IoT in Retail Market Report Scope & Overview:

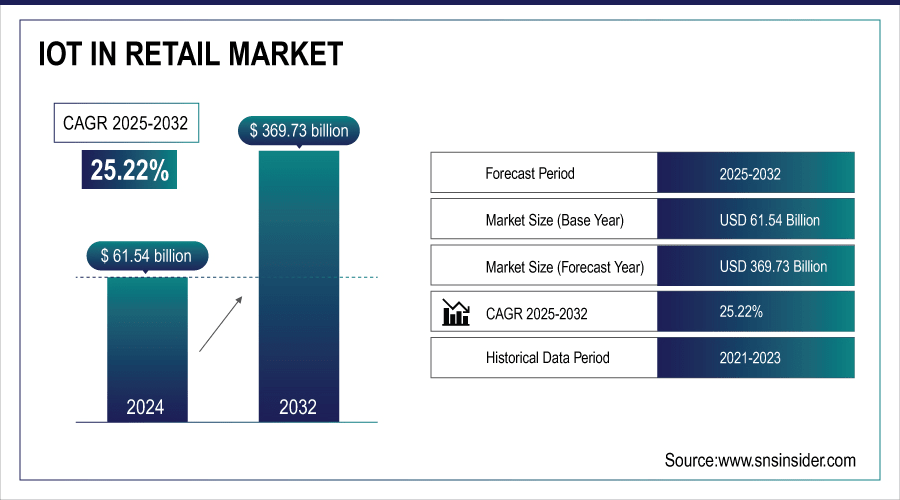

IoT in Retail Market was valued at USD 61.54 billion in 2024 and is expected to reach USD 369.73 billion by 2032, growing at a CAGR of 25.22% from 2025-2032.

The growth of the IoT in Retail Market is driven by increasing adoption of connected devices for inventory management, real-time analytics, and personalized customer experiences. Rising demand for smart shelves, RFID technology, and automated checkout systems enhances operational efficiency. Additionally, the expansion of e-commerce, digital payment integration, and advanced supply chain monitoring fuels market growth across retail sectors.

According to the U.S. Census Bureau of the Department of Commerce, in the second quarter of 2025, U.S. retail e-commerce sales reached USD 304.2 billion, marking a 1.4% increase from the previous quarter, with e-commerce accounting for 16.3% of total retail sales.

The U.S. Census Bureau's "Tech Stats" initiative further centralizes data collections and research products that focus on technology's impact on the economy, including advancements in supply chain monitoring and predictive analytics.

To Get More Information On IoT in Retail Market - Request Free Sample Report

Key IoT in Retail Market Trends

-

Growing adoption of IoT for inventory management, supply chain optimization, and smart shelves.

-

Integration with AI and analytics is enabling personalized customer experiences and predictive insights.

-

Use of IoT-enabled sensors and beacons is enhancing in-store engagement and operational efficiency.

-

Rising demand for contactless payments, smart checkout, and automated retail processes is driving growth.

-

Cloud-based IoT platforms are supporting scalable, real-time data monitoring and decision-making.

-

Retailers are leveraging IoT for energy management, asset tracking, and loss prevention.

-

Expansion of omnichannel retail and smart store concepts is accelerating IoT adoption.

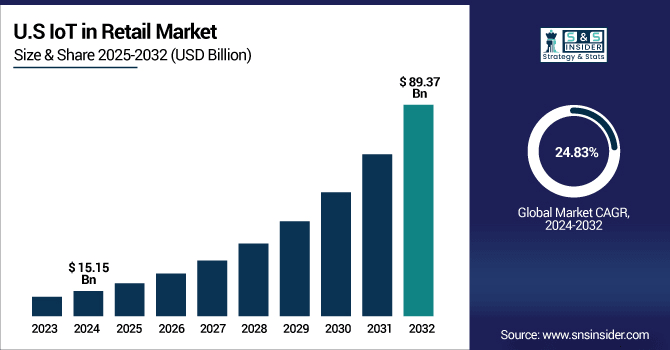

U.S. IoT in Retail Market was valued at USD 15.15 billion in 2024 and is expected to reach USD 89.37 billion by 2032, growing at a CAGR of 24.83% from 2025-2032.

