Laser Interferometer Market Size & Overview:

Get more information on Laser Interferometer Market - Request Sample Report

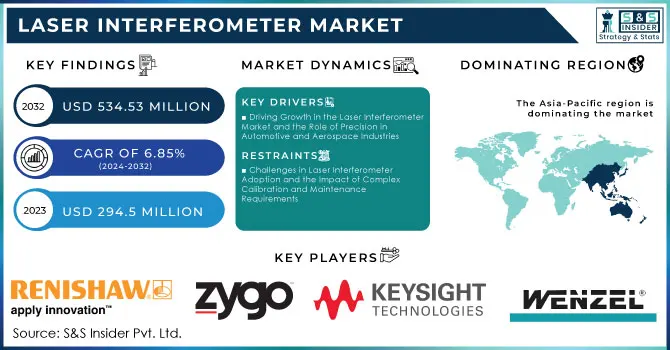

The Laser Interferometer Market Size was valued at USD 294.5 Million in 2023 and expected to reach USD 534.53 Million by 2032, growing at a CAGR of 6.85% over the forecast period 2024-2032.

The laser interferometer market is experiencing significant growth, primarily driven by the rising demand for precision measurement tools in industries such as semiconductors, aerospace, and automotive. These industries require highly accurate systems for manufacturing and quality control, which is propelling the adoption of laser interferometers. As precision measurement becomes essential for technological innovation, especially in high-tech industries, the demand for optical metrology solutions continues to rise. One of the key factors fueling this growth is the increasing need to tackle challenges like bandwidth limitations and space debris tracking, where laser interferometers play a crucial role.

For Instance, Foxconn are investing heavily in the development of superchips to meet the soaring demand in AI, underlining the critical need for precise measurement tools like laser interferometers in complex manufacturing processes. In addition, advancements in laser technology are making significant strides, with innovations improving space debris tracking precision by more than 10,000 times, further boosting the demand for high-accuracy measurement systems. Moreover, as industries focus on sustainability and energy efficiency, projects like HVDC transmission systems in the UK are highlighting the importance of precision in engineering and manufacturing, areas where laser interferometers are indispensable. The ongoing evolution of semiconductor fabrication is another driving factor, as the industry requires increasingly sophisticated metrology tools to meet tighter tolerances. With the expansion of the semiconductor sector and the growing shift toward automation in manufacturing, laser interferometers are becoming vital in achieving the accuracy needed for next-generation technologies.

Laser Interferometer Market Dynamics

Drivers

-

Driving Growth in the Laser Interferometer Market and the Role of Precision in Automotive and Aerospace Industries

The laser interferometer market is experiencing a significant boost due to the growing demand for quality control in industries like automotive and aerospace. As these sectors prioritize safety, precision, and product standards, they are increasingly integrating laser interferometry technology to enhance their manufacturing processes. With advancements in automotive design, particularly in the growing demand for electric vehicles (EVs), manufacturers are turning to laser interferometers for precision measurements to ensure superior product quality. This demand is further driven by aerospace companies like GE Aerospace, which are benefiting from the strong demand for jet engines and aftermarket services, highlighting the need for high-precision tools in the production process. As seen with Air Canada, which raised its profit forecast due to robust international demand, the aerospace sector's focus on high-quality production continues to grow, directly affecting the demand for laser interferometry. Additionally, the automotive sector is increasingly adopting AI-driven quality control systems, which are integrated with laser interferometry to monitor and improve manufacturing standards. This trend is expected to intensify as automotive companies increasingly focus on automated precision for safety and efficiency in production. The rising global demand for high-precision tools in aerospace and automotive manufacturing is expected to drive the growth of the laser interferometer market significantly, with applications ranging from positioning systems in aerospace to advanced laser metrology in automotive production.

