LiDAR Drone Market Report Scope & Overview:

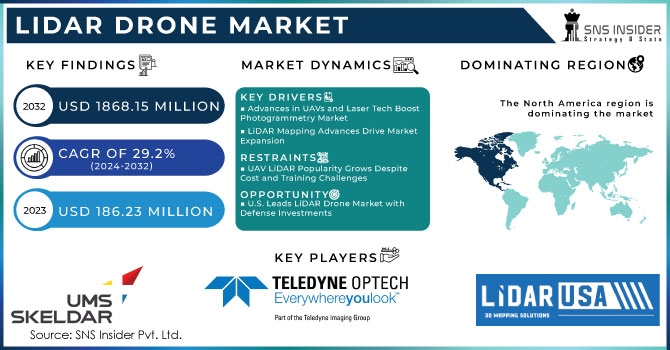

The LiDAR Drone Market Size is expected to grow from USD 186.23 million in 2023 to USD 1868.15 million by 2032 at a CAGR of 29.2% over the forecast period 2024-2032. The global market for LiDAR drones is driven by the growing demand for unmanned aerial vehicles (UAV), due to their diverse partnerships in the most widely used industries, such as agriculture, construction, mining, and defense, among others. The growing adoption of laser technology and sensory navigation technology, mapping, agricultural accuracy, and mining operations is a major factor contributing to market growth. Key factors that enhance the growth of this market include the simplification of regulations related to the use of commercial drones in various systems and the growing demand for LiDAR drones for use in corridor mapping and accurate agricultural applications. However, stricter laws and restrictions on the use of drones in various countries are expected to hinder market growth during forecasting.

To get more information on LiDAR Drone Market - Request Free Sample Report

MARKET DYNAMICS

Key DRIVERS

The growing popularity of non-metallic digital cameras equipped with fixed wings and rotating wing UAVs in the photogrammetric system industry is expected to boost the market. The technology is often linked to laser scanning in the air. Over the past few years, new technologies and drone technologies have seen rapid progress. This type of drone has increased due to advances in sensory and laser components and cameras and drone cameras. Construction, vegetation monitoring, mapping, forestry, geography, archeology, earthquake science, and precision farming are just some of the essential elements. Improved laser sensor technology has emerged in new research, and UAV scanning applications such as LiDAR high-end airplanes have increased the range of applications in the infrastructure business.

LiDAR Mapping is a widely accepted and accurate way to directly generate information about the position and additional features from georeferenced location data. The new development of LiDAR mapping technology for scientists and specialists involves exploring forest ecosystems, architectural settings, and their widespread expansion. The need for a LiDAR map has introduced precise scaling, as it provides better accuracy, precision, and flexibility, providing greater accuracy, precision, and flexibility. These factors are expected to improve market expansion.

Restraints

UAV LiDAR is the most popular in the world. The industry is growing rapidly due to the many technological benefits that come with it. Compared with other technologies, such as the photogrammetric system, laser technology is one of the most expensive. During the projected period, the market will likely be hampered by the easy availability of the photogrammetric system and the low cost.. Limited training centers and specialists with experience in the use of long-range UAVs and the proliferation of drones are important issues in this field. Commercial pilots of traditional aircraft and pilots of aeronautics, contrary to popular belief, are not trained or certified by any institution.

However, unmanned aerial vehicles are always at risk of serious damage or accidents at the airport during long-distance operations. At the time of speculation, these factors are expected to interfere with growth. The federal government of the United States has enacted stricter laws and regulations regarding the use of unmanned aerial vehicles in the aviation industry. The government has used these laws to avoid serious accidents caused by drones. Drones were also banned from flying overnight and over 400 meters during the day by state authorities. Several countries are focusing on developing airline regulations and their commercial operations. Out of safety concerns, many governments have imposed strict limits on the operation of unmanned aircraft at specific altitudes and perimeters.

OPPORTUNITIES

The United States is expected to be the largest market for drones in LiDAR, mainly due to the growth of investment in new plants in the defense sector. In addition, the country has the highest military budget in the world that invests heavily in technological defense tools.

In addition, the emerging trend of data collection at high altitudes and low altitudes is widely accepted in the industry. Many scientists have reported that by using this method, the system can measure soil by 520 points or up to 40 points per square meter. This method is expected to provide an accurate and precise map of the object and is widely used to assess the location of the US accuracy of LiDAR air systems.

