High-Volume Dispensing Systems Market Size Analysis:

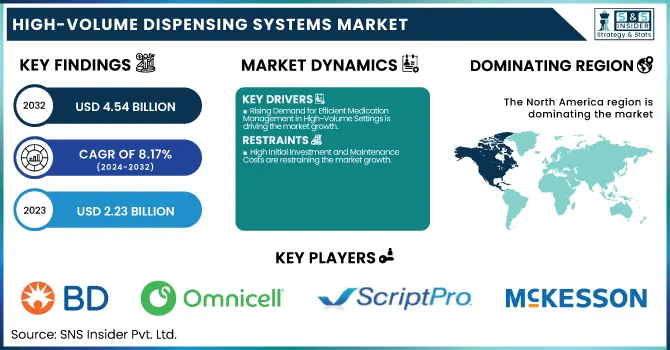

The High-Volume Dispensing Systems Market Size was valued at USD 2.23 billion in 2023 and is expected to reach USD 4.54 billion by 2032, growing at a CAGR of 8.17% from 2024-2032.

To Get more information on High-Volume Dispensing Systems Market - Request Free Sample Report

This report provides exclusive value through the provision of actionable operational statistics and financial information, particularly to the High-Volume Dispensing Systems Market. It features a comparison of average dispensing time before and following automation, showing gains in efficiency. It also contains regional capital and operating expense trends, as well as changing regulatory and compliance drivers that impact system uptake. The report also includes regional reimbursement dynamics for pharmacy automation systems and offers industry benchmarked ROI timetables, providing stakeholders with an actionable perspective of payback periods for investment.

The U.S. High Volume Dispensing Systems Market was valued at USD 0.87 billion in 2023 and is expected to reach USD 1.73 billion by 2032, growing at a CAGR of 7.94% from 2024-2032. The United States commands the largest market share of the High-Volume Dispensing Systems Market in North America, fueled by the extensive use of automation at pharmacies, rising demand for medicines, and the strong presence of major market players such as Omnicell and Becton, Dickinson and Company. The nation's advanced healthcare infrastructure and emphasis on medication error reduction further support its position of leadership in the region.

High-Volume Dispensing Systems Market Dynamics

Drivers

-

Rising Demand for Efficient Medication Management in High-Volume Settings is driving the market growth.

Increasing numbers of prescriptions in retail, hospital, and long-term care pharmacies represent a key impetus for the implementation of high-volume dispensing systems. In the United States alone, more than 6.6 billion prescriptions were processed in 2023, a number that is growing as populations age and more chronic conditions are prevalent. Manual processes are becoming more often displaced by automation to enhance speed, accuracy, and help avoid dispensing errors. Current advances, such as Omnicell's XT Amplify program introduced in April 2024, reflect the focus of the industry on streamlining current dispensing infrastructure to enhance clinical workflow and throughput. These systems not only enhance patient safety but also lower labor requirements, making them critical for pharmacies experiencing staffing challenges and increased demand, particularly in post-acute and hospital-based care environments.

-

The Growing Integration of Automation Technologies in Pharmacy Operations is accelerating the market growth.

Automation in healthcare is seeing high-speed integration, and pharmacy operations are no different. High volume dispensing systems are emerging as a central part of smart pharmacy ecosystems, integrating with EHRs, inventory management solutions, and real-time analytics platforms. According to a 2023 HIMSS Analytics report, more than 60% of North American hospital pharmacies have automated at least one of the most important dispensing functions. This drive for automation is complemented by favorable policies, including CMS incentives to implement technologies enhancing medication safety. In March 2024, BD released new data showing the capability of automated dispensing cabinets in long-term care settings, highlighting improved tracking of medications and lower administration times. As healthcare evolves towards digital transformation, seamless integration into high-volume dispensing systems is fueling adoption as a must-have, forward-thinking solution for contemporary pharmacy operations.

Restraint

-

High Initial Investment and Maintenance Costs are restraining the market growth.

One of the main constraints preventing the large-scale deployment of high-volume dispensing systems is the very high initial investment and maintenance expenses of such technologies. High volume dispensing systems tend to demand significant capital for setup, integration with the current health IT infrastructure, and employee training. Regular software maintenance, hardware maintenance, and possible system outages may also raise operational costs in the long run. For low-budget hospitals, community pharmacies, or institutions in poor areas, these financial obstacles can hinder or even stop implementation. Industry estimates put the cost of full-featured automated systems at over USD 200,000 to USD 500,000, depending on configuration and complexity. Although there is the possibility of long-term return on investment, the high upfront costs of automation pose a major economic challenge for facilities with limited budgets. Such a limitation tends to hinder such organizations, especially in developing countries, from giving automation the priority it needs, thus constraining total market penetration

Opportunities

-

Expansion into Emerging Healthcare Markets presents a significant opportunity for market growth.

