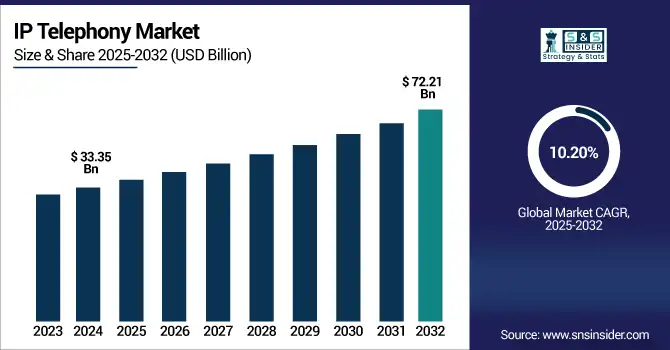

IP Telephony Market Size Analysis:

The IP Telephony Market Size was valued at USD 33.35 billion in 2024 and is expected to reach USD 72.21 billion by 2032 and grow at a CAGR of 10.20% over the forecast period 2025-2032.

To Get more information on IP Telephony Market - Request Free Sample Report

The global IP Telephony market is growing due to the increasing demand for adaptable, scalable and cost-efficient communication solutions. IP-based telephony systems are gaining great popularity as organizations are moving more and more to digital and remote servers. Ever better inter-connects, phone-in fares, pervading cloud penetration, are further speeding up adoption. There is also intensifying competition, innovation and strategic collaborations in the market, which further shapes the dynamic nature of the global communication scenario.

According to research, over 68% of enterprises worldwide now use cloud-based VoIP or IP telephony platforms to support hybrid and remote operations.

The U.S. IP Telephony Market size was USD 8.43 billion in 2024 and is expected to reach USD 15.94 billion by 2032, growing at a CAGR of 8.34% over the forecast period of 2025–2032.

The US IP telephony market growth is primarily driven by the widespread adoption of hybrid work models, demand for unified communication avenues and economical VoIP services. Companies are moving from traditional telephony systems towards leading edge IP based telephones to enjoy improved connectivity, flexibility and communication. Growing digital infrastructure investments and surging penetration of broadband are also fuelling the market rise.

According to research, as of 2024, 94% of U.S. households have broadband internet, providing a strong foundation for IP telephony adoption.

IP Telephony Market Dynamics

Key Drivers:

-

Cost Efficiency And Scalability Make IP Telephony A Strategic Replacement For Traditional Phone Systems In Enterprise Communication Networks.

The ability to significantly reduce operational and call costs while supporting global scalability is prompting businesses to shift from traditional telephony to IP-based systems. IP Telephony eliminates the need for expensive infrastructure and long-distance charges, especially for international communication. It supports seamless expansion, remote access, and integration with CRM and cloud-based services. Companies can adapt easily to changing team sizes and business models. These financial and functional advantages are especially critical in an increasingly digital-first global business environment, making cost savings and flexibility key enablers for market growth.

According to research, integrating VoIP with CRM systems enhances customer engagement by up to 25%, enabling real-time insights, streamlined communication, and improved service delivery across enterprise customer support operations.

Restrain:

-

Concerns About Data Security, Call Interception, And Regulatory Compliance Slow Adoption Across Sensitive Sectors.

IP-based communication systems are susceptible to cybersecurity threats like phishing, eavesdropping, VoIP-specific DDoS attacks, and data breaches. Without robust encryption and regulatory compliance, businesses, especially in finance, government, and healthcare, may avoid adopting IP telephony. Additionally, differing laws on data localization and voice transmission add complexity for international operations. Organizations hesitant to transition from secure legacy systems may delay implementation due to compliance burdens and cyber risk concerns, which remain a key restraint in highly regulated or data-sensitive industries.

Opportunities:

-

Expansion of 5G And Broadband Penetration Opens New Markets For Mobile And Cloud-Based VoIP services.

The rollout of high-speed 5G networks and increasing global broadband coverage is enhancing the quality and reliability of VoIP services. Improved connectivity reduces latency and supports real-time communication even in remote or mobile contexts. This enables broader adoption of IP telephony in developing markets and mobile-first environments. Additionally, small businesses and individuals can now access enterprise-level voice services over mobile devices. This technological advancement presents an untapped opportunity for providers to extend IP-based voice solutions to new customer bases worldwide.

According to research, 5G reduces average VoIP call latency by up to 60% compared to 4G, enhancing call clarity and response time.

Challenges:

-

Intense Competition And Lack Of Standardization Create Pricing Pressures And Interoperability Issues Among IP Telephony Providers.

The IP Telephony Market is highly fragmented, with numerous global and regional players offering similar services at competitive prices. This saturation leads to aggressive pricing strategies, lowering profit margins for service providers. Moreover, the lack of standardized protocols across platforms can result in compatibility and interoperability challenges. Customers may face difficulties integrating different solutions, which hampers user experience and complicates vendor selection. Providers must differentiate through innovation and support while navigating a commoditized landscape with limited standardization and rising customer expectations.