CHALLENGES

LiDAR Drone Market Size, Share, Growth Report examines the competitive landscape by analyzing key players in the market. The company profile of leading market players is included in this report with Porter's five-strength analysis and Value Chain analysis. In addition, the strategies used by companies to grow the business through integration, acquisition, and other business development strategies are discussed in the report. The financial parameters examined include sales, profits, and total revenue earned by key Market players.

IMPACT OF COVID-19

The emergence of COVID-19 has had a positive impact on the growth of the LiDAR Drone market. There is a huge investment in the use of data centers due to operating in remote areas. Other applications such as routers and switches, and servers have also seen high growth rates during the epidemic. Considering the impact of COVID-19 on the global LiDAR Drone market, the report analyzes the impact from both global and regional perspectives. From the end of production to the end of use in regions such as North America, Europe, China, and Japan, the report focused on market analysis under COVID-19 and the corresponding response policy separately.

KEY MARKET SEGMENTATION

By Component

-

Li-DAR Lasers

-

Navigation and Positioning Systems

-

UAV Cameras

-

Others

By Type

-

Rotary-wing Li-DAR Drones

-

Fixed-wing Li-DAR Drones

By Range

-

Short

-

Medium

-

Long

By Application

-

Corridor Mapping

-

Archeology

-

Construction

-

Environment

-

Entertainment

-

Precision Agriculture

-

Others

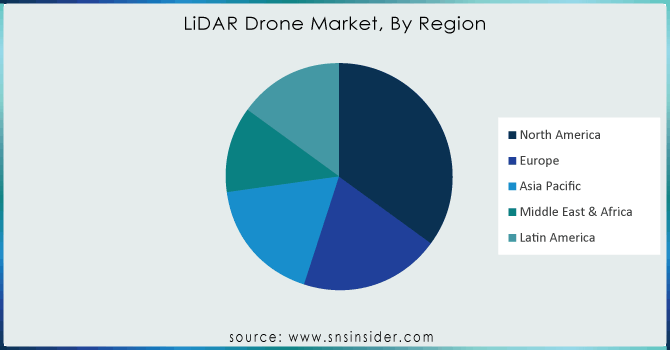

REGIONAL ANALYSIS

Increased focus on military drone programs drives LiDAR Drone Market in North America

Increased focus on military drone systems, space travel, and aerospace capabilities are expected to further market growth. The United States and other developed countries increase investment in research, technology, and commercial services and change organizational strategies to improve their resilience in the military and capabilities. Higher investment and organizational changes in new military space ideas are expected to increase the adoption of the LiDAR Drone. In North America, Governments of various countries are making various efforts to reduce the use of commercial drones to drive market growth.

The Asia Pacific region is expected to have a large share in the forecast period.

Key players working in the LiDAR Drone market are expected to have significant potential for revenue growth over the next five years in emerging economies such as China, India, and Japan. With the rapid development in construction projects, smart city development and accurate agricultural applications are expected to further the adoption of the LiDAR Drone. LiDAR drones in the construction industry are used for designing, testing, and mapping applications, which help process new workflows, as well as applications for related risk reduction.

Need any customization research on KEYWORD Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Key Players are Teledyne Optech, UMS Skeldar, LiDARUSA, YellowScan, Geodetics, Inc., OnyxScan, and Delair, Phoenix LiDAR Systems, RIEGL Laser Measurement Systems GmbH, Velodyne LiDAR, Inc.& Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 186.23 Million |

| Market Size by 2032 | US$ 1868.15 Million |

| CAGR | CAGR of 29.2% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Li-DAR Lasers, Navigation and Positioning Systems, UAV Cameras, Others) • By Type (Rotary-wing Li-DAR Drones, Fixed-wing Li-DAR Drones) • By Range (Short, Medium, Long) • By Application (Corridor Mapping, Archeology, Construction, Environment, Entertainment, Precision Agriculture, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Teledyne Optech, UMS Skeldar, LiDARUSA, YellowScan, Geodetics, Inc., OnyxScan, and Delair, Phoenix LiDAR Systems, RIEGL Laser Measurement Systems GmbH, Velodyne LiDAR, Inc. |