The increasing need for pharmacy automation in growing economies like India, Brazil, and Southeast Asia is a major growth prospect for producers of high-volume dispensing systems. These markets are witnessing fast-paced development of healthcare infrastructure driven by government expenditure and a growing emphasis on updating hospital and pharmacy operations. With rising patient volumes and demands for chronic disease management, the demand for effective medication dispensing increases considerably. Local authorities and private healthcare providers are also becoming increasingly receptive to the use of digital health technologies, particularly in high-density and urban areas. Though cost sensitivity continues to be a consideration, modular and scalable dispensing systems with the ability to be tailored to mid-sized facilities are increasingly sought after. Cost-effective, region-specific solutions provided by manufacturers are a clear path to tapping this untapped market.

Challenges

-

Integration Complexities with Legacy IT Systems are challenging the market from growing.

One of the significant challenges for players in the High-Volume Dispensing Systems Market is the integration of new automated systems with the existing legacy IT infrastructure of hospitals and pharmacies. Most of the healthcare establishments continue to utilize old electronic health records (EHRs), inventory management, or disparate data management platforms, which do not allow seamless interoperability. This absence of standardization creates data silos, longer implementation time, and possible medication dispensing errors. In addition, automating systems frequently demands custom software settings, heavy IT support, and employee retraining—factors that can retard rollout and drive deployment costs upward. These technical challenges can be especially challenging within bigger health systems serving multiple sites, where consistency is paramount. Consequently, integration complexity remains a significant hindrance to widespread adoption, even in markets that are adequately funded.

High-Volume Dispensing Systems Market Segmentation Analysis

By Product

In 2023, the Systems/Cabinets segment dominated the high-volume dispensing systems market with 68.15% market share 2023 because of its widespread use in retail pharmacies and hospital pharmacies for bulk prescription filling. They enable high-speed, automated storage and dispensing of medication with minimal manual error and increased efficiency of operations. Their real-world advantages in inventory management, real-time tracking, and patient protection have made them a must-have within high-throughput settings. Also, large-scale healthcare providers have been making significant investments in sophisticated robotic cabinets like BD Pyxis, Omnicell XT, and ScriptPro SP series, which further boosted the rate of adoption. The capacity of these systems to integrate with barcode verification and labeling also facilitates regulatory compliance, hence becoming a leading choice among pharmacies seeking to streamline their workflows.

The Software Solutions segment is predicted to be the fastest-growing throughout the forecasting period with 8.39% CAGR because of growing momentum in shifting to cloud-based platforms, analytics driven by AI, and EHR interoperability. All of these solutions have real-time management of prescriptions, automated reminder messages for refill requests, compliance tracking, and patient data aggregation, fostering precision and efficiency without physical hardware system footprints. The increasing demand for Software-as-a-Service (SaaS) modes, especially in the cost-constrained and mid-market pharmacy settings, facilitates scalable adoption at reduced capital expenditures. In addition, the regulatory authorities are promoting digitalization of the pharmacy business, which is driving demand for smart software modules optimizing inventory, minimizing drug errors, and improving clinical decision-making.

By End Use

The Retail Pharmacies segment dominated the high-volume dispensing systems market with 82.10% market share in 2023, mainly because of the enormous number of prescriptions they process daily, particularly in urban and densely populated areas. Retail chains like CVS, Walgreens, and Boots are operating at scale and are experiencing increasing pressures from aging populations and chronic patients who need regular medication. To handle this burden effectively, most have embraced high-volume dispensing systems that automate prescription filling, sorting, and labeling, cutting down on waiting time and human error. Retail pharmacies are also increasingly embracing these systems and integrating them with digital health platforms to enable home delivery, medication synchronization, and telepharmacy services. Their robust financial strength, combined with a strong emphasis on customer satisfaction and process optimization, has caused these systems to be in extensive use, further strengthening their dominant position in the market.

High-Volume Dispensing Systems Market Regional Insights

North America dominated the high-volume dispensing systems market with a 55.10% market share in 2023, owing to its extremely developed healthcare infrastructure, robust regulatory systems, and early adoption of healthcare automation technology. The region is favored by the presence of industry leaders like Becton, Dickinson and Company (BD), Omnicell, and McKesson, which continuously invest in research and product development. Also, the growing demand for accurate, efficient, and large-volume medication dispensing solutions in long-term care facilities, retail pharmacies, and hospitals fuels market expansion. Increased spending on healthcare, an aging population, and a stringent focus on the prevention of drug errors further fuel North America's dominant position within the global marketplace.