The U.S. IoT in Retail Market is growing due to increased adoption of smart devices for inventory tracking, personalized shopping experiences, automated checkouts, and advanced analytics, alongside rising e-commerce demand and digital payment integration driving operational efficiency and customer engagement.

IoT in Retail Market Growth Drivers:

-

Rising demand for personalized shopping experiences through real-time data analytics, smart shelves, and connected devices in retail environments

Rising demand for personalized shopping experiences through IoT-powered analytics is transforming retail by enabling businesses to understand consumer behavior in real time. Smart shelves, RFID tags, and connected devices help retailers track inventory, monitor customer preferences, and deliver tailored recommendations. This data-driven personalization improves customer satisfaction, enhances brand loyalty, and drives repeat purchases. Retailers can offer dynamic promotions, adjust pricing instantly, and optimize in-store product placement. With e-commerce competition intensifying, physical stores must leverage IoT to remain competitive by merging convenience with customization. This growing emphasis on personalized experiences remains a significant driver for IoT adoption in retail markets globally.

IoT in Retail Market Restraints:

-

Data privacy concerns and security vulnerabilities pose serious limitations to IoT adoption in retail, creating risks around consumer trust and regulatory compliance

Data privacy concerns significantly restrain IoT growth in retail due to the sensitive nature of consumer information collected through connected devices. Security vulnerabilities in IoT systems can expose retailers to risks such as hacking, identity theft, and data breaches. Consumers are increasingly cautious about sharing personal data, and any breach can damage trust and brand reputation. Additionally, retailers face strict regulatory requirements related to data protection, compliance, and cybersecurity. Failure to meet these standards can lead to legal penalties and financial losses. These challenges make retailers hesitant to adopt IoT technologies fully, thereby limiting the market’s growth potential.

IoT in Retail Market Opportunities:

-

Growing adoption of smart checkout systems and contactless payment solutions enhances customer convenience and drives IoT expansion in retail stores worldwide

Growing adoption of smart checkout systems presents a major opportunity for IoT in retail, as customers increasingly demand faster and seamless shopping experiences. IoT-enabled solutions such as cashier-less checkout, RFID-powered billing, and mobile payment systems minimize waiting times while improving customer convenience. Retailers benefit from reduced operational costs, higher throughput, and enhanced customer satisfaction. The rise of contactless payment adoption during the pandemic accelerated this trend, and retailers continue to invest heavily in digital-first in-store experiences. As consumer preferences evolve toward speed and efficiency, IoT-driven smart checkout systems provide a strong growth opportunity to reshape the future of retail operations.

-

The U.S. Department of the Treasury has mandated that, beginning September 30, 2025, all federal payments including Social Security benefits, tax refunds, and vendor payments will be made electronically, eliminating paper checks. This shift aims to reduce fraud risks associated with paper-based payments.

IoT in Retail Market Segment Highlights

-

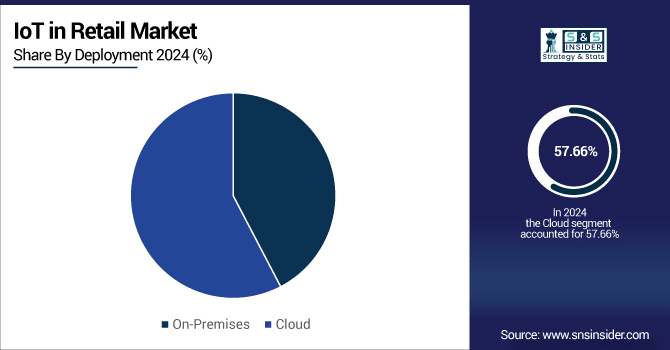

By Deployment, Cloud dominated with ~42% share in 2024; On-Premises fastest growing (CAGR 26.56%).

-

By Application, Operations Management dominated with ~33% share in 2024; Customer Management fastest growing (CAGR 27.58%).

-

By Technology, Near Field Communication dominated with ~35% share in 2024; Bluetooth Low Energy fastest growing (CAGR 27.18%).

-

By Component, Hardware dominated with ~47% share in 2024; Platform fastest growing (CAGR 27.88%).

IoT in Retail Market Segment Analysis

-

By Deployment, Cloud led while On-Premises is expected to grow fastest

Cloud segment dominated the IoT in Retail Market in 2024 with the highest revenue share due to its scalability, cost efficiency, and ease of deployment. Retailers increasingly rely on cloud-based IoT for real-time analytics, remote monitoring, and seamless integration, enabling faster innovation and greater flexibility across multi-location retail operations.

