Genomic Medicine Market Overview:

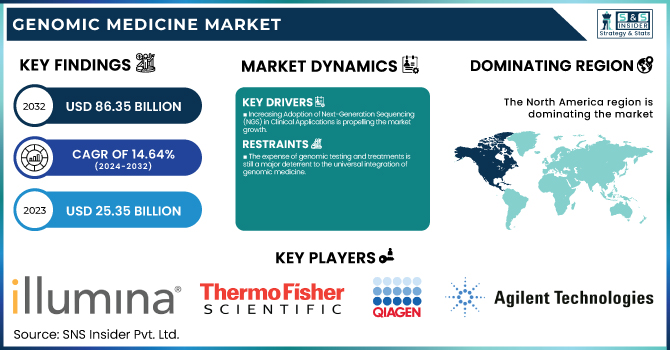

The Genomic Medicine Market was valued at USD 25.35 billion in 2023 and is projected to reach USD 86.35 billion by 2032, expanding at a CAGR of 14.64% from 2024 to 2032.

To Get more information on Genomic Medicine Market - Request Free Sample Report

The Genomic Medicine Market Report provides detailed insights by examining adoption rates by region, identifying the differences in patient access and clinical use. It presents a detailed examination of the regulatory environment, monitoring global policy evolution and approvals driving market forces. The report also delves into technology advancements and R&D investment, examining leading-edge breakthroughs and financing trends. In addition, it also analyzes the market penetration of genomic testing and personalized medicine, highlighting their embedding in healthcare systems. Finally, the report evaluates reimbursement policy and cost analysis, outlining the impact of insurance coverage and affordability of genomic medicine on accessibility and uptake.

U.S. Genomic Medicine Market Size and Forecast

The U.S. Genomic Medicine Market was valued at USD 7.81 billion in 2023 and is expected to reach USD 22.94 billion by 2032, growing at a CAGR of 12.74% from 2024-2032.

The U.S. dominates the North American genomic medicine market with extensive government support in the form of funding, i.e., NIH's All of Us Research Program, and robust adoption of precision medicine. Support from leading corporations like Illumina and Thermo Fisher Scientific and well-developed genomic research facilities also contributes significantly to its strength. Favorable regulatory policies as well as the increasing insurance coverage for genetic tests, also fuel growth in the market.

Genomic Medicine Market Dynamics

Drivers

-

Increasing Adoption of Next-Generation Sequencing (NGS) in Clinical Applications is propelling the market growth.

Next-Generation Sequencing (NGS) is transforming genomic medicine by allowing for rapid, precise, and affordable genetic analysis, greatly improving disease diagnosis and treatment. NGS is being broadly applied in oncology, rare genetic diseases, and infectious disease research. Industry reports indicate that more than 70% of clinical genetic testing is now based on NGS-based platforms. Recent developments, including Illumina's release of the TruSight Oncology 500 ctDNA v2 in November 2023, reflect the increasing use of liquid biopsy-based NGS in precision oncology. Moreover, Thermo Fisher Scientific's collaboration with Pfizer in May 2023 made NGS-based testing more accessible in more than 30 countries, enhancing genomic medicine access globally. The ongoing technological innovations and regulatory clearances for NGS-based testing are spearheading its adoption into standard clinical processes, fueling the growth of the genomic medicine market.

-

Rising Government and Private Investments in Genomic Research are driving the market growth.

The genomic medicine market is being fueled by monumental investments made by governments and private agencies to pursue personalized medicine and gene therapies. The U.S. National Institutes of Health (NIH) has also been investing heavily in genomic research, such as in the All of Us Research Program, to sequence one million genomes to support more precise medicine. Likewise, China's Precision Medicine Initiative is making an investment of over USD 9 billion towards the development of genomics-driven healthcare. In December 2023, Agilent Technologies stated that it integrated its Cell Analysis Division into the Diagnostics and Genomics Group, further underlining its genomics-driven diagnostic focus. Big pharma, too, is increasingly investing in genomic R&D, resulting in advances in gene therapies and CRISPR treatments. Such investment is speeding innovation, bringing genomic medicine closer to being commercially relevant and accessible.

Restraint

-

The expense of genomic testing and treatments is still a major deterrent to the universal integration of genomic medicine.

