Intravenous Iron Drugs Market Size & Overview

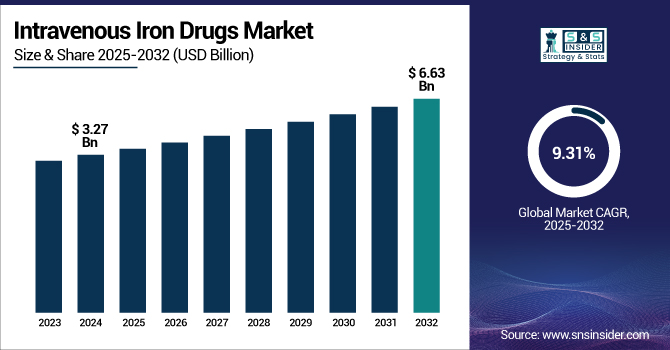

The Intravenous Iron Drugs Market size is projected to grow from USD 3.27 billion in 2024 to USD 6.63 billion by 2032, at a CAGR of 9.31% during the forecast period 2025-2032.

The intravenous iron drugs market is expanding enormously with the rising rate of iron deficiency anemia, especially in patients with gastrointestinal disorders, cancer, and chronic kidney disease. The escalating demand for rapid and effective iron supplementation therapies and the limitations of oral iron supplements are driving market growth.

To Get more information on Intravenous Iron Drugs Market - Request Free Sample Report

USA Intravenous Iron Drugs Market Trends

The U.S. intravenous iron drugs market size was valued at USD 1.22 billion in 2024 and is expected to reach USD 2.40 billion by 2032, growing at a CAGR of 8.87% over the forecast period of 2025-2032. The U.S. held a strong position in the North American intravenous iron drugs market because of favorable iron deficiency anemia rates, increased intravenous iron therapy approvals, and an established healthcare system. Its robust R&D climate and presence of advanced treatment alternatives are also significant contributors to its market leadership within the region.

For Instance, According to, National Health and Nutrition Examination Survey, from August 2021 to August 2023, the total prevalence of anemia in people aged 2 years and older in the United States was 9.3%. The disease was more common in females (13.0%) than in males (5.5%). By age groups, children aged 2–11 years had the lowest prevalence at 4.7%, while adults aged 60 years and above had the highest at 12.5%. Of particular note, anemia prevalence was highest among non-Hispanic Black women (31.4%) and non-Hispanic Black men (10.8%) relative to other racial and ethnic groups.

Intravenous Iron Drugs Market Dynamics

Drivers

-

Rationale for Using Intravenous Iron in Acute Iron Deficiency Anemia to Drive Intravenous Iron Drugs Market Growth

Intravenous iron drugs are typically employed instead of oral supplements when patients require rapid replenishment of iron stores, especially in acute iron deficiency anemia (IDA). Oral iron preparations are slower acting, taking weeks to months to achieve normality of the iron levels, whereas intravenous preparations release iron more quickly, often within hours or days. Intravenous iron is thus of special use in acute iron deficiency or oral iron intolerance secondary to gastrointestinal side effects. The capacity for the delivery of high doses of iron directly into the circulation ensures symptom relief is more rapid, and better treatment is observed in individuals at risk of developing complications from inadequately treated anemia.

-

Drug Formulation Improvements Driving the Intravenous Iron Drugs Market Trends

The recent introduction of new and more effective intravenous iron preparations, such as ferric carboxymaltose and ferric derisomaltose, has significantly enhanced the safety and efficacy of iron therapy. The new forms allow for the administration of greater doses of iron in fewer visits, reducing the number of hospital visits and improving patient compliance. For example, ferric carboxymaltose has more iron per infusion than older forms, allowing for faster treatment times. These kinds of innovations solve long-existing problems with earlier iron infusions that had to be administered repeatedly over extended durations, further increasing demand among providers and patients. In addition, advances in intravenous iron therapy reduce side effects and risks like allergies, and this makes these medications more palatable and safer to take.

Restraint

-

Risk of Adverse Reactions Restraining the Intravenous Iron Therapy Market

Although intravenous iron medications are effective in correcting iron deficiency, they are risky for adverse reactions, including allergic reactions, anaphylaxis, and local injection site reactions. Although these side effects are uncommon, they will discourage healthcare providers and patients alike from using intravenous iron therapy. The risk of a bad reaction necessitates monitoring and frequently requires administration in a medical setting, which may restrict convenience and add to healthcare expenses.

For Instance, according to NCBI, IV and Oral Iron Drugs are progressively utilized for treating iron deficiency anemia (IDA) when oral iron is ineffective, poorly tolerated, or when blood transfusions are not suitable. It is also recommended alongside erythropoiesis-stimulating agents in the management of chronic kidney disease and chemotherapy-induced anemia. Although acute reactions during iron infusions are rare, they can be potentially life-threatening.