Restraints

-

Challenges in Laser Interferometer Adoption and the Impact of Complex Calibration and Maintenance Requirements

Laser interferometers are highly sensitive precision tools that require meticulous calibration to ensure accurate measurements. This process is essential for maintaining their reliability over time, but it can be time-consuming and costly. Regular maintenance is also necessary to keep the system functioning at its optimal level, as even slight deviations in alignment or environment can impact measurement accuracy. According to the National Institute of Standards and Technology (NIST), the calibration of displacement-measuring laser interferometers is a complex task that requires expert knowledge and specialized equipment improper calibration or infrequent maintenance can result in measurement errors, which can significantly affect industries that rely on high-precision measurements, such as aerospace and semiconductor manufacturing. This need for regular recalibration and repair services drives up both operational costs and downtime, limiting the adoption of laser interferometers in some industries. Furthermore, the environmental conditions in which these devices operate, such as temperature fluctuations or vibrations, can further complicate their maintenance needs, as they can degrade the performance of the system over time.

Laser Interferometer Market Segment Analysis

by Type

In 2023, the Fizeau interferometer segment led the laser interferometer market, capturing around 25% of the total revenue. Known for its high accuracy and versatility, it is widely used in semiconductor manufacturing, optical metrology, aerospace, and R&D applications. Fizeau interferometers measure small displacements with precision, making them ideal for flatness, displacement, and surface roughness measurements. The growing demand for optical metrology in industries like automotive and energy generation has further boosted its adoption. Companies like Keysight Technologies, Aerotech Inc., and National Instruments have introduced advanced Fizeau interferometer systems, enhancing precision and automation.

by Application

In 2023, the surface topology application segment led the laser interferometer market, accounting for about 33% of the total revenue. This segment is essential for industries requiring high precision, such as semiconductor manufacturing, aerospace, automotive, and materials science, as it measures surface characteristics like roughness, flatness, and texture. Laser interferometers provide unparalleled accuracy in capturing fine surface details, ensuring component quality and optimal performance. The growing demand for precise surface measurements is fueled by advancements in manufacturing and the need for stringent quality control. In sectors like semiconductor production, even minor surface defects can affect product performance, driving the use of non-contact, high-resolution laser interferometers for accurate surface profiling, minimizing defects, and enhancing production efficiency.

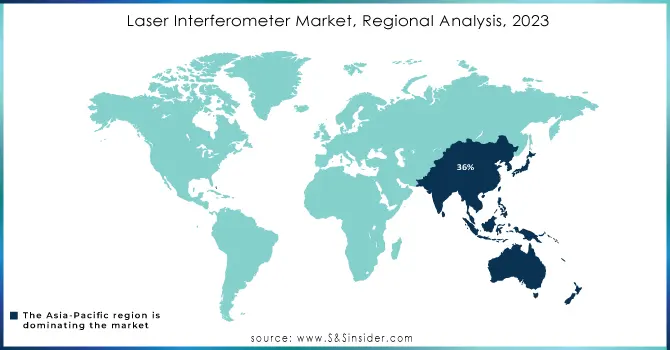

Laser Interferometer Market Regional Overview

In 2023, the Asia-Pacific region led the laser interferometer market with a 36% share, driven by rapid growth in manufacturing industries across countries like China, Japan, South Korea, and India. China, a key market player, is expanding its electronics, semiconductor, and automotive sectors, boosting demand for precision measurement tools. Japan's high-quality automotive and aerospace industries are driving the adoption of laser interferometers, while South Korea’s semiconductor production and precision engineering further fuel market demand. India’s growth in aerospace and automotive sectors, coupled with an emphasis on high-precision manufacturing, contributes to the regional demand. Supported by government initiatives like China's "Made in China 2025" and South Korea's focus on high-tech manufacturing, the Asia Pacific market is set for continued dominance and growth.

In 2023, North America became the fastest-growing region in the laser interferometer market, driven by advancements in aerospace, semiconductor manufacturing, and automotive industries. The United States, with its major aerospace and defense sectors, is a key player, using laser interferometers for precise alignment and quality testing in companies like NASA, Boeing, and Lockheed Martin. The semiconductor industry, led by firms such as Intel and Texas Instruments, has also seen increased use of these tools for wafer inspection. Canada is witnessing growth in aerospace, automotive, and materials science sectors, supported by research and development efforts.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major Key Players in Laser Interferometer Market with product:

-

Renishaw plc (RefletTM, XL-80 Laser System, In-Process Measurement Systems)

-

Zygo Corporation (NewView 9000, ZMI 200, Laser Fizeau Interferometer)

-

Keysight Technologies (5500 Laser Interferometer, Optical Metrology Solutions)