Sophisticated technologies such as Next-Generation Sequencing (NGS), CRISPR gene editing, and targeted genomic treatments are capital-intensive in terms of infrastructure, human resources, and reagents, hence costly to healthcare systems and patients. Whole-genome sequencing, for example, can cost between USD 1,000 and USD 5,000, hence precluding access in low- and middle-income countries. Additionally, variable reimbursement policies generate both provider and patient financial uncertainty. Although the Centers for Medicare & Medicaid Services (CMS) pays for some genomic tests, numerous private payers limit coverage due to cost issues and the absence of standardized guidelines. This economic burden hinders the adoption of genomic medicine, especially in those areas with poor healthcare infrastructure, thus inhibiting market growth.

Opportunities

-

The increased uptake of personalized medicine offers a large opportunity within the genomic medicine market.

With increasing advancements in genome sequencing, biomarker discovery, and artificial intelligence-powered data analysis, medical practitioners can deliver tailored therapies for specific genetic profiles. For instance, the FDA has licensed more than 100 biomarker-based treatments for cancer, cardiovascular conditions, and uncommon genetic disorders, illustrating the widening role of genomics in precision medicine. Also, the growth of direct-to-consumer (DTC) genetic testing, like that of 23andMe and AncestryDNA, raises public interest and demand for genomic-based healthcare options. Governments and research institutions are also investing in large-scale genomic projects, such as the All of Us Research Program in the United States, to promote precision medicine. These conditions make it an attractive time for investment and innovation in the genomic medicine industry.

Challenges

-

Ethical and Data Privacy Concerns are challenging the market from growing.

Among the most significant challenges to the genomic medicine market are ethicality and data protection issues. Genomic information holds very sensitive personal data, prompting fears of unauthorized access, misuse, and genetic discrimination. Patients are concerned with the potential use of their DNA data by insurance firms, employers, or third parties. Regulatory regimes such as the General Data Protection Regulation (GDPR) in Europe and the Genetic Information Nondiscrimination Act (GINA) in the United States attempt to safeguard genetic information, yet enforcement is not consistent. Also, the sheer growth of genomic databases enhances the threat of cybersecurity breaches, such as the recent hacking into genetic testing companies. Providing strong data protection, transparent consent policies, and regulatory compliance is critical to upholding public trust and speeding the global adoption of genomic medicine.

Genomic Medicine Market Segmentation Analysis

By Application

The oncology segment dominated the Genomic Medicine Market with a 22.15% market share in 2023 as a result of the extensive use of genomic-based cancer diagnostics and targeted therapies. Cancer is among the major causes of mortality worldwide, with 19.9 million cases diagnosed in 2023. Genomic medicine has revolutionized oncology through the ability to conduct precision oncology therapy, including biomarker-guided therapies and liquid biopsies that enable the identification of precise mutations such as BRCA1/BRCA2 in breast cancer or EGFR in lung cancer. Moreover, there is a focus on genome-led cancer drug discovery by pharma companies, resulting in a growing number of FDA-approved targeted and immunotherapies. Initiatives such as the Cancer Moonshot program in the U.S. have further boosted investment in genomic oncology research, positioning the same as the most prominent application segment in 2023. The growing uptake of next-generation sequencing (NGS) and companion diagnostics is further advancing the leadership of the segment within the market.

By Products And Services

The consumables segment dominated the Genomic Medicine Market with a 52.40% market share in 2023 as a result of repeated demand for reagents, kits, and assay solutions that are used in genomic sequencing, PCR, and microarray testing. As the use of Next-Generation Sequencing (NGS) and polymerase chain reaction (PCR) technology grows, laboratories and research organizations need a consistent supply of DNA/RNA extraction kits, sequencing reagents, and gene editing supplies. The growth in personalized medicine and molecular diagnostics, especially in oncology and rare genetic diseases, has further accelerated the demand for consumables. Moreover, pharma and biotech firms are constantly investing in high-throughput genomic screening, which continues to fuel strong demand for consumables in research and clinical environments. The consumables segment continues to dominate due to frequent usage, non-reusable, and rising genomic research programs globally.