Intravenous Iron Drugs Market Segmentation Analysis

By Drug Type

The Ferric Carboxymaltose segment dominated the intravenous iron drugs market with a 51.42% market share in 2024 because of its high efficacy, high infusion rate compared to other intravenous iron preparations, and comfort. Ferric carboxymaltose is particularly preferred because it can provide higher iron doses within a short period, which is ideal for IDA patients requiring swift replenishment. In addition, its lower side effects risk and higher convenience to patients and medical personnel have caused it to gain a huge market share.

The other drug types segment will be growing at the fastest rate in the forecast period as a result of escalating development and approval of new intravenous iron formulations that are focused on specific patient requirements. With research evolving further, new classes of drugs are being launched that provide enhanced safety profiles, enhanced tolerability, and more effective treatment for iron deficiency. This advancement, combined with increasing demand for personalized healthcare solutions, is fueling the swift growth of this segment in the market.

By Application

The Chronic Kidney Disease (CKD) segment dominated the intravenous iron drugs market with a 34.08% market share in 2024 because of the widespread presence of anemia among CKD patients. Patients with CKD usually suffer from decreased erythropoiesis secondary to kidney failure, requiring intravenous iron treatment to correct iron deficiency anemia (IDA). In addition, CKD patients need regular supplementation of iron for promoting erythropoiesis, especially those on dialysis, which has helped the segment lead the market as intravenous iron is a more efficient and timely solution than oral iron supplements.

For Instance, according to the CDC, Chronic kidney disease (CKD) is more prevalent in older adults, with 34% of individuals aged 65 years or older affected, compared to 12% of those aged 45–64 and 6% of individuals aged 18–44. CKD is slightly more common in women (14%) than in men (12%). Additionally, non-Hispanic Black adults have the highest prevalence of CKD, at 20%, compared to 14% in non-Hispanic Asian adults and 12% in non-Hispanic White adults. Around 14% of Hispanic adults are also affected by CKD.

The Other applications segment is expected to have the highest growth during the forecast period based on the increasing acceptance of the role of intravenous iron in the treatment of other conditions in addition to CKD. With intravenous iron drugs receiving wider approval for treating anemia in diseases such as inflammatory bowel disease, cancer, and other chronic diseases, demand for these emerging applications is growing. Increasing recognition and use of intravenous iron therapy for treating anemia in these varied patient populations are fueling strong growth in the other applications segment, which is the fastest-growing segment in the market.

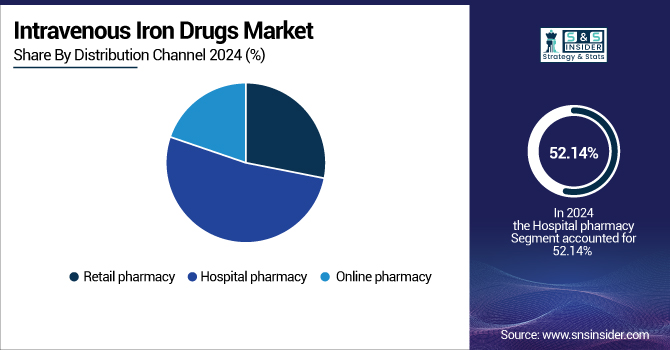

By Distribution Channel

The Hospital pharmacy segment dominated the intravenous iron drugs market with a 54.06% market share in 2024 because hospitals play a critical role in treating iron deficiency anemia when it is severe. Hospital pharmacies are the chief source of dispensing intravenous iron drugs, especially for patients suffering from chronic diseases like chronic kidney disease (CKD) or inflammatory bowel disease (IBD) who need quick and controlled exposure to these medications. Hospitals are well placed to handle complicated cases and provide safe and effective administration, hence the preferred channel of distribution for intravenous iron drugs.

The online pharmacy segment is expected to exhibit the fastest growth during the forecast period because of the growing trend toward e-commerce and the rising preference for convenient, home-based healthcare solutions. Through growth in telemedicine and home healthcare services, patients are more inclined to buy intravenous iron drugs online, particularly for non-acute illnesses or maintenance therapy. The convenience of access, competitive prices, and anonymity of online shopping are driving the fast growth of the online pharmacy segment to emerge as the market's fastest-growing distribution channel.