-

Wenzel America (Laser Micrometer Systems, WENZEL LST 800 Interferometer)

-

Mahr Inc. (Mahr SurfTest, Mahr Linear Measurement Systems)

-

JENOPTIK AG (Fizeau Interferometer, Laser Distance Meter)

-

Festo AG (Optical Measurement Solutions, Laser Displacement Sensors)

-

Micro-Epsilon (optoNCDT Laser Sensors, Laser Displacement Measuring Systems)

-

Leica Microsystems (A Danaher Company) (Laser Scanning Confocal Microscope, Optical Measurement Systems)

-

VIGO System S.A. (High-Speed Laser Interferometer Systems, Precision Optical Metrology Devices)

-

Optodyne, Inc. (Laser Interferometer, OptoScope Interferometer Systems)

-

Optical Metrology Systems (OMS) (Laser Interferometer for Surface Metrology, Optical Inspection Systems)

-

National Instruments (Laser Interferometer System, LabVIEW-Based Laser Metrology Solutions)

-

Nikon Corporation (Laser Microscope Systems, Laser Interferometer for Surface Profiling)

-

MITUTOYO CORPORATION (Laser Displacement Sensors, Laser Interferometers for Precision Measurement)

-

Horiba Scientific (Laser Raman Spectrometers, Optical Metrology Instruments)

-

Marposs S.p.A. (Laser Measurement Systems, Laser-based Metrology for Manufacturing)

-

Keyence Corporation (Laser Displacement Sensor, Optical Measurement Systems)

-

SMX (Smart Micro X) (Laser Profilometer, Surface Topography Laser Systems)

-

Tesa Technology (Laser Micrometer, Surface Measurement Systems, Precision Laser Devices)

List of companies that supply raw materials and components for the laser interferometer market:

-

II-VI Incorporated

-

Corning Inc.

-

Edmund Optics

-

Newport Corporation

-

Thorlabs Inc.

-

SCHOTT AG

-

Hellma Materials

-

Meller Optics

-

Jenoptik Optical Systems

-

Excelitas Technologies

-

Inrad Optics

-

NKT Photonics

-

Advanced Optics, Inc.

-

Photonics Industries

-

LightPath Technologies

-

OSI Optoelectronics

-

Crystal GmbH

-

Optics Balzers

-

Laser Components GmbH

-

Hamamatsu Photonics

Recent Development

-

On October 29, 2024, NASA unveiled a prototype telescope for the Laser Interferometer Space Antenna (LISA), a pioneering space-based gravitational wave detector set to launch in 2034. Funded by the European Space Agency, LISA will utilize three spacecraft to detect gravitational radiation by measuring tiny changes in the distances between them caused by passing gravity waves.

-

On August 26, 2024, a new laser technology was developed that could enable cold-atom interferometers to provide precise navigation in a compact form, potentially fitting an alternative to GPS into a shoebox-sized device. This breakthrough aims to reduce the size and cost limitations currently hindering their widespread use.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 294.5 Million |

| Market Size by 2032 | USD 534.53 Million |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by type (Fabry-Perot, Fizeau, Mach-Zehnder, Twyman-Green, Sagnac, Michelson interferometers) • By application (Surface Topology, Applied Science, Semiconductor Detection, Engineering, Biomedical). • By end-user industry (Aerospace & Defense, Life Sciences, Automotive, Industrial, Electronics Manufacturing, Telecommunication), application (Surface Topology, Applied Science, Semiconductor Detection, Engineering, Biomedical). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Renishaw plc, Zygo Corporation, Keysight Technologies, Wenzel America, Mahr Inc., JENOPTIK AG, Festo AG, Micro-Epsilon, Leica Microsystems (A Danaher Company), VIGO System S.A., Optodyne, Inc., Optical Metrology Systems (OMS), National Instruments, Nikon Corporation, MITUTOYO CORPORATION, Horiba Scientific, Marposs S.p.A., Keyence Corporation, SMX (Smart Micro X), and Tesa Technology. |

| Key Drivers | • Driving Growth in the Laser Interferometer Market and the Role of Precision in Automotive and Aerospace Industries. |

| RESTRAINTS | • Challenges in Laser Interferometer Adoption and the Impact of Complex Calibration and Maintenance Requirements. |