On-Premises segment is expected to grow at the fastest CAGR from 2025–2032 as retailers seek greater data security, regulatory compliance, and control over infrastructure. Sensitive customer information and operational data management needs drive preference for on-premises models, particularly among enterprises handling critical workloads and aiming for customized IoT solutions.

-

By Application, Operations Management dominated while Customer Management is projected to expand fastest

Operations Management segment dominated the IoT in Retail Market in 2024 with the highest revenue share as retailers prioritize process automation, workforce efficiency, and resource optimization. IoT enables real-time monitoring of operations, streamlined workflows, and cost reduction, making operations management central to retail digital transformation strategies worldwide.

Customer Management segment is expected to grow at the fastest CAGR from 2025–2032 driven by increasing demand for personalized shopping experiences, targeted promotions, and loyalty programs. IoT technologies such as beacons, smart shelves, and connected applications enable retailers to track consumer behavior and enhance engagement across multiple touchpoints.

-

By Technology, Near Field Communication led while Bluetooth Low Energy is expected to grow fastest

Near Field Communication segment dominated the IoT in Retail Market in 2024 with the highest revenue share due to its role in enabling contactless payments and secure transactions. Retailers widely adopted NFC for enhancing checkout speed, improving customer convenience, and integrating loyalty systems seamlessly with mobile devices.

Bluetooth Low Energy segment is expected to grow at the fastest CAGR from 2025–2032 as retailers increasingly deploy it for in-store navigation, proximity marketing, and personalized promotions. Its low energy consumption and cost-effectiveness make it ideal for enhancing customer engagement through location-based services within retail environments.

-

By Component, Hardware dominated while Platform is projected to grow fastest

Hardware segment dominated the IoT in Retail Market in 2024 with the highest revenue share due to the essential role of sensors, RFID tags, beacons, and devices in enabling IoT ecosystems. Hardware remains the backbone for data collection, real-time monitoring, and connectivity within retail operations globally.

Platform segment is expected to grow at the fastest CAGR from 2025–2032 as retailers increasingly adopt IoT platforms for centralized data integration, predictive analytics, and scalable connectivity management. Platforms help unify diverse IoT systems, offering actionable insights and supporting the shift toward data-driven retail transformation strategies.

IoT in Retail Market Regional Highlights

-

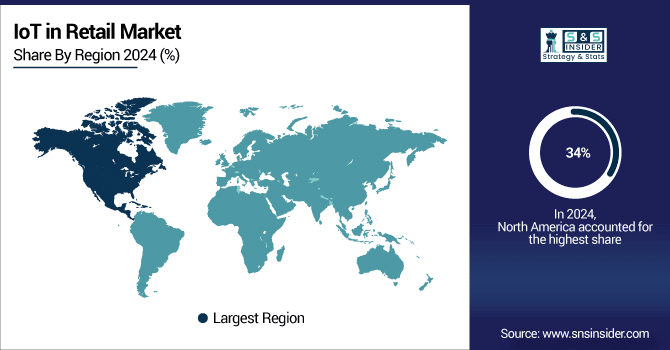

By Region, North America dominated with ~34% share in 2024; Asia Pacific fastest growing (CAGR 27.41%).

IoT in Retail Market Regional Analysis

North America IoT in Retail Market Insights

North America dominated the IoT in Retail Market in 2024 with the highest revenue share due to strong technological infrastructure, early adoption of digital solutions, and widespread presence of major retail chains. Retailers in the region leverage IoT for advanced analytics, inventory automation, and personalized shopping experiences, supported by high consumer demand for convenience and integration of innovative retail technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific IoT in Retail Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025–2032 driven by rapid urbanization, expanding retail ecosystems, and increasing smartphone and internet penetration. Rising consumer expectations for personalized, tech-driven shopping experiences and government initiatives promoting digital transformation further fuel IoT adoption. Emerging economies in the region are investing heavily in connected retail infrastructure, driving strong market growth momentum.

Europe IoT in Retail Market Insights

Europe holds a significant position in the IoT in Retail Market, supported by strong regulatory frameworks, advanced retail infrastructure, and growing consumer demand for digital shopping experiences. Retailers in the region increasingly adopt IoT solutions for supply chain optimization, smart payment systems, and customer engagement. Sustainability-focused initiatives and investment in smart stores further accelerate IoT adoption across European retail markets.

