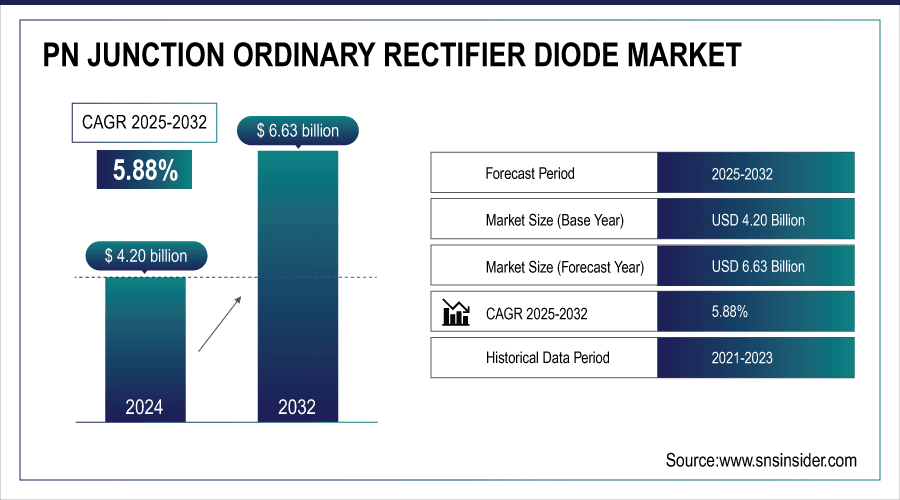

PN Junction Ordinary Rectifier Diode Market Size Analysis:

The PN Junction Ordinary Rectifier Diode Market size was valued at 4.20 Billion in 2024 and is projected to reach USD 6.63 Billion by 2032, growing at a CAGR of 5.88% from 2025 to 2032.

The PN Junction Ordinary Rectifier Diode market is witnessing consistent growth, fueled by increasing demand in sectors such as consumer electronics, automotive, and industrial applications. These diodes are crucial for converting alternating current (AC) to direct current (DC), making them indispensable in power supplies, battery charging systems, and signal demodulation processes. Their reliability and efficiency in handling power conversion tasks make them essential in various electronic devices and systems. As industries continue to expand their reliance on electronic components, particularly in power management and conversion, the market for PN junction rectifier diodes is expected to grow steadily. This trend is further supported by the rising adoption of electric vehicles and the ongoing development of advanced industrial technologies.

To Get More Information On PN Junction Ordinary Rectifier Diode Market - Request Free Sample Report

Infineon Technologies has launched the CoolGaN G5, the world’s first GaN power transistor with an integrated Schottky diode, enhancing power system efficiency by reducing dead-time losses. This innovation simplifies design and cuts costs, ideal for applications like DC-DC converters and motor drives.

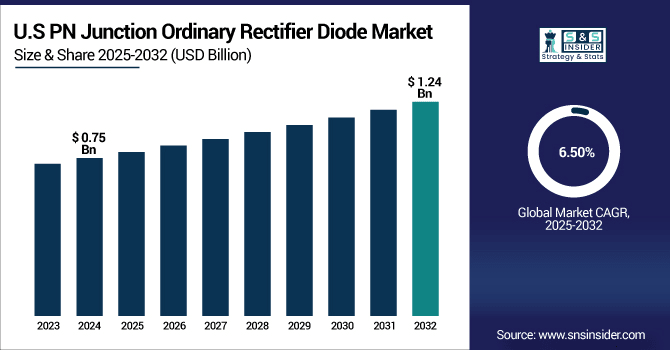

The U.S. PN Junction Ordinary Rectifier Diode market share, valued at USD 0.75 billion in 2024, is projected to reach USD 1.24 billion by 2032, growing at a 6.50% CAGR. The U.S. PN Junction Ordinary Rectifier Diode market is expanding due to rising demand for efficient power conversion, circuit protection, and cost-effective rectification in electronics, EVs, and renewable energy systems.

PN Junction Ordinary Rectifier Diode Market Dynamics:

Drivers:

-

Advancements in Power Electronics Driving Efficiency and Simplification in Modern Energy Systems

Advancements in power electronics are accelerating the market for high-performance components like GaN transistors and rectifier diodes, driven by the demand for higher efficiency, smaller sizes, and enhanced reliability. Industries, including telecommunications, automotive, and industrial sectors, are increasingly focused on reducing power losses and improving system performance. Innovations such as high-performance heterojunction PN diodes facilitate better power conversion and management, addressing the growing need for energy-efficient solutions. The integration of Schottky diodes in GaN devices simplifies power systems, cutting costs and complexity. These breakthroughs are positioning advanced power components as key drivers in the evolution of modern electronics and energy systems.

A breakthrough in high-performance electronics has led to the development of diamond/ε-Ga2O3 heterojunction pn diodes, offering an on-off ratio exceeding 108, a breakdown voltage over 3,000 V, and advanced thermal management. Utilizing ultrawide bandgap semiconductors, these diodes overcome doping limitations, enhancing efficiency and durability in ultra-high-power applications.

