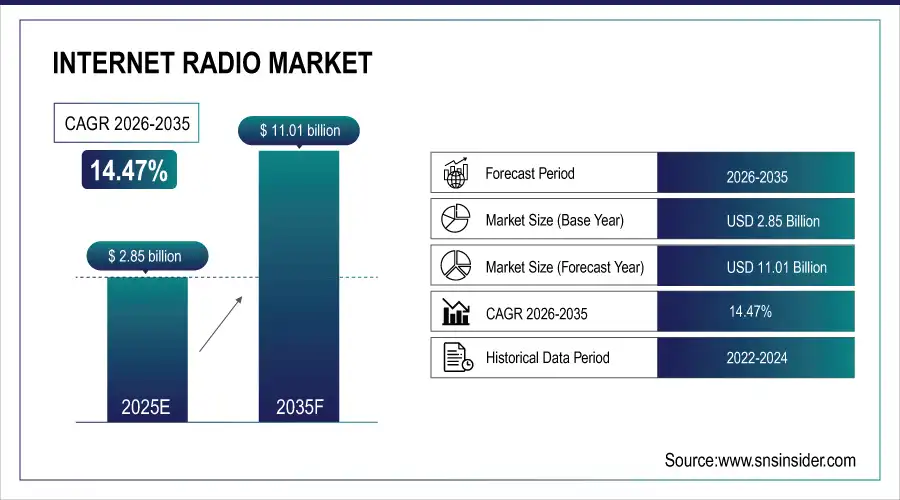

Internet Radio Market Size & Growth:

The Internet Radio Market size was valued at USD 2.85 Billion in 2025 and is projected to reach USD 11.01 Billion by 2035, growing at a CAGR of 14.47% during 2026-2035.

The Internet Radio market is experiencing robust growth, driven by increasing consumer demand for personalized, on-demand audio content and the widespread adoption of smart devices. Technological advancements, such as AI-powered recommendation engines, seamless mobile integration, and voice-activated platforms, are enhancing user experiences and expanding reach across demographics. Advertisers are shifting budgets toward digital audio channels, capitalizing on targeted ad capabilities and growing listener engagement, especially across genres like podcasts, music, and talk shows. As subscription-based models gain traction and global digital infrastructure improves, internet radio is evolving into a mainstream entertainment medium.

Internet Radio Market Size and Forecast:

-

Market Size in 2025: USD 2.85 Billion

-

Market Size by 2035: USD 11.01 Billion

-

CAGR: 14.47% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Internet Radio Market - Request Free Sample Report

Key Trends in the Internet Radio Market:

-

Rapid growth in smartphone penetration and high-speed mobile internet connectivity driving increased adoption of internet radio services.

-

Rising consumer preference for on-demand and personalized audio content, including customized playlists and genre-specific radio stations.

-

Integration of artificial intelligence and machine learning for content recommendation, audience targeting, and personalized advertising.

-

Increasing popularity of smart speakers, connected cars, and IoT-enabled devices supporting seamless internet radio streaming.

-

Growth of programmatic and targeted audio advertising, enabling advertisers to reach specific listener segments more effectively.

-

Expansion of cloud-based streaming platforms improving scalability, content delivery quality, and global reach for internet radio providers.

-

Strategic partnerships between internet radio platforms, music labels, podcast creators, and automotive OEMs to enhance content offerings and distribution channels.