Intravenous Iron Drugs Market Regional Outlook

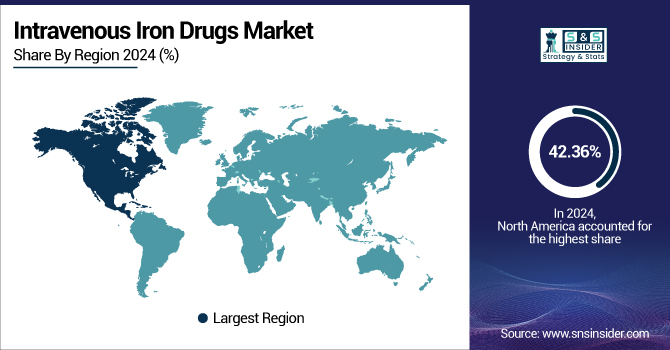

North America dominated the intravenous iron drugs market share with 42.36%, with superior healthcare infrastructure, elevated treatment rates, and strong adoption of intravenous iron therapy. The U.S., in particular, hosts an immense population affected by various chronic diseases, including chronic kidney disease (CKD) and inflammatory bowel disease (IBD), both of which frequently necessitate intravenous administration of iron. Besides, the prevailing high incidence of iron deficiency anemia, combined with good reimbursement strategies, accounts for the market dominance of North America, with the extensive availability of cutting-edge treatments and therapies.

For Instance, according to the CDC report, an estimated 14% of adults in the U.S., approximately 35.5 million people, are affected by chronic kidney disease (CKD). Surprisingly, up to 90% of adults with CKD are unaware of their condition. This lack of awareness is even more pronounced in those with severe CKD, with about one-third of these individuals unaware that they have the disease.

Asia Pacific is anticipated to have the fastest growth over the forecast period, with a 10.34% CAGR, because of a rising incidence of iron deficiency anemia, increasing access to healthcare, and an enhanced awareness of the advantages of intravenous iron therapy. Fast economic growth, enhanced healthcare infrastructure, and an increasing population of elderly with chronic ailments are among the factors powering growth in the region. China and India are also experiencing very good developments in healthcare services, triggering demand for sophisticated medical treatments such as intravenous iron drugs and triggering very fast market growth in this region.

Germany leads the European intravenous iron drugs market because there is a high incidence of iron deficiency anemia, especially of chronic diseases such as chronic kidney disease and inflammatory bowel disease. Germany's well-developed healthcare infrastructure, along with government funding and supportive regulations for drugs, ensures the ready availability of IV iron drugs. These attributes, coupled with the developed health system, led to leadership and expansion by Germany in the intravenous iron drug market in the region.

Latin America has moderate growth in the intravenous iron drugs market because of growing healthcare awareness and demand for anemia treatment in nations such as Brazil and Mexico. However, the unavailability of well-developed healthcare centers and inequality in terms of infrastructure across the region are the reasons for slower growth in this market.

In the Middle East & Africa (MEA) region, growth is stimulated by government programs and enhancements in healthcare infrastructure, especially in Saudi Arabia and the UAE. Though such efforts are in place, economic inequalities and poor access to healthcare in rural areas slow down faster market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Intravenous Iron Drugs Market

Sanofi, Pharmacosmos A/S, AbbVie Inc., Daiichi Sankyo Company Ltd., Pfizer Inc., Zydus Lifesciences Limited, Fresenius SE & Co. KGaA, Teva Pharmaceutical Industries Ltd., Akebia Therapeutics Inc., Rockwell Medical Inc., and other players.

Recent Developments

-

May 2024 – Rockwell Medical, Inc. has announced that it has signed new and expanded distribution deals with BioNuclear and Atlantic Medical International (AMI). The deals are anticipated to generate around USD 1 million of annual revenues, demonstrating the company's initiative to expand its distribution network and commercial presence.

-

March 2023 – Pharmacosmos reported that MonoVer (ferric derisomaltose) has gained national reimbursement approval in Japan and has since been launched in the country. MonoVer is an intravenous (IV) iron therapy for the treatment of iron deficiency anemia (IDA) when oral iron supplements are not effective, cannot be tolerated, or in a situation of emergency where there is a need for immediate iron administration. This is a milestone as the drug enters the world's third-largest pharma market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.27 Billion |

| Market Size by 2032 | USD 6.63 Billion |

| CAGR | CAGR of 7.7% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Drug Type (Iron Dextran, Iron Sucrose, Ferric Carboxymaltose, Other Drug Types) •By Application (Chronic Kidney Disease, Inflammatory Bowel Disease, Cancer, Other Applications) •By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Sanofi, Pharmacosmos A/S, AbbVie Inc., Daiichi Sankyo Company Ltd., Pfizer Inc., Zydus Lifesciences Limited, Fresenius SE & Co. KGaA, Teva Pharmaceutical Industries Ltd., Akebia Therapeutics Inc., Rockwell Medical Inc., and other players. |