Restraints:

-

Market Restraints in the PN Junction Ordinary Rectifier Diode Market due to Edge Current-Induced Failure

Reverse leakage current at the junction’s edge contributes to material degradation and device failure, particularly in high-voltage diodes and power MOSFETs. This issue poses a challenge for manufacturers aiming to enhance the reliability of these components, especially in high-temperature environments. As a result, the performance and longevity of traditional PN junction diodes in power systems may be limited, restricting their widespread adoption in high-performance applications.

The study on edge current-induced failure in semiconductor PN junctions, published in the Microelectronics Reliability journal, outlines how reverse leakage current at the junction's edge contributes to device breakdown under high-voltage operation. This leakage is particularly significant at temperatures exceeding 150°C, leading to material degradation and failure, especially in high-voltage diodes and power MOSFETs.

Opportunities:

-

Rising Demand for Energy-Efficient Components Creates Opportunities for PN Junction Diodes

The increasing global emphasis on energy efficiency across industries particularly in consumer electronics, automotive systems, and industrial applications is creating significant opportunities for PN junction diodes. These diodes play a vital role in AC to DC conversion and power regulation, offering low power losses and reliable performance. As devices become more compact and power-dense, the need for efficient and thermally stable components has intensified. Their cost-effectiveness and proven reliability make them well-suited for integration into next-generation systems focused on sustainability and reduced power consumption

ROHM produces various diode types, such as Zener diodes for voltage regulation and Schottky barrier diodes for high-speed switching, catering to diverse electronic applications.

Challenges:

-

Impact of Raw Material Volatility on the Cost-Efficiency of PN Junction Diodes

The PN junction ordinary rectifier diode market faces rising challenges due to fluctuating raw material costs, particularly silicon and other semiconductor-grade materials. These cost variations disrupt supply chain predictability and raise manufacturing expenses, directly impacting profit margins. With increasing global demand for high-performance electronic components, suppliers often struggle to maintain consistent pricing, especially amid geopolitical tensions and resource scarcity. This economic pressure can deter small and medium manufacturers, reduce competitiveness, and hinder the scalability of production. Additionally, efforts to meet sustainability standards or shift to alternative eco-friendly materials can further inflate production costs, thereby affecting the overall cost-efficiency and market growth of traditional PN junction diodes.

PN Junction Ordinary Rectifier Diode Market Segmentation Overview:

By Product Type

Schottky rectifier diodes are expected to hold a dominant PN Junction Ordinary Rectifier Diode Market share of 45% in 2024, owing to its high power conversion efficiency, ability of switching at high frequency and low forward voltage drop. Compared with normal PN junction diodes, the Schottky diodes have high speed respond and lower forward voltage, so it is widely used in applications that require quick-switching power and low power consumption, such as power supply, automotive electronics, telecommunication.

The Fast Recovery Rectifier Diodes segment is expected to experience significant growth from 2025 to 2032, with a projected CAGR of 7.69%. This growth is driven by increase in their popularity, as they can turn on and turn off very quickly when turned into reverse voltage and have a fast recovery during conduction cycle, which suits its application in high frequency system like power supplies and automotive, and industrial systems. Their increased adoption to reduce power loss and enhance efficiency in fast switching circuits is accelerating the demand in industries, resulting in its progressive growth.

By Application

The Consumer Electronics segment is projected to hold the largest PN Junction Ordinary Rectifier Diode Market share, accounting for 30% of the market in 2024. This growing integration of the PN junction rectifier diodes in smart phones, laptops, and other electronic gadgets is powering this trend. These diodes are essential for cost-effective power conversion and circuit protection to enhance overall performance and energy efficiency for the consumer electronics industry. And as more and more people come to appreciate the benefits of small, low power devices, this portion is expected to continue to grow.

The automotive segment is expected to witness significant growth from 2025 to 2032 with CAGR 7.69%, owing to burgeoning utilization of PN junction rectifier diodes in electric vehicles (EVs), advanced driver-assistance systems (ADAS), and power control units. These diodes serve an important purpose in improving vehicle efficiency, safety and performance.

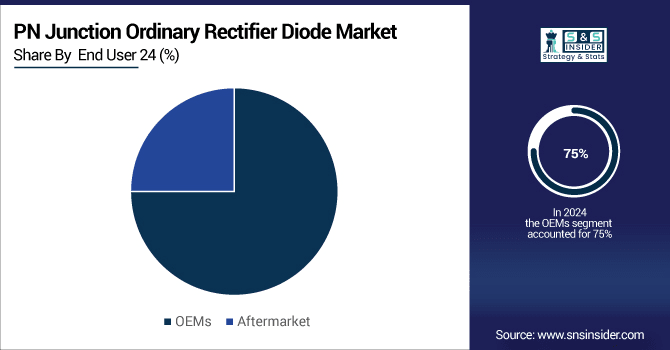

By End User

The OEMs (Original Equipment Manufacturers) segment is to capture the largest PN Junction Ordinary Rectifier Diode Market share of approximately 75% in 2024. This dominance is driven by the growing demand for high-quality, reliable rectifier diodes in the production of electronic systems for industries such as consumer electronics, automotive, and industrial applications.