February 4, 2025 — Spotify Reports First Full-Year Operating Profit of €1.3B in FY24 Following Year of Record Growth Surge Driven by 263M Premium Subscribers

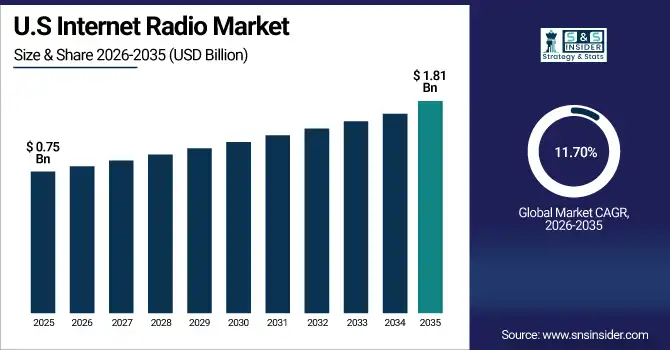

The U.S Internet Radio Market size was valued at USD 0.75 Billion in 2025 and is projected to reach USD 1.81 Billion by 2035, growing at a CAGR of 11.70% during 2026-2035. Factors such as rise in adoption of smart devices, demand for personalized and on-demand audio content, and expanding role of digital advertising drive the growth of the Internet radio market. The rise of recommendations by AI and podcasts popularity also enhance U.S. growth trending up strongly. Internet Radio landscape.

The Internet Radio market trends such as the rapid rise of podcasts and talk shows, AI-driven personalization, and growing integration with smart devices like speakers and connected cars. Mobile-first consumption continues to dominate, especially among younger users, while subscription-based models are gaining popularity for ad-free experiences. Programmatic audio advertising is enhancing targeting precision and ROI for brands. Additionally, content diversification across genres and languages is expanding listener bases. As platforms scale globally, data privacy, exclusive content deals, and creator-led programming are becoming crucial for user trust and platform differentiation.

Internet Radio Market Drivers:

-

AI-Driven Personalization Fuels Subscriber Growth and Market Expansion in Internet Radio

The Internet Radio market is being driven by the rapid expansion of global subscriber bases and the rising demand for personalized audio streaming experiences. With number of people searching for personalized content increasing, platforms started to use AI and machine learning to provide them playlists and recommendations which further improves user engagement. This type of personalization lends itself to a greater degree of listener loyalty and time spent on the platforms, and eventually progression from free to paying customers. That, in turn, allows service providers to spend more on exclusive content, better user interface, and cross-compatible availability. This breeding ground of better personalization driving subscriber growth and then reinvestment into quality of service is a sine qua non for the continued growth of the Internet Radio market and competition across user segments.

Spotify has 456 million monthly active users and 195 million subscribers worldwide, making it a formidable competitor for Pandora. Although Pandora excels at guiding its listeners to discover new music and tailoring radio stations, Spotify could argue that it has a moat when it comes to its massive library of contents, its freemium model, and its social features for onboarding and retention.

Internet Radio Market Restraints:

-

Ad-Saturation and Licensing Costs Restrict Internet Radio Market Scalability

A major restraint in the Internet Radio market is the growing saturation of audio advertisements, which can negatively affect user experience and lead to listener fatigue. Retention is difficult as free-tier users are bombarded with the same annoying ads over and over again with many of these platforms having an ad-free or ad-lite alternatives. Furthermore, the high costs of music licensing and music royalty’ puts enormous financial strain on service providers, making it nearly impossible to achieve profitability or scale. Such licensing requirements are usually an obstacle for smaller players who want to enter or expand in the market. Bring those two together—ad excess and climbing operating expenses—and you end up in a vicious cycle where unhappy users and squeezed margins cause underinvestment in innovation, which, in turn, slows, market expansion and platform competitiveness.

Internet Radio Market Opportunities:

-

Digital Broadcasting Expansion Creates New Revenue Streams and Innovation Potential

The transition from analog to digital broadcasting presents strong market opportunities in the Internet and radio broadcasting sectors. Digital radio standards facilitate improved audio quality, spectrum efficiency, and the capacity for value-added services such as metadata, emergency alerts, and multilingual radio. This creates new monetization opportunities for broadcasters and stimulates consumer demand for supporting devices such as automotive infotainment systems and portable radios. It also allows for domestic innovation circular the manufacture of receivers and related infrastructure, strengthening local supply chains. Digital broadcasting also allows for greater geographic reach and access to areas that need more service. Digital capabilities deliver a competitive edge as user expectations shift, resulting in audience growth for new digital offerings and an opportunity for long-term market growth across media and technology environments.