Middle East & Africa and Latin America IoT in Retail Market Insights

Middle East & Africa and Latin America are experiencing steady growth in the IoT in Retail Market, driven by expanding digital adoption, rising e-commerce, and modernizing retail infrastructure. Retailers increasingly deploy IoT for inventory optimization, personalized promotions, and seamless payments. While infrastructure and cost challenges persist, government initiatives and digital transformation efforts are creating strong opportunities for future market expansion.

IoT in Retail Market Competitive Landscape:

Cisco Systems

Cisco Systems, Inc., a global leader in networking and IoT solutions, plays a pivotal role in the IoT in Retail Market by providing end-to-end connectivity, IoT platforms, and data analytics solutions. Its offerings enable retailers to optimize supply chains, enhance customer experiences through real-time insights, and implement smart store technologies. Cisco’s focus on secure, scalable IoT infrastructure and partnerships with retail technology providers strengthens its market presence and adoption worldwide.

-

In 2025, Cisco launched the “Collaboratory” in Manhattan, a pop-up retail space using IoT integration with Wi-Fi 7, Meraki smart cameras, PoE-powered POS, and AR displays to deliver immersive, interactive shopping experiences.

Microsoft

Microsoft Corporation leverages its Azure IoT platform to drive innovation in the IoT in Retail Market. Its solutions enable retailers to enhance inventory management, implement predictive analytics, and deliver personalized customer experiences. By integrating AI, cloud computing, and connected devices, Microsoft helps retailers optimize operations, reduce costs, and improve engagement. Strategic partnerships and continuous advancements in IoT and AI technologies strengthen Microsoft’s position and adoption across the global retail sector.

-

In 2024, Major updates to AI Store Assistant and Smart Store Analytics enhanced personalization, supported in-store employees, and integrated analytics with Microsoft Fabric, improving operational efficiency and customer experiences across retail environments.

-

In 2024, Microsoft introduced new Copilot templates, prebuilt applications, and retail data solutions, enabling generative AI across shopper journeys and in-store associate experiences, enhancing decision-making, engagement, and operational efficiency in retail stores.

Honeywell International

Honeywell International Inc. delivers advanced IoT solutions that transform retail operations by enhancing supply chain visibility, inventory management, and store automation. Its smart sensors, connected devices, and analytics platforms enable real-time monitoring, predictive maintenance, and efficient workforce management. Honeywell’s technologies support seamless integration of automated checkout systems, smart shelving, and safety monitoring, helping retailers improve operational efficiency, reduce costs, and elevate customer experiences, strengthening its position in the global IoT in Retail Market.

-

In 2024, Honeywell integrated AI and machine learning into its Guided Work Solutions, enhancing operational efficiency and improving shopper experiences across retail environments.

-

In 2024, In collaboration with Qualcomm, Honeywell developed an AI-enabled Multi-Modal Intelligent Agent for mobile devices, allowing natural interactions via voice, images, and barcodes in retail and distribution settings.

Key Players

Some of the IoT in Retail Market Companies

-

Cisco Systems, Inc.

-

IBM Corporation

-

Microsoft Corporation

-

Honeywell International Inc.

-

SAP SE

-

Oracle Corporation

-

Intel Corporation

-

Amazon Web Services (AWS)

-

Google LLC

-

PTC Inc.

-

Siemens AG

-

Hitachi, Ltd.

-

Schneider Electric SE

-

Accenture plc

-

NXP Semiconductors

-

AT&T

-

Telit

-

Avery Dennison Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 61.54 Billion |

| Market Size by 2032 | USD 369.73 Billion |

| CAGR | CAGR of 25.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Platform, Services) • By Technology (Bluetooth Low Energy, Near Field Communication, Zigbee, Others) • By Deployment (On-Premises, Cloud) • By Application (Operations Management, Customer Management, Asset Management, Advertising and Marketing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Honeywell International Inc., SAP SE, Oracle Corporation, Intel Corporation, Zebra Technologies Corporation, Amazon Web Services (AWS), Google LLC, PTC Inc., Siemens AG, Hitachi, Ltd., Schneider Electric SE, Accenture plc, Broadcom, NXP Semiconductors, AT&T, Telit, Avery Dennison Corporation |