IP Telephony Market Segment Analysis:

By Type

The Integrated Access/Session Initiation Protocol (SIP) Trunking segment dominated the IP Telephony Market in 2024, accounting for 58.48% of the total revenue due to its cost efficiency, scalability, and seamless integration with existing PBX systems. It enables businesses to consolidate voice and data services over a single network, reducing operational expenses while enhancing communication reliability. The widespread adoption across enterprises, especially those undergoing digital transformation, has further cemented its leadership position. Moreover, SIP trunking supports a smoother transition from traditional telephony to modern VoIP solutions, ensuring long-term viability.

The Hosted IP PBX segment is projected to grow at the fastest CAGR of 11.92% from 2025 to 2032, driven by its cloud-based infrastructure that minimizes capital expenditure and enhances operational flexibility. IP telephony companies like RingCentral, Inc., are capitalizing on this trend by offering scalable hosted VoIP platforms with integrated video and messaging services. Their solutions are ideal for hybrid and remote teams seeking seamless communication tools. As organizations modernize their IT infrastructure, hosted IP PBX adoption continues to rise rapidly.

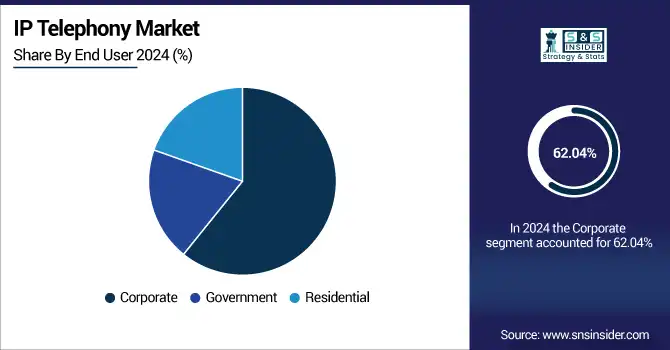

By End User

The Corporate segment dominated the highest IP Telephony Market share in 2024, accounting for approximately 62.04% of the total revenue. This dominance stems from the sector’s reliance on secure, integrated, and cost-effective communication systems. Large-scale deployment across departments and locations drives demand for VoIP-based telephony that supports productivity and customer engagement. The need for reliable, enterprise-grade voice and video communication has made IP-based systems a critical part of corporate digital strategies.

The Residential segment is expected to witness the fastest growth at a CAGR of 11.77% from 2025 to 2032, as more consumers seek affordable and flexible voice solutions. Vonage Holdings Corp. is among the providers seeing growth in this space, offering consumer VoIP packages with features like mobile integration and unlimited international calls. The convenience of internet-based calling and the decline in traditional landline usage have contributed to a steady increase in residential IP telephony adoption.

By Call Type

The International Calls segment dominated the IP Telephony Market in 2024, contributing approximately 67.87% of the total revenue. This is primarily due to the massive cost savings and improved connectivity IP telephony offers over traditional international calling methods. Businesses and individuals benefit from lower call rates, especially for long-distance and cross-border communication, making international VoIP solutions increasingly popular across multiple sectors.

The Domestic Calls segment is poised to grow at the fastest CAGR of 11.39% from 2025 to 2032, driven by rising demand for seamless communication within national boundaries. 8x8, Inc. is a key player expanding its domestic VoIP offerings to serve small businesses and institutions. The combination of unlimited local calling, mobile integration, and real-time collaboration tools appeals to companies looking to replace legacy landline systems with agile, cloud-based alternatives.

By Installation Type

The Wired segment led the IP Telephony Market in 2024 with a revenue share of about 61.17%, owing to its stability, consistent quality, and enterprise-grade performance. Organizations with extensive infrastructure often favor wired systems to ensure secure and uninterrupted communication. Industries with mission-critical requirements, such as healthcare and finance, continue to rely heavily on wired telephony for secure voice transmission and compliance.

The Wireless segment is projected to grow at the highest CAGR of 11.05% from 2025 to 2032, supported by increasing mobile workforce trends and the demand for flexibility in business communications. Cisco Systems, Inc. is among the pioneers in providing wireless VoIP solutions optimized for remote teams and mobile devices. Their secure, cloud-integrated platforms enable real-time communication over Wi-Fi and mobile networks, promoting productivity in dynamic work environments.

By Enterprise Size

The Large Enterprise segment dominated the IP Telephony Market in 2024, accounting for about 57.45% of the total revenue. These organizations prioritize scalable and secure communication networks that support complex operations, global outreach, and regulatory compliance. Investment in unified communication platforms that offer integrated voice, video, and collaboration tools has driven large-scale adoption among multinational firms and government agencies.

