd. (IntelliDose)

-

Sensaphone (Sentinel Monitoring)

-

GreenTech Solutions Group (Smart Sensors)

-

Agrilution (Plantcube)

Recent Trends

-

In December 2024, Heliospectra launched a dynamic multi-channel LED lighting solution designed to enhance precision crop growth, improve yields, and boost energy efficiency in smart greenhouses and controlled environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.91 Billion |

| Market Size by 2032 | USD 4.39 Billion |

| CAGR | CAGR of 9.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hydroponics, Non-hydroponics) • By Material Type (Polyethylene, Polycarbonate, Other) • By Offering (Hardware, Software & Services) • By Component (HVAC Systems, LED Grow Lights, Control Systems & Sensors) • By End Use (Commercial Growers, Research & Educational Institutes, Retail Gardens, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Heliospectra AB, Argus Control Systems Ltd., Rough Brothers Inc., Certhon, Greentech Agro LLC, Netafim, LumiGrow Inc., Hort Americas, Cultivar Ltd., Nexus Corporation, Priva, Autogrow Systems Ltd., Sensaphone, GreenTech Solutions Group, Agrilution. |