Laser Projection Market Size & Growth Analysis:

The Laser Projection Market Size was valued at USD 12.67 Billion in 2023 and is expected to reach USD 57.02 Billion by 2032 and grow at a CAGR of 18.23% over the forecast period 2024-2032. With ever-increasing production volumes driven by high-resolution displays, the laser projection market is maturing. The AI and smart projection make it more automated and interactive with an assured future due to the AI. With energy-efficient and green measures lowering power usage and cost-per-lumen enhancements to laser projectors lowering the price threshold, adoption is blossoming in wider segments in entertainment, education, and business.

To Get more information on Laser Projection Market - Request Free Sample Report

The U.S. laser projection market grew significantly, supported by the growing adoption of laser projectors in education, entertainment, and business environments. Improvements in laser technology increased projector brightness, colors, and longevity until they became more widely used in home theaters and professional environments. Similarly, the incorporation of smart features and designs which are energy-efficient resulted in the growth of the market.

The U.S. Laser Projection Market is estimated to be USD 2.46 Billion in 2023 and is projected to grow at a CAGR of 17.99%. With growing adoption in cinemas, theme parks, and simulation applications, the U.S. laser projection market is growing. Various sectoral industry expansions are further propelled by the rise in demand for 4K and 8K resolution, improvements in laser phosphor and RGB laser technologies, a decrease in maintenance costs, and the global shift towards environmentally friendly projection solutions.

Laser Projection Market Dynamics

Key Drivers:

-

Expanding Laser Projection Market Driven by Energy Efficiency Longevity and Growing Demand Across Multiple Sectors

Rising demand for energy-efficient, high-brightness, and sustainable projection solutions across different industries fuels demand in the laser projection market. The transition from conventional lamp-based projectors to laser has been driven by the advantages of reduced upkeep, higher color fidelity, and increased longevity. The education sector continues to be the leading end-user of laser projectors in developing interactive teaching environments and the growing adoption of image quality modularity in RGB laser projectors is expected to drive the demand in the cinema end-user. Additionally, market growth is being driven quickly due to the increase in home theaters and 4K & 8K resolution displays, which will show priority in gaming and simulation. The increasing usage of digital signage as well as immersive experiences in corporate, retail, and public and private spaces is enhancing the demand too.

Restrain:

-

Challenges in Laser Projection Market Include Adoption Barriers Technical Hurdles and Regulatory Compliance Issues

The lack of familiarity and use of laser projectors for some applications, particularly in developing areas where lamp-based projectors still hold dominance, has proved to be a major obstacle faced by the laser projection market over the last few years. The perception that laser technology is complicated or requires special installation causes many industries and some educational institutions to be reluctant to make the change. Also, high-brightness laser projectors have a great deal of heat management and cooling requirements which represent significant technical hurdles, sometimes negatively impacting long-term performance and efficiency. Regulatory obstacles due to laser safety standards are another hurdle, as certain rectification measures must be taken to eliminate possible risks in public and workplaces.

Opportunity:

-

Laser Projection Market Growth Driven by AR Projection Mapping Smart Cities and Emerging Economy Demand

Technological advancements allowing the development of compact and portable laser projectors are creating new market opportunities, as well as the growing adoption of augmented reality (AR) and projection mapping in entertainment and events. Smart city initiatives coupled with enterprises' digital transformation are creating new market growth opportunities. In addition, there are high growth opportunities due to rapid industrial automation and advancements in medical imaging and surgical visualization. With soaring demand from emerging economies around the world, driven by infrastructure development and an expanding entertainment consumer base, particularly in the Asia-Pacific region, the market boom will only continue to accelerate.

Challenges:

-

The Laser Projection Market Faces Challenges in Content Availability Competition and Precision Requirements in Key Applications

The next bottleneck is the lack of quality laser projection contents, especially at 4k & 8k resolutions, which prevents the use in specific applications like home use and simulation. In addition, competition from other display technologies, such as OLED and LED-based displays, is becoming fiercer and is particularly evident in areas like digital signage and high-end commercial applications. However, AR/VR projection mapping is difficult to integrate and repair when needed, as it requires experts for calibration and maintenance, which can hamper market growth. And, continuous technology development is necessary to achieve accurate color and accurate precision in industrial and medical applications for critical imaging.

Laser Projection Industry Segmentation Analysis

By Product Type

In 2023, the market for laser projectors accounted for 69.7%, increasing demand for education and corporate presentations, cinemas, and entertainment also contributed to the increased adoption of laser projection units and continued to predict that saturated the market. Benefits like better lumens per watt, longevity, and low fuss, have caused them to eclipse bulb-based projectors in popularity. Also, 4K and 8K resolution laser projectors for home theaters, simulation, and gaming continued strong, allowing them to take home this award as well.

The CAD Laser Projection System is the fastest growing segment from 2024-2032 because of its increasing usage in industrial applications, aerospace, and automotive sectors. They allow for laser-guided assembly and projection-based manufacturing, increasing precision and reducing mistakes in complex production environments. With many industries opting to automate and embrace digital transformation, there will be a significant rise in demand for CAD laser projection systems especially in smart factories and advanced manufacturing plants.

By Illumination Type

Laser Phosphor technology retained dominance of the laser projection market in 2023 with a 52.7% share, as the low-cost, long lifecycle, and high energy efficiency of Laser Phosphor technology will remain a strong value proposition in many markets. It is the optimum solution for education, corporate, and large-venue applications as it offers high brightness with low maintenance. Moreover, Laser Phosphor projectors are gaining popularity across conference rooms, auditoriums, and digital signage, which supports their massive market.