The Small & Medium Enterprises (SMEs) segment is forecast to grow at the highest CAGR of 11.48% from 2025 to 2032, driven by rising awareness and accessibility of cost-effective VoIP platforms. Nextiva, Inc. is catering to SMEs with user-friendly, scalable solutions bundled with CRM and analytics tools. These features help smaller businesses enhance customer communication while keeping IT expenses manageable, contributing to the segment’s accelerated adoption.

By Offering

The Solutions segment accounted for the highest share of the IP Telephony Market in 2024, contributing approximately 71.21% of the total revenue. This is due to the comprehensive range of VoIP products such as IP phones, softphones, PBX platforms, and call control systems. Enterprises demand end-to-end telephony infrastructure that ensures uninterrupted communication and improved efficiency across departments and locations.

The Services segment is expected to grow at the fastest CAGR of 10.85% from 2025 to 2032, propelled by the rising need for managed services, support, and consulting. Avaya Holdings Corp. is expanding its service offerings through cloud-based management, technical support, and VoIP migration solutions. These services ease the burden on internal IT teams and provide customizable communication ecosystems, particularly for SMEs and startups seeking operational agility.

IP Telephony Market Regional Outlook:

North America dominated the highest revenue share of the market in 2024 at approximately 37.82%, supported by the region’s early adoption of VoIP technology, widespread high-speed internet access, and a strong presence of major vendors. Businesses in the U.S. and Canada are heavily investing in unified communications and cloud-based telephony to streamline operations. Regulatory compliance requirements and the shift to remote and hybrid work have further strengthened IP telephony adoption across various industries in the region.

-

The U.S. dominates the North American market due to its advanced IT infrastructure, early VoIP adoption, strong enterprise demand, and high penetration of broadband services. Additionally, the presence of major IP telephony providers fuels continued market leadership.

Asia Pacific is expected to witness the fastest growth in the market at a CAGR of 11.58% from 2025 to 2032. This growth is fueled by increasing broadband and mobile internet penetration across emerging economies, along with government-backed digitalization initiatives. The rising number of SMEs, startups, and tech-driven enterprises in countries like China, India, and Indonesia are driving demand for affordable and scalable VoIP solutions. Growing smartphone usage and remote work culture are also contributing to the region’s rapid market expansion.

-

China leads the Asia Pacific market owing to rapid digitalization, strong government support for ICT, and the expansion of high-speed internet. Its large SME base and growing enterprise digitization drive robust demand for cloud-based communication solutions.

Europe holds a significant share in the market due to widespread adoption of unified communication tools across enterprises and strong regulatory support for digital transformation. Countries like Germany, the U.K., and France are investing in scalable, secure VoIP systems to improve operational efficiency. The rising demand for cost-effective cross-border communication also contributes to market expansion across the region.

-

Germany dominates the European market due to its advanced digital infrastructure, strong enterprise sector, and high adoption of unified communication solutions. Continuous investment in VoIP technology and supportive government policies further strengthen its position as the regional market leader.

The Middle East & Africa market is led by the UAE, driven by strong digital infrastructure and enterprise demand, while South Africa and Saudi Arabia show rising adoption. In Latin America, Brazil dominates due to expanding broadband access, growing SME digitization, and increasing investments in cloud communication technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

IP Telephony Companies are:

Major Key Players in IP Telephony Market are Cisco Systems, Inc., Avaya Inc., Mitel Networks Corporation, NEC Corporation, RingCentral, Inc., Vonage Holdings Corp., Alcatel-Lucent Enterprise, Microsoft Corporation, Zoom Video Communications, Inc., 8x8, Inc and others.

Recent Development:

-

In June 2025, RingCentral rolled out advanced enhancements to its MVP and Contact Center platforms, adding seamless integration with Microsoft Teams 2.0 and deep AWS compatibility for improved cloud telephony experiences.

-

In March 2025, Alcatel-Lucent Enterprise introduced private 5G networks for industrial settings, accelerating the convergence of wireless and VoIP technologies to support enterprise digital transformation and next-generation communication infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 33.35 Billion |

| Market Size by 2032 | USD 72.21 Billion |

| CAGR | CAGR of 10.20% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Integrated Access/Session Initiation Protocol (SIP) Trunking, Managed IP PBX, Hosted IP PBX) • By End User (Corporate, Government, Residential) • By Call Type (International Calls, Domestic Calls) • By Installation Type (Wired, Wireless) • By Enterprise Size (Large Enterprise, Small & Medium Enterprises) • By Offering (Solutions, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Avaya Inc., Mitel Networks Corporation, NEC Corporation, RingCentral, Inc., Vonage Holdings Corp., Alcatel-Lucent Enterprise, Microsoft Corporation, Zoom Video Communications, Inc., 8x8, Inc. |