The services segment, encompassing genomic testing, data analysis, interpretation, and genetic counseling, is anticipated to experience the fastest growth rate owing to the increasing demand for precision medicine and direct-to-consumer (DTC) genetic tests. The increasing use of genomic data in personalized medicine has driven the demand for bioinformatics solutions and AI-powered genomic interpretation. Furthermore, the growing availability of whole-genome and exome sequencing has led to a boom in genetic counseling services, enabling people to comprehend their genomic information for the assessment of disease risk and inherited disorders. Governments and private entities are heavily investing in genomic data analysis and management, driving services as a major growth inducer. With the ongoing development of cloud-based genomic platforms and artificial intelligence-powered diagnostics, the segment of services is going to expand exponentially over the next several years.

By Technology

The Next-Generation Sequencing (NGS) segment dominated the Genomic Medicine Market with a 38.64% market share in 2023 because of its unmatched capability to offer high-throughput, affordable, and quick genomic analysis. NGS has transformed precision medicine, oncology diagnosis, and rare disease detection by allowing extensive sequencing of whole genomes, exomes, and transcriptomes with very high accuracy. The increasing need for tailored treatments, biomarker identification, and targeted therapies has also fueled NGS adoption in clinical, research, and pharmaceutical industries. Furthermore, government initiatives and partnerships, the All of Us Research Program in the United States and the 100,000 Genomes Project in the United Kingdom, have also accelerated genomic sequencing advancements. With the emergence of liquid biopsy, non-invasive prenatal testing (NIPT), and AI-aided genomic interpretation, NGS is still the leading technology defining the future of genomic medicine.

By End-User

The Pharmaceutical & Biotechnology Companies segment dominated the Genomic Medicine Market with a 37.12% market share in 2023, as drug discovery, development, and precision medicine efforts increasingly depend on genomic information. These businesses significantly invest in genomics research to create targeted therapies in oncology, rare diseases, and neurodegenerative disorders. Companion diagnostics, gene therapy, and CRISPR-based gene editing have also propelled demand for genomic technologies in pharmaceutical R&D. Moreover, large industry players are entering strategic partnerships with genomic service providers and sequencing technology companies to increase drug efficacy and patient stratification. For instance, the alliance between Pfizer and Thermo Fisher Scientific to expand next-generation sequencing (NGS)-based testing highlights the increasing role of genomics in pharma innovation. The segment's robust funding prowess and regulatory innovations cement its leading position in genomic medicine.

Genomic Medicine Market Regional Insights

North America dominated the genomic medicine market with a 42.62% market share in 2023 because of the well-developed healthcare infrastructure in the region, large research and development activities, and large-scale government and private investments in genomics. The existence of influential market players like Illumina, Thermo Fisher Scientific, and Roche contributes to the strengthening of the regional leadership. The U.S., specifically, has spearheaded developments in precision medicine, next-generation sequencing (NGS), and genetic therapies, backed by programs such as the NIH's All of Us Research Program and strong funding from institutions such as the National Human Genome Research Institute (NHGRI). In addition, the large adoption of genetic testing, positive reimbursement policies, and an escalating emphasis on personalized medicine drive North America's leadership in the genomic medicine market.

The Asia Pacific is the fastest-growing region in the genomic medicine market with 15.41% CAGR throughout the forecast period as a result of rising government initiatives, increasing biotechnology investments, and a high population with an elevated prevalence of genetic disorders. Countries like Japan, China, and India are contributing extensively towards genomic studies via national initiatives like Japan's Genome Analysis Project and China's Precision Medicine Initiative. The region is also seeing genomic sequencing laboratories spread wider, heightened interactions among pharma companies and research organizations, and better accessibility to advanced genome technologies. Moreover, the cost-effectiveness of Asia Pacific sequencing services versus Western regions is propelling the uptake of genomic medicine, rendering it the most rapidly growing region in the projection period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Genomic Medicine Market

-

Illumina, Inc. (NovaSeq X Plus, TruSeq DNA Library Prep Kit)

-

Thermo Fisher Scientific Inc. (Ion Torrent Genexus System, Oncomine Dx Target Test)

-

Qiagen N.V. (QIAseq Targeted DNA Panels, QIAsymphony SP)

-

Agilent Technologies, Inc. (SureSelect XT HS2 DNA Library Prep, GenetiSure Pre-Screen Kit)

-

F. Hoffmann-La Roche Ltd. (AVENIO Tumor Tissue CGP Kit, FoundationOne CDx)

-

Oxford Nanopore Technologies plc (MinION Sequencer, PromethION 24)

-

PacBio (Pacific Biosciences of California, Inc.) (Revio System, HiFi Sequencing)