China adopts standard for AM and shortwave bands and moves to national dual analog-digital radio infrastructure build out This strategic initiative enables improved coverage in particular in the eastern provinces and within the growing automotive and industry stakeholder base.

Internet Radio Market Challenges:

-

Technical Limitations and Adoption Barriers Hinder Digital Radio Market Penetration

The Internet and digital radio broadcasting market faces key challenges that limit its full-scale adoption. High infrastructure costs for upgrading transmitters and building compatible networks pose a financial burden, especially in rural or low-income regions. Limited availability of affordable DRM-enabled consumer devices and lack of public awareness hinder user uptake. Technical barriers, such as signal interference and coverage inconsistencies in dense urban or remote areas, further impact service quality. Additionally, regulatory fragmentation and slow industry alignment on global standards delay uniform implementation. These challenges create a cycle where limited adoption discourages investment, and weak infrastructure reduces user appeal, ultimately slowing the pace of digital radio transformation and its potential benefits to broadcasters and listeners alike.

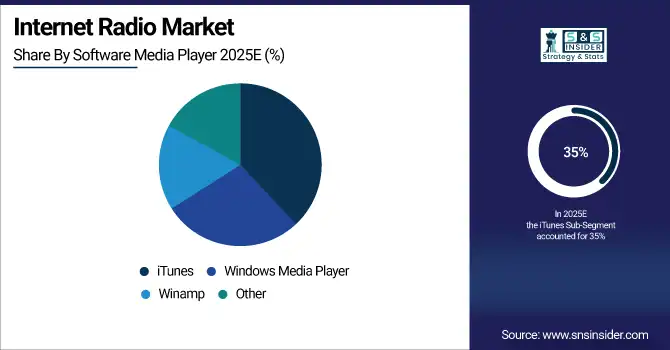

Internet Radio Market Segmentation Analysis:

By Software Media Player, iTunes Segment Dominates Internet Radio Market with 35% Share in 2025, Others Segment to Record Fastest Growth with 17.70% CAGR

The iTunes segment held a dominant share of approximately 35% in 2025, driven by strong brand loyalty, seamless integration with Apple’s ecosystem, and a curated content experience. Its extensive existing user base, premium audio quality, and personalized playlists continue to attract listeners seeking reliable and device-integrated internet radio services. The dominance of iTunes reflects a consumer preference for trusted platforms that offer consistent performance and high-quality streaming experiences.

The Others segment is expected to experience the fastest growth in the Internet Radio Market over 2026–2035, registering a CAGR of 17.70%. This growth is fueled by the rapid emergence of new streaming platforms, niche content providers, and region-specific services catering to diverse audience preferences. Flexible pricing models, localized content offerings, and modern user interfaces are appealing to younger, tech-savvy listeners, reflecting the market’s shift toward platform and content innovation.

By Device Support, PC Segment Leads Internet Radio Market with 28% Share in 2025, Smart Devices Segment to Grow at Fastest CAGR of 16.44%

The PC segment accounted for approximately 28% of the market share in 2025, supported by its widespread use in workplaces and home environments. PCs remain a preferred device for listeners who value multitasking capabilities, stable Wi-Fi connectivity, and web-based streaming platforms. Integration with desktop applications and browser-based radio services continues to sustain consistent user engagement within this segment.

The Smart Devices segment is projected to witness the fastest growth in the Internet Radio Market during 2026–2035, with a CAGR of 16.44%. Widespread adoption of smartphones, smart speakers, and wearable devices, along with growing demand for voice-activated and on-the-go streaming, is driving segment expansion. Advancements in AI assistants, seamless app connectivity, and improved affordability of smart devices are enhancing user accessibility and convenience, reinforcing the market’s shift toward mobile-first consumption.