The Asia Pacific region is experiencing the fastest growth in the high-volume dispensing systems market with 8.80% CAGR throughout the forecast period, driven by the fast development of healthcare infrastructure, growing healthcare spending, and rising awareness of the advantages of pharmacy automation. China, India, and Japan are among the countries that are heavily investing in upgrading their healthcare systems, especially to handle high patient volumes and automate pharmacy operations. Also, the increasing number of chronic diseases, urbanization, and supportive government policies encouraging digital health transformation are driving the adoption of automated dispensing technologies in hospitals and pharmacies in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

High-Volume Dispensing Systems Market Key Players

-

Becton, Dickinson and Company (BD Pyxis MedStation, BD Rowa Vmax)

-

Omnicell, Inc. (Omnicell XR2 Automated Central Pharmacy System, Omnicell Medimat)

-

ScriptPro LLC (ScriptPro SP 200, ScriptPro SP Central Pharmacy Management System)

-

McKesson Corporation (McKesson PharmacyRx, McKesson Automated Dispensing Cabinets)

-

Parata Systems, LLC (Parata Max, Parata PASS 208)

-

Talyst Systems, LLC (AutoPack, InSite Remote Dispensing System)

-

Swisslog Healthcare (BoxPicker, PillPick)

-

ARxIUM (RIVA IV Compounding System, MedSelect Flex)

-

Capsa Healthcare (NexusRx VBM 200F, MedLink Mobile Computing Workstation)

-

Innovation Associates (PharmaFlow, PharmASSIST Symphony+ High Volume)

-

Health Robotics (Omnicell) (i.v STATION, i.v SOFT Assist)

-

TCGRx (now part of Capsa Healthcare) (ATP 2, InspectRx)

-

Yuyama Co., Ltd. (Litrea Ⅱ, DimeRo)

-

Willach Pharmacy Solutions (CONSIS.E, CONSIS.B)

-

Kirby Lester (Capsa Healthcare) (KL60, KL1Plus)

-

RxSafe, LLC (RxSafe 1800, RapidPakRx)

-

Cerner Corporation (RxStation, RxHub)

-

Accu-Chart Plus Healthcare Systems, Inc. (Accu-Flo, Accu-Pack)

-

TouchPoint Medical (AcuDose-Rx, MedDispense Series)

-

AVANTech Inc. (PharmaFill, DoseOne)

Suppliers (These suppliers commonly provide electronic components, sensors, connectors, power supplies, and automation control systems essential for the precise functioning, communication, and operation of high volume dispensing units) in the High Volume Dispensing Systems Market.

-

3M Company

-

Siemens AG

-

Molex LLC

-

TE Connectivity Ltd.

-

Schneider Electric

-

Honeywell International Inc.

-

Phoenix Contact

-

Murata Manufacturing Co., Ltd.

-

Amphenol Corporation

-

Delta Electronics, Inc.

Recent Development in the High-Volume Dispensing Systems Market

-

April 2024 – Omnicell, Inc., a recognized leader in pharmacy care delivery innovation, unveiled the XT Amplify, a multi-year innovation initiative. The initiative seeks to advance the value proposition for hospitals, health systems, and post-acute care facilities that use Omnicell's XT Automated Dispensing System. XT Amplify is intended to fuel better clinical and operational results at the point of care and in pharmacy operations.

-

March 2024 – BD (Becton, Dickinson and Company), a leading global medical technology company, unveiled new results from a recent study. The study evaluated the effect of installing automated dispensing cabinets (ADCs) in long-term care facilities and in an off-site, long-term care pharmacy environment. The findings emphasized the contribution of ADCs to improving medication management and overall care efficiency in these settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.23 Billion |

| Market Size by 2032 | US$ 4.54 Billion |

| CAGR | CAGR of 8.17 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Systems/Cabinets, Software Solutions) • By End Use (Retail Pharmacies, Hospital Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Omnicell, Inc., ScriptPro LLC, McKesson Corporation, Parata Systems, LLC, Talyst Systems, LLC, Swisslog Healthcare, ARxIUM, Capsa Healthcare, Innovation Associates, Health Robotics (Omnicell), TCGRx, Yuyama Co., Ltd., Willach Pharmacy Solutions, Kirby Lester, RxSafe, LLC, Cerner Corporation, Accu-Chart Plus Healthcare Systems, Inc., TouchPoint Medical, AVANTech Inc., and other players. |