The aftermarket segment is set for the fastest growth from 2025 to 2032, with a projected CAGR of 7.69%. This PN Junction Ordinary Rectifier Diode Market Trends is fueled by the growing need for replacement parts, upgrades, and service across industries such as automotive and consumer appliance where reliability and performance are critical to operation.

PN Junction Ordinary Rectifier Diode Market Regional Analysis

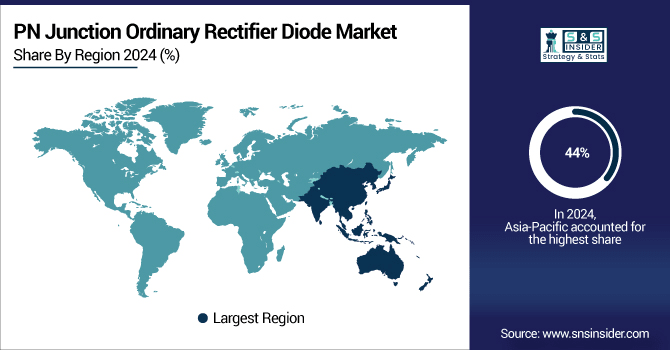

The Asia-Pacific region dominates the PN Junction Ordinary Rectifier Diode Market, holding the largest share of revenue of around 44% in 2024. This dominance is attributed to the region's strong manufacturing base, rapid industrialization, and significant demand from key sectors such as automotive, consumer electronics, and energy, making it a crucial hub for diode production and consumption.

Get Customized Report as Per Your Business Requirement - Enquiry Now

PN Junction Ordinary Rectifier Diode Market is dominated by China. China's dominance is backed by a robust consumer electronics-manufacturing sector, and its high volume of semiconductor manufactured, as well as demand from automotive, consumer electronics and industrial application sectors.

The North America region is expected to witness steady growth in the PN Junction Ordinary Rectifier Diode Market from 2025 to 2032, with a CAGR of 7.53%. owing to emerging demand, with a CAGR of 7.53%. It is being propelled by growing demand for power-saving devices in sectors such as automotive, consumer electronics, and renewable energy, as well as advancements in power conversion systems.

The U.S. is dominating the North America PN Junction Ordinary Rectifier Diode market, dominance is driven by increasing demand for energy-efficient components in key industries such as automotive, consumer electronics, and renewable energy.

Europe holds a moderate share in the PN Junction Ordinary Rectifier Diode Market, driven by its strong automotive and industrial sectors. The region’s demand for energy-saving solutions and durable technologies drive the market growth, even though competing with faster, albeit inferior quality market participants. Germany is dominating the Europe PN Junction Ordinary Rectifier Diode market due to the high usage of automotive, industrial, and electronics in the region

In the Latin America and Middle East regions, the PN Junction Ordinary Rectifier Diode market is experiencing moderate growth. This requirement is largely associated to the evolution of the industry (automotive, consumer electronics, telecommunications). Furthermore, the increasing focus on energy-saving technologies and environmentally-friendly solutions are accelerating the market growth. Even though the growth is slower than North America or Asia-Pacific, the market has been following North America and Asia-Pacific in embracing modern infrastructure and technology.

PN Junction Ordinary Rectifier Diode Companies:

Some of the major key players are PN Junction Ordinary Rectifier Diode market include Infineon Technologies, ON Semiconductor, Nexperia, STMicroelectronics, Vishay Intertechnology, Diodes Incorporated, Rohm Semiconductor, Texas Instruments, Microchip Technology, and Sanken Electric.

Recent Developments

-

April 9 2025, Nexperia unveils high-speed, bidirectional ESD protection diodes in flip-chip land-grid-array (FC-LGA) packaging, optimized for automotive data communication links. These diodes offer superior signal integrity, ultra-low capacitance, and up to 6 GHz bandwidth improvement for applications like in-vehicle cameras and automotive Ethernet.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.20 Billion |

| Market Size by 2032 | USD 6.63 Billion |

| CAGR | CAGR of 5.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Standard Rectifier Diodes, Fast Recovery Rectifier Diodes, Schottky Rectifier Diodes) • By Application(Consumer Electronics, Automotive, Industrial, Telecommunications, Others) • By End User(OEMs, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | PN Junction Ordinary Rectifier Diode market include Infineon Technologies, ON Semiconductor, Nexperia, STMicroelectronics, Vishay Intertechnology, Diodes Incorporated, Rohm Semiconductor, Texas Instruments, Microchip Technology, and Sanken Electric. |