By Advertiser Type, Insurance Segment Dominates with 24% Share in 2025, Media & Entertainment Segment to Record Fastest Growth with 21.04% CAGR

The Insurance segment held approximately 24% of the Internet Radio Market share in 2025, driven by the effectiveness of targeted digital audio advertising and measurable return on investment. Insurance companies increasingly leverage internet radio platforms to deliver personalized, contextually relevant audio ads that reach consumers during daily activities, resulting in higher engagement and conversion rates.

The Media & Entertainment segment is expected to grow at the fastest pace over 2026–2035, with a CAGR of 21.04%. Rising demand for music streaming, podcasts, live shows, and celebrity-driven content is attracting significant advertising investments. Enhanced mobile access, social media integration, and evolving consumer habits toward on-demand entertainment continue to support strong growth in this segment.

By Content Genre, Music Segment Leads Internet Radio Market with 34% Share in 2025, Talk Shows & Podcasts Segment to Grow at Fastest CAGR of 21.04%

The Music segment accounted for approximately 34% of the market share in 2025, driven by high listener engagement, growing demand for diverse music genres, and the convenience of on-demand streaming. Internet radio platforms continue to prioritize music content through curated playlists, algorithm-driven recommendations, and exclusive artist releases, attracting large global audiences.

The Talk Shows & Podcasts segment is anticipated to register the fastest growth over the 2026–2035 period, with a CAGR of 21.04%. Increasing consumer interest in personalized, niche audio content, improved accessibility through mobile platforms, and growing investments in exclusive podcast production are key growth drivers. Compelling storytelling formats and influential creators are enhancing listener retention and expanding the role of spoken-word content within the evolving digital audio ecosystem.

Internet Radio Market Regional Insights:

North America Dominates Internet Radio Market in 2025

In 2025, North America accounted for approximately 44% of the Internet Radio Market revenue, driven by high digital adoption, robust broadband infrastructure, and widespread smartphone usage. The presence of leading internet radio platforms such as Pandora and iHeartRadio has significantly strengthened regional market performance. Additionally, advanced multichannel advertising monetization models and a mature listener base transitioning from traditional live radio to streaming services continue to support sustained market growth across the region.

The United States leads the North American market, supported by strong advertiser demand, a well-developed digital ecosystem, and high consumer engagement with personalized and on-demand audio content.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the Fastest-Growing Region in the Internet Radio Market

Asia-Pacific is expected to witness the fastest growth in the Internet Radio Market over 2026–2035, registering a projected CAGR of 16.25%. This rapid expansion is driven by rising smartphone penetration, increasing internet accessibility in rural and semi-urban areas, and a large young population with a strong preference for on-demand audio content. Government investments in digital infrastructure and the growing popularity of local-language streaming platforms are further accelerating market growth.

China, India, and Southeast Asian countries are key contributors to regional expansion, supported by the integration of internet radio services with smart devices, connected cars, and voice assistants. The rise of regional content providers is also boosting listener engagement across emerging economies.

Europe Internet Radio Market Insights, 2025

In 2025, Europe emerged as a promising region in the Internet Radio Market, supported by strong regulatory frameworks promoting digital broadcasting and high broadband penetration. Growing demand for personalized audio content, along with increased adoption of smart speakers and connected vehicles, has enhanced consumer interaction and market expansion.

Countries such as the United Kingdom, Germany, and France are leading the European market, driven by multilingual platforms, advanced digital infrastructure, and increasing consumer preference for streaming-based radio services.

Latin America and Middle East & Africa Internet Radio Market Insights

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Internet Radio Market, fueled by increasing mobile internet penetration and the widespread adoption of internet-connected smartphones. Growing popularity of streaming platforms among younger audiences, combined with improving digital infrastructure and expanding availability of local content, is supporting regional market development.

Brazil and Mexico are key growth markets in LATAM, while South Africa and Gulf countries are driving adoption in the MEA region. Rising advertiser interest and favorable digital consumption trends are expected to further contribute to market expansion across these emerging regions.

Internet Radio Market Companies are:

-

Spotify Technology S.A.