-

BGI Genomics Co., Ltd. (DNBSEQ-T7, NIFTY Prenatal Test)

-

PerkinElmer, Inc. (EONIS SCID-SMA Assay, NEXTFLEX Rapid DNA-Seq Kit)

-

Myriad Genetics, Inc. (MyRisk Hereditary Cancer Test, Prolaris Prostate Cancer Test)

-

Invitae Corporation (Carrier Screening Panel, Personalized Cancer Panel)

-

Genomic Health (Exact Sciences) (Oncotype DX Breast Recurrence Score, Oncotype DX Colon Cancer Test)

-

Bio-Rad Laboratories, Inc. (QX200 Droplet Digital PCR System, CFX96 Touch Real-Time PCR System)

-

23andMe, Inc. (Ancestry + Health Test, BRCA1/BRCA2 Genetic Risk Test)

-

Nebula Genomics (30X Whole Genome Sequencing, Genome Exploration Reports)

-

GenScript Biotech Corporation (CRISPR-Based Gene Editing Services, Single-Cell Sequencing Solutions)

-

Twist Bioscience Corporation (Twist NGS Methylation Detection System, Twist Comprehensive Exome Panel)

-

Eli Lilly and Company (LOXO-292 RET Inhibitor, Verzenio CDK4/6 Inhibitor)

-

Regeneron Pharmaceuticals, Inc. (Regeneron Genetics Center Sequencing Initiative, VelocImmune Gene Editing)

-

Bluebird Bio, Inc. (Zynteglo for Beta-Thalassemia, Skysona for Cerebral Adrenoleukodystrophy)

Suppliers (These suppliers provide genomic reagents, DNA/RNA extraction kits, sequencing consumables, enzymes for molecular biology, and next-generation sequencing (NGS) library preparation tools, which are essential for genomic medicine applications such as gene therapy, diagnostics, and personalized medicine.) In the Genomic Medicine Market

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

Qiagen N.V.

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories, Inc.

-

New England Biolabs (NEB)

-

Integrated DNA Technologies (IDT)

-

PerkinElmer, Inc.

-

Twist Bioscience Corporation

-

Pacific Biosciences of California, Inc.

Recent Developments in the Genomic Medicine Industry

-

November 2023 – Illumina launched the TruSight Oncology 500 ctDNA v2, a state-of-the-art liquid biopsy assay for the whole-genome, comprehensive genomic profiling of solid tumors. The advanced assay provides an accelerated turnaround time of less than four days and improved analytical sensitivity, greatly expanding noninvasive cancer research and precision medicine.

-

May 2023 – Thermo Fisher Scientific unveiled a strategic partnership with Pfizer to expand access to next-generation sequencing (NGS)-based cancer testing for patients in over 30 countries, such as those in Latin America, Africa, the Middle East, and Asia. The partnership will help to broaden the availability of affordable and advanced genomic testing for breast and lung cancer and ultimately improve patient outcomes in emerging markets.

-

December 2023 – Agilent Technologies overhauled the organizational structure by consolidating the Cell Analysis Division into its Diagnostics and Genomics Group (DGG). This consolidation aims to simplify the company's molecular and cell-based solutions, enhancing workflow efficiency and driving growth in the genomic medicine market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.35 Billion |

| Market Size by 2032 | US$ 86.35 Billion |

| CAGR | CAGR of 14.64 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Oncology, Cardiology, Paediatrics, Endocrinology, Respiratory Medicine, Rare Genetic Disorders, Infectious Diseases, Other Applications) • By Products And Services (Instruments and Equipment, Consumables, Services [Genomic Testing, Data Analysis, Interpretation, Genetic Counselling]) • By Technology (Next-Generation Sequencing [NGS], Polymerase Chain Reaction [PCR], Microarray, Sanger Sequencing, Others) • By End-User (Hospitals & Clinics, Academic Institutions, Research Institutions, Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Other End-Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Thermo Fisher Scientific, Qiagen, Agilent Technologies, F. Hoffmann-La Roche, Oxford Nanopore Technologies, PacBio, BGI Genomics, PerkinElmer, Myriad Genetics, Invitae, Genomic Health (Exact Sciences), Bio-Rad Laboratories, 23andMe, Nebula Genomics, GenScript Biotech, Twist Bioscience, Eli Lilly and Company, Regeneron Pharmaceuticals, Bluebird Bio, and other players. |