RGB Laser projection segment is projected to hold the fastest CAGR of 10.3% during the forecast period of 2024-2032, due to superior color accuracy, higher levels of brightness, and exceptional contrast ratios. Growth is driven by the rising demand for high-end applications such as cinemas, simulations, theme parks, and immersive experiences. Over the coming years, with higher adoption levels for 4K and 8K content as well as demand for state-of-the-art display technologies in several industries, RGB laser projectors will experience strong growth, specifically in high-end entertainment and professional visualization segments.

By Resolution

The WXGA and XGA resolutions accounted for the largest share of the laser projection market, at 37.3%, in 2023 because of their cost-effectiveness, high reliability, and extensive applications in the education and corporate sectors. These are the resolutions that are frequently used inside the class, inside business conference rooms, and inside business meetings where display quality at the top end is not necessarily needed. These devices have been on the market for quite some time due to their economical nature and compatibility with existing infrastructure.

4K is projected to register the fastest compound annual growth rate from 2024 to 2032 owing to rising preference for ultra-high-definition visuals in home theater, professional cinema, simulation, and gaming applications. The trend towards more immersive experiences, digital signage, and high-quality content streaming is fostering a migration to 4K laser projectors. With enhancing technology and reduction in advanced cost, 4K projectors will become more economical, especially on the higher end and high-volume entertainment, design visualization, and big event application, and hence will be adopted sooner than later.

By Vertical

The education sector held the largest share of the laser projection market in 2023 with 29.7%, primarily benefiting from the growing uptake of digital learning, interactive classrooms, and presentations in lecture halls. Due to their long-lasting, low-maintenance characteristics and high brightness, laser projectors are excellent for the long-term use needed in schools, universities, and training centers. The move towards blended and online learning environments has driven demand even more, as institutions look for quality display solutions to cater to both in-person and virtual instruction.

The enterprise sector can be anticipated to expand with the fastest CAGR from 2024 to 2032, attributed to the growing preference for advanced presentation solutions coupled with digital signage and collaborative workspaces. High-resolution laser projectors are being more widely embraced in boardrooms, conferences, and large-scale events. The enterprise segment is also set to exhibit significant growth, bolstered by rising investments in modern projection systems in conjunction with the hybrid work model and virtual meetings trend.

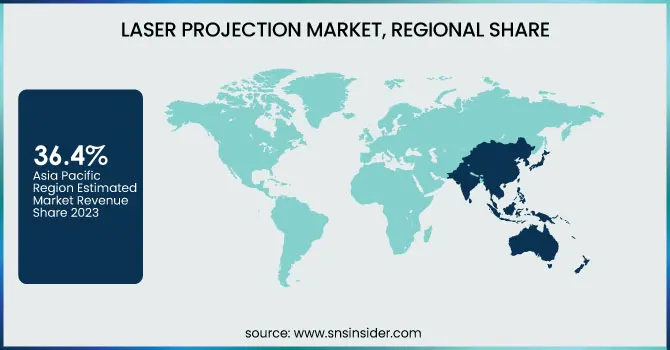

Laser Projection Market Regional Landscape

The laser projection market was led by Asia Pacific, which held 36.4% of the market in 2023, and is projected to attain the fastest CAGR from 2024–2032 There is significant growth in the region due to increasing demand for digital displays, higher adoption in education, along with rapidly growing entertainment industries. Heavy implementations of laser projectors in classroom conditions, corporate offices, and large-scale events, make China, Japan, South Korea, and India some of the leading countries in the world. The RGB laser projection systems are promoted by major cinema software companies in China and internationally, with Chinese moviegoers purchasing more and more RGB laser-based screens as the appetite for film grows there are big players like Wanda Cinemas transforming traditional projection systems into much more efficient laser-based screens for cinema as more viewers flock to the cinemas, so relying on increasingly better RGB laser-based screening is natural in China, and CGV Cinemas upgrading their historical equipment to RGB from traditional RGB laser units.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Laser Projection Market are:

-

Sony Corporation (Sony VPL-XW5000)

-

Panasonic Corporation (Panasonic PT-RQ35K)

-

Epson (Seiko Epson Corporation) (Epson EH-LS12000B)

-

Barco NV (Barco UDX-W32)

-

Christie Digital Systems USA, Inc. (Christie E3LH)

-

LG Electronics Inc. (LG CineBeam HU85LA)

-

BenQ Corporation (BenQ TK860i)

-

NEC Display Solutions (NEC PX2000UL)

-

Mitsubishi Electric Corporation (Mitsubishi LVP-XD600U)

-

Dell Technologies Inc. (Dell Advanced 4K Laser Projector)

-

Xiaomi Corp. (Xiaomi Mi Laser Projector 150")

-

Optoma (Optoma UHZ35ST)

-

InFocus (InFocus Mondopad)

-

Eiki (Eiki EK-820U)

-

Hisense (Hisense PX3-Pro)

Recent Trends

-

In September 2024, Sony introduced two new 4K HDR laser BRAVIA® projectors, featuring the XR Processor for enhanced brightness, contrast, and immersive home cinema experiences.

-

In February 2024, Panasonic Connect launched the RQ7 Series 1-Chip DLP Projector at ISE 2024, expanding its 4K lineup for enhanced immersive visuals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.67 Billion |

| Market Size by 2032 | USD 57.02 Billion |

| CAGR | CAGR of 18.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Laser Projector, CAD Laser Projection System) • By Illumination Type (Laser Phosphor, Hybrid, RGB Laser, Laser Diode) • By Resolution (WUXGA, WQXGA, and 2K, 4K, WXGA and XGA, HD and Full HD, Others) • By Vertical (Enterprise, Public Places, Cinema, Education, Retail, Medical, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sony, Panasonic, Epson, Barco, Christie Digital, LG, BenQ, NEC, Mitsubishi Electric, Dell, Xiaomi, Optoma, InFocus, Eiki, Hisense. |