-

Apple Inc. (Apple Music / iTunes Radio)

-

Amazon.com, Inc. (Amazon Music)

-

Alphabet Inc. (YouTube Music / Google Radio features)

-

iHeartMedia, Inc. (iHeartRadio)

-

Sirius XM Holdings Inc.

-

Pandora Media LLC

-

TuneIn Inc.

-

LiveXLive Media Inc.

-

Deezer S.A.

-

Audacy, Inc.

-

AccuRadio LLC

-

Jango.com, Inc.

-

Somafm.com, LLC

-

Radio.co

-

RadioIO (Radioio)

-

Simplecast

-

Podbean

-

Acast

-

DI.FM

Competitive Landscape of the Internet Radio Market:

Spotify Technology S.A.

Spotify Technology S.A. is a Sweden-based global leader in music streaming and internet radio services, offering personalized playlists, on-demand content, and algorithm-driven recommendations. The company specializes in ad-supported and premium subscription models, enabling users to access high-quality music, podcasts, and radio stations across multiple devices. Its role in the Internet Radio Market is pivotal, providing scalable streaming infrastructure and personalized audio experiences to millions of listeners worldwide.

-

In 2024, Spotify expanded its podcast and internet radio offerings, integrating AI-driven content recommendations and enhancing targeted audio advertising capabilities.

Apple Inc. (Apple Music / iTunes Radio)

Apple Inc., based in the U.S., operates Apple Music and iTunes Radio, providing a curated and premium internet radio experience. The platform leverages its strong ecosystem of Apple devices to offer seamless integration, personalized playlists, and exclusive content. Its role in the Internet Radio Market is substantial, attracting loyal users and supporting monetization through subscriptions and advertising.

-

In 2024, Apple Music and iTunes Radio enhanced personalized playlist algorithms and regional content availability, increasing engagement across global markets.

Amazon.com, Inc. (Amazon Music)

Amazon.com, Inc., headquartered in the U.S., offers Amazon Music, a platform combining on-demand streaming, internet radio, and personalized audio content. The company integrates its streaming services with Alexa-enabled smart devices, allowing voice-controlled access to internet radio and playlists. Its role in the Internet Radio Market is significant, enabling enhanced consumer convenience and promoting ad-supported and subscription-based revenue models.

-

In 2024, Amazon Music expanded its curated radio stations and launched new AI-driven recommendation features for seamless listener experiences across smart speakers and mobile apps.

Alphabet Inc. (YouTube Music / Google Radio features)

Alphabet Inc., the U.S.-based parent company of Google, operates YouTube Music and Google’s internet radio services, offering streaming music, live radio stations, and personalized playlists. The platform leverages Google’s AI and search capabilities to deliver highly personalized content, targeting specific listener preferences and demographics. Its role in the Internet Radio Market is critical, providing global reach, advanced recommendation engines, and integration across Android devices and Google Assistant.

- In 2024, YouTube Music expanded its internet radio playlists, live streaming content, and personalized recommendation algorithms to increase user engagement and monetization opportunities.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.85 Billion |

| Market Size by 2035 | USD 11.01 Billion |

| CAGR | CAGR of 14.47% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software Media Player(iTunes, Windows Media Player, Winamp and Others) • By Device Support(PC, Laptop, Tablet, Smart Device and Other Devices) • By Advertiser Type(Insurance, Travel and Airlines, Restaurant, Consumer Electronics, Media and Entertainment and Others) • By Content (Genre, News, Music, Sports, Talk Shows & Podcasts, Educational, Religious and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Internet Radio Market Companies are CBS Corporation, Citadel Broadcasting, Chrysalis Group, Pandora Media Inc., TuneIn Inc., Slacker Radio, SomaFM, Napster, Spotify, Aspiro AB, iHeartMedia, Audacy Inc., SiriusXM, Radio.com, AccuRadio, Jango, Rdio, BBC Sounds, Mixcloud, CBS Corporation, Live365. and Others. |